PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852067

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852067

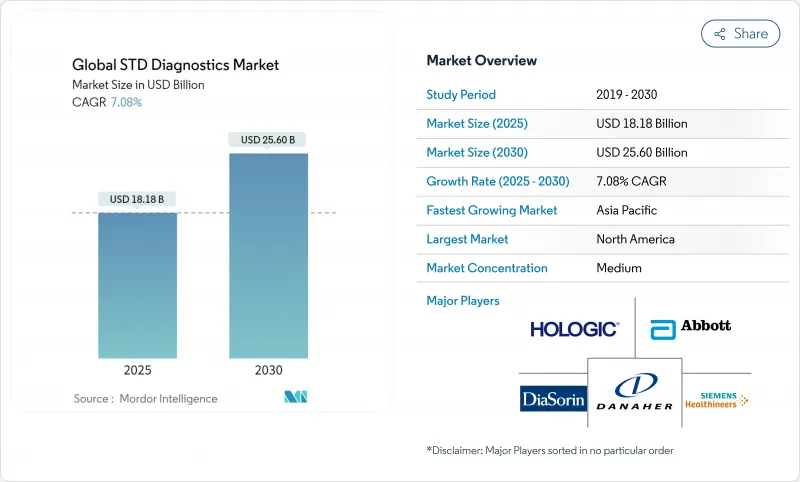

Global STD Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The STD diagnostics market is valued at USD 18.18 billion in 2025 and is projected to reach USD 25.60 billion by 2030, advancing at a 7.08% CAGR.

Growth is propelled by an 80% surge in U.S. syphilis cases-exceeding 207,000 confirmed infections in 2022-and the creation of a federal task force to curb the trend. The World Health Organization now tracks 8 million global syphilis cases for 2022, underscoring the gap to its 2030 goal of a 90% reduction in adult infections. Overall STI incidence has climbed 58.38% since 1990, with the sharpest burdens in low socio-demographic regions. Regulatory momentum continues as the FDA reclassified nucleic-acid STI assays to Class II in May 2025, shortening approval cycles for innovative platforms. Insurers updated preventive-service tables in May 2024 to guarantee zero-cost STD screening, expanding routine testing volumes. Yet 68% of individuals still cite shame and 85% fear provider judgment, fueling demand for home-based and digitally connected diagnostics.

Global STD Diagnostics Market Trends and Insights

Rising Global STD Incidence

WHO confirmed 374 million new curable STI cases worldwide in 2024, with syphilis alone reaching 8 million infections. Southeast Asia's reproductive-age women posted an 11.6% prevalence in 2025, amplifying diagnostic needs. Younger cohorts remain at disproportionate risk; people aged 15-24 represent one-half of all new infections, intensifying calls for universal screening. A 58.38% rise in STI cases since 1990 underscores the chronic nature of the burden. This epidemiological pressure keeps routine testing volumes high and sustains revenue streams independently of macroeconomic cycles.

Government-Funded Screening Programmes

In 2024, the U.S. CDC endorsed doxycycline post-exposure prophylaxis, reframing testing as preventive care. Federal coordination improved with formation of a National Syphilis Task Force that sets uniform protocols across states. Private insurers followed suit; a 2025 Blue Cross NC policy now reimburses individual STI codes rather than bundled panels, enhancing provider economics. Worldwide, WHO's revised HIV testing guidance adds dual HIV/syphilis kits and self-testing to essential-care lists. These measures institutionalize STD testing as a core health-system function, ensuring predictable demand.

Social Stigma & Low Awareness

A 2025 mixed-methods study found that 68% of potential test seekers defer care because of shame, and 85% fear provider judgment. Cultural norms intensify hesitancy; qualitative research in the U.K. Black Caribbean community revealed stigma rooted in faith-based purity beliefs. Even cost-free services go under-used in rural U.S. counties where 70% cite distance as a deterrent. Low disclosure rates prolong transmission chains, sustaining disease reservoirs that undercut preventive strategies. Ongoing education and community engagement remain critical to unlock full market potential.

Other drivers and restraints analyzed in the detailed report include:

- Advances in NAAT & Rapid PoC Platforms

- Home Self-Testing & Digital Connectivity

- Skilled-Lab-Staff Shortages in LMICs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

HIV testing held a dominant 28.89% share of the STD diagnostics market size in 2024, reflecting decades-long investment in universal screening and treatment pathways. Mycoplasma genitalium assays are the fastest-growing, projected at a 7.89% CAGR amid rising antimicrobial resistance alerts. Continued expansion stems from tech-enabled self-collection kits that boost privacy and convenience. Enhanced surveillance for Neisseria gonorrhoeae resistance motivates adoption of multiplex panels that combine chlamydia, gonorrhea, and syphilis markers in a single cartridge, supporting stewardship efforts. Market vendors are now bundling fungal and protozoal targets to offer truly comprehensive sexual-health panels, which is set to redefine consumer expectations.

Diagnostics for chlamydia and gonorrhea remain cornerstone services because of their high prevalence and frequent co-infection profiles. Point-of-care treponemal/non-treponemal dual assays capture renewed interest due to the recent syphilis resurgence, while HPV self-collection approvals in 2024 broaden the eligible target demographic. Trichomonas detection lags in market penetration despite its global incidence, making it a focus area for low-cost immunochromatographic strips. Expect further differentiation as vendors integrate artificial-intelligence-driven risk stratification into result portals, offering personalized care recommendations alongside lab findings.

The molecular platform category accounted for 51.34% of STD diagnostics market share in 2024, anchored by NAAT systems that deliver unparalleled sensitivity and are reimbursed under established CPT codes. Next-generation sequencing is the rising star at a projected 9.29% CAGR, prized for its simultaneous pathogen detection and resistance profiling capabilities. Declining run-costs and simplified bioinformatics pipelines are narrowing the affordability gap, inviting clinical laboratories to pilot sequencing workflows. Immunoassays retain a solid customer base for rapid screening in resource-limited clinics, while biosensor-enabled microfluidic chips are carving niches in emergency departments where every minute counts.

Regulatory alignment is steering innovation; the FDA's Class II designation knocked months off approval timelines, incentivizing R&D investment. At the same time, WHO prequalification programs now fast-track molecular kits for low-resource settings, expanding addressable volumes. Vendors are also embedding cloud-hosted analytics that auto-generate resistance-tracking dashboards for public-health agencies. All told, technology selection is tilting toward platforms that combine speed, breadth, and actionable data, thereby cementing molecular diagnostics as the backbone of future STD disgnostics market growth.

The STD DisgnosticsMarket Report is Segmented by Test Type (Chlamydia, Gonorrhea, Syphilis, and More), Technology (Immunoassay-Based Methods, Molecular Diagnostics, Next-Generation Sequencing, and More), Location of Testing (Central & Hospital Laboratories, and More), End User (Hospitals & Clinics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 42.23% of global revenue in 2024, sustained by insurance mandates that make preventive STD services cost-free and by robust federal coordination to counter the syphilis surge. High discretionary healthcare spending and rapid regulatory approvals keep the region at the innovation vanguard. Nevertheless, intra-regional gaps prevail; Southern states report above-average infection rates, signaling under-served pockets even within a mature market.

Europe follows with a stable base built on universal health coverage and pan-regional regulatory harmonization, yet faces budgetary pressure that favors cost-effective point-of-care models. Asia-Pacific is the fastest-growing territory at a forecast 10.93% CAGR, driven by urbanization, public-health investments, and an 11.6% STI prevalence among reproductive-age women in Southeast Asia. China's anti-corruption clampdown in healthcare briefly slowed foreign diagnostic imports in 2024, but infrastructure spending across ASEAN and India is widening test access.

Latin America and the Middle East & Africa together form an emerging corridor where rising awareness and mobile-health penetration offset infrastructure deficits. WHO-backed funding for integrated diagnostics and low-cost multiplex panels is steering donor capital into these regions. South Africa records the world's highest age-standardized STI rates, making it a focal point for donor-supported pilot projects that could shape future expansion models. Overall, geographic diversification strategies will define revenue resilience for vendors competing in the global STD Diagnostics market.

- Abbott Laboratories

- Roche

- Hologic

- Beckton Dickinson

- Danaher

- Siemens Healthineers

- bioMerieux

- Thermo Fisher Scientific

- QIAGEN

- Bio-Rad Laboratories

- DiaSorin

- QuidelOrtho

- Trinity Biotech plc

- Chembio Diagnostics Inc.

- Orasure Technologies

- Sekisui Diagnostics

- Genetic Signatures Ltd.

- LumiraDx Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global STD incidence

- 4.2.2 Government-funded screening programmes

- 4.2.3 Advances in NAAT & rapid PoC platforms

- 4.2.4 Home self-testing & digital connectivity

- 4.2.5 Multiplex AMR panels for STI pathogens

- 4.2.6 Corporate pre-employment screening in EMs

- 4.3 Market Restraints

- 4.3.1 Social stigma & low awareness

- 4.3.2 Regulatory & reimbursement hurdles

- 4.3.3 Skilled-lab-staff shortages in LMICs

- 4.3.4 Cross-reactivity-driven false positives

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Test Type

- 5.1.1 Chlamydia Testing

- 5.1.2 Gonorrhea Testing

- 5.1.3 Syphilis Testing

- 5.1.4 HPV Testing

- 5.1.5 HSV Testing

- 5.1.6 HIV Testing

- 5.1.7 Trichomonas Testing

- 5.1.8 Mycoplasma genitalium Testing

- 5.1.9 Chancroid Testing

- 5.2 By Technology

- 5.2.1 Immunoassay-based Methods

- 5.2.2 Molecular Diagnostics

- 5.2.3 Next-Generation Sequencing

- 5.2.4 Biosensor / Microfluidics & Other Emerging Platforms

- 5.3 By Location of Testing

- 5.3.1 Central & Hospital Laboratories

- 5.3.2 Rapid Point-of-Care Platforms

- 5.3.3 Over-the-Counter / Home Self-Testing

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Diagnostic Laboratories

- 5.4.3 Home Care / OTC

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 Hologic Inc.

- 6.3.4 Becton Dickinson and Company

- 6.3.5 Danaher Corporation (Cepheid)

- 6.3.6 Siemens Healthineers AG

- 6.3.7 bioMerieux SA

- 6.3.8 Thermo Fisher Scientific Inc.

- 6.3.9 Qiagen N.V.

- 6.3.10 Bio-Rad Laboratories Inc.

- 6.3.11 DiaSorin S.p.A.

- 6.3.12 QuidelOrtho Corporation

- 6.3.13 Trinity Biotech plc

- 6.3.14 Chembio Diagnostics Inc.

- 6.3.15 OraSure Technologies Inc.

- 6.3.16 Sekisui Diagnostics LLC

- 6.3.17 Genetic Signatures Ltd.

- 6.3.18 LumiraDx Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment