PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907315

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907315

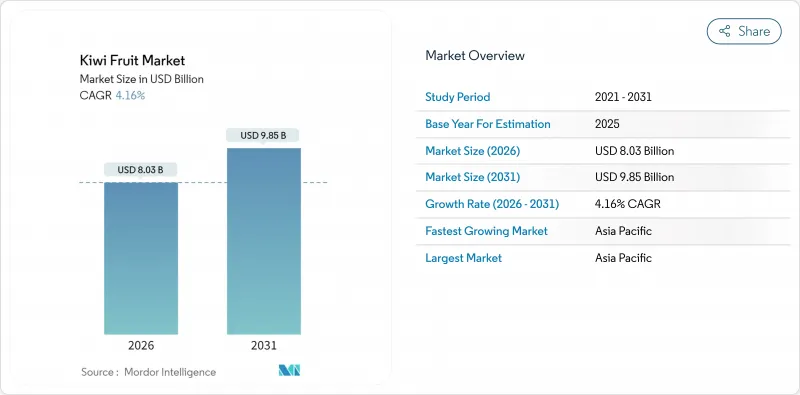

Kiwi Fruit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

kiwi fruit market size in 2026 is estimated at USD 8.03 billion, growing from 2025 value of USD 7.71 billion with 2031 projections showing USD 9.85 billion, growing at 4.16% CAGR over 2026-2031.

This growth trajectory underscores the category's transition from niche produce to core functional food as consumers prioritize vitamin-C rich options and retailers mainstream premium green, gold, and emerging red cultivars. Trade liberalization, notably the New Zealand-European Union pact that removed tariffs in 2024, is opening higher-value channels just as controlled-atmosphere logistics unlock year-round availability. Innovations such as high-density orchards and rootstock dwarfism are lifting per-hectare yields and lowering unit costs, while AI-enabled cold-chain tools reduce spoilage and expand viable shipping windows. Disease-resistant breeding programs and advanced biocontrols are mitigating PSA bacterial canker risks, supporting investor confidence, and reinforcing the kiwi fruit market's long-term fundamentals.

Global Kiwi Fruit Market Trends and Insights

Rising Demand for Vitamin C-Rich Fruits

Consumer awareness of kiwi fruit's exceptional nutritional density has intensified following clinical research demonstrating that two SunGold kiwi fruits daily can replace vitamin C supplementation while providing additional fiber and antioxidants. Clinical studies showing that two SunGold kiwis can fulfill daily vitamin C requirements have positioned the fruit as a natural alternative to supplements. At 90 mg of vitamin C per 100 g, kiwi fruit outperforms oranges and supports immune function, digestive health, and antioxidant intake. Retailers such as Whole Foods place kiwi fruit alongside other functional foods, reinforcing the fruit's wellness halo and boosting the kiwi market's household penetration in affluent urban centers.

Expansion of Commercial Orchards

High-density systems now yield 20-45 metric tons per hectare versus traditional 15-25 metric tons, widening margins and accelerating supply expansion in China, Iran, and Greece. Gene-editing breakthroughs that shorten juvenile phases promise even higher throughput, encouraging growers to convert existing acreage and fueling output gains that stabilize prices in the kiwi market. The economic incentive for expansion remains strong, with Zespri forecasting average per-hectare returns exceeding previous records across all kiwi categories.

PSA Bacterial Canker Outbreaks

Pseudomonas syringae pv. actinidiae represents the industry's most significant biological threat, with economic losses reaching hundreds of millions of dollars globally. Resistant cultivars and phage-based biocontrols are advancing, yet ongoing surveillance and cultivar renewal are required to safeguard orchards and sustain investor interest in the kiwi market. The development of Pseudomonas syringae pv. actinidiae-tolerant cultivars through traditional breeding and emerging gene-editing technologies offers long-term solutions, though implementation timelines extend beyond typical investment horizons.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Health-Conscious Consumer Segment

- Trade Liberalization Lowers Tariffs on Fresh Fruit

- Seasonal Labor Shortages During Peak Harvest

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Kiwi Fruit Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific anchors the kiwi market with a 59.02% share in 2025, driven by China's 2.4 million metric tons output and rising middle-class health focus. The region's 8.55% CAGR through 2031 reflects urbanization trends and rising disposable incomes, particularly in secondary Chinese cities where kiwi fruit adoption accelerates among health-conscious middle-class consumers. New Zealand's dominance in high-value exports continues, with the country holding 40% of the global kiwi fruit trade share. Japan remains a premium market for golden varieties, while India's emerging consumption patterns suggest significant long-term growth potential as cold chain infrastructure develops.

Europe has emerged as New Zealand's largest kiwi fruit market following the EU-NZ Free Trade Agreement implementation in May 2024, surpassing China due to tariff elimination that immediately improved price competitiveness. The Netherlands functions as the primary entry point for exotic fruits, including kiwi fruit, facilitating distribution across the continent through established logistics networks. Consumer preference studies across Italy, Spain, France, and Germany reveal growing interest in premium red-pulp varieties, suggesting market readiness for continued innovation beyond conventional green and gold offerings. The region's emphasis on sustainability and organic certification creates opportunities for producers who can meet stringent environmental standards while maintaining competitive pricing.

North America constitutes a mature but evolving arena. Canada and Mexico complete the regional picture, with Mexico's participation in the North American Free Trade Agreement (NAFTA) facilitating kiwi fruit distribution across North American markets. The region's focus on premium varieties and organic certification aligns with consumer willingness to pay higher prices for perceived quality and health benefits.

- Market Overview

- Market Drivers

- Market Restraints

- Value/Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTEL Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for vitamin C-rich fruits

- 4.2.2 Expansion of commercial orchards

- 4.2.3 Growth in health-conscious consumer segment

- 4.2.4 Trade liberalization lowers tariffs on fresh fruit

- 4.2.5 High-density planting and rootstock innovations

- 4.2.6 Controlled-atmosphere shipping lengthening shelf life

- 4.3 Market Restraints

- 4.3.1 PSA bacterial canker outbreaks

- 4.3.2 High post-harvest perishability in emerging markets

- 4.3.3 Seasonal labor shortages during peak harvest

- 4.3.4 Sudden biosecurity-driven import bans

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTEL Analysis

5 Market Size and Growth Forecasts

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.2 South America

- 5.1.2.1 Brazil

- 5.1.2.2 Argentina

- 5.1.2.3 Chile

- 5.1.3 Europe

- 5.1.3.1 Germany

- 5.1.3.2 France

- 5.1.3.3 Italy

- 5.1.3.4 United Kingdom

- 5.1.4 Asia-Pacific

- 5.1.4.1 China

- 5.1.4.2 India

- 5.1.4.3 Japan

- 5.1.4.4 Australia

- 5.1.5 Middle East

- 5.1.5.1 Turkey

- 5.1.5.2 Saudi Arabia

- 5.1.6 Africa

- 5.1.6.1 South Africa

- 5.1.6.2 Kenya

- 5.1.6.3 Egypt

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Stakeholders

7 Market Opportunities and Future Outlook