PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852080

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852080

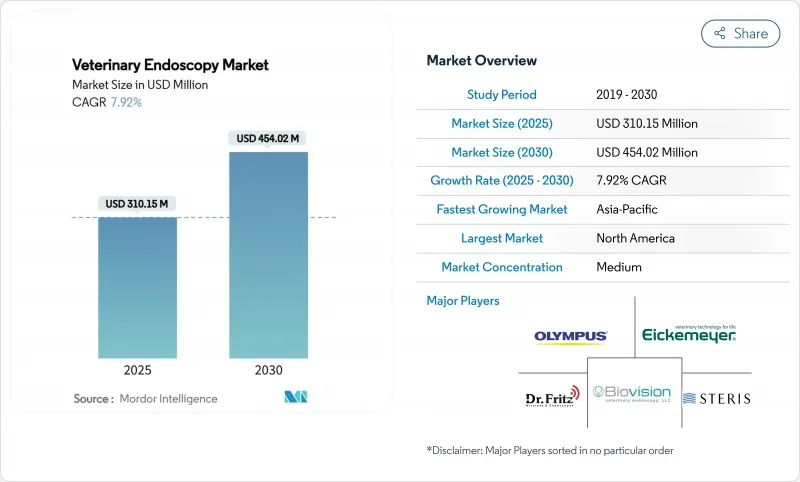

Veterinary Endoscopy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global veterinary endoscopy market size is USD 310.15 million in 2025 and is forecast to reach USD 454.02 million by 2030, advancing at a 7.92% CAGR during the period.

Rising demand for minimally invasive diagnostics, continued miniaturization of equipment, and expanding corporate hospital networks are underpinning this steady expansion of the veterinary endoscopy market. Flexible video systems remain the technology of choice for most companion-animal and equine procedures, yet capsule devices are carving out rapid adoption niches as smaller practices seek anesthesia-free options. Regionally, North America benefits from deep specialty referral networks and high insurance penetration, while Asia-Pacific's escalating pet ownership and disposable income are propelling the fastest regional CAGR. Competitive momentum is intensifying as diversified human-device majors and veterinary-focused specialists vie for share, but a shortage of skilled endoscopists still constrains the full potential of the veterinary endoscopy market.

Global Veterinary Endoscopy Market Trends and Insights

Rising Gastrointestinal and Respiratory Disorders

Growing incidence of chronic enteropathies, inflammatory bowel disease, and lower airway disease is prompting veterinarians to adopt endoscopy as first-line diagnostics. Practices report measurably higher diagnostic yields versus radiography; one study recorded a 37% uptick in definitive GI diagnoses when endoscopy was deployed. Prolonged companion-animal lifespans also expose more animals to age-related GI pathologies, further swelling procedure volumes. Large-animal practitioners increasingly use upper airway endoscopy for racehorses and bronchoscopy for dairy herds, broadening demand beyond companion clinics. Together, these clinical trends are raising throughput and justifying equipment investment across the veterinary endoscopy market.

Pet Humanization and Premium Care Spend

Households without children are channeling discretionary income toward advanced companion-animal healthcare, reinforcing willingness to pay for endoscopic diagnostics and minimally invasive therapy. Morgan Stanley projects annual household pet outlays to hit USD 1,733 by 2030, with veterinary services the fastest-expanding line item. High-definition video and capsule modalities align well with owner preferences for gentle, low-scarring interventions. The converging influence of insured procedures and third-party financing platforms is also reducing upfront cost sensitivity, allowing specialty centers to market comprehensive endoscopic packages. Consequently, pet humanization continues to boost procedure frequency and revenue across the veterinary endoscopy market.

High Equipment Costs Limiting Adoption

Entry-level HD systems can exceed USD 45,000, a hurdle for small or rural clinics battling declining foot traffic and thinning margins. Service contracts, scope repair, and specialty cleaning units add to lifecycle outlays, lengthening payback periods. Emerging-market practices face even steeper import duties and limited financing, stalling penetration of the veterinary endoscopy market. Vendors offering pay-per-use or leasing models are attempting to ease adoption, yet overall budget constraints remain a strong drag on market growth.

Other drivers and restraints analyzed in the detailed report include:

- Technological Miniaturization Expanding Accessibility

- Tele-Endoscopy and Cloud-Based Image Management

- Veterinary Endoscopist Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible video systems delivered 46% of 2024 revenue, underscoring their versatility in GI, respiratory, and urogenital work. HD chip-on-tip optics provide crisp imagery, while variable stiffness insertion tubes improve maneuverability. Correspondingly, the segment captured the largest slice of the veterinary endoscopy market share. Capsule modules, although accounting for lower absolute revenue, post an 11.9% CAGR as clinics embrace anesthesia-free imaging for cats, small dogs, and exotics. The veterinary endoscopy market size for capsule devices is on track to more than double by 2030. Rigid scopes retain popularity in arthroscopy owing to durable optics and tactile control, and robot-assisted units, though nascent, attract premium equine centers exploring remote joystick manipulation.

Complementary visualization consoles and integrated AI analytics represent the second-largest revenue pool, driven by system upgrades rather than new room builds. Accessory sales-biopsy forceps, snares, retrieval baskets-generate high-margin recurring income for OEMs. The segment benefits as therapeutic procedure counts climb, knitting consumable pull-through to each intervention.

Diagnostic work comprised 64% of global cases in 2024, supported by superior mucosal assessment over radiography. High tissue-sampling accuracy reduces exploratory surgeries and informs targeted pharmacologic regimens, reinforcing demand. Still, therapeutic endoscopy is the momentum engine, projected to log a 10.5% CAGR through 2030 as scope channels widen and accessory toolkits diversify. Stricture dilations, polyp resections, and foreign-body retrievals now performable in a single anesthetic window drive client acceptance. Combined diagnostic-therapeutic workflows compress visit counts, appealing to busy pet owners and reducing stress on animals. Manufacturers responding with torque-stable overtubes and laser-compatible working channels stand to capture the fastest-growing pocket of the veterinary endoscopy market.

The Veterinary Endoscopy Market Report is Segmented by Product Type (Endoscopes, Visualization & Imaging Systems, and More), Procedure (Diagnostic and Therapeutic), Application (Gastrointestinal, Urogenital, and More), Animal Type (Companion Animals and Livestock), End User (Veterinary Hospitals & Referral Clinics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38% of 2024 global revenue, cementing regional supremacy for the veterinary endoscopy market. High pet insurance uptake and the world's densest population of diplomate-level specialists sustain premium procedure demand. U.S. referral hospitals spearhead adoption of capsule and 4K imaging, while Canadian clinics lean on university affiliations for complex case overflow. Mexico's urban corridors exhibit double-digit growth as middle-income households pivot toward Western pet-care norms.

Europe ranks second by value, buttressed by stringent welfare regulations and long-established referral networks. Germany's engineering pedigree supports local OEM production, driving early adoption of robotic articulating scopes. The United Kingdom combines strong pet-ownership culture with robust specialty certification, fostering high per-capita procedure volumes. Mediterranean countries lag Northern peers but close gaps swiftly as specialty hospitals proliferate.

Asia-Pacific is the locomotive of global growth, slated for a 9.4% CAGR through 2030. China's expanding middle class elevates pet medical spend, stimulating multi-site hospital chains that can amortize endoscope investments. Japan showcases advanced technique maturity, while India's growth stems from a low base but benefits from rising urban pet populations and Western educational collaborations. Australia and South Korea sustain high-quality benchmarks, but intra-regional disparity persists as rural sectors remain underserved.

South America and the Middle East & Africa represent smaller shares yet register healthy growth as veterinary colleges upgrade curricula and corporates enter metropolitan markets. Equipment donation programs and tele-endoscopy partnerships mitigate specialist shortages, further unlocking latent demand.

- Biovision Veterinary Endoscopy

- Karl Storz

- Olympus

- Medtronic

- STERIS

- Dr. Fritz Endoscopy

- Eickemeyer Veterinary Equipment

- Zhuhai Seesheen Medical Technology

- Fujifilm Holdings Corp.

- SonoScape Medical Corp.

- Cook Group

- Endoscopy Support Services Inc.

- VetOvation

- Arthrex Vet Systems

- Jorgensen Laboratories

- Hill-Rom Holdings (Welch Allyn Vet)

- iM3 Veterinary

- B. Braun

- TianSong Medical Instrument

- Medit Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Gastrointestinal & Respiratory Disorders in Companion and Livestock Animals

- 4.2.2 Rising Pet Ownership and Humanization Boosting Spend on Advanced Veterinary Care

- 4.2.3 Continuous Technological Advancements in High-Definition & Miniaturized Systems

- 4.2.4 Growing Adoption of Tele-Endoscopy and Cloud-Based Image Management Among Referral Networks

- 4.2.5 Consolidation of Veterinary Hospital Chains Driving Capital Investment in Endoscopic Equipment

- 4.3 Market Restraints

- 4.3.1 High Capital and Lifecycle Costs of Endoscopic Platforms for Small & Rural Clinics

- 4.3.2 Global Shortage of Skilled Veterinary Endoscopists and Specialized Support Staff

- 4.3.3 Sterilization, Reprocessing, and Cross-Species Infection Control Challenges

- 4.4 Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Endoscopes

- 5.1.1.1 Capsule

- 5.1.1.2 Flexible Video

- 5.1.1.3 Rigid

- 5.1.1.4 Robot-assisted

- 5.1.2 Visualization & Imaging Systems

- 5.1.3 Accessories & Consumables

- 5.1.1 Endoscopes

- 5.2 By Procedure

- 5.2.1 Diagnostic

- 5.2.2 Therapeutic / Interventional

- 5.3 By Application

- 5.3.1 Gastrointestinal

- 5.3.2 Respiratory & ENT

- 5.3.3 Urogenital

- 5.3.4 Orthopedic / Arthroscopy

- 5.3.5 Others

- 5.4 By Animal Type

- 5.4.1 Companion Animals

- 5.4.1.1 Canine

- 5.4.1.2 Feline

- 5.4.1.3 Equine

- 5.4.2 Livestock

- 5.4.2.1 Bovine

- 5.4.2.2 Porcine

- 5.4.2.3 Poultry

- 5.4.2.4 Ovine/Caprine

- 5.4.1 Companion Animals

- 5.5 By End User

- 5.5.1 Veterinary Hospitals & Referral Clinics

- 5.5.2 Ambulatory & Specialty Centers

- 5.5.3 Academic & Research Institutes

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Biovision Veterinary Endoscopy LLC

- 6.3.2 Karl Storz SE & Co. KG

- 6.3.3 Olympus Corporation

- 6.3.4 Medtronic PLC

- 6.3.5 Steris PLC

- 6.3.6 Dr. Fritz Endoscopy GmbH

- 6.3.7 Eickemeyer Veterinary Equipment

- 6.3.8 Zhuhai Seesheen Medical Technology

- 6.3.9 Fujifilm Holdings Corp.

- 6.3.10 SonoScape Medical Corp.

- 6.3.11 Cook Medical

- 6.3.12 Endoscopy Support Services Inc.

- 6.3.13 VetOvation

- 6.3.14 Arthrex Vet Systems

- 6.3.15 Jorgensen Laboratories

- 6.3.16 Hill-Rom Holdings (Welch Allyn Vet)

- 6.3.17 iM3 Veterinary

- 6.3.18 B. Braun Melsungen AG

- 6.3.19 TianSong Medical Instrument

- 6.3.20 Medit Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment