PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852092

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852092

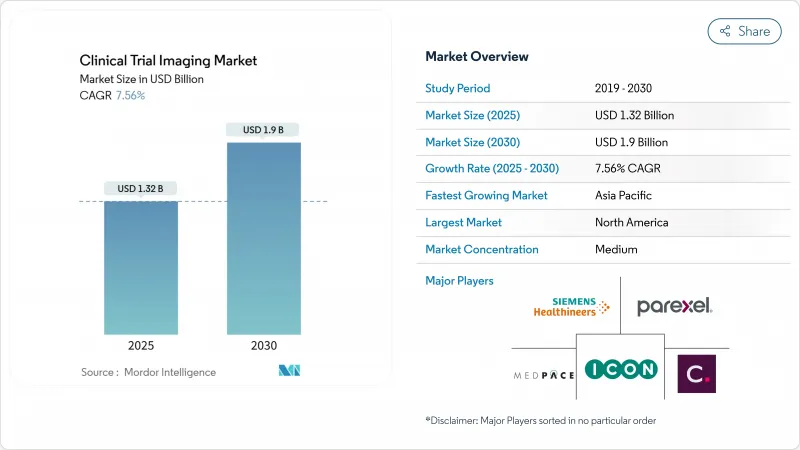

Clinical Trial Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The clinical trial imaging market size stands at USD 1.32 billion in 2025 and is poised to reach USD 1.90 billion by 2030, advancing at a 7.56% CAGR.

This expansion mirrors the surge in global pharmaceutical R&D budgets, the growing use of imaging biomarkers in complex studies, and the steady migration toward AI-enabled data analysis. Oncology and neurology trials dominate demand because they rely on visual endpoints to prove therapeutic value, while decentralized and hybrid trial models are widening access to patient pools and accelerating enrollment timelines. AI adoption is speeding image interpretation, cutting reader variability, and improving protocol compliance across multi-site programs. Consolidation among imaging core laboratories and modality vendors is intensifying as firms bundle hardware, software, and analytics to deliver end-to-end services. Regulatory shifts-most notably the European Union Clinical Trials Regulation (EU CTR)-are harmonizing processes across borders and encouraging standardized imaging workflows.

Global Clinical Trial Imaging Market Trends and Insights

Increasing Pharmaceutical and Biotechnology R&D Expenditure

R&D budgets climbed 9.7% in 2024 among large drug makers, and pipelines now exceed 8,000 active assets, deepening demand for imaging endpoints that objectively track therapeutic impact. Biologics and gene therapies-expected to represent more than 60% of new approvals by 2030-often require molecular-level visualization, pushing sponsors to secure sophisticated imaging core lab support. Leading firms such as Eli Lilly have extended investments in GLP-1 programs, and each protocol embeds specialized MRI or PET components to monitor metabolic and cardiovascular parameters. As outsourcing grows, suppliers able to scale imaging services across continents stand out, with over 80% of R&D executives planning double-digit spending increases on external partners. This funding momentum anchors a long-term tailwind for the clinical trial imaging market.

Growing Outsourcing of Imaging Services to Contract Research Organizations

CRO revenues hit USD 52.19 billion in 2023, reflecting a strategic pivot by drug developers toward external imaging expertise to cut fixed costs and speed trial execution. ICON alone reported USD 9.974 billion in new business wins during 2024, underscoring sponsor appetite for integrated imaging networks capable of protocol harmonization, real-time QC, and automated AI analytics. Outsourcing can trim study timelines by up to 30% by centralizing image data and applying predefined read algorithms, advantages magnified in hybrid and decentralized models that collect scans from community sites and patients' homes. CROs are matching demand with targeted acquisitions in teleradiology, ophthalmic imaging, and quantitative biomarker platforms to widen service breadth across therapeutic areas.

High Capital Investment and Operational Costs of Imaging Equipment

State-of-the-art PET-MRI systems can cost USD 4-6 million, and photon-counting CT platforms add another USD 2-3 million burden before siting, shielding, and maintenance are factored in. Nuclear medicine programs require on-site radiopharmaceutical facilities that meet stringent cGMP standards, lifting total start-up spending far beyond many regional CROs or academic core labs. Rapid hardware cycles further complicate ROI calculations, pushing stakeholders toward mergers or strategic alliances, as seen in Affinity Equity Partners' USD 658 million purchase of Lumus Imaging aimed at gaining scale economies.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Medical Imaging Modalities

- Rising Adoption of Artificial Intelligence in Clinical Trial Imaging

- Shortage of Skilled Imaging Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Imaging software accounted for 32.33% of the clinical trial imaging market in 2024, cementing its status as the backbone of data flow across global sites. These platforms automate QC, anonymize datasets, and integrate seamlessly with electronic data capture systems, lowering error rates and ensuring consistency. In revenue terms, the segment formed the largest slice of the clinical trial imaging market size, and its influence will grow as AI modules move from pilot to production. The rise of SaaS deployment models is shifting budgets from capex to opex, appealing to small and mid-sized sponsors seeking scalability without heavy infrastructure outlay.

Imaging biomarker development services, meanwhile, are projected to expand at a 9.45% CAGR, reflecting escalating demand for validated, quantitative endpoints capable of persuading regulators and payers. Underpinning this surge are FDA initiatives that underscore the value of imaging biomarkers in accelerated approvals, and the movement toward personalized therapies that require sensitive measures of treatment response. Vendors that fuse software, biomarker science, and regulatory consulting are capturing higher-margin projects, intensifying competition in this growth pocket of the clinical trial imaging market.

Computed tomography held 25.23% of the clinical trial imaging market in 2024 thanks to its ubiquity, rapid acquisition times, and validated role in solid tumor trials. Its dominance also stems from reimbursement support and wide reader familiarity, factors essential to large phase III studies. Even so, the modality's share is slowly eroding as sponsors pivot to lower-dose photon-counting systems and hybrid imaging that better resolve soft-tissue changes.

Positron emission tomography is expected to post a 9.57% CAGR through 2030, the fastest among modalities. Growth hinges on a pipeline of novel radiotracers that move beyond glucose metabolism to target cell-surface receptors, hypoxia markers, and amyloid aggregates. PET's sensitivity in detecting molecular changes ahead of anatomical shifts makes it invaluable for early dose-response studies and adaptive trial designs. The spread of total-body PET scanners, which cut dose and bolster throughput, further sharpens its appeal and enlarges its role within the clinical trial imaging market.

The Clinical Trial Imaging Market Report is Segmented by Product & Service (Trial Design Consulting Services, and More), Modality (Magnetic Resonance Imaging, and More), Phase of Clinical Trial (Phase I, and More), End-User (Pharmaceutical & Biotechnology Companies, and More), Therapeutic Area (Oncology, and More), Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.54% of global revenue in 2024 on the strength of mature reimbursement systems, a dense network of academic-industrial partnerships, and clear FDA guidance governing imaging endpoints. The United States also hosts many of the top 20 pharma sponsors, amplifying domestic demand for high-throughput core labs that can scale across therapeutic franchises. Private-equity investments and acquisitions-RadNet spent USD 54 million on targets in 2024-are consolidating imaging capacity and integrating AI platforms, deepening the region's competitive moat.

Asia-Pacific is projected to deliver the highest regional CAGR at 8.67% through 2030, propelled by streamlined ethics approvals and attractive cost structures. Regulatory agencies in Japan, South Korea, and Singapore routinely finalize clinical trial applications within six months, shortening study start-up compared with legacy markets. Local CROs such as Wuxi AppTec have scaled imaging units that serve domestic and Western sponsors alike, leveraging broad site networks and government incentives to host multinational programs. The growing popularity of decentralized trials, tele-radiology, and bring-your-own-device imaging apps augments APAC's role in the clinical trial imaging market.

Europe sits between these poles as it transitions to the EU CTR, which mandates full use of the Clinical Trials Information System by January 2025. The unified portal promises consistent application reviews across 30 countries and should lower administrative overhead on cross-border imaging protocols. Yet divergent rules governing radiopharmaceutical handling and data privacy remain obstacles, particularly in Germany and France. Efforts by the EMA to publish an AI reflection paper and clarify validation expectations indicate that Europe aims to retain a leadership position in governance even as operational execution evolves.

- Clario

- Icon plc

- IXICO

- Parexel International Corp.

- Medpace Holdings, Inc.

- Navitas Clinical Research

- WorldCare Clinical LLC

- Radiant Sage

- Resonance Health

- WCG (WIRB-Copernicus Group)

- Siemens Healthineers

- GE HealthCare Technologies Inc.

- Calyx

- Signant Health

- Imaging Endpoints

- Perspectum Diagnostics

- BioClinica Inc.

- Collective Minds Research (CMRAD)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Pharmaceutical and Biotechnology R&D Expenditure

- 4.2.2 Growing Outsourcing of Imaging Services to Contract Research Organizations

- 4.2.3 Technological Advancements in Medical Imaging Modalities

- 4.2.4 Rising Adoption of Artificial Intelligence in Clinical Trial Imaging

- 4.2.5 Growth in Oncology and Neurology Clinical Trials

- 4.2.6 Expansion of Decentralized and Hybrid Clinical Trial Models

- 4.3 Market Restraints

- 4.3.1 High Capital Investment and Operational Costs of Imaging Equipment

- 4.3.2 Shortage of Skilled Imaging Professionals

- 4.3.3 Stringent Regulatory and Data Privacy Requirements

- 4.3.4 Lack of Standardized Imaging Protocols Across Trial Sites

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product & Service

- 5.1.1 Trial Design Consulting Services

- 5.1.2 Read Analysis Services

- 5.1.3 Operational Imaging Services

- 5.1.4 Imaging Software

- 5.1.5 Imaging Data-management Services

- 5.1.6 Imaging Biomarker Development Services

- 5.2 By Modality

- 5.2.1 Magnetic Resonance Imaging

- 5.2.2 Computed Tomography

- 5.2.3 Positron Emission Tomography

- 5.2.4 Ultrasound

- 5.2.5 Echocardiography

- 5.2.6 Other Modalities

- 5.3 By End-User

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Contract Research Organizations

- 5.3.3 Medical Device Manufacturers

- 5.3.4 Academic & Government Research Institutes

- 5.4 By Therapeutic Area

- 5.4.1 Oncology

- 5.4.2 Neurology

- 5.4.3 Cardiology

- 5.4.4 Endocrinology & Metabolic Disorders

- 5.4.5 Rare Diseases

- 5.4.6 Other Therapeutic Areas

- 5.5 By Phase of Clinical Trial

- 5.5.1 Phase I

- 5.5.2 Phase II

- 5.5.3 Phase III

- 5.5.4 Phase IV

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Clario

- 6.3.2 Icon plc

- 6.3.3 IXICO plc

- 6.3.4 Parexel International Corp.

- 6.3.5 Medpace Holdings, Inc.

- 6.3.6 Navitas Clinical Research

- 6.3.7 WorldCare Clinical LLC

- 6.3.8 Radiant Sage LLC

- 6.3.9 Resonance Health

- 6.3.10 WCG (WIRB-Copernicus Group)

- 6.3.11 Siemens Healthineers AG

- 6.3.12 GE HealthCare Technologies Inc.

- 6.3.13 Calyx

- 6.3.14 Signant Health

- 6.3.15 Imaging Endpoints

- 6.3.16 Perspectum Diagnostics

- 6.3.17 BioClinica Inc.

- 6.3.18 Collective Minds Research (CMRAD)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment