PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852095

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852095

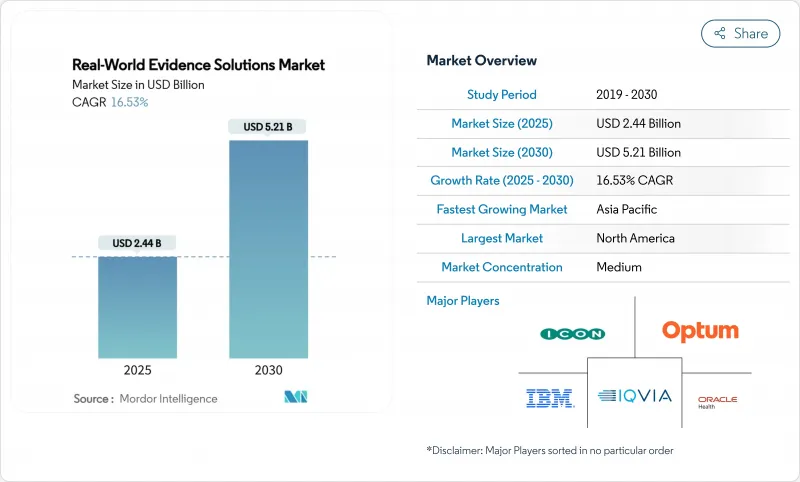

Real-World Evidence Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The real-world evidence solutions market size stands at USD 2.44 billion in 2025 and is projected to reach USD 5.21 billion by 2030, advancing at a vigorous 16.53% CAGR.

Digitized clinical, genomic and administrative data sets are expanding at double-digit rates across major healthcare systems, while regulators in the United States, European Union and Japan continue to publish guidance on how sponsors can incorporate non-traditional data into submissions, cutting development timelines without sacrificing scientific rigor. Biopharma budgets are tilting toward large, curated patient cohorts that lower recruitment risk, and payers are tying premium pricing to outcomes, forcing manufacturers to adopt analytics that validate real-world effectiveness at launch. Venture capital inflows favor platform companies with scalable cloud architectures, giving them the capital to acquire niche datasets and consolidate share. At the same time, privacy-preserving techniques such as tokenization and federated learning are becoming procurement prerequisites, steering contracts toward vendors with proven security and governance.

Global Real-World Evidence Solutions Market Trends and Insights

Growing Regulatory Acceptance Across Major Agencies

The U.S. FDA's Real-World Evidence Framework and corresponding pilot programs have formalized pathways for submitting externally controlled cohorts built from claims and EHR records. The European Medicines Agency mirrors this trend under its Data Analysis and Real-World Interrogation Network, publishing positive qualification opinions for multiple synthetic-arm proposals. Japan's PMDA followed with its 2024 guidance on real-world data reliability testing. Sponsors now embed observational endpoints as early as phase II, reducing uncertainty in pivotal trials. Transparent data lineage has thus shifted from a compliance afterthought to a frontline differentiator, rewarding vendors that deliver audit-ready pipelines and accelerating contract sign-offs among risk-averse biopharma procurement teams.

Rapid Expansion of Digitized Healthcare Data

Electronic health record adoption levels surpassed 89.0% among U.S. non-federal acute-care hospitals in 2024, adding petabytes of structured data to the real-world evidence solutions market. Wearables generate continuous physiologic streams, while next-generation sequencing outputs enrich disease registries with molecular signatures. Multi-modal linkages enable researchers to combine imaging, pharmacy claims and social-determinant indicators, uncovering phenotypes invisible to traditional trials. Yet stricter privacy statutes such as the EU's GDPR and California's CPRA are sharpening oversight. Tokenization providers that convert identifiers into non-reversible hashes have become central partners, and federated-learning networks that move code to the data rather than aggregating raw files allow cross-border collaboration without breaching residency rules. Vendors able to harmonize disparate taxonomies under common data models shorten study start-up by months, gaining a measurable edge.

AI and Advanced Analytics Platforms Mature to Extract Actionable Insights

Transformer-based natural language processing models achieved F1 scores above 0.90 on extracting oncology endpoints from unstructured pathology reports in 2024 validation studies, cutting manual abstraction costs by more than 60%. NVIDIA's DGX H100 clusters, deployed through IQVIA's Applied AI portfolio, reduce model training times from days to hours, enabling rapid iteration on predictive models. Synthetic-data generation techniques address class imbalance and privacy constraints, broadening training sets without exposing identifiable records. Such productivity gains justify premium license fees, pushing AI platform growth faster than the overall real-world evidence solutions market. GPU-accelerated inferencing also lowers query latency, a key buying criterion for medical-affairs teams conducting on-demand evidence searches during payer negotiations.

Other drivers and restraints analyzed in the detailed report include:

- Pharmaceutical Companies Leverage RWE to Curb R&D Timelines and Costs

- Value-Based Reimbursement Models Drive Outcomes-Oriented Evidence

- Data Privacy and Interoperability Challenges Hinder Seamless Integration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services generated 55.0% of the real-world evidence solutions market in 2024, reflecting sponsor dependence on external epidemiologists, HEOR consultants and biostatisticians for study design, data curation and regulatory strategy. Large service providers such as IQVIA, ICON and Syneos Health bundle tokenization pipelines that connect pharmacy claims with EHR feeds, extending longitudinal follow-up and raising client switching costs. Multi-year outsourcing frameworks ensure predictable revenue visibility, cushioning macro-economic swings. Services teams also advise on privacy-impact assessments required under GDPR, expediting European study approvals.

Software, though currently smaller, is scaling at an 18.0% CAGR as platform vendors commercialize cloud-native architectures. Subscription models replace volatile project fees, improving vendor cash flow. AI modules embedded in core platforms automatically extract endpoints from radiology and genomic reports, eliminating manual coding bottlenecks. ConcertAI's SaaS suite, for example, ingests unstructured pathology notes, classifies tumor staging with transformer models and returns structured data formats ready for analysis. Platform adoption often triggers follow-on service requests for bespoke analytics, creating a symbiotic growth loop between software and consulting units.

Cloud captured 65.0% of the real-world evidence solutions market size in 2024, benefiting from elastic compute and pay-as-you-go pricing. AWS Marketplace listings for RWE analytics rose by more than 40% year on year, indicating strong buyer preference for pre-approved vendors that satisfy shared-responsibility security models. Early migrations involve de-identified cohorts, with protected health information moving only after encryption frameworks and key-management policies mature. U.S. health systems leverage public cloud GPU bursts to train NLP models during peak demand, avoiding capital-intensive server purchases.

Hybrid deployment is advancing at 21.0% CAGR as academic medical centers and publicly funded research networks balance on-premise data sovereignty with scalable analytics. Oracle's Cloud@Customer nodes, for instance, sit behind hospital firewalls yet federate with public regions for high-intensity compute jobs, satisfying European Data Protection Board residency guidance. Vendors that deliver policy-based workload orchestration-automatically routing PHI-sensitive queries to private clusters-address a critical adoption hurdle and displace legacy on-prem installations. Capital-intensive sites extend the lifespan of existing server racks while accessing cloud GPUs for burst workloads, improving total cost of ownership.

The Real-World Evidence Solutions Market Report is Segmented by Component (Services, and More), Deployment Mode (Cloud-Based, and More), Therapeutic Area (Drug Development & Approvals, and More), Application (Drug Development & Approvals, and More), End User (Pharmaceutical & Medical-Device Companies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the real-world evidence solutions market in 2024 with a 41.3% share. The FDA's RWE pilot programs provide clear procedural guidance, reducing evidentiary risk for sponsors, while U.S. insurers embed outcome metrics into high-cost drug contracts, indirectly driving demand for compliant analytics. Capital markets reward data-centric business models; valuations for listed RWE vendors on Nasdaq trade at revenue multiples above clinical CRO peers, enabling aggressive reinvestment in product roadmaps.

Europe ranked second, supported by the upcoming European Health Data Space regulation, which mandates technical and legal frameworks for cross-border data reuse. GDPR-compliant architectures and HDS accreditation smooth vendor onboarding with national health services. Multi-payer environments foster niche opportunities: France's ATU system and Germany's AMNOG pathway increasingly accept real-world evidence to confirm added benefit, opening business for specialized oncology and rare-disease datasets.

Asia-Pacific is the fastest-growing region, projected at a 17.8% CAGR. China's National Medical Products Administration issued 2024 guidance on accepting foreign real-world data for supplemental New Drug Applications, lowering submission barriers for multinational sponsors. Japan's MHLW funds digital-biomarker pilots, expanding sources for neurology studies. Australia's My Health Record system surpasses 95% population coverage, creating robust longitudinal datasets that attract overseas sponsors. Cross-border public-private partnerships are standardizing data dictionaries, enabling multi-country cohort pooling and improving algorithm generalizability for global AI models.

- IQVIA

- Optum

- Oracle Health

- ICON

- IBM

- Syneos Health

- TriNetX LLC

- Thermo Fisher Scientific

- Flatiron Health

- SAS Institute, Inc.

- Aetion Inc.

- Komodo Health

- MedPace

- ConcertAI

- Tempus Labs

- Clarivate

- Clinerion Ltd.

- Veeva Systems

- Verto Health

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Acceptance Across Major Agencies

- 4.2.2 Expansion Of Digitized Healthcare Data

- 4.2.3 Pharmaceutical Use Of External Control Arms

- 4.2.4 Value-Based Reimbursement Models

- 4.2.5 Artificial-Intelligence And Advanced Analytics Platforms Maturing

- 4.2.6 Strategic Collaborations Between Cros, Tech Vendors, And Health Systems

- 4.3 Market Restraints

- 4.3.1 Data Privacy And Interoperability Hurdles

- 4.3.2 Regulatory Fragmentation In Cross-Border Studies

- 4.3.3 High Acquisition And Licensing Costs For Curated Longitudinal Datasets

- 4.3.4 Stakeholder Skepticism Regarding Methodological Rigor And Bias In RWE Studies

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Services

- 5.1.2 Data Sets

- 5.1.2.1 Clinical-Settings Data

- 5.1.2.2 Claims & Billing Data

- 5.1.2.3 Pharmacy Dispensing Data

- 5.1.2.4 Patient-Powered & PRO Data

- 5.1.2.5 Other Components

- 5.1.3 Software & Analytics Platforms

- 5.2 By Deployment Mode

- 5.2.1 Cloud-based

- 5.2.2 On-premise

- 5.2.3 Hybrid

- 5.3 By Therapeutic Area

- 5.3.1 Oncology

- 5.3.2 Cardiology

- 5.3.3 Diabetes

- 5.3.4 Neurology

- 5.3.5 Psychiatry

- 5.3.6 Immunology

- 5.3.7 Other Therapeutic Areas

- 5.4 By Application

- 5.4.1 Drug Development & Approvals

- 5.4.2 Medical-Device Development & Approvals

- 5.4.3 Pharmacovigilance & Safety Studies

- 5.4.4 Regulatory Decision-making & Reimbursement

- 5.5 By End User

- 5.5.1 Pharmaceutical & Medical-Device Companies

- 5.5.2 Contract Research Organizations (CROs)

- 5.5.3 Healthcare Providers & Payer-provider networks

- 5.5.4 Other End Users

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle-East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 IQVIA Inc.

- 6.4.2 Optum Inc.

- 6.4.3 Oracle Health

- 6.4.4 ICON plc

- 6.4.5 IBM

- 6.4.6 Syneos Health

- 6.4.7 TriNetX LLC

- 6.4.8 Thermo Fisher Scientific, Inc.

- 6.4.9 Flatiron Health

- 6.4.10 SAS Institute, Inc.

- 6.4.11 Aetion Inc.

- 6.4.12 Komodo Health

- 6.4.13 Medpace Holdings Inc.

- 6.4.14 ConcertAI

- 6.4.15 Tempus Labs

- 6.4.16 Clarivate

- 6.4.17 Clinerion Ltd.

- 6.4.18 Veeva Systems

- 6.4.19 Verto Health

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment