PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910485

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910485

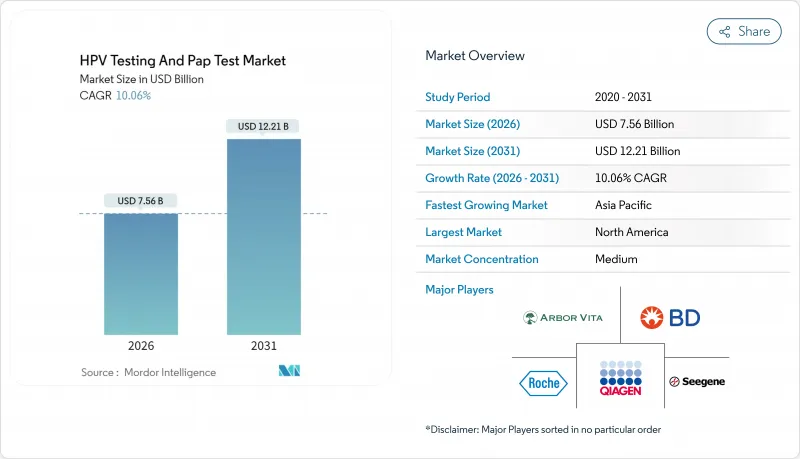

HPV Testing And Pap Test - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The HPV Testing and Pap Test market was valued at USD 6.87 billion in 2025 and estimated to grow from USD 7.56 billion in 2026 to reach USD 12.21 billion by 2031, at a CAGR of 10.06% during the forecast period (2026-2031).

Uptake accelerates as primary HPV screening becomes the standard of care, self-collection gains regulatory backing, and governments align with the WHO 90-70-90 elimination targets. Rapid guideline shifts, AI-enabled cytology, and DNA-methylation triage biomarkers improve test accuracy and laboratory throughput while widening access in low-resource settings. HPV vaccination generates future volume headwinds, yet near-term demand remains buoyant because screening coverage in many regions is still below 50%. Consolidation pressure is mounting after the FDA's 2024 rule on laboratory-developed tests, which favors vendors able to shoulder heavier compliance costs.

Global HPV Testing And Pap Test Market Trends and Insights

Rising incidence of cervical cancer

WHO's February 1, 2024 press release explicitly states: "In 2022, cervical cancer accounted for 661,044 new cases and 348,186 deaths globally. Screening coverage is still 4% in sub-Saharan Africa, creating a large untreated population base. China's plan to reach 70% coverage by 2030 could generate 400 million additional tests. India faces 1.5 million DALYs in 2025, spurring federal and state screening initiatives. These dynamics underpin sustained demand for both cytology-based and molecular diagnostics.

Shift to primary HPV testing guidelines

WHO, ASCCP, and many national programs now endorse DNA-based HPV tests as first-line screening because sensitivity exceeds 95% for CIN2+ versus 53% for Pap cytology. Ontario replaced Pap tests with HPV testing in March 2025. British Columbia saw 25,000 self-screens in months after its January 2024 switch. These policy moves accelerate laboratory investment in high-throughput PCR platforms.

HPV vaccination curbing test volumes

CDC surveillance shows CIN2-3 lesions plummeted 79% among U.S. women aged 20-24 between 2008 and 2022. England observed an 83.9% cervical-cancer reduction in vaccinated cohorts. Germany reports a 51.1% drop in CIN2+ prevalence post-immunization. These successes shrink long-term screening pools, especially in high-income countries.

Other drivers and restraints analyzed in the detailed report include:

- Growing adoption of self-collection kits

- Government-backed screening programs

- Regulatory and reimbursement hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

HPV testing is forecast to grow at an 10.88% CAGR, overtaking cytology even though Pap tests still held 52.78% HPV Testing and Pap Test market share in 2025. The HPV Testing and Pap Test market size for HPV assays is projected to reach USD 6.62 billion by 2031, supported by policy mandates in Canada, U.K., and Australia. Laboratories retain dual workflows, co-testing and reflex cytology, during the transition.

Liquid-based cytology (LBC) remains integral because LBC slides feed AI algorithms that raise accuracy with minimal staffing increases. Conventional Paps persist in resource-constrained geographies lacking PCR capacity but will gradually decline as donor-funded PCR initiatives expand. Vendors position multiplex HPV genotyping panels to increase clinical value and offset falling Pap volumes.

Clinician-collected cervical samples captured 68.95% of HPV Testing and Pap Test market size in 2025, but self-collection is growing 11.02% annually and could approach parity by 2031. The HPV Testing and Pap Test market share for self-collection is buoyed by strong patient preference scores and health-equity objectives.

Urine-based sampling shows promise for remote communities though clinical validation remains ongoing. Blood-based serology is still niche, used primarily in epidemiology. Providers are integrating mail-order logistics, telehealth consent, and automated result portals to support self-sampling scale-up.

The HPV Testing and Pap Test Market Report is Segmented by Test Type (HPV Testing, Pap Test), Sample Collection Method (Clinician-Collected Cervical Sample, and More), Product & Service (Instruments & Analyzers, and More), Application (Cervical Cancer Screening, and More), End User (Hospitals & Surgical Clinics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Roche

- Beckton Dickinson

- QIAGEN

- Hologic

- Abbott Laboratories

- Labcorp Holdings Inc.

- Thermo Fisher Scientific

- Seegene

- bioMerieux

- Cepheid (Danaher)

- BGI Genomics Co., Ltd.

- Norchip AS

- DaAn Gene Co., Ltd.

- DiaCarta Inc.

- Greiner Bio-One GmbH

- SelfScreen B.V.

- Femasys Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of cervical cancer

- 4.2.2 Shift to primary HPV testing guidelines

- 4.2.3 Growing adoption of self-collection kits

- 4.2.4 Government-backed screening programs

- 4.2.5 DNA-methylation biomarkers for triage

- 4.2.6 AI-assisted cytology platforms

- 4.3 Market Restraints

- 4.3.1 HPV vaccination curbing test volumes

- 4.3.2 Regulatory & reimbursement hurdles

- 4.3.3 Limited molecular-lab capacity (LICs)

- 4.3.4 Data-privacy concerns in at-home screening

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Test Type

- 5.1.1 HPV Testing

- 5.1.1.1 Primary HPV Screening

- 5.1.1.2 Follow-up HPV Testing

- 5.1.1.3 Co-testing (HPV + Pap)

- 5.1.2 Pap Test

- 5.1.2.1 Liquid-based Cytology (LBC)

- 5.1.2.2 Conventional Pap Smear

- 5.1.1 HPV Testing

- 5.2 By Sample Collection Method

- 5.2.1 Clinician-Collected Cervical Sample

- 5.2.2 Self-Collected Vaginal Swab

- 5.2.3 Urine-based Sampling

- 5.2.4 Blood / Serum-based (Serology)

- 5.3 By Product & Service

- 5.3.1 Instruments & Analyzers

- 5.3.2 Consumables & Reagents

- 5.3.3 Software & AI Platforms

- 5.3.4 Testing Services

- 5.4 By Application

- 5.4.1 Cervical Cancer Screening

- 5.4.2 Post-treatment Follow-up

- 5.4.3 Clinical Trials & Epidemiology

- 5.4.4 Others

- 5.5 By End User

- 5.5.1 Hospitals & Surgical Clinics

- 5.5.2 Diagnostic Laboratories

- 5.5.3 Physician Offices

- 5.5.4 Home Care / Direct-to-Consumer

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 F. Hoffmann-La Roche AG

- 6.3.2 Becton, Dickinson and Company

- 6.3.3 QIAGEN N.V.

- 6.3.4 Hologic, Inc.

- 6.3.5 Abbott Laboratories

- 6.3.6 Labcorp Holdings Inc.

- 6.3.7 Thermo Fisher Scientific Inc.

- 6.3.8 Seegene Inc.

- 6.3.9 bioMerieux SA

- 6.3.10 Cepheid (Danaher)

- 6.3.11 BGI Genomics Co., Ltd.

- 6.3.12 Norchip AS

- 6.3.13 DaAn Gene Co., Ltd.

- 6.3.14 DiaCarta Inc.

- 6.3.15 Greiner Bio-One GmbH

- 6.3.16 SelfScreen B.V.

- 6.3.17 Femasys Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessmen