PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852045

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852045

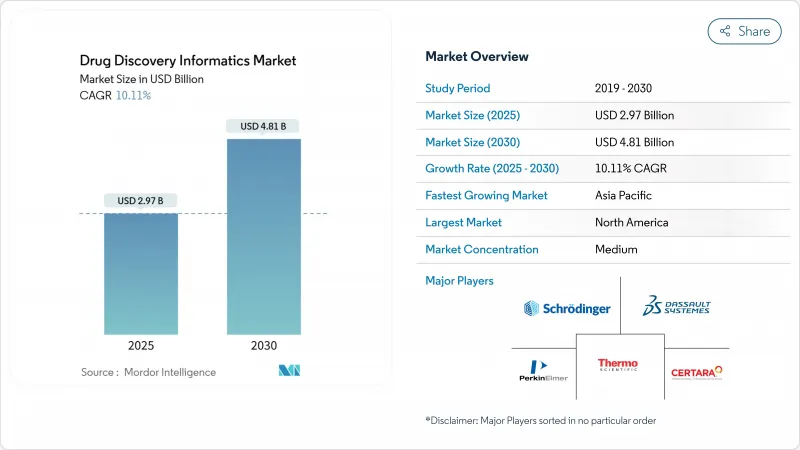

Drug Discovery Informatics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The drug discovery informatics market size is currently valued at USD 2.97 billion and is set to reach USD 4.81 billion by 2030, supported by a 10.11% CAGR during 2025-2030.

Rapid adoption of AI-driven target identification, cloud-based molecular modeling, and multi-omics integration is helping pharmaceutical companies compress discovery timelines from 10-15 years to nearly half that period. More than 93% of life-sciences technology executives intend to increase AI budgets, signalling durable demand for platforms that convert expanding genomic, proteomic, and clinical data sets into viable leads. Market momentum also reflects heightened R&D spending, regulatory initiatives that clarify AI validation pathways, and rising demand for precision medicine solutions able to match therapies to smaller patient subpopulations. Meanwhile, large-scale acquisitions-such as Siemens' USD 5.1 billion purchase of Dotmatics-underline an industry pivot toward unified, end-to-end digital research environments that cover everything from experiment capture to compliant data archiving.

Global Drug Discovery Informatics Market Trends and Insights

Advancements in Artificial Intelligence and Machine Learning

AI-powered platforms now cut lead-identification cycles by up to 50%, allowing researchers to test millions of in-silico molecules before a single synthesis run occurs. Bioptimus' USD 76 million fundraising for foundation models exemplifies the race to generate biologically aware LLMs that can predict protein folding and disease phenotypes at scale. The FDA's January 2025 draft guidance gives sponsors a risk-based rubric for evidencing AI model "credibility," unlocking faster approvals for digital experimentation workflows. Pharmaceutical-tech alliances-including Eli Lilly's collaboration with OpenAI-showcase how generative models are now embedded across discovery, preclinical, and clinical operations. Downstream, AI also shortens patient-recruitment windows by dynamically matching electronic health record cohorts to protocol-defined inclusion criteria, thereby lifting enrollment rates and lowering trial delays.

Growing Adoption of Cloud-Based Informatics Platforms

Cloud elasticity supplies on-demand high-performance computing that trims total cost of ownership for computational chemistry workloads by 60-80% compared with on-premises clusters. Novo Nordisk's use of NVIDIA's Gefion supercomputer illustrates how GPU-optimized infrastructure speeds training of bespoke protein-language models aimed at neurological indications. The FDA's electronic-health-record-to-clinical-data-capture pilot proves that standardized, cloud-hosted APIs can shrink study-startup timelines by up to 60%. To mitigate IP leakage, most biopharma organizations are deploying hybrid architectures that keep sensitive datasets in virtual private clouds while bursting large simulations to public instances located in compliant regions.

High Implementation and Licensing Costs

Enterprise-grade discovery suites can require USD 500,000-2 million in upfront fees, and services often double the bill over a 3-5-year horizon, stretching lean biotech budgets. Integration work-linking ELNs, LIMS, and high-content screening systems-pushes deployment windows to 12-18 months. Even though cloud subscriptions cut capital outlay, many firms still worry about exposing proprietary lead series in shared environments, especially where patent filings are pending. Continuous release cycles also trigger frequent upgrade spending, creating a moving target for total cost-of-ownership calculations.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Omics Data Generation and Integration

- Rising Pharmaceutical R&D Investments Globally

- Shortage of Skilled Informatics Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sequencing and target data analysis held the largest slice of the drug discovery informatics market at 35.67% in 2024, reflecting how genomics and proteomics shape early discovery campaigns. The segment remains foundational because high-throughput sequencing feeds gigantic datasets into downstream modeling and screening pipelines. Molecular modeling, although smaller, is the fastest riser with a 13.56% CAGR as transformer-based architectures such as FeatureDock outperform classical docking tools and reduce false positives in virtual screens. The drug discovery informatics market size for molecular modeling is on track to expand rapidly as quantum-assisted simulation moves from proof-of-concept to routine use in lead optimization workflows.

AI accelerates conformer generation, free-energy perturbation, and prediction of ADMET properties, tightening feedback loops between design and synthesis. Cloud resources lower entry barriers, allowing mid-tier firms to run tens of thousands of molecular dynamics trajectories overnight. Regulatory momentum further favors in-silico toxicology, as agencies accept computational evidence to waive certain animal studies. Together, these trends keep molecular modeling a coveted competency and a magnet for venture capital.

Pharmaceutical companies owned 48.34% of the drug discovery informatics market share in 2024, supported by enterprise rollouts that integrate discovery, preclinical, and early development data within a single digital thread. Collaborations such as Novartis' USD 2.3 billion agreement with Schrodinger illustrate the scale at which big pharmas now license AI platforms. At the same time, contract research organizations exhibit a 12.56% CAGR, outpacing all other customer groups. Sponsors turn to CROs for specialized analytics, cloud hosting, and algorithm validation, allowing internal teams to focus on therapeutic biology instead of IT upkeep.

CROs enhance appeal by bundling data science, regulatory writing, and decentralized trial management under unified service agreements. This integrated approach resonates with small biotechnology clients that lack deep pockets but still require compliant informatics infrastructure. University labs and government institutes also expand platform use as funding bodies increasingly demand reproducible, shareable data. Collectively, diversified end-user demand supports a balanced revenue mix, making vendor roadmaps less susceptible to any single customer cohort.

The Drug Discovery Informatics Market Report is Segmented by Function (Sequencing & Target Data Analysis, and More), End User (Pharmaceutical Companies, and More), Solution (Software and Services), Workflow (Discovery Informatics and Development Informatics), Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with 45.34% of global revenue in 2024, backed by USD 100 billion-plus annual R&D outlays and clear FDA guidance for AI model reliability. Large hardware-software alliances-such as NVIDIA's multi-partner life-sciences program announced at the 2025 JP Morgan Healthcare Conference-show that Silicon Valley and Wall Street capital continue to converge around computational discovery. Despite the region's vast talent pool, 83% of companies still report recruiting pain points, reinforcing service-provider demand.

Europe remains significant, propelled by EMA initiatives that standardize medicinal-product identifiers and improve cross-border data interoperability. Strong privacy rules under GDPR encourage development of privacy-preserving AI methods such as federated learning. While Brexit created parallel regulatory tracks, the United Kingdom sustains generous tax credits for AI research, helping domestic SMEs stay competitive.

Asia-Pacific is the fastest-growing territory with a 14.20% forecast CAGR through 2030. China's pipeline doubled to 4,391 investigational assets between 2021 and 2024, and China-to-West licensing deals hit USD 8.4 billion in 2024. Regulatory reforms curbing approval timelines and a reverse brain drain bolster local informatics demand. Japan and South Korea streamline trial governance, while India's robust CRO sector supplies cost-efficient data-management services. Singapore's biotech workforce is projected to grow 60% this decade, although talent gaps still widen as project counts rise.

- Thermo Fisher Scientific

- Dassault Systmes (BIOVIA)

- PerkinElmer

- Schrodinger

- Certara

- IBM

- Infosys

- Collaborative Care Diagnostics

- Genedata

- Charles River

- Jubilant Biosys

- Selvita

- Aragen Life Sciences

- Eurofins

- Zifo RnD Solutions

- Exscientia

- Benevolent AI

- Insilico Medicine

- Atomwise

- ChemAxon

- BioSolveIT

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Advancements In Artificial Intelligence And Machine Learning

- 4.2.2 Growing Adoption Of Cloud-Based Informatics Platforms

- 4.2.3 Expansion Of Omics Data Generation And Integration

- 4.2.4 Rising Pharmaceutical R&D Investments Globally

- 4.2.5 Government Incentives For Domestic Drug Innovation

- 4.2.6 Increasing Demand For Precision Medicine And Personalized Therapies

- 4.3 Market Restraints

- 4.3.1 High Implementation And Licensing Costs

- 4.3.2 Shortage Of Skilled Informatics Professionals

- 4.3.3 Interoperability And Data Standardization Challenges

- 4.3.4 Data Security And Intellectual Property Concerns

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power Of Suppliers

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Threat Of New Entrants

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Investment & Funding Trends

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Function

- 5.1.1 Sequencing & Target Data Analysis

- 5.1.2 Docking

- 5.1.3 Molecular Modeling

- 5.1.4 Library & Database Preparation

- 5.1.5 Other Functions

- 5.2 By End User

- 5.2.1 Pharmaceutical Companies

- 5.2.2 Biotechnology Companies

- 5.2.3 Contract Research Organizations

- 5.2.4 Other End Users

- 5.3 By Solution

- 5.3.1 Software

- 5.3.2 Services

- 5.4 By Workflow

- 5.4.1 Discovery Informatics

- 5.4.2 Development Informatics

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Thermo Fisher Scientific, Inc.

- 6.3.2 Dassault Systmes (BIOVIA)

- 6.3.3 PerkinElmer

- 6.3.4 Schrdinger, Inc.

- 6.3.5 Certara

- 6.3.6 IBM

- 6.3.7 Infosys

- 6.3.8 Collaborative Drug Discovery

- 6.3.9 Genedata

- 6.3.10 Charles River Laboratories

- 6.3.11 Jubilant Biosys

- 6.3.12 Selvita

- 6.3.13 Aragen Life Sciences

- 6.3.14 Eurofins Discovery

- 6.3.15 Zifo RnD Solutions

- 6.3.16 Exscientia

- 6.3.17 BenevolentAI

- 6.3.18 Insilico Medicine

- 6.3.19 Atomwise

- 6.3.20 ChemAxon

- 6.3.21 BioSolveIT

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment