PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852079

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852079

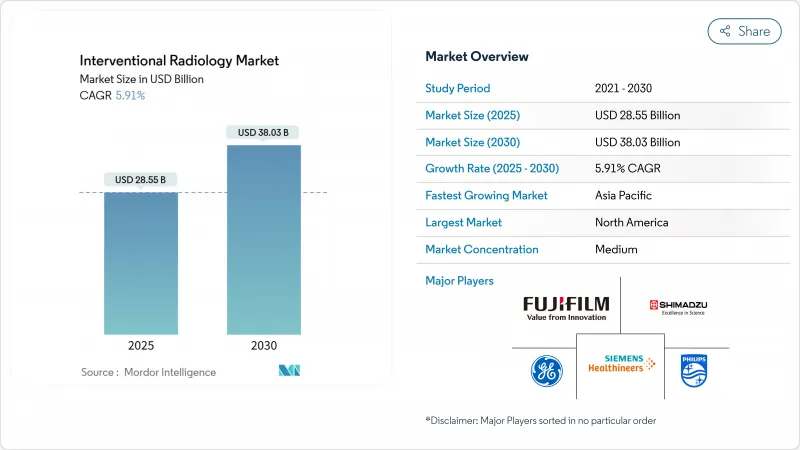

Interventional Radiology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The interventional radiology market size is valued at USD 28.55 billion in 2025 and is forecast to reach USD 38.03 billion by 2030, advancing at a 5.91% CAGR.

Rapid migration from open surgery to minimally invasive, image-guided therapies underpins this expansion, reducing recovery times and lowering total expenditure for payers and providers. Artificial intelligence embedded in advanced imaging suites improves real-time guidance, elevates care quality, and stimulates procedure volumes in complex cardiovascular, oncologic, and neurovascular cases. Demand also benefits from a worldwide rise in chronic diseases that require repeat interventions and long-term disease management. At the same time, outpatient centers capture shifting procedure flows as pay-for-value reimbursement models reward cost-efficient care settings. Intensifying R&D investment from leading manufacturers sustains a strong pipeline of devices, software, and robotics that widen the addressable patient pool and open high-margin consumable revenue streams.

Global Interventional Radiology Market Trends and Insights

Rising Prevalence of Chronic and Lifestyle Diseases

Cardiovascular and oncologic burdens elevate demand for catheter-based interventions that offer durable clinical benefits. Transcatheter aortic valve replacement alone generated nearly USD 7 billion in 2024, signaling sustained procedure uptake. Neurovascular advances such as Terumo's WEB system achieved an 86.5% occlusion rate for ruptured aneurysms, broadening indications previously treated via open craniotomy. Peripheral artery disease therapies progress with Abbott's FDA-cleared Esprit BTK dissolving stent, designed for more than 20 million affected Americans. As life expectancy rises, chronic comorbidities generate steady procedural pipelines, anchoring long-term growth for the interventional radiology market.

Continuous Advancements in Minimally Invasive Imaging Technologies

Artificial intelligence reduces fluoroscopy times and radiation dose, exemplified by Siemens Healthineers' Ciartic Move, which accelerates spine and pelvic procedures by up to 50%. Robotics integrated with AI enable leadless left bundle branch pacing, first performed with Abbott's investigational conduction system pacing platform. RapidAI's Lumina 3D reconstructs high-quality neuro images within minutes, addressing technologist shortages and supporting time-sensitive stroke workflows. Philips deepens innovation capacity through a multi-year collaboration with NVIDIA to develop MRI foundational models that deliver zero-click scan planning. Together, these developments raise procedural accuracy and create defensible differentiation for premium imaging suites.

High Capital and Operating Costs of Hybrid Imaging Suites

Hybrid suites blending angiography, CT, and MRI can exceed several million USD and require specialized shielding, HVAC upgrades, and multi-modal software integration. Ongoing service contracts and staff training raise the total cost of ownership and deter adoption in budget-constrained hospitals. Siemens Healthineers mitigates these barriers through decade-long Value Partnerships that amortize modernization costs and standardize equipment fleets. Nonetheless, small facilities often pursue mergers to access financing and pooled procurement, slowing diffusion in less-developed health systems.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Interventional Radiology Applications Across Therapeutic Areas

- Shift Toward Outpatient and Day-Case Treatment Settings

- Stringent Radiation Safety Regulations and Compliance Burdens

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, Imaging Systems retained a 46.34% share, underscoring their foundational role in procedure planning and guidance. Continuous feature upgrades-such as AI-trained bone-removal algorithms on Siemens' syngo DynaCT-support recurrent capital replacement cycles even as budgets tighten. IR Consumables, however, exhibit a 7.45% CAGR through 2030, reflecting their recurring revenue advantage as case volumes climb. Single-use catheters and embolization coils reduce cross-contamination risks and streamline inventory control, making them attractive for outpatient labs where turnover is high. The interventional radiology market size for consumables is projected to broaden swiftly as therapeutic complexity rises.

Accessories and workflow software outpace hardware growth because cloud analytics lower modality downtime and optimize scheduling. Philips' helium-free BlueSeal MRI saves nearly 40 MWh annually per unit, illustrating how eco-efficiency complements clinical performance. Fluoroscopy systems that bundle AI-enabled dose monitoring meet tightening safety mandates and appeal to mid-tier hospitals. Overall, mature imaging infrastructure sets the stage for high-margin disposable uptake, driving profitable expansion across the interventional radiology market.

Therapeutic procedures are advancing at a 7.66% CAGR, propelled by device breakthroughs like Merit Medical's Wrapsody cell-impermeable endoprosthesis that achieved strong primary patency for hemodialysis access. Angioplasty and stenting benefit from absorbable scaffolds that support vessel healing while ensuring drug delivery, such as Abbott's Esprit BTK platform. Ablation technology progression yields predictable lesion boundaries and shrinks collateral injury, broadening oncology and pain-management indications. Consequently, the interventional radiology market size attributed to therapeutic services is projected to reach USD 25.2 billion by 2030 at segment level.

Diagnostic procedures hold a 38.23% share, providing essential imaging roadmaps for interventionists but delivering lower revenue per case. Nevertheless, innovations in cone-beam CT and AI-assisted angiography enhance diagnostic accuracy, indirectly supporting therapeutic expansion. Biopsy and drainage remain vital for oncologic staging and infection control. The enduring diagnostic foundation ensures a steady flow of patients into the therapeutic pipeline, sustaining growth momentum in the broader interventional radiology market.

The Interventional Radiology Market Report is Segmented by Product (Imaging Systems, IR Consumables, and More), Procedure Type (Diagnostic and Therapeutics), Application (Cardiology, Oncology, and More), End-User (Hospitals, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 43.21% revenue in 2024, supported by established clinical guidelines, high device penetration, and robust R&D commitments including Siemens Healthineers' USD 150 million facility expansion in the United States. Payment pressures loom as Medicare enacts a 2.83% fee schedule reduction and a projected 4% cut in interventional radiology reimbursements, spurring provider investment in cost-efficient outpatient capacity. Regulatory initiatives such as the FDA's Transitional Coverage for Emerging Technologies pathway expedite market uptake for breakthrough devices, sustaining innovation flow despite fiscal tightening.

Asia-Pacific registers the fastest growth at a 6.34% CAGR, fueled by large unmet procedural needs, urban hospital build-outs, and joint ventures. Inari Medical's partnership with 6 Dimensions Capital accelerates commercialization of thrombectomy devices in Greater China, illustrating foreign-domestic collaboration that localizes advanced therapies. Governments prioritize imaging infrastructure and physician training to curb outbound medical tourism, while public-private alliances leverage cloud platforms to scale AI tools across regional networks.

Europe maintains stable expansion anchored by tight device-safety standards and strong university hospital networks. Philips led European Patent Office filings with 594 medical technology applications in 2024, reinforcing the region's innovation reputation. Eastern European systems allocate European Union cohesion funds to upgrade angiography labs, boosting procedure capacity. The Middle East & Africa and South America remain nascent but show accelerating adoption as training initiatives like Tanzania's Road2IR program complete more than 1,500 procedures with high success rates. Multinational OEMs tailor financing packages to penetrate these value-conscious markets, diversifying revenue streams across the global interventional radiology market.

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips

- Canon

- FUJIFILM

- Shimadzu

- Hologic

- Samsung Medison Co. Ltd.

- Boston Scientific

- Medtronic

- Cook Group

- Terumo Corp.

- Abbott Laboratories

- Stryker

- Penumbra

- AngioDynamics

- Merit Medical Systems

- Cardinal Health

- Teleflex

- Esaote

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic And Lifestyle Diseases

- 4.2.2 Continuous Advancements in Minimally Invasive Imaging Technologies

- 4.2.3 Expansion of Applications Across Therapeutic Areas

- 4.2.4 Shift Toward Outpatient and Day-Case Treatment Settings

- 4.2.5 Increasing Capital Investments in High-End Imaging Infrastructure

- 4.2.6 Growing Reimbursement Support For Image-Guided Procedures

- 4.3 Market Restraints

- 4.3.1 High Capital and Operating Costs Of Hybrid Imaging Suites

- 4.3.2 Stringent Radiation Safety Regulations and Compliance Burdens

- 4.3.3 Shortage of Skilled Interventional Radiologists and Staff

- 4.3.4 Competitive Pressure From Alternative Endovascular Specialties

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Imaging Systems

- 5.1.1.1 Angiography Systems

- 5.1.1.2 Fluoroscopy Systems

- 5.1.1.3 CT Scanners

- 5.1.1.4 MRI Systems

- 5.1.2 IR Consumables

- 5.1.2.1 Catheters & Guidewires

- 5.1.2.2 Balloon & Stent Systems

- 5.1.2.3 Embolization & Thrombus Devices

- 5.1.3 Accessories & Software

- 5.1.1 Imaging Systems

- 5.2 By Procedure Type

- 5.2.1 Diagnostic

- 5.2.1.1 Angiography

- 5.2.1.2 Biopsy & Drainage

- 5.2.2 Therapeutic

- 5.2.2.1 Angioplasty & Stenting

- 5.2.2.2 Embolization

- 5.2.2.3 Ablation

- 5.2.1 Diagnostic

- 5.3 By Application

- 5.3.1 Cardiology

- 5.3.2 Oncology

- 5.3.3 Gastroenterology & Hepatology

- 5.3.4 Urology & Nephrology

- 5.3.5 Other Applications

- 5.4 By End-user

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers (ASCs)

- 5.4.3 Office-Based Labs (OBLs) & Imaging Centers

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Siemens Healthineers AG

- 6.3.2 GE HealthCare

- 6.3.3 Koninklijke Philips NV

- 6.3.4 Canon Medical Systems Corp.

- 6.3.5 Fujifilm Holdings Corporation

- 6.3.6 Shimadzu Corporation

- 6.3.7 Hologic Inc.

- 6.3.8 Samsung Medison Co. Ltd.

- 6.3.9 Boston Scientific Corp.

- 6.3.10 Medtronic PLC

- 6.3.11 Cook Medical LLC

- 6.3.12 Terumo Corp.

- 6.3.13 Abbott Laboratories

- 6.3.14 Stryker Corp.

- 6.3.15 Penumbra Inc.

- 6.3.16 AngioDynamics Inc.

- 6.3.17 Merit Medical Systems Inc.

- 6.3.18 Cardinal Health Inc.

- 6.3.19 Teleflex Inc.

- 6.3.20 Esaote SpA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment