PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907304

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907304

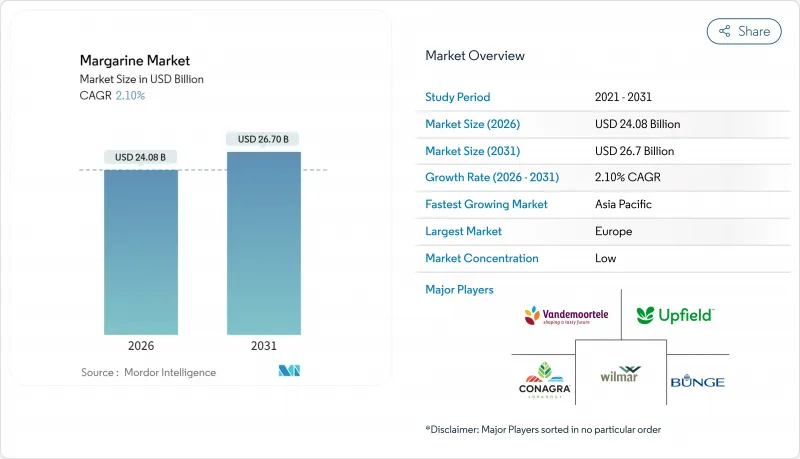

Margarine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Margarine market size in 2026 is estimated at USD 24.08 billion, growing from 2025 value of USD 23.58 billion with 2031 projections showing USD 26.7 billion, growing at 2.10% CAGR over 2026-2031.

The market growth reflects the industry's adaptation to trans-fat elimination regulations while benefiting from plant-based innovations, fortified products, and increased industrial demand. Regulations from the Food and Drug Administration (FDA) and World Health Organization (WHO) have driven the adoption of zero-trans processing technologies, requiring higher capital investments but enhancing consumer confidence. The shift to zero-trans processing has necessitated significant equipment upgrades and process modifications across manufacturing facilities. Enzymatic interesterification has become a standard production method due to its energy efficiency and ability to maintain product consistency. Additionally, the European Union's Deforestation-Free Regulation has prompted manufacturers to develop palm-oil-free formulations, affecting supply chain dynamics and production costs. This transition has led companies to explore alternative oil sources, including sunflower, rapeseed, and soybean oils, while investing in research and development to maintain product quality and functionality.

Global Margarine Market Trends and Insights

Premiumization of margarine through low-fat and fortified variants

The increasing focus on health and wellness among consumers worldwide has fundamentally transformed spreads from basic commodity alternatives into functional food products with targeted nutritional benefits. Fortified spreads now provide essential micronutrient benefits through carefully selected vitamins and minerals, enabling manufacturers to implement strategic premium pricing approaches that effectively manage raw material cost fluctuations in the global market. Advanced liquid formulations with significantly reduced saturated fat content successfully maintain optimal texture, consistency, and baking performance in cakes, pastries, and other baked goods. Comprehensive Vitamin A fortification programs implemented across various Asian markets have demonstrated substantial measurable improvements in retinol levels among children, directly addressing critical nutritional deficiencies in these populations. In developed markets, spreads containing specific plant sterols have consistently demonstrated robust clinical efficacy in reducing LDL cholesterol levels by significant percentages, firmly establishing their position as scientifically validated health-beneficial food products in the daily diet.

Surge in industrial demand from frozen bakery manufacturers

The industrial margarine market is experiencing growth driven by increased production from frozen bakery manufacturers responding to rising convenience food consumption. The segment benefits from specialized margarine formulations designed for automated processing and longer shelf life. CSM Ingredients' Crema facility demonstrates this expansion through new production lines that boost capacity to over 70,000 tons annually, focusing on frozen bakery applications where margarine offers improved sustainability metrics compared to animal-based alternatives. Moreover, Bunge's margarine portfolio for bakery applications showcases the technical requirements of the industry, providing specialized hardstocks that ensure consistent performance across various baking applications, from cookies to bread products. Industrial margarine's functionality in laminated products and stability during freeze-thaw cycles makes it particularly valuable for frozen bakery distribution. Manufacturers utilize advanced emulsifier technologies to produce stable food emulsions across hard, soft, and liquid margarine variants, each optimized for specific industrial requirements. The increased industrial demand aligns with the broader market shift toward processed convenience foods, where margarine's technical properties support efficient large-scale food manufacturing operations.

Trans-fat ban compliance raising reformulation costs in emerging markets

The elimination of trans-fats presents significant challenges for manufacturers in emerging markets, who must balance technological investments and product reformulation with maintaining affordable prices. These manufacturers face substantial financial pressures in upgrading their production facilities, developing new formulations, and sourcing alternative ingredients while ensuring their products remain accessible to price-sensitive consumers. Malaysia's implementation of strict trans-fat regulations from September 2025, which will prohibit food containing more than 2g/100g of fat in trans fatty acids, demonstrates the increasing regulatory requirements in emerging markets to align with WHO recommendations. Thailand's trans-fat reduction program succeeded through extensive public-private collaboration, highlighting the need for institutional coordination in markets with limited regulatory capacity. India's reformulation studies indicate that while technical solutions are available, manufacturers face obstacles in maintaining product texture and managing increased palm oil costs. Small and medium-sized producers particularly struggle with the technical expertise required for reformulation and the financial implications of switching to alternative ingredients. The compliance requirements create market entry barriers and may lead to industry consolidation as smaller manufacturers struggle to meet regulations while keeping prices competitive, potentially reshaping the competitive landscape in these emerging markets.

Other drivers and restraints analyzed in the detailed report include:

- Palm-oil-free formulations gaining traction due to sustainability regulations

- Growth of plant-based spreads

- Volatility in vegetable-oil prices linked to climate-induced yield shifts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquid margarines gained market share as food manufacturers automated high-volume production lines. While soft spreads maintained 54.68% of 2025 revenue, liquid formats achieved the highest growth rate at 5.60% CAGR. Industrial bakeries prefer pumpable oils that reduce labor requirements and enhance measurement precision. The liquid margarine market is projected to reach USD 5.32 billion by 2031, driven by enzymatic structuring technologies that preserve air incorporation and crumb texture. Soft variants remain dominant in retail refrigerated sections, providing consumers versatility for cooking, baking, and spreading. Hard margarines maintain a specific segment in laminated pastry production where precise melting points are essential.

The shift toward liquid formats supports product premiumization. Reduced saturated fat content aligns with EU front-of-pack labeling requirements, which increasingly influence urban millennial purchasing decisions. Manufacturing facilities that implement continuous micro-crystallization technology report improved production efficiency and reduced energy consumption, enhancing cost effectiveness. This transition demonstrates how the margarine market is evolving its product offerings to meet industrial automation needs while maintaining traditional consumer demand.

Regular spreads (>80% fat) maintain a dominant 59.72% market share in 2025, primarily due to their superior taste profile, enhanced mouthfeel, and exceptional baking performance in both domestic and commercial applications. Light variants (<40% fat) are experiencing 6.00% annual growth, driven by increasing consumer focus on calorie reduction and health-conscious dietary choices. Manufacturers are improving light spreads through advanced multilamellar emulsions that maintain structural stability during prolonged refrigeration while preserving essential nutrients, particularly vitamins A and D.

Mid-range spreads (40-80% fat) serve as an effective compromise, particularly in emerging market HoReCa segments where chefs require acceptable texture and spreadability at lower costs than butter. Current innovation focuses on sophisticated botanical flavor extracts and advanced salt micro-encapsulation techniques to achieve comparable sensory qualities with reduced fat content. These technological developments enable the margarine market to align with current dietary guidelines while maintaining the indulgent characteristics essential for consumer acceptance across various demographic segments and usage occasions.

The Margarine Market Report is Segmented by Type (Hard, Soft, Liquid), Fat Content (Regular >80%, Low-Fat 40-80%, Light <40%), Oil Source (Palm-Oil-Based, Soybean-Oil-Based, and More), End User (Retail, HoReCa/Foodservice, Industrial/B2B Processing), Packaging Type (Tubs and Cups, Sticks and Blocks, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe accounted for 29.85% of global revenue in 2025, maintaining its leadership position due to established consumption patterns, broad acceptance of fortified products, and advanced palm-oil-free product development. The market shows low single-digit growth as it matures and consumers shift toward premium plant-based butter alternatives. Clear regulations on labeling and deforestation have improved supply-chain transparency, enabling brands to differentiate themselves through verified sustainable sourcing.

Asia-Pacific demonstrates strong growth potential with a projected 6.30% CAGR through 2031. This growth stems from urbanization, increasing disposable incomes, and expanding frozen-bakery adoption. Chinese quick-service restaurants increasingly adopt liquid margarine for cost management, while Indian refiners seek tariff adjustments to obtain competitive oil supplies.

North America maintains mid-single-digit growth, with zero-trans and non-GMO products becoming standard market requirements. Industrial bakeries transition to high-oleic blends, using domestic soybeans to minimize imported oil dependencies. Latin America and the Middle East/Africa represent smaller but growing markets. The expansion of discount retailers supports private label spread sales, while government-mandated vitamin-A fortification programs strengthen margarine's position in public health initiatives, especially in regions addressing micronutrient deficiencies.

- Conagra Brands Inc

- Wilmar International Ltd.

- Upfield Holdings B.V.

- Vandemoortele NV

- Associated British Foods plc

- Bunge Limited

- Puratos Group

- Richardson International Limited

- Fuji Oil Holdings Inc.

- Land O'Lakes, Inc.

- Cargill, Incorporated

- Aigremont S.A.

- Royale Lacroix S.A.

- Currimjee Group

- Goodman Fielder Pty Limited

- Remia C.V.

- Lam Soon Group

- Yildiz Holding A.?.

- BRF S.A.

- AAK AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumization of margarine through low-fat and fortified variants

- 4.2.2 Surge in industrial demand from frozen bakery manufacturers

- 4.2.3 Palm-oil-free formulations gaining traction due to sustainability regulations

- 4.2.4 Growth of plant-based spreads

- 4.2.5 Rising sunflower oil supply from ukraine boosting cost competitiveness

- 4.2.6 Expansion of private-label margarine in discount retail formats

- 4.3 Market Restraints

- 4.3.1 Trans-fat ban compliance raising reformulation costs in emerging markets

- 4.3.2 Volatility in vegetable-oil prices linked to climate-induced yield shifts

- 4.3.3 Negative health perception versus butter

- 4.3.4 Import tariff escalations on palm oil

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Hard

- 5.1.2 Soft

- 5.1.3 Liquid

- 5.2 By Fat Content

- 5.2.1 Regular (>80% Fat)

- 5.2.2 Low-Fat (40-80% Fat)

- 5.2.3 Light (<40% Fat)

- 5.3 By Oil Source

- 5.3.1 Palm-Oil-Based

- 5.3.2 Soybean-Oil-Based

- 5.3.3 Rapeseed/Canola-Oil-Based

- 5.3.4 Others

- 5.4 By End User

- 5.4.1 Retail

- 5.4.1.1 Supermarkets/Hypermarkets

- 5.4.1.2 Convenience and Grocery Stores

- 5.4.1.3 Online Retail Stores

- 5.4.1.4 Other Channels

- 5.4.2 HoReCa/Foodservice

- 5.4.3 Industrial/B2B Processing

- 5.4.1 Retail

- 5.5 By Packaging Type

- 5.5.1 Tubs and Cups

- 5.5.2 Sticks and Blocks

- 5.5.3 Sachets and Pouches

- 5.5.4 Bulk (10 kg+)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Positioning Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Conagra Brands Inc

- 6.4.2 Wilmar International Ltd.

- 6.4.3 Upfield Holdings B.V.

- 6.4.4 Vandemoortele NV

- 6.4.5 Associated British Foods plc

- 6.4.6 Bunge Limited

- 6.4.7 Puratos Group

- 6.4.8 Richardson International Limited

- 6.4.9 Fuji Oil Holdings Inc.

- 6.4.10 Land O'Lakes, Inc.

- 6.4.11 Cargill, Incorporated

- 6.4.12 Aigremont S.A.

- 6.4.13 Royale Lacroix S.A.

- 6.4.14 Currimjee Group

- 6.4.15 Goodman Fielder Pty Limited

- 6.4.16 Remia C.V.

- 6.4.17 Lam Soon Group

- 6.4.18 Yildiz Holding A.?.

- 6.4.19 BRF S.A.

- 6.4.20 AAK AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK