PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852033

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852033

Flight Simulator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

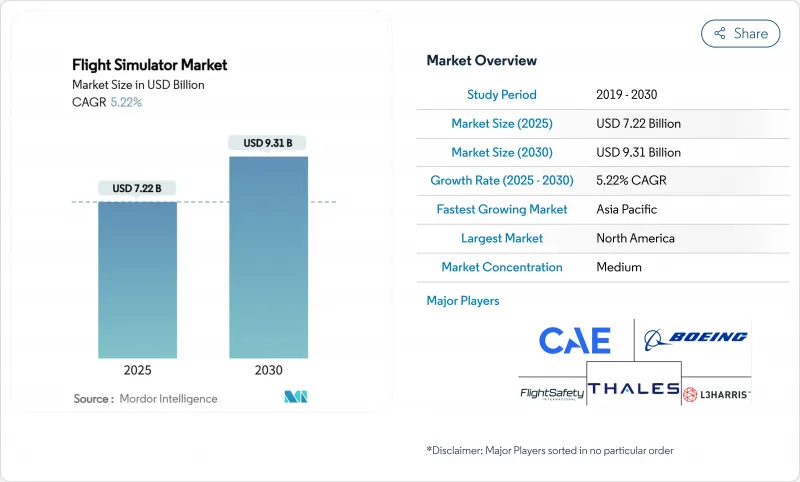

The flight simulator market size stood at USD 7.22 billion in 2025 and is projected to reach USD 9.31 billion by 2030, advancing at a 5.22% CAGR over the forecast period.

Mandatory training regulations, a widening pilot shortage, and the shift toward advanced air-mobility platforms keep demand on a steady, structural growth path even as post-pandemic catch-up spending fades. Airlines and militaries are modernizing curricula around competency-based frameworks, prompting sustained investment in immersive technologies that compress training cycles while protecting safety margins. Service-oriented business models increasingly dominate procurement, insulating operators from upfront capital burdens and allowing suppliers to monetize lifetime support. Regionally, North America maintains scale leadership, yet Asia-Pacific shows the fastest capacity build-out as India and China race to staff their record aircraft backlogs. Consolidation among top vendors is accelerating as companies seek vertical integration that bundles hardware, software, and training analytics into a single outcome-based offering.

Global Flight Simulator Market Trends and Insights

Post-COVID Pilot-Shortage Accelerating Simulator Demand

Global pilot pipelines remain stressed even after temporary hiring pauses, keeping full-motion device utilization at record levels. Regional carriers in the United States report fewer resignations, yet cannot meet long-run cockpit staffing needs as fleet growth outpaces training capacity. Australia lost 25,000 aviation workers during the pandemic, forcing Boeing Australia to double technician apprenticeship slots to maintain maintenance schedules. India's plan for more than 50 new academies underscores how emerging markets institutionalize simulators to close a projected 30,000-pilot gap within 15-20 years. These structural shortages boost recurring demand for both initial and recurrent training devices, anchoring revenue visibility across the flight simulator market.

Mandatory Upset-Recovery and MPL Curriculum Adoption

Regulators have codified upset-prevention and recovery training, transforming what was once best practice into a legal obligation. The International Civil Aviation Organization's competency-based template now guides FAA and EASA rulemaking, embedding high-fidelity simulation into core syllabi. Multi-Crew Pilot License (MPL) pathways further compress live-flight hour requirements, redirecting training budgets toward full-motion and mixed-reality devices replicating complex scenarios. Airlines adopting CBTA frameworks report measurable gains in flight-path management and crew resource skills, reinforcing simulator demand across recurrent cycles.

Supply-Chain Constraints on Visual-Display Collimators

High-fidelity Level D devices rely on precision optics built by several suppliers. Delivery of collimated display assemblies is slipping as aerospace primes pull critical components into their programs, delaying acceptance tests and inflating backlogs. An industry survey found 60% of tier-2 avionics vendors citing the B737 MAX production ramp as the single largest bottleneck dragging down deliveries across the training device ecosystem. The shortage inflates unit prices and forces OEMs to prioritize airline contracts over flight-school orders, slowing adoption of mixed-reality trainers that rely on the same projection glass. Some operators resort to interim retrofits that fall short of FAA Level-D fidelity, delaying regulatory approvals and revenue service. Unless new suppliers enter the optics niche, these constraints will cap near-term growth despite strong demand signals.

Other drivers and restraints analyzed in the detailed report include:

- Fleet Renewal Toward Composite and E-Propulsion Aircraft

- Defense Shift to Live-Virtual-Constructive Training

- Rising Cyber-Hardening Certification Costs (DO-326A)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Full-flight simulators (FFS) retained nearly half of 2024 revenue. Yet mixed/virtual-reality procedural trainers are pacing the flight simulator market with a 10.45% CAGR, signaling operator confidence in immersive technologies for non-maneuver tasks. The cost of a compact VR trainer can be a fraction of a full-motion device, enabling airlines to deploy multiple units at crew bases and cut travel overhead. Alaska Airlines' investment in Loft Dynamics VR B737 platforms exemplifies the shift, with installations planned at several hubs pending FAA sign-off.

Immersive headsets paired with motion-cueing now deliver sufficient fidelity for cockpit familiarization and emergency drills, freeing scarce Level D capacity for final proficiency checks. The FAA's joint program with Vertex Solutions and Varjo to craft XR standards should speed certification pathways, accelerating adoption across regional carriers and flight schools. As device prices fall and software ecosystems mature, mixed-reality trainers will capture larger slices of the flight simulator market share by the early 2030s.

Fixed-wing devices commanded 60.45% of the 2024 flight simulator market size on the back of commercial airline demand, but the eVTOL segment is slated for the fastest expansion at 9.55% CAGR. FAA Part 419 establishes a new type-rating regime for powered-lift, locking in simulator hours as a prerequisite for airline-style urban air-mobility operations. CAE's 700MXR leverages mixed-reality visuals, compact six-axis motion, and AI traffic generators to create urban environment scenarios that legacy helicopter simulators cannot replicate.

Rotary-wing and unmanned platforms continue to see steady replacement demand, particularly in utility missions and offshore support. Militaries also pool fighter and drone simulators into common LVC networks, boosting cross-domain proficiency and squeezing incremental efficiencies from tight defense budgets. Still, eVTOL remains the headline growth story, and suppliers able to validate training devices ahead of Type Certification are positioned to win early adopter contracts.

The Flight Simulator Market Report is Segmented by Simulator Type (Full Flight Simulator, Flight Training Device, and More), Aircraft Platform (Fixed-Wing, Rotary-Wing, Unmanned Aerial Vehicle, and Advanced Air Mobility/EVTOL), Method (Synthetic and Virtual), Solution (Hardware, Software, and Services), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 39.92% of 2024 spending thanks to entrenched airline hubs, military budgets, and FAA regulatory sway. Yet Asia-Pacific is slated to post 7.23% CAGR as Indian and Chinese carriers induct thousands of narrowbodies and retirees drive attrition across regional fleets. Domestic training capacity is racing to catch up, prompting joint ventures with global providers and government incentives for greenfield academies.

Europe remains a steady contributor, propelled by Airbus's new Toulouse campus, which will train 10,000 personnel annually and house 12 FFS. The Middle East continues to invest in hub-based training centers aligned with its global airline strategy. At the same time, Africa and South America progress more slowly as economic volatility affects capital flows. Nevertheless, local regulators are harmonizing with ICAO standards, opening the door for new training partnerships that will enlarge the addressable flight simulator market over the next decade.

- CAE Inc.

- The Boeing Company

- FlightSafety International Inc.

- L3Harris Technologies, Inc.

- Thales Group

- Collins Aerospace (RTX Corporation)

- Airbus SE

- ALSIM EMEA (HQ)

- SIMCOM Aviation Training

- Avion B.V. (Gen24 Group)

- Indra Sistemas S.A.

- Prepar3D (Lockheed Martin Corporation)

- Leonardo S.p.A.

- VirTra Inc.

- Telespazio S.p.A.

- TRU Simulation + Training Inc. (Textron Inc.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-COVID pilot-shortage accelerating simulator demand

- 4.2.2 Mandatory upset-recovery and MPL curriculum adoption

- 4.2.3 Fleet renewal toward composite and e-propulsion aircraft

- 4.2.4 Defense shift to Live-Virtual-Constructive (LVC) training

- 4.2.5 eVTOL type-rating regulations (Part 419)

- 4.2.6 AI-enabled adaptive training analytics

- 4.3 Market Restraints

- 4.3.1 Supply-chain constraints on visual-display collimators

- 4.3.2 Rising cyber-hardening certification costs (DO-326A)

- 4.3.3 Mid-tier flight schools' capital-access squeeze

- 4.3.4 Increasing availability of low-cost PC-based sims

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Simulator Type

- 5.1.1 Full Flight Simulator (FFS)

- 5.1.2 Flight Training Device (FTD)

- 5.1.3 Fixed-Base and Desktop Trainer

- 5.1.4 Mixed-/Virtual-Reality Procedural Trainer

- 5.2 By Aircraft Platform

- 5.2.1 Fixed-Wing

- 5.2.2 Rotary-Wing

- 5.2.3 Unmanned Aerial Vehicle (UAV)

- 5.2.4 Advanced Air Mobility/eVTOL

- 5.3 By Method

- 5.3.1 Synthetic

- 5.3.2 Virtual

- 5.4 By Solution

- 5.4.1 Hardware

- 5.4.2 Software

- 5.4.3 Services

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Italy

- 5.5.2.5 Russia

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CAE Inc.

- 6.4.2 The Boeing Company

- 6.4.3 FlightSafety International Inc.

- 6.4.4 L3Harris Technologies, Inc.

- 6.4.5 Thales Group

- 6.4.6 Collins Aerospace (RTX Corporation)

- 6.4.7 Airbus SE

- 6.4.8 ALSIM EMEA (HQ)

- 6.4.9 SIMCOM Aviation Training

- 6.4.10 Avion B.V. (Gen24 Group)

- 6.4.11 Indra Sistemas S.A.

- 6.4.12 Prepar3D (Lockheed Martin Corporation)

- 6.4.13 Leonardo S.p.A.

- 6.4.14 VirTra Inc.

- 6.4.15 Telespazio S.p.A.

- 6.4.16 TRU Simulation + Training Inc. (Textron Inc.)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment