PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852048

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852048

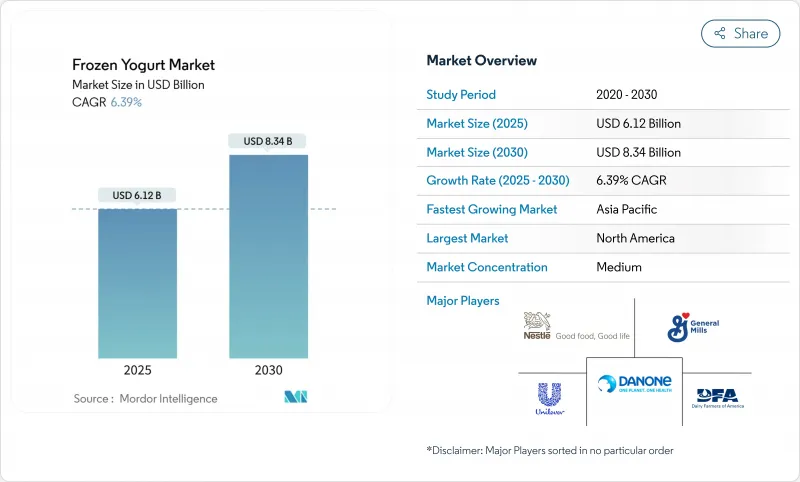

Frozen Yogurt - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The frozen yogurt market size is projected to grow from an estimated USD 6.12 billion in 2025 to USD 8.34 billion by 2030, registering a CAGR of 6.39% during the forecast period.

This growth is primarily driven by increasing consumer preference for desserts that combine indulgence with health benefits. Manufacturers are responding by incorporating probiotics, reducing sugar content, and focusing on clean-label ingredients to meet these demands. The introduction of plant-based alternatives is further expanding the market, while self-serve retail formats and easy-to-use digital ordering platforms are transforming the shopping experience. Additionally, regulatory support, such as the FDA's updated "healthy" definition set to take effect in February 2025, is encouraging the development of lower-sugar products, giving frozen yogurt a competitive advantage over traditional ice cream. The Asia-Pacific region is expected to witness the fastest growth, supported by rising urban incomes, while North America remains the leading market due to its well-established franchise networks and widespread smartphone usage, which facilitates loyalty app engagement.

Global Frozen Yogurt Market Trends and Insights

Rising Flexitarian Demand for Dairy-Alternative Desserts

Flexitarian diets are transforming the frozen yogurt market, as consumers gravitate towards plant-based options while still enjoying some dairy. This shift has spurred advancements in non-dairy frozen yogurt, now boasting flavors and textures rivaling their dairy counterparts. Research from Food Chemistry in 2024 highlights that oat-based milk substitutes, specifically those with 20% oats and 0.5% xanthan gum, offer rheological and sensory qualities on par with traditional dairy. Additionally, the incorporation of other plant-based ingredients, such as almond and coconut milk, is further diversifying product offerings to cater to varying consumer preferences. While The Good Food Institute notes a minor dip in plant-based food sales in 2023, there has been a notable uptick in governmental backing for plant-based research. Canada has pledged CAD 150 million, joined by Germany and the United Kingdom, all bolstering alternative protein research and development. This collective support fosters a thriving environment for the evolution of non-dairy frozen yogurt, with manufacturers leveraging these investments to enhance production processes and expand distribution networks.

E-commerce Expansion Increasing At-Home Consumption Frequency

Digital platforms are reshaping how consumers relish frozen yogurt, shifting from in-store purchases to the convenience of home delivery. Yogurtland's three-year growth streak, driven by its digital push, underscores the power of savvy online strategies. But this digital shift isn't just about making sales; it's about engaging customers, paving the way for tailored marketing and loyalty initiatives. Highlighting the trend's importance, the U.S. Department of Agriculture points out the growing role of online grocery shopping in accessing nutritious foods. With programs like SNAP backing online purchases, healthier dessert choices, including frozen yogurt, stand to gain. Additionally, the integration of advanced technologies such as artificial intelligence and data analytics is enabling frozen yogurt brands to better understand consumer preferences, optimize supply chains, and enhance customer experiences. This evolution is especially crucial for frozen yogurt brands aiming to broaden their reach beyond conventional retail avenues.

Seasonal Demand Fluctuations

Frozen yogurt businesses grapple with operational hurdles due to seasonal consumption patterns. Demand surges in warmer months but plummets in colder ones. This cyclical trend compels companies to devise strategies to stabilize revenue throughout the year. To counteract off-peak lulls, businesses have turned to seasonal promotions and exclusive product launches. Additionally, some companies are leveraging loyalty programs and partnerships with delivery platforms to drive consistent sales regardless of the season. The challenge of seasonality hits self-serve outlets especially hard. With their high fixed costs, these establishments must deftly manage staffing and inventory to stay profitable during leaner times. Monthly operating costs for frozen yogurt shops, especially in urban locales, range from USD 2,500-7,500 for rent, with staffing consuming 30-40% of total revenue and utilities accounting for 8-15% of monthly expenses. This financial landscape intensifies the pressure during seasonal slumps, prompting some businesses to explore diversification into complementary products, such as smoothies or hot beverages, to mitigate revenue fluctuations.

Other drivers and restraints analyzed in the detailed report include:

- Flavor Innovation and Customization

- Government Sugar-Reduction Initiatives Favoring Low-Fat Yogurt over Ice-Cream

- Limited Shelf-Life Restricts Long-Haul Exports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, dairy-based frozen yogurt commands a dominant 82.12% market share, owing to established consumer familiarity and robust supply chains. Innovations in probiotic fortification bolster this segment's strength, with research highlighting dairy-based frozen yogurt's ability to sustain probiotic viability above 8.5 log CFU/mL even after 30 days of storage. Flavor experimentation remains a key driver of consumer interest in the dairy segment, as manufacturers delve into novel combinations and functional additives to elevate both taste and nutritional value.

Although the non-dairy/plant-based segment is boasting a projected CAGR of 11.41% from 2025 to 2030, this surge is fueled by advancements in formulation technology, enhancing taste and texture. With rising lactose intolerance globally, brands are rolling out diverse products to cater to these consumers. There's a notable uptick in demand for dairy-free flavored yogurts crafted from plant-based ingredients like soy, oats, coconuts, and rice. In response, market players are unveiling innovative products to capture a larger share. A case in point: In February 2024, Danone Canada launched a new line of plant-based yogurts, crafted from Canadian pea protein, in two flavors: Key Lime and Vanilla.

In 2024, flavored frozen yogurt dominates the market, seizing a robust 83.21% share, fueled by consumers' desires for variety and indulgence. Both the ice cream and yogurt sectors are embracing a trend of flavor experimentation, with manufacturers exploring unique combinations to differentiate themselves in a saturated market. Flavored yogurts are on the rise, showcasing a diverse range of flavors and types. Offerings now include green yogurt, plant-based variants, and specialty selections like lactose-free and high-protein options, catering to a broad spectrum of consumer tastes. Industry giants like General Mills Inc., Drums Food International, and Chobani are spearheading innovations that have significantly propelled flavored yogurt consumption.

Plain frozen yogurt, while holding a modest 16.79% market share, is poised for growth, projected to expand at a CAGR of 5.61% from 2025 to 2030. This segment appeals mainly to health-conscious consumers and those seeking a customizable base for toppings. The growth is further supported by rising consumer awareness about added sugars, with 66% of US consumers actively steering clear of them, according to the International Food Information Council 2024 report . Moreover, plain varieties stand to benefit from regulatory changes, as the FDA's updated Nutrition Facts label and the new "healthy" definition lean towards lower-sugar options.

The Frozen Yogurt Market Report Segments the Industry by Product Type (Dairy-Based and Non-Dairy/Plant-Based); by Flavor (Plain and Flavored); by Distribution Channel (Off-Trade and On-Trade); by Packaging Type (Cups and Tubs, Cones and Sticks, and Others); and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America commands a 38.45% share of the frozen yogurt market, buoyed by its established self-serve retail framework and a pronounced consumer shift towards healthier dessert choices. Regulatory shifts, notably the FDA's revamped "healthy" definition set to take effect in February 2025, are tilting the competitive balance in favor of lower-sugar frozen yogurt variants. Complementing this, the U.S. Department of Agriculture champions programs that bolster access to nutritious foods, frozen yogurt included. Further underscoring the U.S. dairy sector's global prowess, the National Milk Producers Federation and U.S. Dairy Export Council revealed a robust USD 8.1 billion in dairy exports for 2023, accounting for 17% of the nation's total milk output .

Asia-Pacific is on a rapid ascent, eyeing a CAGR of 10.83% from 2025 to 2030, spurred by urbanization, rising incomes, and evolving dietary habits. Rapid urbanization, rising disposable incomes, and a shift toward healthier dessert alternatives are significantly driving this surge. The growing prevalence of lactose sensitivity and an increasing demand for probiotic-rich functional foods are further propelling consumption. Additionally, government-backed initiatives aimed at modernizing the dairy sector are playing a crucial role. The expansion of organized retail, particularly in India and Southeast Asia, as highlighted in the OECD-FAO Agricultural Outlook 2024-2033, is further accelerating market penetration.

In Europe, rising health consciousness and demand for low-fat, probiotic-rich desserts are fueling innovation, with premium players launching indulgent yet guilt-free options to attract urban millennials. South America shows steady expansion driven by growing middle-class incomes and increased availability of frozen yogurt in supermarkets, although price sensitivity limits premiumization. Meanwhile, in the Middle East and Africa, rising tourism and Western dining concepts are popularizing frozen yogurt, especially in affluent Gulf markets where mall culture drives foot traffic to frozen dessert kiosks.

- General Mills Inc,

- Nestle S.A

- Unilever Plc

- Yasso Frozen Greek Yogurt

- Dairy Farmers of America Inc.

- Groupe Lactalis SA

- HP Hood LLC

- Danone S.A.

- Lakeview Farms(Noosa Frozen Yogurt)

- Bulla Dairy Foods

- Turkey Hill Dairy

- Wells Enterprise

- Menchie's Frozen Yogurt

- Yogurtland Franchising, Inc.

- MTY Food Group (TCBY)

- Pinkberry (Kahala Brands)

- Walmart Inc,(Great Value)

- Yumilicious

- Brix Holdings(Orange Leaf Frozen Yogurt)

- Sugar Creek Foods International, Inc,(Honey Hill Farms)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising flexitarian demand for dairy-alternative desserts

- 4.2.2 Proliferation of self-serve retail formats

- 4.2.3 Product premiumization through probiotic fortification driving repeat purchases

- 4.2.4 E-commerce expansion increasing at-home consumption frequency

- 4.2.5 Flavor innovation and customization

- 4.2.6 Government sugar-reduction initiatives favoring low-fat products over ice-cream

- 4.3 Market Restraints

- 4.3.1 Seasonal demand fluctuations

- 4.3.2 Cold-chain energy costs undermining margin in developing regions

- 4.3.3 Limited shelf-life restricts long-haul exports

- 4.3.4 Limited penetration in emerging markets

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Type

- 5.1.1 Dairy-Based

- 5.1.2 Non-Dairy/Plant-Based

- 5.1.2.1 Soy

- 5.1.2.2 Almond

- 5.1.2.3 Coconut

- 5.1.2.4 Oat

- 5.1.2.5 Others

- 5.2 By Flavor

- 5.2.1 Plain

- 5.2.2 Flavored

- 5.3 By Distribution Channel

- 5.3.1 Off-Trade

- 5.3.1.1 Supermarkets and Hypermarkets

- 5.3.1.2 Convenience Stores

- 5.3.1.3 Online Retail

- 5.3.1.4 Other Distribution Channels

- 5.3.2 On-Trade

- 5.3.1 Off-Trade

- 5.4 By Packaging Type

- 5.4.1 Cups and Tubs

- 5.4.2 Cones and Sticks

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Peru

- 5.5.2.6 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Netherlands

- 5.5.3.6 Poland

- 5.5.3.7 Belgium

- 5.5.3.8 Sweden

- 5.5.3.9 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 Indonesia

- 5.5.4.6 South Korea

- 5.5.4.7 Thailand

- 5.5.4.8 Singapore

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 General Mills Inc,

- 6.4.2 Nestle S.A

- 6.4.3 Unilever Plc

- 6.4.4 Yasso Frozen Greek Yogurt

- 6.4.5 Dairy Farmers of America Inc.

- 6.4.6 Groupe Lactalis SA

- 6.4.7 HP Hood LLC

- 6.4.8 Danone S.A.

- 6.4.9 Lakeview Farms(Noosa Frozen Yogurt)

- 6.4.10 Bulla Dairy Foods

- 6.4.11 Turkey Hill Dairy

- 6.4.12 Wells Enterprise

- 6.4.13 Menchie's Frozen Yogurt

- 6.4.14 Yogurtland Franchising, Inc.

- 6.4.15 MTY Food Group (TCBY)

- 6.4.16 Pinkberry (Kahala Brands)

- 6.4.17 Walmart Inc,(Great Value)

- 6.4.18 Yumilicious

- 6.4.19 Brix Holdings(Orange Leaf Frozen Yogurt)

- 6.4.20 Sugar Creek Foods International, Inc,(Honey Hill Farms)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK