PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852039

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852039

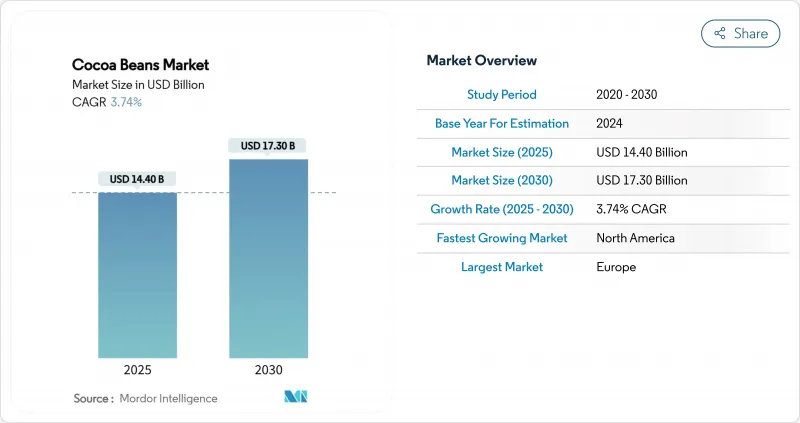

Cocoa Beans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cocoa Beans Market size is estimated at USD 14.40 billion in 2025, and is expected to reach USD 17.30 billion by 2030, at a CAGR of 3.74% during the forecast period (2025-2030).

The market maintains stable growth, supported by Europe's processing capacity, production challenges in West Africa, and increasing premium consumption in North America. Processors are investing in traceability systems to meet deforestation regulations, while implementing AI-based agricultural solutions to enhance yields in climate-vulnerable regions. The growing ready-to-drink (RTD) beverage segment expands market opportunities beyond confectionery, particularly for processors supplying polyphenol-rich ingredients.

Global Cocoa Beans Market Trends and Insights

Demand for Cocoa Beans in the Chocolate Industry

The global premium chocolate market is growing due to product innovation and advanced manufacturing technologies. Affluent consumers seek products with clean-label ingredients, traceable sourcing, minimal toxicity, and specific sensory characteristics. Manufacturers are expanding their portfolios across dark, milk, and white chocolate categories with diverse flavors, fillings, and formats, including vegan and low-sugar variants. This diversification attracts more consumers and increases cocoa bean demand. Companies continue to develop new products to capitalize on the cocoa beans market potential. In 2024, the Hershey Company, North America's largest premium chocolate manufacturer, introduced Hershey's Choco Delights, a milk chocolate bar with melt-in-mouth crunchy pieces.

Increasing Adoption of Advanced Farming Technologies

Technological advancements are transforming cocoa bean farming through improved efficiency, sustainability, and productivity. Precision farming tools, including sensors, drones, and satellite imaging, enable farmers to monitor soil health, weather conditions, and crop status, supporting informed decisions for planting, irrigation, fertilization, and pest control. Kerala Agricultural University in India introduced a cocoa bean extractor in 2023 under the ICAR AICRP project. The machine features a hopper, metallic roller assembly, rotating cylindrical strainers, and a frame assembly to optimize cocoa pod processing. This development reduces manual labor requirements, decreases worker injuries, and increases productivity while maintaining bean quality. Lutheran World Relief launched Cacao Movil in 2024, a mobile application for South American cocoa farmers that provides interactive training modules and tutorials on improved farming methods. The application enables farmers in remote areas to access agricultural information without formal training.

Disease Outbreaks and Climate Challenges in Cocoa Bean Production

Disease outbreaks significantly affect global cocoa bean production and yield. In 2023, Ghana's Western North region faced a severe outbreak of swollen shoot disease that affected 330,456 hectares out of the total 410,229 hectares, representing 81% of the area. The virus, transmitted by mealybugs, reduces cocoa yields and ultimately kills the trees, requiring complete removal and soil treatment before replanting. Additionally, black pod disease, caused by Phytophthora species, impacts cocoa production across West Africa, particularly in Ivory Coast and Ghana. The prevalent wet and humid conditions have created favorable environments for this fungal disease, which causes pod rot and substantial crop losses.

Other drivers and restraints analyzed in the detailed report include:

- Supportive Government Initiatives

- Functional RTD Cocoa Beverages Driving Polyphenol Ingredient Uptake

- Emergence of Cocoa Bean Substitutes in the Market

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Cocoa Beans Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, and More). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Europe maintains a 45% share of the global cocoa bean processing market despite pressures from high bean prices and compliance costs. Major European processors are implementing blockchain-based traceability systems, with Barry Callebaut implementing end-to-end digital tracking from farm to factory. While ports in Amsterdam and Antwerp provide cost advantages, reduced stockpiles, and increased energy costs affect profit margins. The market benefits from high consumer awareness of sustainability, with retail assortments focusing on ethically certified products, maintaining premium segment strength despite mid-range segment contraction.

North America projects a 7.2% CAGR through 2030, reflecting market diversification. The market sees increased launches of functional beverages using cocoa extracts as natural stimulants across grocery and convenience stores. U.S. processing capacity has increased by 8% annually, driven by mid-sized grinders focusing on small-batch, flavor-specific liquors for craft chocolate production. Companies respond to high cocoa prices through different strategies, such as reducing product sizes and modifying formulations, or maintaining high cocoa content to protect brand value. These approaches balance volume reduction with value growth in the cocoa bean market.

Asia-Pacific and South America are expanding their presence in the cocoa supply chain. Brazil aims to double production by 2030 through large-scale estates with mechanized operations and disease-resistant varieties. Indonesia uses its geographical advantages and government incentives to attract processors seeking proximity to its origin. This regional expansion in production and processing reduces global dependence on West African supplies. New port facilities in Para and Sulawesi reduce transportation times to Asian confectionery manufacturing centers, decreasing freight risks and ensuring better bean quality upon delivery.

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for Beans in the Chocolate Industry

- 4.2.2 Increasing Adoption of Advanced Farming Technologies

- 4.2.3 Supportive Government Initiatives

- 4.2.4 Functional RTD Cocoa Beverages Driving Polyphenol Ingredient Uptake

- 4.3 Market Restraints

- 4.3.1 Disease Outbreaks and Climate Challenges in Cocoa Bean Production

- 4.3.2 Emergence of Cocoa Bean Substitutes in the Market

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 Netherlands

- 5.1.2.3 United Kingdom

- 5.1.2.4 France

- 5.1.2.5 Belgium

- 5.1.2.6 Russia

- 5.1.3 Asia-Pacific

- 5.1.3.1 India

- 5.1.3.2 Malaysia

- 5.1.3.3 Indonesia

- 5.1.3.4 Singapore

- 5.1.3.5 Japan

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Ecuador

- 5.1.5 Middle East

- 5.1.5.1 United Arab Emirates

- 5.1.5.2 Saudi Arabia

- 5.1.5.3 Iran

- 5.1.6 Africa

- 5.1.6.1 Ghana

- 5.1.6.2 Uganda

- 5.1.6.3 Nigeria

- 5.1.6.4 Cote D'lvoire

- 5.1.6.5 Cameroon

- 5.1.1 North America

6 Market Opportunities and Future Outlook