PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852078

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852078

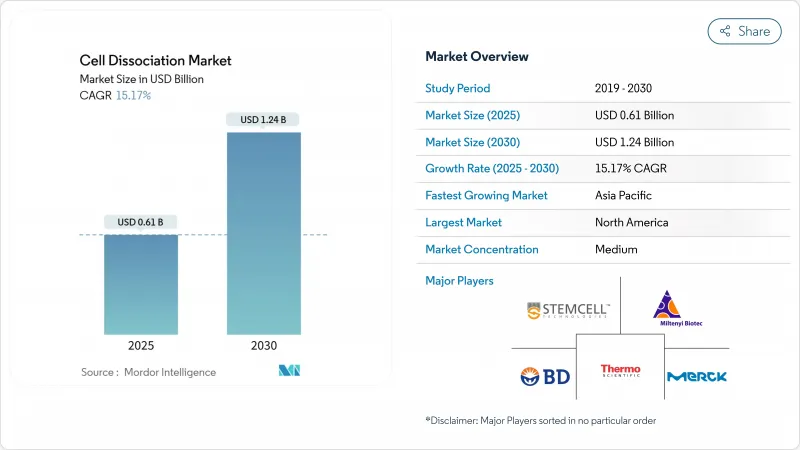

Cell Dissociation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cell dissociation market size is valued at USD 0.61 billion in 2025 and is projected to reach USD 1.24 billion by 2030, expanding at a 15.17% CAGR.

The market's ascent is tied to its enabling role in cell and gene therapy production, single-cell omics, and personalized-medicine pipelines. Regulatory approvals for advanced therapies, automation breakthroughs, and large-scale public biotechnology funding collectively accelerate adoption. Pharmaceutical and biotechnology firms remain the primary purchasers, yet contract research organizations (CROs) capture rising share as sponsors outsource complex tasks. North America keeps the lead owing to established infrastructure, while Asia-Pacific posts the fastest growth backed by multibillion-dollar national programs in China, Japan, and India.

Global Cell Dissociation Market Trends and Insights

Expansion of Cell and Gene Therapy Pipelines

Seven cell and gene therapies secured FDA approval in 2024, and the agency expects 10-20 clearances annually through 2025. Each product requires sophisticated cell-isolation protocols, elevating demand for automated dissociation platforms that can cut lot-release costs by 50%. Solid-tumor and autoimmune programs diversify tissue inputs, intensifying reagent-quality and scalability requirements. Allogeneic formats further raise batch volumes per donor, underscoring the need for standardized, GMP-grade workflow.

Rising Adoption of Single-Cell Omics Technologies

Microfluidic chips now process upward of 100,000 cells per run, a step-change from prior capacities. To preserve RNA integrity, new FixNCut protocols enable reversible tissue fixation before dissociation, easing sample transport without data loss. Oncology applications dominate demand as heterogeneity studies rely on high-viability single-cell suspensions. AI-augmented pipelines intensify the push for standardized protocols that minimize variability.

High Cost of Advanced Dissociation Technologies

Closed, fully automated suites frequently exceed USD 1 million, limiting adoption among smaller labs. The global pancreatic-enzyme shortage further inflates raw-material costs and delivery times. China's CAR-T landscape shows how high production costs can shift most payments out-of-pocket.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Biomanufacturing for Personalized Medicine

- Increasing Demand for High-Throughput Automation

- Variability and Standardization Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Enzymatic reagents retained 58.76% share in 2024, with bacterial collagenase from Clostridium histolyticum prized for specificity. Trypsin dominates routine passaging, while dispase and elastase service niche applications. Non-enzymatic formulations post the fastest 17.67% CAGR as single-cell workflows shy away from protease exposure. ATCC's chelator-based solution and recombinant TrypLE exemplify this regulatory-friendly shift. Automated tissue dissociators now come bundled with reagent cartridges to minimize operator variability.

The Cell Dissociation Market Report is Segmented by Product (Enzymatic Dissociation Products, and More), Tissue (Connective Tissue, Epithelial Tissue, Muscular Tissue, and More), End-User (Pharmaceutical & Biotechnology Companies, Research & Academic Institutes, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.78% of market share in 2024, buoyed by FDA fast-track pathways for advanced therapies. New York's USD 430 million BioGenesis Park adds 1,530 jobs and new GMP suites. Canada's USD 22.5 million investment in STEMCELL Technologies ensures domestic reagent capacity. Sartorius and Siemens collaborate on digital-twin automation that trims lot-release time.

Asia-Pacific advances at 16.56% CAGR, led by China's USD 4.17 billion biopark program. Japan's Startup Development Five-Year Plan and aging-society needs push biotech growth toward ¥15 trillion by 2030. India's BioE3 policy aims to position local CDMOs as global suppliers in anticipation of supply-chain diversification from U.S. Biosecure Act compliance.

Europe benefits from the EU biotechnology strategy targeting greater participation in the EUR 720 billion global market. EMA guidelines for cell-based products and new European Pharmacopoeia QC chapters provide regulatory clarity. Lonza's Dutch plant produces CASGEVY for Vertex, underscoring Europe's relevance as a high-volume contract-manufacturing hub.

- Thermo Fisher Scientific

- Beckton Dickinson

- Merck

- Miltenyi Biotec

- Roche

- GE Healthcare

- American Type Culture Collection

- Stem Cell Technologies

- HiMedia Laboratories

- PAN-Biotech

- Worthington Biochemical Corporation

- Danaher

- Corning

- Lonza Group

- Sartorius

- Takara Bio

- Bio-Rad Laboratories

- Advanced Cell Diagnostics (Bio-Techne)

- TissueGnostics

- CellData Sciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Cell and Gene Therapy Pipelines

- 4.2.2 Rising Adoption of Single-Cell Omics Technologies

- 4.2.3 Surge In Biomanufacturing for Personalized Medicine

- 4.2.4 Growing Investments in Regenerative Medicine Research

- 4.2.5 Increasing DemandfFor High-Throughput Automation

- 4.2.6 Government Initiatives to Strengthen Biotechnology Infrastructure

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Dissociation Technologies

- 4.3.2 Variability and Standardization Challenges

- 4.3.3 Stringent Regulatory and Validation Requirements

- 4.3.4 Limited Availability of GMP-Grade Enzymes

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power Of Buyers/Consumers

- 4.5.2 Bargaining Power Of Suppliers

- 4.5.3 Threat Of New Entrants

- 4.5.4 Threat Of Substitute Products

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Enzymatic Dissociation Products

- 5.1.1.1 Collagenase

- 5.1.1.2 Trypsin

- 5.1.1.3 Papain

- 5.1.1.4 Dispase

- 5.1.1.5 Elastase & Hyaluronidase

- 5.1.2 Non-Enzymatic Dissociation Products

- 5.1.2.1 Chelating Agents

- 5.1.2.2 Recombinant Enzyme-Free Solutions (Accutase, TrypLE)

- 5.1.2.3 Mechanical Dissociation Kits & Filters

- 5.1.3 Instruments & Accessories

- 5.1.3.1 Automated Tissue Dissociators

- 5.1.3.2 Microfluidic Dissociation Devices

- 5.1.3.3 Cell Strainers & Filtration Units

- 5.1.3.4 Consumable Accessories (Tubes, Rotors)

- 5.1.1 Enzymatic Dissociation Products

- 5.2 By Tissue

- 5.2.1 Connective Tissue

- 5.2.2 Epithelial Tissue

- 5.2.3 Muscular Tissue

- 5.2.4 Nervous Tissue

- 5.2.5 Tumor & Organoid Samples

- 5.3 By End-User

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Research & Academic Institutes

- 5.3.3 Contract Research Organizations

- 5.3.4 Hospitals & Diagnostic Laboratories

- 5.3.5 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Thermo Fisher Scientific, Inc.

- 6.3.2 Becton, Dickinson And Company

- 6.3.3 Merck KGaA

- 6.3.4 Miltenyi Biotec

- 6.3.5 F. Hoffmann-La Roche Ltd

- 6.3.6 GE Healthcare

- 6.3.7 American Type Culture Collection (ATCC)

- 6.3.8 STEMCELL Technologies

- 6.3.9 HiMedia Laboratories

- 6.3.10 Pan-Biotech

- 6.3.11 Worthington Biochemical Corporation

- 6.3.12 Danaher Corporation

- 6.3.13 Corning Incorporated

- 6.3.14 Lonza Group

- 6.3.15 Sartorius AG

- 6.3.16 Takara Bio Inc.

- 6.3.17 Bio-Rad Laboratories

- 6.3.18 Advanced Cell Diagnostics (Bio-Techne)

- 6.3.19 TissueGnostics

- 6.3.20 CellData Sciences

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment