PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852040

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852040

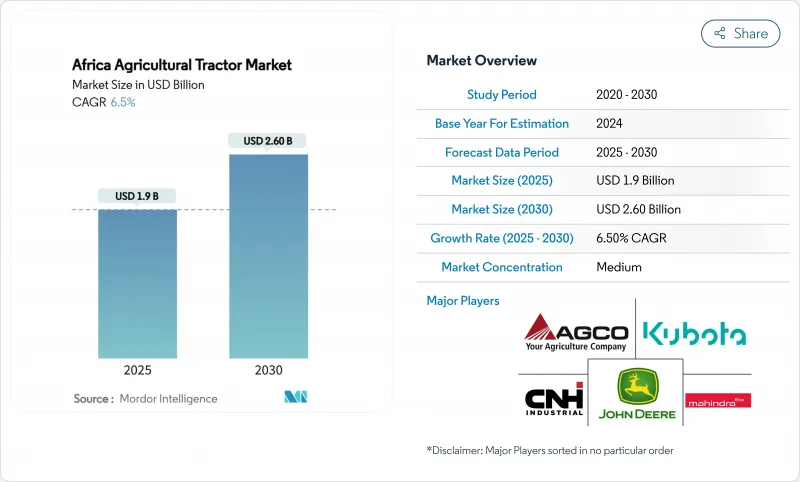

Africa Agricultural Tractor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Africa agricultural tractor market size is USD 1.9 billion in 2025 and is projected to reach USD 2.6 billion by 2030, growing at a CAGR of 6.5%.

The market growth is driven by increasing mechanization, expansion of commercial farming estates, and government support programs. The introduction of innovative financing options has reduced barriers to equipment ownership, while advancements in precision guidance and connectivity technologies encourage farmers to upgrade to higher-horsepower tractors. Digital platforms for equipment rental have improved access for smallholder farmers by increasing utilization rates. Currency fluctuations and fragmented landholdings constrain market growth, while addressing the shortage of skilled operators and maintenance personnel remains a key challenge.

Africa Agricultural Tractor Market Trends and Insights

Increasing Adoption of Farm Mechanization and Precision Agriculture

Africa currently operates fewer than two tractors per 1,000 hectares, indicating significant potential for equipment adoption. Nigeria aims to deploy tractors across 9 million hectares of new production through a public-private partnership with Hello Tractor over five years. South African commercial farmers are implementing GPS guidance and telematics systems, while Case IH eliminated subscription fees for its FieldOps application on machines purchased after October 2024 to increase usage. Kenya's Big Four Agenda supports automation trials combining mechatronics with data-driven crop management. The improved yields and reduced waste from these technologies encourage farmers to invest in higher horsepower and advanced machinery in the Africa agricultural tractor market.

Government Subsidies and Mechanization Programs

Government subsidies are reducing initial costs for farmers. Kenya's National Fertilizer Subsidy Program allocated 3.55 billion Kenyan shillings (USD 23 million) in September 2022 and distributed 3.5 million 50 kg bags by July 2023, driving demand for agricultural equipment. Nigeria has shifted from government-operated rental programs to mixed models combining private operators and pay-as-you-go leasing, which has improved equipment utilization. South Africa uses blended financing mechanisms in its agricultural master plan to provide credit to farmers, supporting export earnings that reached USD 13.7 billion in 2024. Egypt's climate-smart strategy emphasizes mechanization to address projected yield reductions by 2050. Success depends on combining financial support with private service providers and farmer training programs.

Fragmented Land Holdings Limiting Tractor Utilization Rates

Farm plot sizes continue to decrease as families subdivide their agricultural holdings, reducing equipment efficiency. Studies in Kenya show increased transportation costs and equipment downtime due to movement between scattered land parcels. Labor assessments in Eastern and Southern Africa indicate that demand surpasses supply, emphasizing access limitations rather than lack of need. While Rwanda's Land Use Consolidation program demonstrates promise, it primarily benefits farmers with adjacent plots. Though custom-hire services help address land fragmentation issues, significant fleet management costs remain. Land parcel exchanges and intensive cropping practices may enhance equipment utilization, but broad implementation requires time.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Commercial Horticulture and Export-Oriented Cash Crops

- Expansion of Agricultural Credit and Tractor Financing Facilities

- Shortage of Skilled Operators and Maintenance Technicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 35-50 HP segment holds 35.2% of the Africa agricultural tractor market share in 2024, providing an optimal cost-to-performance ratio for diverse smallholder operations. Farmers access these units through financing programs for land preparation, seeding, and transport activities. The 76-100 HP tractor segment grows at 8.2% CAGR, driven by farm consolidation and expansion of export crops. This market evolution toward higher-powered models increases revenue growth beyond unit sales volumes.

Manufacturers develop modular platforms across power segments. In 2024, Mahindra introduced the OJA series in Cape Town, featuring 20-70 HP four-wheel-drive models with digital intelligence systems, emphasizing adaptability. While below-35 HP tractors remain crucial for orchards and small plots, their growth is limited as rental fleets prefer mid-range machines. Over 100 HP tractors represent a small but growing segment, particularly in South African grain-producing regions where productivity requirements support higher investments. The varying demand across horsepower ranges reflects the correlation between mechanization adoption, farm size, and economic capacity.

Two-wheel drive (2WD) tractors account for 81.2% of the Africa agricultural tractor market size in 2024. The dominance stems from the region's predominantly flat terrain and cost considerations. Four-wheel drive (4WD) tractors are projected to grow at a 10.1% CAGR as farmers expand operations into sloped and uncultivated areas while implementing precision agriculture. This growth trend is particularly evident in South Africa, where improved rainfall patterns support agricultural expansion.

Four-wheel drive (4WD) tractors reduce soil compaction and enable the use of heavier implements required for conservation tillage practices. The Kenyan government's focus on food security supports increased adoption of 4WD tractors, which offer greater versatility for multiple field operations throughout the growing season. Telematics data demonstrating operational efficiency has prompted agricultural contractors to invest in 4WD models to enhance service reliability. This ongoing transition toward performance-focused equipment is anticipated to gradually reduce the two-wheel-drive market share.

The Africa Agricultural Tractor Market Report is Segmented by Engine Power (Less Than 35 HP, and More), by Traction Technology (2-Wheel Drive (2WD), and More), by Propulsion (Diesel, and Hybrid/Electric), by Application (Row-Crop Farming, and More), by Distribution Channel (Authorised Dealerships, and More), and by Geography (South Africa, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- AGCO Corporation

- CNH Industrial N.V.

- Deere & Company

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Argo Tractors S.p.A.

- Tractors and Farm Equipment Limited

- International Tractors Limited

- CLAAS KGaA mbH

- SDF S.p.A (Same Deutz-Fahr Tanzania Limited)

- YTO Group Corporation

- Zetor Tractors a.s.

- J C Bamford Excavators Ltd.

- Caterpillar Inc.

- Captain Tractors Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Farm Mechanization and Precision Agriculture

- 4.2.2 Government Subsidies and Mechanization Programs

- 4.2.3 Growth in Commercial Horticulture and Export-Oriented Cash Crops

- 4.2.4 Expansion of Agricultural Credit and Tractor Financing Facilities

- 4.2.5 Pay-As-You-Go Tractor Leasing via Mobile Platforms

- 4.2.6 Uptake of Low-Horsepower Autonomous Electric Tractors on Large Estates

- 4.3 Market Restraints

- 4.3.1 Fragmented Land Holdings Limiting Tractor Utilization Rates

- 4.3.2 Shortage of Skilled Operators and Maintenance Technicians

- 4.3.3 Volatile Foreign-Exchange Rates and Import Duties Inflating Tractor Purchase Prices

- 4.3.4 Grey-Market Spare-Parts Supply-Chain Disruptions

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Engine Power

- 5.1.1 Less than 35 HP

- 5.1.2 35 - 50 HP

- 5.1.3 51 - 75 HP

- 5.1.4 76 - 100 HP

- 5.1.5 Above 100 HP

- 5.2 By Traction Technology

- 5.2.1 2-Wheel Drive (2WD)

- 5.2.2 4-Wheel Drive (4WD)

- 5.3 By Propulsion

- 5.3.1 Diesel

- 5.3.2 Hybrid/Electric

- 5.4 By Application

- 5.4.1 Row-Crop Farming

- 5.4.2 Horticulture and Viticulture

- 5.4.3 Plantation and Estate Crops

- 5.5 By Distribution Channel

- 5.5.1 Authorized Dealerships

- 5.5.2 Online and Mobile-App-Based Rental Platforms

- 5.6 By Geography

- 5.6.1 South Africa

- 5.6.2 Kenya

- 5.6.3 Egypt

- 5.6.4 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AGCO Corporation

- 6.4.2 CNH Industrial N.V.

- 6.4.3 Deere & Company

- 6.4.4 Kubota Corporation

- 6.4.5 Mahindra & Mahindra Ltd.

- 6.4.6 Argo Tractors S.p.A.

- 6.4.7 Tractors and Farm Equipment Limited

- 6.4.8 International Tractors Limited

- 6.4.9 CLAAS KGaA mbH

- 6.4.10 SDF S.p.A (Same Deutz-Fahr Tanzania Limited)

- 6.4.11 YTO Group Corporation

- 6.4.12 Zetor Tractors a.s.

- 6.4.13 J C Bamford Excavators Ltd.

- 6.4.14 Caterpillar Inc.

- 6.4.15 Captain Tractors Pvt. Ltd.

7 Market Opportunities and Future Outlook