PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852014

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852014

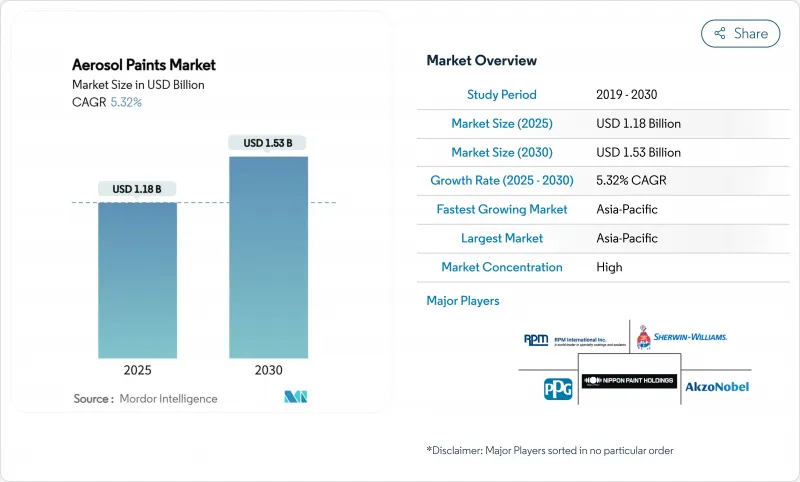

Aerosol Paints - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Aerosol Paints Market size is estimated at USD 1.18 billion in 2025, and is expected to reach USD 1.53 billion by 2030, at a CAGR of 5.32% during the forecast period (2025-2030).

Construction recovery, automotive personalization, and a flourishing DIY culture fuel volume growth, while continuous resin innovation and automated dispensing systems support premium pricing. Manufacturers accelerate water-borne transitions to meet stricter VOC rules without sacrificing finish quality, and specialty 2-K polyurethane systems gain traction for booth-free repairs. Competitive intensity pivots around technology integration, sustainability credentials, and targeted mergers and acquisitions that broaden geographic footprints and boost access to high-margin niches.

Global Aerosol Paints Market Trends and Insights

Rising Residential and Commercial Construction Activities

Demand accelerates as new housing and renovation projects specify precision touch-up coatings, allowing the aerosol paints market to penetrate both initial build and maintenance phases. Contractors favor aerosols for color-matching occupied spaces, reducing downtime and overspray. Manufacturers respond with substrate-specific blends that combine rapid cure with abrasion resistance, ensuring consistent performance across masonry, composites, and metal fixtures. Regulatory alignment across regions is streamlining product approvals and driving uniform label standards that further ease cross-border project execution.

Growing Automotive Customisation and Refinishing Culture

Rule 1151 amendments grant temporary VOC leniency, enabling continued supply of high-performance refinishing aerosols. Covestro's clearcoat benchmarking validates nano-modified 2-K polyurethane dominance in scratch resistance. Enthusiasts in North America and Europe customize wheels, calipers, and trim, driving steady aerosol volumes despite plateauing vehicle sales. In emerging markets, personalization indicates social status, fostering localized color palettes and UV-stable formulations tailored to tropical climates. OEMs collaborate with paint suppliers to launch dealer-approved aerosol touch-up kits that protect warranty coverage and capture aftermarket revenue.

Stringent VOC-Content Regulations

California's 2023-2031 rules cut allowable VOC levels and ban aromatic solvents, compelling costly reformulations. The U.S. EPA deferred compliance to January 2027, yet industry testing cycles remain compressed. Canada's 2024 limits span 130 products, requiring distinct SKUs per jurisdiction. Reformulation increases raw-material complexity and may reduce gloss or coverage, particularly in cold-spray environments. However, early movers leveraging advanced water-borne chemistries anticipate global rollout efficiencies once performance parity is achieved.

Other drivers and restraints analyzed in the detailed report include:

- Emerging 2-K Polyurethane Aerosol Systems Enabling Booth-Free Repairs

- Nano-Ceramic Direct-to-Metal Sprays for Ageing Infrastructure

- Phase-Down of HFC Propellants Under Kigali Amendment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic formulations held the leading 32.87% share of the aerosol paints market in 2024, with a parallel 5.57% CAGR to 2030. Their balance of adhesion, UV stability, and low-VOC adaptability underpins widespread acceptance across architectural and DIY channels. Polyurethane earns premium positioning in automotive and industrial sectors, where two-component aerosol kits deliver factory-grade durability. Epoxy systems remain essential for heavy-duty anticorrosion protection despite slower growth, while alkyd retains niche loyalty among craftsmen who favor traditional finishes. Hybrid nano-enhanced resins in the "other" category promise targeted gains such as infrared reflectivity and accelerated cure, nudging suppliers toward modular formulation platforms that streamline custom orders.

In response to regulatory scrutiny, acrylic suppliers invest in self-crosslinking emulsions that deliver solvent-borne hardness with water clean-up, shrinking the environmental gap. Shared monomer backbones allow rapid pivoting between aerosol and bulk-spray formats, improving economies of scale. As DIY users demand all-surface products, multi-substrate acrylics compatible with plastics, metals, and masonry gain prominence. Concurrently, polyurethane developers tackle latency management to extend post-activation pot life, broadening appeal to fleet maintenance crews operating in remote locations.

The Aerosol Paints Report is Segmented by Resin (Acrylic, Epoxy, Polyurethane, Alkyd, and Other Resins), Technology (Solvent-Borne, Water-Borne), End-User Industry (Automotive, Architectural, Wood and Packaging, Transportation, Do-It-Yourself (DIY), and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 45.42% global share in 2024 and advances at 5.71% CAGR. China's mega-projects sustain architectural demand, while India's middle-class households spur growth in DIY metallic and pastel shades. Nippon Paint's USD 2.3 billion AOC acquisition and Indian expansions illustrate strategic anchoring in the region. Government infrastructure outlays infuse stable volume pipelines even during cyclical consumer dips.

North America benefits from an entrenched DIY culture, generating steady cash flow for branded lines and private labels alike. Although inflation weighs on big-ticket remodeling, smaller decor touch-ups remain resilient.

Europe's market fosters technology leadership through collaborative compliance consortia that standardize test methods and share best practices on water-borne conversion. Public funding incentivizes pilot projects employing low-GWP propellants, while consumer eco-labels sway purchase choices. Supply-chain resilience exercises following geopolitical disruptions push manufacturers to near-shore key raw materials, subtly reshaping cost structures and regional capacity allocation.

- Aeroaids Corporation

- Akzo Nobel N.V.

- BASF

- Kobra Paint

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- RPM International Inc.

- RusTA

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Residential and Commercial Construction Activities

- 4.2.2 Increasing DIY Refurbishment and Decor Projects

- 4.2.3 Growing Automotive Customisation and Refinishing Culture

- 4.2.4 Emerging 2-K Polyurethane Aerosol Systems Enabling Booth-Free Repairs

- 4.2.5 Nano-Ceramic Direct-to-Metal Sprays for Ageing Infrastructure

- 4.3 Market Restraints

- 4.3.1 Stringent VOC-Content Regulations

- 4.3.2 Phase-Down of HFC Propellants Under Kigali Amendment

- 4.3.3 Fire-Code Restrictions on Pressurised Paint Storage

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Polyurethane

- 5.1.4 Alkyd

- 5.1.5 Other Resins

- 5.2 By Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Architectural

- 5.3.3 Wood and Packaging

- 5.3.4 Transportation

- 5.3.5 Do-It-Yourself (DIY)

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Aeroaids Corporation

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 BASF

- 6.4.4 Kobra Paint

- 6.4.5 Masco Corporation

- 6.4.6 Nippon Paint Holdings Co., Ltd.

- 6.4.7 PPG Industries Inc.

- 6.4.8 RPM International Inc.

- 6.4.9 RusTA

- 6.4.10 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment