PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852062

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852062

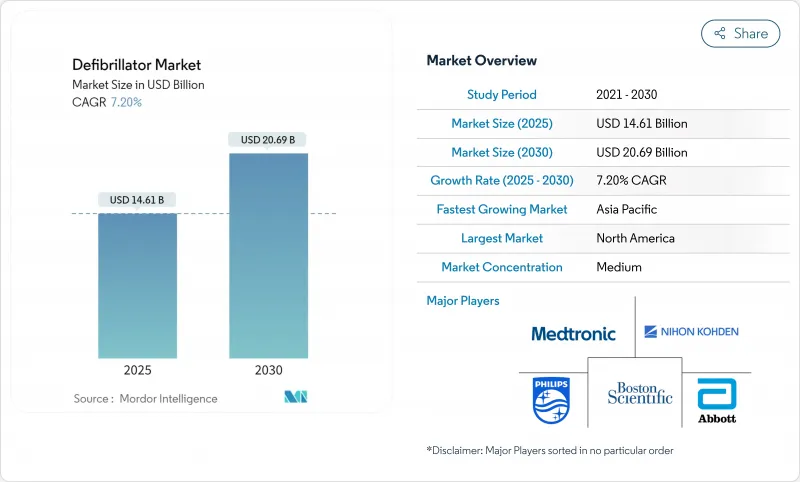

Defibrillator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The defibrillator market size stood at USD 14.61 billion in 2025 and is forecast to reach USD 20.69 billion by 2030, advancing at a 7.20% CAGR during the period.

Sustained incidence of sudden cardiac arrest, rapid adoption of AI-enabled devices, and wider public-access programs keep demand resilient despite supply-chain headwinds. Device makers are lengthening battery life, embedding cloud connectivity, and leaning on predictive analytics to differentiate. Payers and regulators in high-income countries increasingly reimburse cloud monitoring, while emerging markets boost baseline healthcare outlays to narrow treatment gaps. Competitive intensity rises as innovators secure FDA clearances for extravascular implantation and patch-based wearables, signaling a new product cycle poised to accelerate the defibrillator market over the next five years.

Global Defibrillator Market Trends and Insights

Rising Prevalence of Cardiovascular Diseases

Cardiovascular conditions drive two-thirds of deaths across Asia-Pacific, prompting governments to scale emergency response capacity and underpinning sustained growth of the defibrillator market. Ischemic heart disease mortality climbs even as cardiomyopathy prevalence lags Western levels, underscoring unmet prevention needs and stimulating long-run device demand. Regional health budgets rise faster than the OECD mean, though outlays still average only USD 600 per person, offering significant headroom for defibrillator penetration. Aging demographics and accelerated urban lifestyles heighten arrhythmic risk, further cementing long-term volume expansion. Workforce training gaps amplify the opportunity: in China only 17.5% of nurses report adequate AED knowledge, pointing to parallel demand for education and hardware .

Technological Advancements in ICDs and AEDs

FDA approval of Medtronic's Aurora EV-ICD in 2023 shifted the defibrillator market toward extravascular implantation that avoids venous complications yet delivers antitachycardia pacing, achieving 98.7% effectiveness. Battery longevity extends about 60%, improving lifetime economics for providers and patients. AI algorithms now curtail false alarms; Element Science's Jewel Patch wearable won clearance in 2025 after demonstrating high compliance and low inappropriate-shock rates. Modular architectures gain traction, with Boston Scientific reporting 97.5% complication-free performance for its leadless-pacemaker/defibrillator combination. Collectively these innovations reinforce premium pricing and stimulate replacement demand, supporting mid-single-digit unit growth across the defibrillator market.

Stringent Multi-Region Regulatory Frameworks

The EU Medical Device Regulation (MDR 2017/745) obliges recertification of legacy products, with half of manufacturers planning portfolio cuts and roughly one-third of devices slated for exit owing to cost and timeline burdens. ZOLL's sequential MDR approvals for its AED line illustrate the added year or more now needed for market entry. Across the Atlantic the U.S. Food and Drug Administration requires software bills of materials and vulnerability reporting for "cyber devices," adding documentation layers that elongate clearance cycles. Divergent rule sets compel dual certification efforts, straining budgets and slowing innovation throughput in the defibrillator market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Public-Access Defibrillation Programs

- AI-Enabled Wearable Defibrillators Bridge Post-MI Care Gaps

- High Total Cost of ICD Implantation & Follow-Ups

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Implantable cardioverter defibrillators held 71.54% of defibrillator market share in 2024, reaffirming physician familiarity and robust clinical evidence. Adoption benefits from Medtronic's extravascular approach, which not only eliminates venous leads but also extends battery life, fostering replacement demand and enlarging the defibrillator market size for implantables. Subcutaneous systems, now feasible even in toddlers, widen addressable populations. Cardiac resynchronization therapy defibrillators integrate ultrasound-based pacing and promise lower complication loads, supporting steady growth among heart-failure cohorts.

External defibrillators, while contributing a smaller base, are projected to compound at 7.84% through 2030, reflecting public-access expansion and AI-driven form factors. Wearable cardioverter units such as the FDA-cleared Jewel Patch enhance compliance by suppressing nuisance alarms and enabling barefoot therapy, factors that deepen user adoption. Drone-delivered automated external devices could raise survival from 34% higher four-minute response improvement scenarios, underscoring logistical innovation now shaping the defibrillator market. The segment also gains from subscription models that bundle connectivity, maintenance, and analytics, making budgeting predictable for municipalities and enterprises.

The Defibrillator Market Report is Segmented by Product (Implantable Cardioverter Defibrillator, and More), End User (Hospitals & Cardiac Centers, Home Care Settings, Other End Users), Patient Type (Adult Patients, Pediatric Patients), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America led with 44.28% of defibrillator market share in 2024, supported by integrated emergency systems and reimbursement clarity. King County's 5,000-plus registered AEDs linked to dispatch exemplify best-practice public-access integration. The FDA's prompt clearance of innovations like the Aurora EV-ICD and Jewel Patch cultivates early adoption, reinforcing regional leadership. Drone pilots in North Carolina cut response times to 4 minutes, hinting at further survival gains once scaled.

Europe sustains moderate growth as MDR compliance stabilizes. Although roughly one-third of devices risk discontinuation, successful certifications such as ZOLL's AED line prove that committed manufacturers can navigate the process. Remote monitoring uptake remains uneven: Germany and the UK reimburse connectivity, whereas Belgium and Spain lag, tempering defibrillator market penetration. Netherlands-based drone-AED projects highlight technological enthusiasm, and mandated installations in South Australia mirror the regulatory push for accessibility.

Asia-Pacific exhibits the highest CAGR at 8.36%, propelled by healthcare expenditure growth above OECD averages despite lower baseline spends. Training deficits are sizable-only 17.5% of Chinese nurses feel AED-ready-but national curricula and corporate upskilling initiatives aim to bridge gaps [DOI.ORG]. ICD adoption still trails Western benchmarks due to cost constraints, yet expanding insurance coverage and local manufacturing-e.g., MicroPort's European catheter rollout-should ease affordability and bolster the defibrillator market . Venture funding volatility poses a short-term challenge, but demographic shifts and policy support suggest durable demand through 2030.

- Abbott Laboratories

- Boston Scientific

- Medtronic

- Koninklijke Philips

- ZOLL Medical Corp. (Asahi Kasei)

- Stryker Corp. (Physio-Control)

- BIOTRONIK

- Nihon Kohden

- LivaNova

- MicroPort CRM

- Kestra Medical Technologies

- Mindray

- Defibtech

- Cardiac Science

- Bexen Cardio

- Schiller

- CU Medical Systems Inc.

- Element Science

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Cardiovascular Diseases

- 4.2.2 Technological Advancements In ICDS and AEDS

- 4.2.3 Expansion Of Public-Access Defibrillation Programs

- 4.2.4 AI-Enabled Wearable Defibrillators Bridge Post-MI Care Gaps

- 4.2.5 Cloud-Connected Defibrillators Enable Subscription Models

- 4.2.6 Drone-Delivered Aed Networks Cut Rural Response Times

- 4.3 Market Restraints

- 4.3.1 Stringent Multi-Region Regulatory Frameworks

- 4.3.2 High Total Cost Of ICD Implantation & Follow-Ups

- 4.3.3 Cyber-Security Risks For Connected Defibrillators

- 4.3.4 Lithium-Supply Pressure On Battery Lifecycles

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value & Volume)

- 5.1 By Product

- 5.1.1 Implantable Cardioverter Defibrillator (ICD)

- 5.1.1.1 Transvenous ICDs (T-ICDs)

- 5.1.1.1.1 Single-Chamber

- 5.1.1.1.2 Dual-Chamber

- 5.1.1.2 Subcutaneous ICDs (S-ICDs)

- 5.1.1.3 Cardiac Resynchronization Therapy-D (CRT-D)

- 5.1.2 External Defibrillator

- 5.1.2.1 Automated External Defibrillators (AEDs)

- 5.1.2.1.1 Semi-Automated

- 5.1.2.1.2 Fully-Automated

- 5.1.2.2 Manual External Defibrillators

- 5.1.2.3 Wearable Cardioverter Defibrillators (WCDs)

- 5.1.1 Implantable Cardioverter Defibrillator (ICD)

- 5.2 By End User

- 5.2.1 Hospitals & Cardiac Centers

- 5.2.2 Home Care Settings

- 5.2.3 Other End Users

- 5.3 By Patient Type

- 5.3.1 Adult Patients

- 5.3.2 Pediatric Patients

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Medtronic PLC

- 6.3.4 Koninklijke Philips N.V.

- 6.3.5 ZOLL Medical Corp. (Asahi Kasei)

- 6.3.6 Stryker Corp. (Physio-Control)

- 6.3.7 BIOTRONIK SE & Co. KG

- 6.3.8 Nihon Kohden Corporation

- 6.3.9 LivaNova PLC

- 6.3.10 MicroPort CRM

- 6.3.11 Kestra Medical Technologies

- 6.3.12 Mindray Medical International Ltd.

- 6.3.13 Defibtech LLC

- 6.3.14 Cardiac Science Corporation

- 6.3.15 Bexen Cardio

- 6.3.16 Schiller AG

- 6.3.17 CU Medical Systems Inc.

- 6.3.18 Element Science

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment