PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852088

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852088

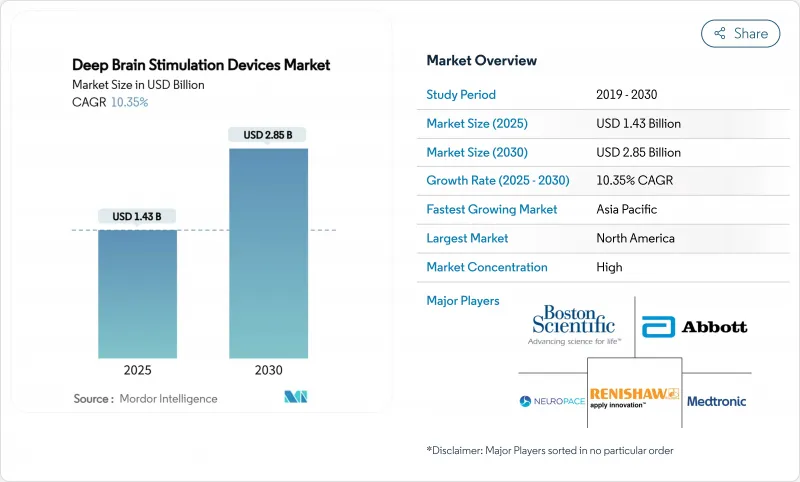

Deep Brain Stimulation Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The deep brain stimulation market size stood at USD 1.43 billion in 2025 and is projected to reach USD 2.85 billion by 2030, registering a 10.35% CAGR.

Rising adoption of sensing-enabled closed-loop generators, broader reimbursement for earlier-stage Parkinson's patients, and a steady pipeline of adaptive algorithms are accelerating procedure volumes. Hospitals remain the primary implant setting, but migration toward ambulatory surgical centers is lifting capacity without comparable capital spend. Miniaturized rechargeable IPGs that last 9-15 years are lowering lifetime ownership costs, while AI-guided candidate selection tools improve responder rates and justify payor coverage. North America anchors global revenue, yet Asia-Pacific is closing the gap as surgeon-training initiatives and government neurotechnology programs scale access. Tight ^99Mo supply and post-implant infection risk temper momentum but also stimulate innovation in diagnostics and antimicrobial hardware.

Global Deep Brain Stimulation Devices Market Trends and Insights

Rapid uptake of sensing-enabled closed-loop IPGs

BrainSense Adaptive DBS won FDA clearance in February 2025, marking the first commercial closed-loop platform that automatically titrates stimulation from real-time neural signals. Multicenter data show median 50% motor-symptom reduction compared with open-loop systems, alongside a one-third cut in programming visits. Physicians report faster optimization curves and fewer side effects, improving patient satisfaction and health-economic value. Early adoption is strongest in U.S. and German centers where reimbursement rewards outcome-based models. Expanding indications in epilepsy and depression further widen the deep brain stimulation market.

Reimbursement expansion for earlier-stage Parkinson's patients

Medicare removed the "advanced-stage only" criterion in late 2024, instantly enlarging the U.S. eligible population. Private payors aligned policies within six months, accelerating referral volumes. Comparable moves by France's HAS and Germany's G-BA support broader European uptake. Earlier intervention improves long-term functional status and reduces levodopa cost burden, reinforcing the deep brain stimulation market outlook. Manufacturers are funding outcomes registries to generate real-world evidence that sustains the policy shift.

Post-implant infection rates driving precautionary revisions

Hardware-related infections occur in 2.6-6.9% of implants, often requiring complete system explantation and extended antibiotic courses. Revision costs exceed USD 20,000 per episode and stall new referrals when publicized outcomes erode confidence. Summer seasonality and comorbidity prevalence escalate risk, especially in facilities lacking laminar airflow theaters. Antimicrobial-coated leads and stricter peri-operative protocols are lowering rates in high-volume U.S. centers, yet widespread uptake in emerging markets remains limited. Persistent infection fears moderate the deep brain stimulation market's penetration curve.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Asia-Pacific neurosurgeon training programs

- Miniaturized rechargeable IPGs lengthen replacement cycles

- Global shortage of ^99Mo for imaging prolongs diagnosis windows

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Devices generated 83.67% revenue in 2024, anchored by implantable pulse generators that integrate sensing, rechargeable batteries, and MRI safety features. Dual-channel generators now surpass single-channel units in new implants, reflecting bilateral procedure growth. Accessories-directional leads, sensing electrodes, and extensions-grow at 10.89% CAGR as closed-loop systems require specialized hardware upgrades. Replacement cycles are shorter for accessories, creating an annuity stream that triples lifetime revenue per patient. Deep brain stimulation market size for accessories is projected to reach USD 0.52 billion by 2030, amplified by software-based programming kits adopted by community neurologists. Competitive pressure centers on electrode geometry and material science rather than standalone pricing, protecting margins.

Technological breakthroughs in segmented leads deliver more precise targeting and reduce adverse effects, spurring conversion from legacy systems. Manufacturers bundle upgrade paths with existing generators, raising switching barriers for hospitals. Regulatory clearances in Europe and the United States for adaptive leads position accessories as the primary innovation frontier. Growth in refurbishment and resterilization services for extensions also contributes to segment revenue, especially in cost-sensitive markets. Consequently, accessories will outpace device unit growth yet remain reliant on installed generator bases within the deep brain stimulation market.

The Deep Brain Stimulation Report is Segmented by Product Type (Devices: Single-Channel Systems, Implantable Pulse Generators, Dual-Channel Systems; Accessories: Leads/Electrodes, Extensions & Accessories), Application (Parkinson's Disease, Essential Tremor, and More), End User (Hospitals, Neurology Clinics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the revenue anchor with 42.23% deep brain stimulation market share in 2024, bolstered by broad Medicare coverage, high neurosurgeon density, and early adoption of closed-loop systems. U.S. growth continues as outpatient implants rise, while Canada's universality sustains steady volume albeit with tighter device margins.

Europe contributes a quarter of global sales, characterized by stable reimbursement and consistent procedure volumes across leading German, French, and Nordic centers. Adoption of rechargeable generators and directional leads is mature, yet bureaucratic procurement processes elongate replacement cycles.

Asia-Pacific leads expansion at 11.45% CAGR, propelled by China's pricing frameworks for brain-computer interfaces and aggressive capacity building in tertiary hospitals. Japan's aging demographics and robust research output sustain premium device demand, whereas India advances value-engineered solutions to address affordability constraints. Local manufacturing partnerships and regulatory harmonization initiatives lower entry barriers, making the region the strategic battleground for the deep brain stimulation market. Middle East and Africa record single-digit growth, limited by capital equipment scarcity and reimbursement gaps, yet Gulf states invest in centers-of-excellence that could seed broader adoption.

- Medtronic

- Boston Scientific

- Abbott Laboratories

- Beijing PINS Medical

- SceneRay Corporation Ltd.

- Aleva Neurotherapeutics SA

- Newronika S.p.A.

- Functional Neuromodulation Ltd.

- Soterix Medical

- Alpha Omega Engineering Ltd.

- NeuroPace

- BrainsWay Ltd.

- AlphaDBS Solutions (Deep Brain Innovations)

- NeuroStar/Neuronetics Inc.

- Synaptic Medical (Shenzhen) Co., Ltd.

- Shanghai Sinovation Medical Tech.

- LivaNova plc

- PulseNeuro LLC

- Neuralink Corp. (long-term pipeline)

- Kinetica Ventures (Implanet DBS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid uptake of sensing-enabled closed-loop IPGs

- 4.2.2 Reimbursement expansion for earlier-stage Parkinson's patients

- 4.2.3 Surge in Asia-Pacific neurosurgeon training programs

- 4.2.4 Miniaturised rechargeable IPGs lengthen replacement cycles

- 4.2.5 FDA fast-track for adaptive DBS algorithms

- 4.2.6 AI-guided patient selection improves responder rates

- 4.3 Market Restraints

- 4.3.1 Post-implant infection rates driving precautionary revisions

- 4.3.2 Global shortage of ^99Mo for imaging prolongs diagnosis windows

- 4.3.3 Cyber-security vulnerability disclosures for Bluetooth-enabled IPGs

- 4.3.4 High capital cost of intra-operative imaging suites in South America

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Device

- 5.1.1.1 Single-Channel Systems

- 5.1.1.2 Implantable Pulse Generators

- 5.1.1.3 Dual-Channel Systems

- 5.1.2 Accessories

- 5.1.2.1 Leads / Electrodes

- 5.1.2.2 Extensions & Accessories

- 5.1.1 Device

- 5.2 By Application

- 5.2.1 Parkinson's Disease

- 5.2.2 Essential Tremor

- 5.2.3 Dystonia

- 5.2.4 Epilepsy

- 5.2.5 Obsessive-Compulsive Disorder

- 5.2.6 Depression (Investigational)

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Neurology Clinics

- 5.3.3 Ambulatory Surgical Centers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Abbott Laboratories

- 6.3.4 Beijing PINS Medical Co., Ltd.

- 6.3.5 SceneRay Corporation Ltd.

- 6.3.6 Aleva Neurotherapeutics SA

- 6.3.7 Newronika S.p.A.

- 6.3.8 Functional Neuromodulation Ltd.

- 6.3.9 Soterix Medical Inc.

- 6.3.10 Alpha Omega Engineering Ltd.

- 6.3.11 NeuroPace, Inc.

- 6.3.12 BrainsWay Ltd.

- 6.3.13 AlphaDBS Solutions (Deep Brain Innovations)

- 6.3.14 NeuroStar/Neuronetics Inc.

- 6.3.15 Synaptic Medical (Shenzhen) Co., Ltd.

- 6.3.16 Shanghai Sinovation Medical Tech.

- 6.3.17 LivaNova plc

- 6.3.18 PulseNeuro LLC

- 6.3.19 Neuralink Corp. (long-term pipeline)

- 6.3.20 Kinetica Ventures (Implanet DBS)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment