PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852052

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852052

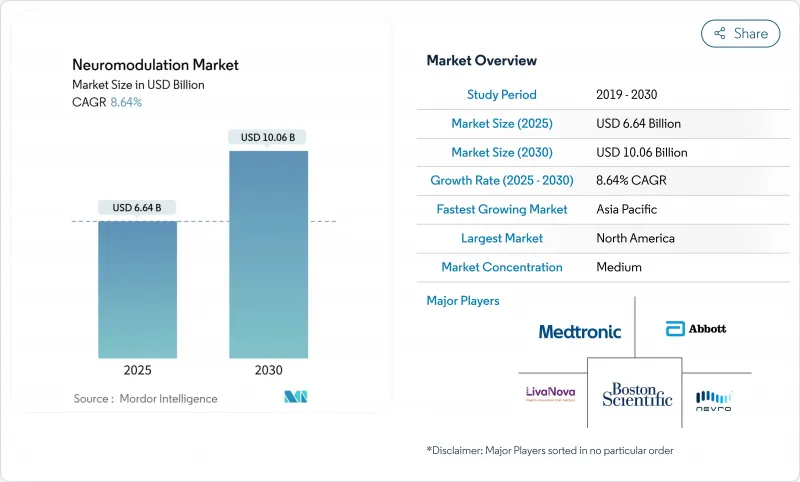

Neuromodulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The neuromodulation devices market size is valued at USD 6.64 billion in 2025 and is projected to reach USD 10.06 billion by 2030, registering a steady 8.64% CAGR.

Rising clinical adoption beyond chronic pain, the shift to rechargeable implantable pulse generators, and cloud-enabled data analytics are amplifying procedure volumes and accelerating vendor service revenues. Closed-loop spinal cord stimulators and deep-brain systems dominate because physicians can verify functional gains through real-time telemetry, reinforcing payer confidence. Regional expansion is equally pivotal: while North America still represents about 45% of global demand, Asia-Pacific centers are booking double-digit case growth, encouraged by universal insurance reforms and an ageing population demanding drug-free pain relief. Competitive moves now hinge on integrated hardware-software platforms; manufacturers that combine neuromodulation with remote programmers and analytics are shortening programming sessions for clinicians and expanding the Neuromodulation Devices market into outpatient pathways.

Global Neuromodulation Market Trends and Insights

Global Rise in Chronic Neurological and Pain Disorders

Escalating prevalence of chronic pain, migraine, and movement disorders enlarges the patient pool for the Neuromodulation Devices market every year. Neurological burden now affects nearly 1.7 billion people worldwide. North American clinics increasingly position spinal cord stimulation ahead of long-term opioid therapy, generating double-digit unit growth. High-frequency repetitive transcranial magnetic stimulation delivers measurable relief for fibromyalgia patients, reinforcing non-invasive credibility. Hospitals starting neuromodulation programs attract referrals from neighboring districts, increasing market coverage without incremental promotion. Earlier implantation correlates with superior functional outcomes, a finding likely to shift future treatment guidelines toward earlier device placement.

Technological Advancements in Implantable and Non-Invasive Platforms

Engineering progress centers on closed-loop control, energy efficiency, and miniaturization, all of which elevate patient experience. The shape-morphing cortical-adhesive sensor dynamically tailors stimulation parameters and avoids artifacts that historically hindered seizure management. Optoelectronic vagus-nerve implants now use optical fibers rather than metallic leads, enabling MRI scans without device explantation. These hardware-software ecosystems shorten programming visits, extend battery life, and support remote parameter updates, which are crucial where patient travel remains a barrier. Competitive differentiation is moving from waveform counts to data management, accelerating M&A for software capabilities.

High Initial Costs of Devices and Procedures

Implant purchase prices ranging from USD 10,000-40,000 limit adoption in economies where out-of-pocket payments dominate. Yet cost-utility analyses show spinal cord stimulation offsets drug and hospitalization expenses within three years, validating high upfront spending. Vendors now offer leasing or pay-per-use models, mirroring software-as-a-service pricing. Rechargeable generators deliver decade-long lifespans, sparing patients from repeat surgeries and lowering anesthesia risks, which helps procurement teams justify purchases on total-ownership rather than sticker cost. Nonetheless, low-income regions still face affordability gaps, suggesting a future role for philanthropic funding or tiered pricing.

Other drivers and restraints analyzed in the detailed report include:

- Broader Clinical Indications and Regulatory Approvals

- Growing Preference for Minimally Invasive, Drug-Free Solutions

- Complex Global Regulatory Approval Processes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Internal stimulators accounted for 70.0% of the Neuromodulation Devices market in 2024, reflecting strong payer coverage for closed-loop spinal cord and deep-brain platforms. Spinal cord stimulation alone delivered nearly 40.0% of total revenue, underpinned by multicenter proof of chronic back-pain relief. Responsive neurostimulation, optimized for epilepsy, dynamically adjusts pulses in milliseconds, achieving seizure reduction that warrants premium pricing. The Neuromodulation Devices market size for internal platforms is projected to grow steadily alongside broader coverage for adaptive algorithms.

External technologies advance rapidly in transcranial magnetic and remote electrical neuromodulation. Reimbursement delays temper overall volumes, yet streamlined office-based protocols attract primary-care referrals. Manufacturers are building hybrid portfolios that span implantables and wearables, requiring supply-chain shifts toward both sterile implant kits and consumer-friendly packaging. Early adopters that master inventory duality can mitigate cannibalization risk and widen channel reach.

The Neuromodulation Market Report is Segmented by Technology (Internal Neuromodulation and External Neuromodulation (Non-Invasive)), Application (Pain Management, and More), End-User (Hospitals & Ambulatory Surgical Centers, Clinics & Physiotherapy Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

Geography Analysis

North America led the Neuromodulation Devices market with a solid 45.0% revenue share in 2024, buoyed by comprehensive insurance coverage and a mature clinical research infrastructure. FDA breakthrough designations shorten development timelines, allowing firms to commercialize earlier and recoup capital faster. Nationwide opioid-stewardship programs further raise neuromodulation's profile as a front-line option. Academic-industry collaborations focus on AI-guided parameter optimization, turning the region into a live test bed for algorithmic neuromodulation.

Europe is the second-largest contributor and demonstrates a clear tilt toward non-invasive modalities. Germany and France dominate in deep-brain stimulation, whereas the United Kingdom's NICE endorses repetitive transcranial magnetic stimulation for depression. Cross-border healthcare rules enable patients to seek specialized procedures abroad, driving traffic to centers of excellence. Procurement teams increasingly demand lifecycle carbon-footprint disclosures, favoring rechargeable generators. Suppliers offering cloud patient portals gain competitive advantage as digital care pathways mature.

Asia-Pacific is forecast to post the fastest 9.9% CAGR between 2025 and 2030, reflecting sizable unmet need and progressive reimbursement policies. China's tier-one hospitals invest heavily in spinal-cord stimulation suites, and Japan's insurance now covers responsive neurostimulation for drug-resistant epilepsy. Indian providers, dealing with high out-of-pocket spending, pilot installment payment plans. The ASEAN Medical Device Directive promises partial regulatory harmonization, potentially trimming market-entry timelines by up to 18 months. As local contract manufacturers increase component capacity, multinationals mitigate geopolitical risks while tapping growth in the Neuromodulation Devices market.

- Abbott Laboratories

- Boston Scientific

- Medtronic

- Nevro

- NeuroPace

- NeuroSigma

- Neuronetics

- LivaNova

- Nuvectra

- Synapse Biomedical

- Soterix Medical

- MicroTransponder Inc.

- Inspire Medical Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Global Prevalence of Chronic Neurological and Pain Disorders

- 4.2.2 Continuous Technological Innovations in Implantable and Non-Invasive Neuromodulation Platforms

- 4.2.3 Expansion Of Approved Clinical Indications and Regulatory Clearances for Neuromodulation Therapies

- 4.2.4 Rising Patient and Physician Preference for Minimally Invasive, Drug-Sparing Treatment Alternatives

- 4.2.5 Accelerating Investments, M&A Activity and Strategic Partnerships Across the Neuromodulation Value Chain

- 4.2.6 Improving Reimbursement Frameworks and Overall Healthcare Expenditure on Neurotechnology

- 4.3 Market Restraints

- 4.3.1 High Upfront Capital Cost of Devices and Implantation Procedures

- 4.3.2 Stringent And Heterogeneous Regulatory Approval Pathways Worldwide

- 4.3.3 Limited Availability of Specialized Neurosurgeons and Trained Implant Specialists

- 4.3.4 Safety Concerns, Device Malfunctions and Associated Adverse Event Recalls

- 4.4 Regulatory & Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technology

- 5.1.1 Internal Neuromodulation

- 5.1.1.1 Spinal Cord Stimulation (SCS)

- 5.1.1.2 Deep Brain Stimulation (DBS)

- 5.1.1.3 Vagus Nerve Stimulation (VNS)

- 5.1.1.4 Sacral Nerve Stimulation (SNS)

- 5.1.1.5 Gastric Electrical Stimulation (GES)

- 5.1.1.6 Other Internal Neuromodulation

- 5.1.2 External Neuromodulation (Non-invasive)

- 5.1.2.1 Transcutaneous Electrical Nerve Stimulation (TENS)

- 5.1.2.2 Transcranial Magnetic Stimulation (TMS)

- 5.1.2.3 Other External Neuromodulations

- 5.1.1 Internal Neuromodulation

- 5.2 By Application

- 5.2.1 Pain Management

- 5.2.2 Parkinson's Disease

- 5.2.3 Epilepsy

- 5.2.4 Depression

- 5.2.5 Dystonia

- 5.2.6 Other Applications

- 5.3 By End-user

- 5.3.1 Hospitals & Ambulatory Surgical Centers

- 5.3.2 Clinics & Physiotherapy Centers

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Abbott

- 6.4.2 Boston Scientific Corporation

- 6.4.3 Medtronic PLC

- 6.4.4 Nevro Corporation

- 6.4.5 Neuropace Inc.

- 6.4.6 Neurosigma Inc.

- 6.4.7 Neuronetics Inc.

- 6.4.8 LivaNova PLC

- 6.4.9 Nuvectra

- 6.4.10 Synapse Biomedical Inc.

- 6.4.11 Soterix Medical

- 6.4.12 MicroTransponder Inc.

- 6.4.13 Inspire Medical Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment