PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852066

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852066

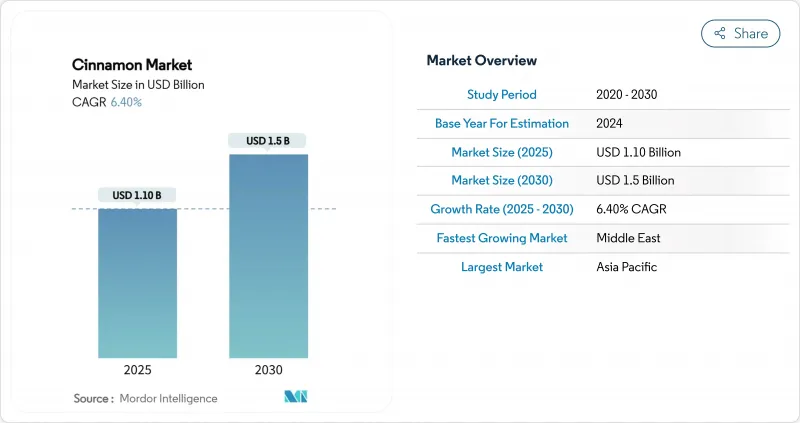

Cinnamon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cinnamon market size reached USD 1.1 billion in 2025 and is projected to advance at a 6.4% CAGR to generate USD 1.5 billion by 2030.

Growth is being propelled by steady household and foodservice usage in the Asia-Pacific region, an upsurge in nutraceutical launches focused on blood glucose management, and the premiumization of clean-label bakery and plant-based dairy products. Ready-to-drink functional beverages that contain cinnamon are broadening the spice's appeal among Gen Z consumers, while deeper e-commerce penetration is enabling direct-to-consumer brands to monetize long-tail flavor preferences in mature economies. Policy catalysts such as World Trade Organization (WTO) tariff reductions and the commercialization of cinnamon-leaf-oil-based antimicrobial packaging further widen downstream opportunities. The cinnamon market faces persistent pest-linked yield losses, El Nino-driven price swings, and growing scrutiny of coumarin safety in cassia varieties, all of which can tighten raw-material availability and erode farmer income.

Global Cinnamon Market Trends and Insights

Expanding Nutraceutical Launches Positioned Around Blood-Glucose Control

Cinnamon's polyphenolic compounds that modulate insulin sensitivity have elevated its profile in supplements targeting type-2 diabetes management. In 2025, North American brands introduced clinically dosed Ceylon-capsule lines that won dietitian endorsements, while Indian ayurvedic firms blended cinnamon extracts with fenugreek to bolster efficacy. Such launches position cinnamon-based nutraceuticals as affordable adjuncts to mainstream antihyperglycemic therapies, which drives recurring demand across pharmacy and online channels. Emerging regulatory clarity around permissible daily coumarin intake is also guiding marketers toward differential positioning of cassia versus true cinnamon formats. The expanding elderly population in China and Indonesia widens the addressable consumer base, allowing the cinnamon market to capture health-oriented spend that previously went to ginseng or bitter melon supplements. The combined effect lifts average selling prices and cushions farmers from volatility in commodity-grade bark sales.

Rising Demand for Clean-Label Flavoring in Plant-Based Dairy Alternatives

Oat, almond, and coconut milk processors rely on cinnamon's warm sensory profile to mask legume-based off-notes without artificial stabilizers. Formulators are replacing caramel coloring with cinnamon to deepen tone naturally, securing Non-Genetically Modified Organism (Non-GMO) project verification in the United States and Nutri-Score A ratings in the European Union. Ingredient-solution providers such as Givaudan recently offer micro-encapsulated cinnamon emulsions tailored to high-shear Ultra-High Temperature (UHT) lines, easing application in aseptic cartons. Retail scan data from 2025 shows that North American barista oat milks containing cinnamon grew 38% faster than plain variants, underscoring their differentiation power. As plant-based milk penetration in foodservice chains accelerates, bulk demand for sustainably certified cinnamon is set to escalate, reinforcing upstream investment in traceability.

Persistent Pest-Related Yield Losses in Smallholder Plantations

Shoot borer infestations cause bark recovery rates to fall by up to 15% in Indonesian and Sri Lankan plantations, directly constraining supply. Limited access to bio-pesticides and fragmented extension services hamper smallholders' ability to implement integrated pest management. The resulting quality downgrades invite steeper reject rates from importers, forcing exporters to discount prices. Unless regional governments expedite farmer-training programs and subsidize resistant cultivars, pest pressures will restrain the cinnamon market from achieving its full production potential. Climate change exacerbates pest pressure through altered precipitation patterns and temperature ranges that favor insect reproduction cycles. The concentration of cinnamon production in specific geographic regions amplifies supply chain risks when pest outbreaks occur simultaneously across major growing areas.

Other drivers and restraints analyzed in the detailed report include:

- Innovations in Functional Beverage Formats

- Robust Growth of E-Commerce Spice Retailing in Emerging Economies

- Volatile Farm-Gate Prices due to El Nino-Linked Supply Shocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Cinnamon Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, South America, and More). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific held the leading regional position with 45% of the 2024 value, driven by entrenched culinary traditions and the presence of major producing nations. Indonesia exported 138,000 metric tons in 2024, a 4% rise over 2023, while Sri Lanka recorded a 7% uptick in Ceylon shipments after mechanized peeling pilots improved productivity. Rapid urbanization in India and China continues to elevate processed snack consumption, reinforcing baseline demand. The region is projected to be supported by government incentives for spice-processing zones and expanding export financing facilities.

The Middle East is forecast as the fastest-growing market at a 10.0% CAGR through 2030, buoyed by premium bakery launches, tourism-driven foodservice spending, and tariff reductions that lower shelf prices. Middle East bakery chains have started marketing Turkish-style cinnamon rolls with date syrup, elevating per-capita cinnamon intake. Meanwhile, North America posted a 7.5% regional CAGR as health-adjacent product development broadens cinnamon's seasonality, and direct-to-consumer spice firms leverage Amazon's fulfillment ecosystem for next-day deliveries.

Europe's mature consumption base continues to expand at 6.9% CAGR amid regulatory pressure on coumarin. Major retailers are diversifying SKUs (Stock Keeping Units) toward Ceylon and certified organic lines to meet consumer safety expectations. Africa and South America register high-single-digit growth trajectories fueled by nascent industrial bakery sectors and growing disposable incomes. Trade routes through the port of Durban and Santos are being optimized with cold-chain capacity, mitigating quality losses that previously discouraged importers and ensuring the cinnamon market's expansion in these geographies.

- Market Drivers

- Market Restraints

- Value/Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTEL Analysis

- List of Key Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Expanding nutraceutical launches positioned around blood-glucose control

- 4.1.2 Rising demand for clean-label flavoring in plant-based dairy alternatives

- 4.1.3 Innovations in functional beverage formats

- 4.1.4 Robust growth of e-commerce spice retailing in emerging economies

- 4.1.5 WTO (World Trade Organization) tariff reductions on spice imports in key consuming nations

- 4.1.6 Commercial scale-up for active food packaging

- 4.2 Market Restraints

- 4.2.1 Persistent pest-related yield losses in smallholder plantations

- 4.2.2 Volatile farm-gate prices due to El Nino-linked supply shocks

- 4.2.3 Rising coumarin-related safety scrutiny on cassia varieties

- 4.2.4 Trade-finance bottlenecks for SMEs (Small and Medium Enterprise) after Basel IV implementation

- 4.3 Value/Supply-Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 PESTEL Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 Spain

- 5.1.2.3 France

- 5.1.2.4 United Kingdom

- 5.1.2.5 Russia

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 India

- 5.1.3.3 Indonesia

- 5.1.3.4 Sri Lanka

- 5.1.3.5 Japan

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.4.3 Peru

- 5.1.5 Middle East

- 5.1.5.1 Saudi Arabia

- 5.1.5.2 United Arab Emirates

- 5.1.6 Africa

- 5.1.6.1 South Africa

- 5.1.6.2 Madagascar

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Key Stakeholders

7 Market Opportunities and Future Outlook