PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852100

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852100

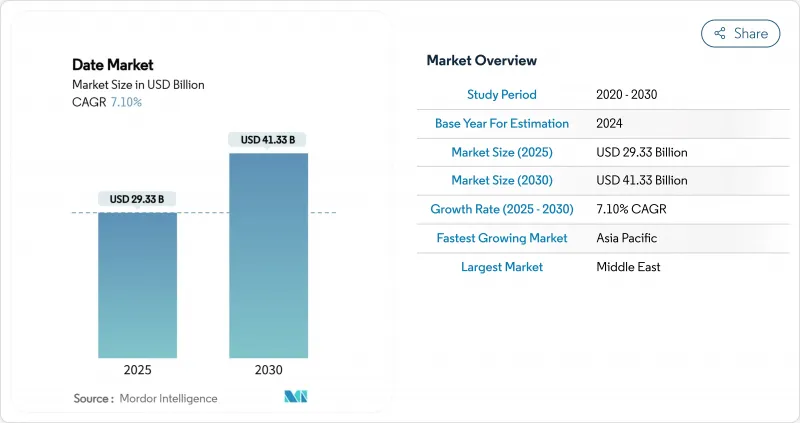

Dates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The dates market size is estimated at USD 29.33 billion in 2025 and is projected to reach USD 41.33 billion by 2030, at a CAGR of 7.10% during the forecast period.

Surging consumer appetite for natural sweeteners, rising festival-linked demand peaks, and expanding cold-chain capacity collectively strengthen growth momentum across the dates market. Health-focused shoppers increasingly view dates as a functional food rich in fiber, minerals, and antioxidants, lifting premium price acceptance even in cost-sensitive regions. Smart-farming investments from precision irrigation to sensor-driven pest monitoring are raising average yields while addressing water scarcity and labor shortages. Trade support programs anchored in Saudi Arabia's Vision 2030 and similar initiatives in the United Arab Emirates, Morocco, and Mexico continue to incentivize mechanization, export diversification, and value-added processing. Intensifying competition for premium Medjool varieties underscores the strategic importance of post-harvest technologies that preserve texture and flavor and unlock higher margins throughout the dates market.

Global Dates Market Trends and Insights

Growing Demand for Plant-Based Natural Sweeteners

Escalating sugar-reduction targets in packaged foods are catalyzing industrial Research and Development around date-derived syrups and powders. Tate and Lyle's USD 1.8 billion purchase of CP Kelco in 2024 underscored mainstream ingredient suppliers' move toward botanical sweetener portfolios. European clean-label regulation accelerates adoption, giving date processors the ability to deliver standardized Brix and flavor profiles, a compelling advantage. The dates market increasingly rewards producers that secure organic certification and traceability, prerequisites for multinational food and beverage contracts. Rapid adoption in snack bars, breakfast cereals, and vegan desserts anchors resilient demand even during macroeconomic slowdowns. The strategic value of date-based sweeteners, therefore, extends beyond niche health-food aisles into large-scale bakery, dairy, and beverage applications, amplifying premium variety demand across the dates market.

Growing Festival-Driven Consumption in Non-Producing Import Markets

Ramadan continues to trigger predictable demand spikes, enabling exporters to lock in premium forward contracts and optimize shipping cycles. Natural Delights reports that Medjool volumes quadruple during the holy month, with sales now spilling over to non-Muslim wellness shoppers seeking fiber-rich "superfruits". European imports, at 184,000 metric tons valued at EUR 481 million (USD 520 million), reveal strong seasonal peaks around Christmas and New Year holidays, particularly in France, Germany, and the United Kingdom. This convergence of religious and secular holiday demand diversifies revenue risks and elevates the dates market in mature economies where alternative natural sweeteners already enjoy broad shelf space. Exporters that align packaging and marketing to festival themes consistently outperform commodity suppliers, highlighting the role of cultural alignment in the dates market.

High Water Footprint Amid Tightening Water Quotas

Date palms require 60-95 m3 of water per tree annually, placing growers under pressure as Gulf governments redistribute scarce aquifer reserves toward strategic food-security crops. Water-productivity targets of 1.3 kg fresh fruit per cubic meter challenge flood-irrigated plantations, driving accelerated adoption of drip and subsurface systems that can halve consumption while doubling yield. Upfront equipment costs remain prohibitive for many smallholders, prompting calls for shared-infrastructure hubs and concessional loans. Growers failing to modernize risk losing subsidies and export licenses, constraining expansion in traditional strongholds and influencing supply dynamics in the dates market.

Other drivers and restraints analyzed in the detailed report include:

- Government Initiatives and Trade Support

- Development of Date-Based Sugar Substitutes

- Labor Shortages for Hand-Pollination and Harvest

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Dates Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

The Middle East held 38% of the dates market size in 2024, with Saudi Arabia and the United Arab Emirates contributing substantial export revenues in 2024. National programs provide subsidized loans for pack-house automation and branding campaigns that position regional cultivars as luxury food gifts. Meanwhile, sustained aquifer depletion and escalating red palm weevil outbreaks demand a rapid transition to precision irrigation and integrated pest management, raising capital requirements across the dates market.

Asia-Pacific's dates market consumption value is projected to climb steadily, fueled by a 7.4% CAGR through 2030. India's significant date imports in 2024 were driven by increasing urban health consciousness and traditional holiday consumption patterns. The expansion of e-commerce, which is projected to dominate global online trade by 2025, has enabled the distribution of premium Medjool dates to tier-two and tier-three cities. In Indonesia and Malaysia, government initiatives to cultivate dates locally are underway, with success contingent on agricultural adaptability to humid conditions.

Europe's consumption profile favors organic and Fair-Trade labels, with seasonal peaks at Ramadan and Christmas supporting predictable import scheduling. Proactive sustainability demands push exporters to disclose water footprint metrics and traceability data, benefitting growers who have invested in QR-code supply-chain systems. North American demand shows consistent single-digit growth. Domestic production in California's Coachella Valley ensures year-round availability, while imports supplement premium and diversified varietal offerings. South America, particularly Mexico's Sonora region, is in early-stage expansion, leveraging CRISPR-bred salt-tolerant cultivars to penetrate the dates market.

- Market Overview

- Market Drivers

- Market Restraints

- Regulatory Landscape

- Technological Outlook

- Value/Supply-Chain Analysis

- PESTLE Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for plant-based natural sweeteners

- 4.2.2 Growing festival-driven consumption in non-producing import markets

- 4.2.3 Rising Yield and Area Harvested Under Dates

- 4.2.4 Government Initiatives and Trade Support

- 4.2.5 Expansion of post-harvest cold-chain infrastructure

- 4.2.6 Development of date-based sugar substitutes

- 4.3 Market Restraints

- 4.3.1 High water footprint amid tightening water quotas

- 4.3.2 Rising incidence of pest infestation

- 4.3.3 Volatile export tariffs from key producers

- 4.3.4 Labor shortages for hand-pollination and harvest

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Value/Supply-Chain Analysis

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 United Kingdom

- 5.1.2.3 France

- 5.1.2.4 Netherlands

- 5.1.2.5 Italy

- 5.1.3 Asia-Pacific

- 5.1.3.1 India

- 5.1.3.2 Indonesia

- 5.1.3.3 Malaysia

- 5.1.3.4 Pakistan

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.5 Middle East

- 5.1.5.1 United Arab Emirates

- 5.1.5.2 Saudi Arabia

- 5.1.5.3 Oman

- 5.1.6 Africa

- 5.1.6.1 Egypt

- 5.1.6.2 Morocco

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Stakeholders

7 Market Opportunities and Future Outlook