PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852016

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852016

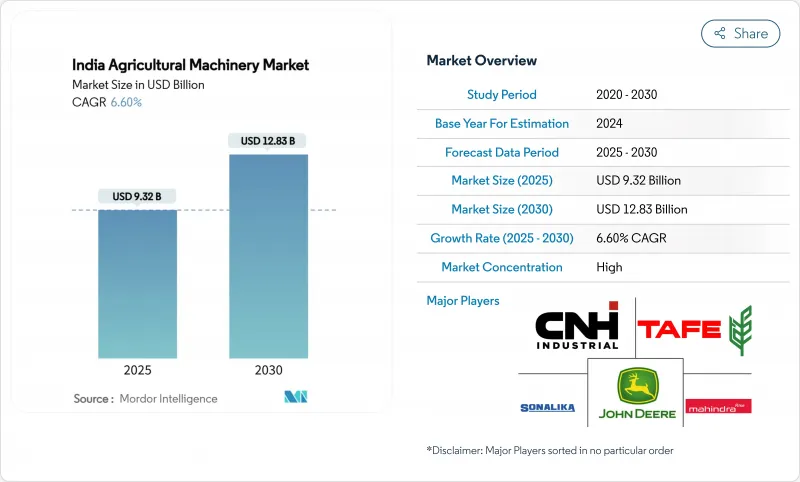

India Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Agricultural Machinery Market size is estimated at USD 18.15 billion in 2025 and is projected to reach USD 27.29 billion by 2030, at a CAGR of 8.5% during the forecast period.

Robust public-sector incentives, persistent rural labor shortages, and rapid digitalization are converging to accelerate equipment adoption nationwide. Subsidies under the Sub-Mission on Agricultural Mechanization (SMAM) lower the upfront cost of tractors, irrigation systems, and precision implements, while custom-hiring centers extend access to smallholder farmers. Rising urban migration reduces available farm labor, pushing growers toward mechanized solutions that can sustain timely planting and harvesting operations. In parallel, the Digital Agriculture Mission is creating a farmer registry and geotagged crop database that will underpin precision equipment deployment and data-driven financing. Emission regulations plus emerging incentives for low-emission tractors spur investment in cleaner powertrains, positioning electric and hybrid models as a nascent but strategic growth pocket. Competitive rivalry intensifies as the top five vendors command an 81.5% share, prompting new product launches and capacity expansions geared toward mid-power tractors and smart implements.

India Agricultural Machinery Market Trends and Insights

Government schemes boosting mechanization adoption

Policy interventions under SMAM provide 40%-50% subsidies on individual machinery purchases and up to 80% on custom-hiring centers. In Uttar Pradesh alone, SMAM disbursed INR 65.66 billion (USD 790 million) between 2014 and 2024, distributing 176,000 machines and establishing 10,769 custom-hiring centers, which collectively expand access to high-capacity equipment across smallholder communities. Complementary initiatives such as the Kisan Drone subsidy and crop-specific support under the National Food Security Mission channel further demand high-precision implements. These programs not only minimize upfront costs but also strengthen after-sales networks, thereby fostering sustained mechanization across diverse agro-climatic zones.

Rural labor shortage caused by sustained migration to urban centers

Household survey data indicate that only 9% of main income earners remain in farming, down from historic norms above 50%. Seasonal out-migration peaks during planting and harvesting, intensifying labor deficits that mechanization can bridge through timely tillage, sowing, and harvesting. Combine harvesters cut labor requirements by up to 30% and reduce post-harvest losses by 2-4 percentage points, making them indispensable in rice-wheat rotations. Equipment sharing through custom-hiring centers further leverages scarce machinery to maintain cropping intensities in labor-scarce districts.

High equipment cost and limited credit access

Despite generous subsidies, a mid-horsepower tractor still requires an outlay exceeding INR 600,000 (USD 7,200), a sum beyond the reach of many marginal growers. Formal lenders often demand collateral, and interest spreads remain 200-300 basis points above prime lending, deterring big-ticket investments. Custom-hiring centers cushion the cost hurdle but are unevenly distributed, eastern India hosts fewer than 12 centers per district versus 45-plus in parts of the north, perpetuating regional disparities.

Other drivers and restraints analyzed in the detailed report include:

- FPOs and contract farming aggregation

- Digital credit platforms enabling financing

- Fragmented landholdings limit scale efficiency

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors retained a 40.5% revenue share in 2024, underscoring their foundational role in tillage and haulage across diverse cropping systems. Irrigation Machinery is the fastest growing segment with micro-irrigation pumps and drip systems advancing at a 10.5% CAGR, propelled by drought-mitigation programs and rising electricity tariffs that favor precision watering. Equipment segments, including plows, harrows, and rotovators, benefit from the mechanization push in smallholder farming, where these implements provide entry-level mechanization solutions that require lower capital investment than tractors. Harvesting machinery experiences steady growth as labor shortages intensify during peak seasons, with combine harvesters and forage harvesters becoming essential for timely crop collection in commercial farming operations.

Adapters that merge global navigation satellite systems with traditional implements are converting conventional tractors into smart machines that execute straight-line plowing and seed placement within +-2.5 cm precision, reducing input waste by 6%-8%. Electric-assist rotovators and battery-powered orchard sprayers are gaining traction among fruit growers, where low noise and zero emissions are prized. The India agricultural machinery market continues to diversify as balers, mowers, and mulchers gain relevance in residue-management schemes aimed at curbing open-field burning. Market leaders respond with modular attachment ecosystems, allowing a single tractor chassis to support over 20 task-oriented implements, thereby spreading ownership cost over multiple revenue streams.

The India Agricultural Machinery Market Report is Segmented by Type (Tractors, Equipment, Irrigation Machinery, Harvesting Machinery, and More) and by End-User Farm Size (Smallholdings, Medium Farms, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mahindra & Mahindra Ltd

- TAFE Motors and Tractors Limited

- Deere & Company

- CNH Industrial N.V.

- International Tractors Limited (Sonalika)

- Escorts Kubota Limited

- VST Tillers Tractors Ltd.

- AGCO Corporation

- CLAAS KGaA mbH

- Yanmar Holdings Co., Ltd.

- SDF Group S.p.A.

- Tirth Agro Technology Private Limited

- Kirloskar Group

- Jain Irrigation Systems Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Schemes Boosting Mechanization Adoption

- 4.2.2 Rural labor shortage caused by sustained migration to urban centers

- 4.2.3 FPOs and Contract Farming Aggregation

- 4.2.4 Digital Credit Platforms Enabling Financing

- 4.2.5 Electric Equipment Incentives Accelerating Adoption

- 4.2.6 Climate Insurance Favoring Mechanized Cultivation

- 4.3 Market Restraints

- 4.3.1 High Equipment Cost and Limited Credit Access

- 4.3.2 Fragmented Landholdings Limit Scale Efficiency

- 4.3.3 Emission Norms Vary Across States

- 4.3.4 Lack of Skilled Telematics Technicians

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Tractors

- 5.1.1.1 Less than 50 HP

- 5.1.1.2 50 to 75 HP

- 5.1.1.3 76 to 100 HP

- 5.1.1.4 101 to 150 HP

- 5.1.1.5 Greater than 150 HP

- 5.1.2 Equipment

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Rotovators and Cultivators

- 5.1.2.4 Seed and Fertilizer Drills

- 5.1.2.5 Other Equipment (Post-Hole Diggers, Power Weeders, etc.)

- 5.1.3 Irrigation Machinery

- 5.1.3.1 Sprinkler Irrigation

- 5.1.3.2 Drip Irrigation

- 5.1.3.3 Other Irrigation Machinery (Center-Pivot Systems, Micro-Sprinklers, etc.)

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Other Harvesting Machinery (Sugarcane Harvesters, Potato Harvesters, etc.)

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers and Conditioners

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying and Forage Machinery (Tedders, Rakes, etc.)

- 5.1.1 Tractors

- 5.2 By End-User Farm Size

- 5.2.1 Smallholdings (Less than 5 ha)

- 5.2.2 Medium Farms (5 to 20 ha)

- 5.2.3 Large Farms (Greater than 20 ha)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Mahindra & Mahindra Ltd

- 6.4.2 TAFE Motors and Tractors Limited

- 6.4.3 Deere & Company

- 6.4.4 CNH Industrial N.V.

- 6.4.5 International Tractors Limited (Sonalika)

- 6.4.6 Escorts Kubota Limited

- 6.4.7 VST Tillers Tractors Ltd.

- 6.4.8 AGCO Corporation

- 6.4.9 CLAAS KGaA mbH

- 6.4.10 Yanmar Holdings Co., Ltd.

- 6.4.11 SDF Group S.p.A.

- 6.4.12 Tirth Agro Technology Private Limited

- 6.4.13 Kirloskar Group

- 6.4.14 Jain Irrigation Systems Ltd.

7 Market Opportunities and Future Outlook