PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852069

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852069

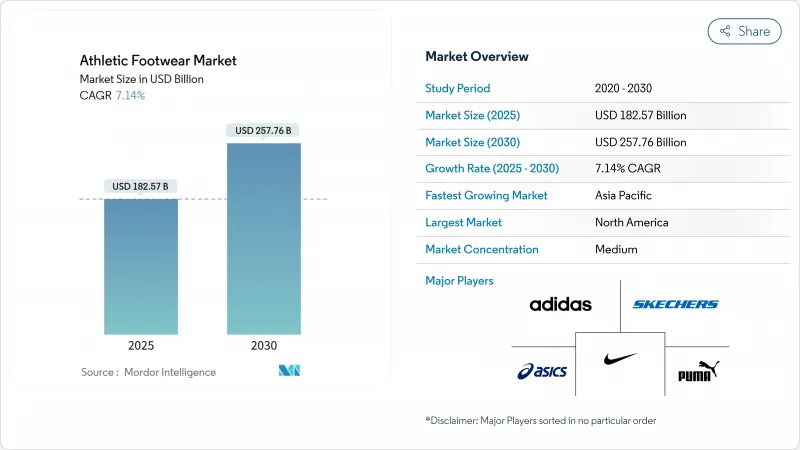

Athletic Footwear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The athletic footwear market size is estimated to be valued at USD 182.57 billion in 2025 and is forecast to reach USD 257.76 billion by 2030, advancing at a 7.14% CAGR.

As demand for performance and lifestyle shoes remains strong, and with more women participating in organized sports, the lines between athletic and casual wear are increasingly blurred. This trend is expanding opportunities in the athletic footwear market. Brands are now introducing products tailored to women's biomechanics, integrating advanced cushioning and plate technologies into their running models to enhance performance and comfort. They're also enhancing their digital direct-to-consumer (DTC) platforms, which not only boost engagement but also improve profit margins by reducing reliance on intermediaries. Furthermore, brands are leveraging data analytics to personalize customer experiences and optimize product offerings. Additionally, the athletic footwear market is seeing growth in both developed and emerging economies, bolstered by channel consolidation among specialty retailers, a swift shift towards e-commerce, and increased government investment in sports infrastructure. The growing focus on sustainability and eco-friendly materials is also influencing product innovation and consumer preferences in this market.

Global Athletic Footwear Market Trends and Insights

Significant growth in women sports participation rate

The increasing participation of women in sports is driving transformative changes in the athletic footwear market, compelling brands to adapt their product portfolios to meet evolving consumer preferences. According to a 2024 report by the Women's Sports Foundation, 67% of surveyed women attributed their sports involvement to the development of leadership skills, emphasizing the broader societal impact of this trend. Start-ups like Moolah Kicks, which exclusively cater to female basketball players, exemplify the market's potential. The company has achieved an impressive 150% compound sales growth over four years and expanded its retail presence from 140 to 630 stores, showcasing the growing demand for women-focused athletic footwear. In response, established brands are innovating by designing products tailored to female biomechanics, including adjustments to lasts, cushioning densities, and traction patterns. Additionally, they are collaborating with prominent female athletes to launch style-driven colorways that resonate with women consumers. This shift is fostering greater inclusivity, encouraging higher participation rates, and significantly expanding the athletic footwear market, which has historically been male-dominated. The evolving focus on women's needs is not only reshaping product innovation but also redefining the market dynamics, creating new growth opportunities for both emerging and established players.

Aggressive marketing by reputed brands

The athletic footwear market is undergoing rapid transformation as leading global players enhance their advertising strategies and adopt advanced audience micro-segmentation techniques to secure or expand their market share. Nike, which accounts for approximately 18% of the global market share, has set a goal of achieving an average annual revenue growth of 5% over the next decade. A significant portion of this growth is expected to come from Greater China, where the company is targeting an 11% growth rate. This region presents substantial opportunities driven by accelerating urbanization, an expanding middle class, and rising disposable incomes, which are boosting demand for high-quality athletic footwear. Simultaneously, Adidas is strategically redirecting its media budgets toward U.S. channels, leveraging competitor weaknesses to strengthen its shelf presence and expedite market penetration. Both companies are heavily investing in data-driven personalization and omnichannel integration, which are enabling enhanced customer engagement, improved conversion rates, and faster sell-through processes. Additionally, the increasing adoption of e-commerce platforms and the growing trend of athleisure are further contributing to the market's expansion. These strategic initiatives, coupled with evolving consumer preferences and technological advancements, are driving the sustained growth and intensifying competition within the athletic footwear market.

Proliferation of counterfeit products

Counterfeiting remains a critical challenge, eroding consumer trust and causing substantial revenue losses in the athletic footwear market. The OECD reported that counterfeit shoes constituted 21.4% of all customs seizures in 2025, with China, Turkiye, and Hong Kong identified as the primary sources of these counterfeit goods. The European Union (EU) has become a significant destination for such products, underscoring the global scale of the issue. Furthermore, the U.S. Trade Representative, in its 2025 Special 301 Report, highlighted the pivotal role of intellectual property (IP)-intensive sectors in driving economic growth, while also emphasizing the far-reaching macroeconomic consequences of counterfeiting. To combat this issue, brands are increasingly adopting advanced anti-counterfeiting technologies such as RFID authentication, blockchain-based tracking systems, and forensic labeling. These solutions enhance product security and traceability; however, they also introduce higher operational costs. As a result, businesses face the challenge of either absorbing these costs, which can strain profit margins, or passing them on to consumers through higher prices, creating a complex trade-off in the market.

Other drivers and restraints analyzed in the detailed report include:

- Influence of social media platforms and celebrity endorsements

- Favourable government initiatives to boost sports culture

- Volatile raw material prices increase production expenses and squeeze profit margins.

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, sports shoes captured 46.89% of the athletic footwear market, driven by their versatility in team sports and the growing athleisure trend. This dominance is attributed to their dual functionality, catering to both performance and lifestyle needs. Nike reported USD 33.4 billion in footwear sales for FY 2024, supported by higher average selling prices despite a decline in unit volumes. The segment continues to benefit from the increasing adoption of performance silhouettes as everyday wear. Furthermore, the introduction of diverse colorways and strategic collaborations with athletes, designers, and influencers has elevated sports shoes to fashion staples, ensuring sustained demand across genders, age groups, and regions.

Running shoes are projected to grow at a strong 7.35% CAGR from 2025 to 2030, outpacing the overall athletic footwear market. This growth is fueled by continuous innovation in design and materials, with brands incorporating advanced features such as carbon-fiber plates, oversized midsoles, and adaptive mesh uppers to enhance energy return, improve comfort, and reduce injury risks. Flagship product launches, including the Pegasus Premium, Adizero Boston 13, and Hyperion Elite 3, highlight a shift toward lightweight foams with stack heights exceeding 40 mm, appealing to both elite athletes and recreational runners. Additionally, with over 30% of new models integrating recycled materials, the segment aligns with rising consumer demand for sustainability. This combination of performance, innovation, and environmental responsibility strengthens the segment's position as a key driver within the athletic footwear market.

In 2024, shoes maintained their dominance in the athletic footwear market, accounting for a substantial 87.38% share. This dominance stems from continuous advancements in R&D, particularly in the development of PEBA-based midsoles, which have significantly enhanced footwear performance. These midsoles are lighter and more responsive, reducing foot pressure by double-digit percentages compared to traditional EVA midsoles. Additionally, the integration of cutting-edge technology with strategic style collaborations has strengthened the appeal of shoes, positioning them as essential for both urban lifestyles and sports activities. This blend of innovation, comfort, and style has cemented shoes as the backbone of the athletic footwear market, meeting the demands of a diverse and expanding consumer base.

On the other hand, the boots segment is forecasted to grow at a strong 6.86% CAGR, driven by the rising popularity of outdoor activities such as hiking and trail running, coupled with the increasing adoption of outdoor-centric lifestyles. Prominent models like the Merrell Moab Speed 2 and Hoka Anacapa 2 Low GTX have gained widespread recognition for their advanced features, including waterproof designs, sustainable uppers, and plush cushioning, all while maintaining a lightweight profile under 400 g. This segment's growth underscores a growing consumer preference for versatile footwear that effortlessly transitions between rugged outdoor trails and urban settings. As a result, the boots category is expanding the athletic footwear market's reach within outdoor-focused retail channels, catering to the evolving needs of active and environmentally conscious consumers.

The Athletic Footwear Market Report Segments the Industry by Activity (Running Shoes, Sports Shoes and More), Product Type (Shoes and Boots), End User (Men, Women, and Kids/Children), Category (Mass and Premium), Distribution Channel (Sports and Athletics Goods Stores, Supermarkets/Hypermarkets, and More) and Geography (North America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America held a dominant 34.81% share of global revenue, driven by its established fitness culture, high per-capita incomes, and the strategic location of major brand headquarters. The region's growth reflects the increasing appeal of boutique running events, rising participation in sports leagues, and the strength of a thriving direct-to-consumer (DTC) market. Retail consolidation has gained momentum, highlighted by DICK'S acquisition of Foot Locker. This strategic move strengthens distributor control over product offerings and pricing strategies while enabling capital reallocation toward innovative store formats that integrate traditional shopping with advanced digital features.

Europe remains a mature market for athletic footwear, characterized by steady growth and a strong focus on sustainability. The region's consumers increasingly prefer eco-friendly and ethically produced footwear, driving brands to adopt sustainable manufacturing practices. Additionally, the popularity of outdoor activities, such as hiking and running, continues to support demand. Western Europe, led by countries like Germany, the United Kingdom, and France, dominates the market, while Eastern Europe shows potential for growth due to rising disposable incomes and increasing health awareness.

Asia-Pacific is set to lead global growth, with a forecasted CAGR of 8.44% through 2030. China and India dominate as the region's primary markets. India's young population and growing middle class create opportunities for both mid-tier and premium brands. Vietnam's emergence as a significant manufacturing hub signals a shift in supply-chain strategies, offering shorter lead times and improved efficiency. Additionally, government-supported fitness campaigns in Southeast Asia, coupled with increased social media engagement, are attracting new consumers to the athletic footwear market, driving the region's growth trajectory.

- Nike Inc.

- Adidas Group

- Puma SE

- Skechers USA Inc.

- ASICS Corporation

- Under Armour Inc.

- New Balance Athletics Inc.

- VF Corporation (Vans, The North Face)

- Fila Holdings Corp.

- Columbia Sportswear Company

- Berkshire Hathaway Inc.

- On Holding AG (On Running)

- Deckers Outdoor Corporation

- Li-Ning Company Ltd.

- Anta Sports Products Ltd.

- Decathlon S.A.

- Mizuno Corporation

- Xtep International Holdings Ltd.

- Wolverine World Wide, Inc.

- Yonex Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Significant growth in women sports participation rate

- 4.2.2 Aggressive marketing by reputed brands

- 4.2.3 Influence of social media platforms and celebrity endorsements

- 4.2.4 Favourable government initiatives to boost sports culture

- 4.2.5 Innovations like better cushioning attract consumers

- 4.2.6 Online shopping has made athletic footwear more accessible

- 4.3 Market Restraints

- 4.3.1 Proliferation of counterfeit products

- 4.3.2 Volatile raw material prices increase production expenses and squeeze profit margins

- 4.3.3 Stringent labor and environmental regulations

- 4.3.4 Concerns over sustainability and sourcing

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Activity

- 5.1.1 Running Shoes

- 5.1.2 Sports Shoes

- 5.1.3 Adventure Sports Shoes

- 5.1.4 OtherProduct Types

- 5.2 By Product Type

- 5.2.1 Shoes

- 5.2.2 Boots

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Kids/Children

- 5.4 By Category

- 5.4.1 Premium

- 5.4.2 Mass

- 5.5 By Distribution Channel

- 5.5.1 Sports and Athletic Goods Stores

- 5.5.2 Supermarkets/Hypermarkets

- 5.5.3 Online Retaile Stores

- 5.5.4 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Nike Inc.

- 6.4.2 Adidas Group

- 6.4.3 Puma SE

- 6.4.4 Skechers USA Inc.

- 6.4.5 ASICS Corporation

- 6.4.6 Under Armour Inc.

- 6.4.7 New Balance Athletics Inc.

- 6.4.8 VF Corporation (Vans, The North Face)

- 6.4.9 Fila Holdings Corp.

- 6.4.10 Columbia Sportswear Company

- 6.4.11 Berkshire Hathaway Inc.

- 6.4.12 On Holding AG (On Running)

- 6.4.13 Deckers Outdoor Corporation

- 6.4.14 Li-Ning Company Ltd.

- 6.4.15 Anta Sports Products Ltd.

- 6.4.16 Decathlon S.A.

- 6.4.17 Mizuno Corporation

- 6.4.18 Xtep International Holdings Ltd.

- 6.4.19 Wolverine World Wide, Inc.

- 6.4.20 Yonex Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK