PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852091

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852091

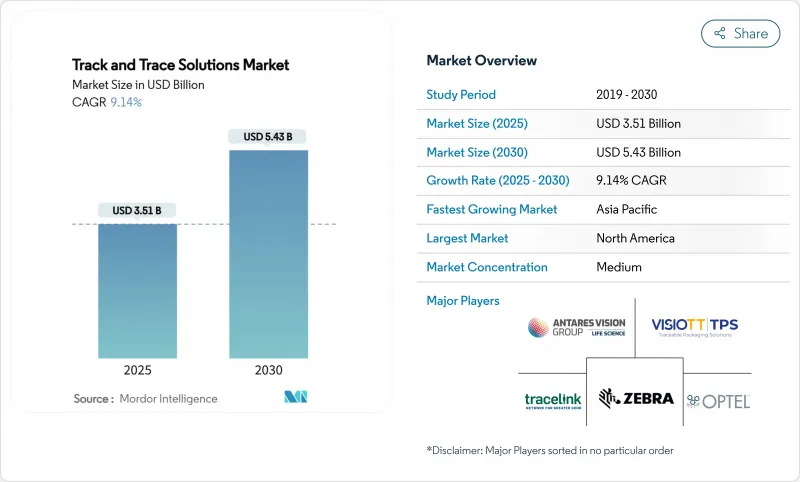

Track And Trace Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The track & trace solutions market is valued at USD 3.51 billion in 2025 and is projected to reach USD 5.43 billion by 2030, translating into a 9.14% compound annual growth rate (CAGR).

Heightened regulatory pressure across pharmaceutical supply chains is turning serialization from a compliance chore into a strategic differentiator, prompting companies to invest in more sophisticated, data-rich platforms. As serialization and aggregation converge on cloud architectures, vendors are eyeing fresh data-monetization avenues while simultaneously confronting new cybersecurity risks. Meanwhile, the Track & Trace Solutions market share of smaller niche vendors is expanding in emerging regions because modular cloud architecture allows them to compete without a global sales footprint.

Global Track And Trace Solutions Market Trends and Insights

Convergence of Global Pharmaceutical Traceability Mandates

Momentum toward harmonized standards is compelling firms to design systems that satisfy multiple jurisdictions in a single deployment. Vendors therefore invest heavily in flexible data models that map country codes to a common core, which quietly reduces lifetime integration costs for multinational plants. One evident consequence is that manufacturers now issue global requests for proposal instead of region-specific tenders, concentrating purchasing power and accelerating vendor consolidation. This regulatory convergence simultaneously shortens rollout cycles because configuration replaces custom coding, allowing quicker payback periods and freeing budgets for advanced analytics.

Escalating Counterfeit Drug Threat Elevating Patient-Safety Imperatives

The rising sophistication of counterfeit networks forces brand owners to look beyond serialization and adopt multi-layer security that joins tamper-evident packaging, authentication algorithms, and real-time verification portals. By embedding unique identifiers inside layered packaging, companies are discouraging illicit repackaging, a fresh deterrent that also minimizes recall scope when an incident occurs. Health agencies publicly link counterfeit suppression to improved therapy adherence, which drives political endorsement of stricter serialization audits. As a direct result, solution vendors report an uptick in demand for mobile inspection apps that allow frontline staff to validate codes at every hand-off.

Divergent Country-Level Timelines Generating Investment Uncertainty

Uneven regulatory calendars compel firms to stage capital allocations carefully, often prioritizing export markets over domestic ones to protect revenue streams. Finance teams increasingly evaluate serialization projects through real-options analysis, treating each regional rollout as a sequential option rather than a deterministic plan, a mindset shift that influences vendor contracting terms. Solution providers respond by offering modular licensing that activates only when a country deadline approaches, a pricing innovation that shortens sales cycles.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Direct-to-Patient and E-commerce Channels Requiring End-to-End Visibility

- Digitalization of Pharma Supply Chains and Cloud-Native SaaS Adoption

- High Capital and Integration Costs with Legacy MES, ERP, and Packaging Lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software claimed a 52.64% track and trace solutions market size in 2024 and is projected to grow at a 8.63% CAGR through 2030. The acceleration reflects a shift toward value extraction from serialization data as firms seek operational insights and not just compliance records. Platform vendors increasingly bundle professional services, which offsets the skills gap in mid-tier manufacturers and increases switching costs. A notable pattern is that successful deployments now start with a data-governance workshop, illustrating the convergence of IT and quality functions inside pharmaceutical firms.

Hardware still anchors initial compliance, yet its track and trace solutions market share will likely be above 29.77% by 2030 as capital cycles complete. Printing, vision inspection, and tamper-evidence modules remain essential, and vendors differentiate through modularity that reduces line downtime during retrofits. Demand for RFID printers and on-printer verification grows fastest inside the hardware basket, mirroring the gradual sensorization of packaging lines. A secondary effect is that resale markets for second-generation printers gain liquidity, lowering entry barriers for late adopters in emerging economies.

Barcodes held a commanding 55.76% track and trace solutions market share in 2024, yet RFID solutions are forecast to expand at 9.90% CAGR until 2030, closing the gap steadily. Pharmaceutical warehouses, eager to cut manual scans, now pilot mixed tagging schemes in which high-value biologics carry RFID while generics retain 2D codes, demonstrating a hybrid approach that balances cost and capability. Real-time location data from RFID pallets feeds WMS algorithms that slash pick times, a benefit that quietly offsets tag costs in large distribution centers.

The resilience of barcodes stems from ubiquitous scanners and consistent regulatory acceptance, keeping the technology relevant for the foreseeable future. However, the falling price of passive UHF inlays suggests that the inflection point for wider RFID adoption is drawing nearer. As proof, several national health services request RFID for hospital logistics, creating a pull effect back up the supply chain. This developing preference nudges packaging-line OEMs to embed RFID tunnels in standard equipment offerings.

The Track and Trace Solutions Market is Segmented by Component (Hardware Systems [Printing & Marking Equipment, and More], Software Solutions, and More), Technology (Barcode / 2-D DataMatrix, and More), Application (Serialization Solutions and Aggregation Solutions), End User (Pharmaceutical Manufacturers, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, with 42.24% Track & Trace Solutions market share in 2024, remains the largest region because of the Drug Supply Chain Security Act that mandates unit-level traceability by August 2025. A notable consequence is that even small generics firms accelerate projects to avoid supply interruptions, which inflates near-term demand for validation services. The region's mature electronic health-record infrastructure enables linkage between serialization data and clinical outcomes, providing a feedback loop that informs value-based contracting. This linkage also stimulates analytics investments by insurers aiming to verify adherence in specialty therapies. Large-scale wholesalers integrate serialization with robotics, reducing manual case handling and reshaping labor allocation across distribution centers.

Asia-Pacific shows the fastest trajectory at a forecast 10.29% CAGR, underpinned by aggressive anti-counterfeit campaigns in China and export incentives in India. Governments often couple local content rules with traceability grants, encouraging domestic IT firms to partner with global solution providers. Multinational manufacturers, confronted with compressed timelines, select configurable cloud platforms that can flip on country modules as rules mature. The same architecture supports language localization, a subtle yet critical success factor across a linguistically diverse region. Rapid e-commerce expansion forces regulators to tighten parcel-level verification, injecting further urgency into adoption.

Europe retains a significant position due to the mature Falsified Medicines Directive, which pushes verification down to the pharmacy counter. National medicine verification organization databases, already operational, anchor a dense scanning network that covers nearly every dispensing point. Manufacturers adapt by embedding tamper-evident seals on cartons, a design choice that raises consumer expectations globally. The region's next focus is environmental sustainability, and stakeholders explore how serialization data can support carbon-footprint reporting, demonstrating the multi-dimensional potential of track and trace infrastructure.

- OPTEL Group

- TraceLink

- Antares Vision SpA

- SEA Vision SRL

- Syntegon Technology

- Zebra Technologies

- Mettler Toledo

- Korber

- ACG Worldwide

- VISIOTT

- Uhlmann

- Sato Holdings Corporation

- 74Software

- Siemens Healthineers

- Brother Industries, Ltd. (Domino Printing Sciences plc)

- Dover Corporation (Markem-Imaje)

- Wipotec-OCS GmbH

- Veralto Corporation (Videojet Technologies Inc.)

- Coesia S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convergence of Global Pharmaceutical Traceability Mandates (WHO, ISO)

- 4.2.2 Escalating Counterfeit Drug Threat Elevating Patient?Safety Imperatives

- 4.2.3 Surge in Direct-to-Patient & E-commerce Channels Requiring End-to-End Visibility

- 4.2.4 Digitalization of Pharma Supply Chains and Cloud-native SaaS Adoption

- 4.2.5 Transition to Personalized & Small-Batch Therapies Necessitating Flexible Serialization

- 4.2.6 Brand Reputation & Recall Cost Avoidance Driving Investment in Track & Trace Analytics

- 4.3 Market Restraints

- 4.3.1 Divergent Country-level Timelines Generating Investment Uncertainty

- 4.3.2 High Capital & Integration Costs with Legacy MES/ERP and Packaging Lines

- 4.3.3 Data Privacy & Cyber-security Risks in Networked Traceability Platforms

- 4.3.4 Limited Per-unit ROI for Low-margin Generic Manufacturers

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Hardware Systems

- 5.1.1.1 Printing & Marking Equipment

- 5.1.1.2 Monitoring & Verification Systems

- 5.1.1.3 Labeling & Tamper-evident Solutions

- 5.1.1.4 Other Hardware

- 5.1.2 Software Solutions

- 5.1.2.1 Plant-level Management Suites

- 5.1.2.2 Line Controller Software

- 5.1.2.3 Bundle / Pallet Tracking Software

- 5.1.2.4 Enterprise & Cloud Platforms

- 5.1.3 Professional & Managed Services

- 5.1.1 Hardware Systems

- 5.2 By Technology

- 5.2.1 Barcode / 2-D DataMatrix

- 5.2.2 RFID & NFC

- 5.2.3 Advanced IoT Sensors & BLE Beacons

- 5.3 By Application

- 5.3.1 Serialization Solutions

- 5.3.1.1 Bottle Serialization

- 5.3.1.2 Blister & Strip Serialization

- 5.3.1.3 Carton & Case Serialization

- 5.3.1.4 Data-Matrix / QR Serialization

- 5.3.2 Aggregation Solutions

- 5.3.2.1 Bundle Aggregation

- 5.3.2.2 Case Aggregation

- 5.3.2.3 Pallet Aggregation

- 5.3.1 Serialization Solutions

- 5.4 By End User

- 5.4.1 Pharmaceutical Manufacturers

- 5.4.2 Contract Manufacturing & Packaging Organizations (CMOs/CPOs)

- 5.4.3 Medical Device Manufacturers

- 5.4.4 Healthcare Distributors & Wholesalers

- 5.4.5 Other Life-science Stakeholders (OTC, Nutraceuticals, Cosmetics, Legal Cannabis)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 OPTEL Group

- 6.3.2 TraceLink Inc.

- 6.3.3 Antares Vision SpA

- 6.3.4 SEA Vision SRL

- 6.3.5 Syntegon Technology GmbH

- 6.3.6 Zebra Technologies Corp.

- 6.3.7 Mettler-Toledo International Inc.

- 6.3.8 Korber Medipak Systems GmbH

- 6.3.9 ACG Worldwide

- 6.3.10 VISIOTT

- 6.3.11 Uhlmann

- 6.3.12 Sato Holdings Corporation

- 6.3.13 74Software

- 6.3.14 Siemens

- 6.3.15 Brother Industries, Ltd. (Domino Printing Sciences plc)

- 6.3.16 Dover Corporation (Markem-Imaje)

- 6.3.17 Wipotec-OCS GmbH

- 6.3.18 Veralto Corporation (Videojet Technologies Inc.)

- 6.3.19 Coesia S.p.A.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment