PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852050

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852050

India Instant Noodles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

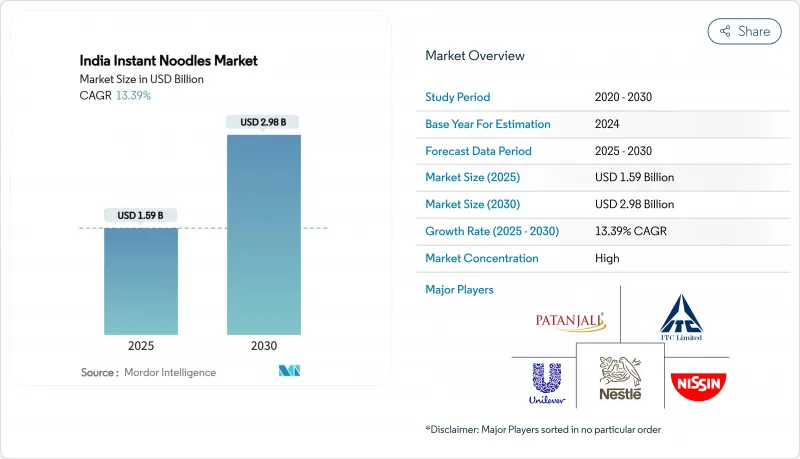

The Indian instant noodles market size stands at USD 1.59 billion in 2025 and is projected to reach USD 2.98 billion by 2030, reflecting a strong 13.39% CAGR.

Rapid urban migration, quick-commerce penetration, and a growing appetite for global flavors are broadening both the buyer base and the usage occasions for the Indian instant noodles market. Urban households now combine traditional masala preferences with adventurous Korean variants, creating parallel value and volume growth streams. Retail digitalization, led by 10-minute delivery apps, is reshaping route-to-market economics, while packaging innovation in cup formats adds premium price ceilings without material demand erosion. Simultaneously, programs focusing on fortification, millet incorporation, and sodium reduction highlight the Indian instant noodles market's blend of nutrition and convenience in its offerings.

India Instant Noodles Market Trends and Insights

Rapid urbanization and changing lifestyles

India's urban transformation is driving shifts in demand patterns, extending beyond basic convenience. This change highlights that urbanization is not only increasing consumption volumes but also redirecting spending towards premium segments. The Ministry of Statistics and Programme Implementation reported that the average monthly per capita consumption expenditure (MPCE) in urban India for 2023-24 was INR 6,996, excluding the value of items provided free through various social welfare programs. As more of India's working-age population moves to cities, this trend is accelerating, particularly in areas where traditional cooking facilities are less accessible. Urban residents, often pressed for time, are increasingly opting for quick meal solutions like instant noodles. Urbanization is not restricted to large metropolitan areas; smaller cities are also expanding, widening the customer base for instant noodles beyond conventional urban markets. According to the World Bank, India's urbanization rate reached 36.36% in 2023. This urban expansion is driving the growth of supermarkets, hypermarkets, and modern retail outlets, where instant noodles are widely available, boosting their market penetration. These urban and lifestyle changes are creating a favorable environment for instant noodles to emerge as a preferred, convenient meal option in India, driving substantial market growth.

Premiumization via Korean/K-flavour wave

The influence of Korean culture, initially rooted in entertainment, is now reshaping Indian culinary preferences, a shift often underestimated by traditional market analyses. Driven by the popularity of K-pop, K-dramas, and Korean cuisine, Indian consumers, especially millennials and Gen Z, are increasingly drawn to authentic Korean flavors, with spicy ramen varieties gaining significant traction. This rising demand has created a premium segment within the instant noodle market, where Korean-style noodles are sold at higher price points. Indo Nissin's Geki brand exemplifies this trend, appealing to consumers willing to pay more for authentic Korean spice profiles. This cultural shift not only challenges conventional perceptions of Indian taste preferences but also highlights a key insight: cultural affinity can outweigh price sensitivity in specific demographic groups. Recognizing this opportunity, major FMCG companies are capitalizing on the demand for Korean flavors. Nestle and Hindustan Unilever have introduced Korean variants to capture this growing market. In November 2023, Nestle Maggi launched barbeque-flavored Korean noodles in two variants-BBQ Chicken and BBQ Veg. Priced at INR 60 and INR 55, respectively, each 90g pack reflects the premium positioning of these products.

Health concerns about high sodium, MSG, and preservatives

With rising health consciousness, companies are focusing on balancing convenience with wellness. Regular consumption of instant noodles, especially among women, has been associated with cardiometabolic syndrome. Seasoning packets typically contain most of the sodium and additives, which can worsen health issues. The combination of high sodium and capsaicin in spicy instant noodles can further aggravate these problems. The increased risks of heart disease and diabetes linked to frequent instant noodle consumption have driven calls for reformulation. In response, companies are enhancing noodles with iron, launching reduced-sodium options, and using organic ingredients. However, these adjustments often lead to higher costs and potential changes in taste profiles, posing challenges to retaining consumer loyalty. The situation is further complicated as health-conscious consumers prioritize both convenience and transparency in ingredient lists.

Other drivers and restraints analyzed in the detailed report include:

- Product innovation and packaging

- Rising demand for convenient, ready-to-eat food

- Anti-HFSS advertising rules restricting kid-focused promos

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vegetarian SKUs held 68.37% share of the India instant noodles market in 2024 and are on track for 13.57% CAGR through 2030. Familial dietary norms and price competitiveness underpin this dominance. In 2023, about 30% of India's population adhered to a vegetarian diet, as per the India Brand Equity Foundation (IBEF). This reflects increasing awareness among Indians regarding the health and environmental benefits of plant-based diets. Producers exploit whole-grain flours and Ayurvedic herbs to extend the vegetarian palette, thereby shielding margins from commodity-meat volatility and halal certification overheads. Non-vegetarian SKUs appeal to protein seekers in metro cities yet face episodic supply disruptions.

Regional consumption patterns heighten segmentation complexity. North Indian buyers prefer paneer-flavored variants, while southern states gravitate toward curry-leaf and tomato notes. Patanjali positions its INR 15 wheat-based noodle as a "satvik" snack, reinforcing trust among cost-conscious buyers. This granular tailoring tightens shelf rotation, indicating that cultural alignment is critical for maintaining leadership in the Indian instant noodles market.

In 2024, single-serve units led the category, contributing 62.82% of its value. These packets, designed for single meals or snacks, minimize food wastage compared to multi-packs and appeal to small families, bachelors, and students. At the same time, multi-serve packs are experiencing growth, with a 13.51% CAGR, surpassing the category average. This growth is fueled by nuclear families increasingly choosing noodles as a quick dinner option. On e-commerce platforms, 4-pack and 6-pack bundles are popular due to improved shipping economics, which see an 8-10% cost reduction. This allows platforms to set free delivery thresholds, encouraging larger purchases.

From a production perspective, multi-serve packs offer significant cost advantages, with per-unit film costs decreasing by 12% compared to single-serve packs. Brands are using these savings to enhance the quality of spice mixes. For example, Tata Consumer repackaged its Schezwan range into family packs to target weekday dinner occasions. These innovations are shifting noodles from being just snacks to quasi-meals, broadening their consumption throughout the day.

The India Instant Noodles Market Report is Segmented by Product Type (Vegetarian, Non-Vegetarian), Serving (Single Serve Packs, Multi Serve Packs), Packaging (Cup/Bowl, Packet), Flavor Variant (Masala, Spicy Korean, Chinese, Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Nestle SA

- ITC Ltd. (YiPPee!)

- Nissin Foods Holdings Co., Ltd

- CG Foods (Wai Wai)

- Ulilever Plc

- Patanjali Ayurved

- Capital Foods (Smith and Jones)

- Inbisco India (Mamee)

- GSK Consumer Healthcare (Horlicks Foodles)

- Future Consumer Limited (Tasty Treat)

- Ayoni Foods (Private-label manufacturer)

- ITA Foods (MasterChow)

- Bambino Agro

- Balaji Wafers Private Limited

- Gopal Snacks Ltd

- Orkla (MTR)

- Haldiram Snacks Food Pvt. Ltd

- Veeba Foods

- Asian Thai Foods

- Supreme Nutri Grain Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid urbanization and changing lifestyles

- 4.2.2 Premiumization via Korean/K-flavour wave

- 4.2.3 Product innovation and packaging

- 4.2.4 Rising demand for convenient, ready-to-eat food

- 4.2.5 Flavor experimentation and trend adoption

- 4.2.6 Growth of e-commerce and quick-commerce platforms

- 4.3 Market Restraints

- 4.3.1 Health concerns about high sodium, MSG, and preservatives

- 4.3.2 Regulatory and food safety scrutiny

- 4.3.3 Intense competition and price wars

- 4.3.4 Anti-HFSS (high fat, salt, sugar) advertising rules restricting kid-focused promos

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter-s Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Vegetarian

- 5.1.2 Non-Vegetarian

- 5.2 By Serving

- 5.2.1 Single Serve Packs

- 5.2.2 Multi Serve Packs

- 5.3 By Packaging

- 5.3.1 Cup/Bowl

- 5.3.2 Packet

- 5.4 By Flavor Variant

- 5.4.1 Masala

- 5.4.2 Spicy (Korean)

- 5.4.3 Chinese

- 5.4.4 Others

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Convenience/Grocery Stores

- 5.5.3 Online Retail Stores

- 5.5.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle SA

- 6.4.2 ITC Ltd. (YiPPee!)

- 6.4.3 Nissin Foods Holdings Co., Ltd

- 6.4.4 CG Foods (Wai Wai)

- 6.4.5 Ulilever Plc

- 6.4.6 Patanjali Ayurved

- 6.4.7 Capital Foods (Smith and Jones)

- 6.4.8 Inbisco India (Mamee)

- 6.4.9 GSK Consumer Healthcare (Horlicks Foodles)

- 6.4.10 Future Consumer Limited (Tasty Treat)

- 6.4.11 Ayoni Foods (Private-label manufacturer)

- 6.4.12 ITA Foods (MasterChow)

- 6.4.13 Bambino Agro

- 6.4.14 Balaji Wafers Private Limited

- 6.4.15 Gopal Snacks Ltd

- 6.4.16 Orkla (MTR)

- 6.4.17 Haldiram Snacks Food Pvt. Ltd

- 6.4.18 Veeba Foods

- 6.4.19 Asian Thai Foods

- 6.4.20 Supreme Nutri Grain Private Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK