PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852101

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852101

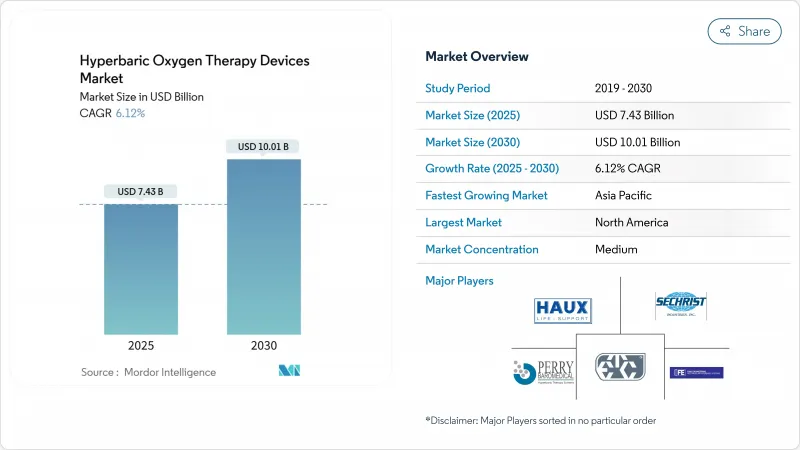

Hyperbaric Oxygen Therapy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hyperbaric oxygen therapy devices market size generated USD 7.43 billion in 2025 and is on track to reach USD 10.01 billion by 2030, translating into a reliable 6.12% CAGR that keeps the technology ahead of the broader medical-device field.

Continuous publication of positive clinical data in wound care, diabetic-foot management and emerging post-viral indications underpins this expansion. Providers view the therapy as a cost-effective way to prevent amputations, shorten inpatient stays and improve quality scores, which sustains hospital demand even as portable systems open new care pathways. Asia-Pacific captures growing capital flows thanks to government-funded chamber hubs in tourist zones and aggressive medical-tourism marketing, while North America remains the clinical-research anchor that validates new indications. Device makers add digital sensors, AI-guided oxygen dosing and remote-monitoring software, raising clinician confidence and reducing adverse-event risk, which in turn reinforces the hyperbaric oxygen therapy devices market growth outlook.

Global Hyperbaric Oxygen Therapy Devices Market Trends and Insights

Rising Burden of Acute & Chronic Wounds

Diabetic-foot ulcers affect 15% of the global diabetes population and account for a disproportionate share of inpatient costs. Hyperbaric sessions elevate tissue oxygen levels, support angiogenesis and achieve a 44-fold improvement in reaching the first 30% wound-size reduction milestone compared with standard care. Payers respond by broadening coverage for chronic-wound protocols, while hospital wound centers allocate capital for additional monoplace chambers to meet referral demand.

Growing Prevalence of Diabetes & Diabetic-Foot Ulcers

Meta-analyses show significant gains in hematological and inflammatory markers and higher closure percentages when diabetic wounds receive hyperbaric oxygen therapy. Clinicians also record faster peripheral-neuropathy recovery, which positions HBOT as a multi-benefit intervention in endocrine clinics. Asia-Pacific's accelerating diabetes incidence drives chamber installations in regional hospitals that seek to curb future amputation rates.

High Capex & Opex of HBOT Installations

Even an entry-level monoplace unit can cost USD 40,000 to USD 200,000, and complete facility build-outs range from USD 250,000 to USD 750,000 once specialized ventilation, fire suppression and accreditation fees are added. Annual service contracts and operator training push total ownership higher, curbing adoption in smaller clinics. Leasing trims upfront expense but extends payback periods beyond five years for low-volume sites.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Portable, Digital & Hybrid Chambers

- Expanding Use in Cosmetic & Sports-Medicine Procedures

- FDA-Approved Vs. Off-Label Indication Gap

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The hyperbaric oxygen therapy devices market size for wound-healing indications reached USD 1.54 billion in 2024 and maintained leadership with a 38.65% revenue share. Integrated wound-care centers rely on HBOT to lower infection risk and speed closure for pressure ulcers, venous ulcers and complex surgical wounds. The diabetic-foot-ulcer sub-segment grows fastest at an 8.65% CAGR due to rising global diabetes prevalence and systematic-review evidence showing 67.5% full-healing rates with only 17.5% recurrence within 12 months. Decompression-sickness demand stays stable among commercial dive and tourism hubs, supported by centers in Thailand that treat up to 500,000 visiting divers each year.

Diversification continues as clinicians test HBOT in radiation-induced cystitis and hemorrhagic complications, reporting promising symptoms relief even in elderly patients who exhausted standard measures. Long-COVID patient cohorts also benefit from improved cognition and reduced fatigue after individualized hyperbaric regimens, broadening the therapy's neurologic footprint. Together, these applications anchor a demand profile that keeps equipment utilization high across multidisciplinary hospital programs.

The Hyperbaric Oxygen Therapy Devices Market Report is Segmented by Application (Decompression Sickness, Diabetic Foot Ulcers, Gas Embolism, Infection Treatment, Wound Healing, and Other Applications), Product Type (Monoplace HBOT Devices, Multiplace HBOT Devices, and More), End User (Hospitals, and More), Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 42.45% revenue in 2024 and remains the research and reimbursement leader. Academic centers such as Duke and Mayo Clinic publish peer-reviewed outcome studies that influence global clinical-guideline writers. Insurers reimburse FDA-approved indications, which underpins steady chamber utilization. The 2025 Oakland County explosion renewed focus on accreditation, prompting regulators to intensify on-site inspections and raising the compliance bar for new entrants. Established manufacturers that offer turnkey safety packages are well positioned to benefit.

Asia-Pacific records the highest growth at a 7.45% CAGR up to 2030. The Philippines earmarked PHP 50 million to create hyperbaric hubs in key dive islands, a strategy expected to lift tourism revenue and improve diver safety. Thailand's Bangkok Hospital markets international packages priced 50% to 90% below United States equivalents, attracting self-pay patients seeking wound-care or sports-recovery treatments. China still hosts the world's largest installed base but faces a replacement wave as aging steel chambers approach end-of-life certification, creating a retrofit opportunity for suppliers.

Europe is a mature yet innovation-oriented arena where national health services fund HBOT for approved oncologic and reconstructive applications. Germany's stringent equipment-testing regime favors premium vendors with CE-marked pressure vessels, while the United Kingdom directs new spending toward community-based wound-care centers that include hyperbaric suites inside outpatient clinics. Middle East and Africa markets grow from a smaller base as Gulf state hospitals add HBOT to burn-unit protocols. South America sees moderate uptake, led by Brazil's private orthopedic chains bundling post-surgery hyperbaric sessions into rehab packages.

- Environmental Tectonics

- HAUX-LIFE-SUPPORT

- Sechrist Industries

- Perry Baromedical Corp.

- Fink Engineering

- Hearmec

- Hyperbaric SAC

- Hyperbaric Modular Systems Inc. (HMS)

- Pan America Hyperbarics Inc.

- OxyHeal Health Group

- IHC Hytech B.V.

- BioBarica

- BAROKS Hyperbaric

- AHA Hyperbarics

- Tekna Manufacturing

- Gulf Coast Hyperbarics

- Submarine Mfg & Products Ltd

- Eternalhealth Medical Equip.

- OxyVal Hyperbaric

- Hyperbaric Medical Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Acute & Chronic Wounds

- 4.2.2 Growing Prevalence of Diabetes & Diabetic-Foot Ulcers

- 4.2.3 Technological Advances (Portable, Digital & Hybrid Chambers)

- 4.2.4 Expanding Use in Cosmetic & Sports-Medicine Procedures

- 4.2.5 AI-Driven Oxygen-Dosing & Remote-Monitoring Platforms

- 4.2.6 Repurposing Surplus Industrial Pressure Vessels In EMS

- 4.3 Market Restraints

- 4.3.1 High Capex & Opex of HBOT Installations

- 4.3.2 FDA-Approved Vs. Off-Label Indication Gap

- 4.3.3 Escalating Fire-Safety Insurance Premiums for Centers

- 4.3.4 Shortage of Certified Hyperbaric Clinicians & Technicians

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Application

- 5.1.1 Decompression Sickness

- 5.1.2 Diabetic Foot Ulcers

- 5.1.3 Gas Embolism

- 5.1.4 Infection Treatment

- 5.1.5 Wound Healing

- 5.1.6 Other Applications

- 5.2 By Product Type

- 5.2.1 Monoplace HBOT Devices

- 5.2.2 Multiplace HBOT Devices

- 5.2.3 Topical / Portable HBOT Devices

- 5.2.4 Hybrid Low-Pressure Chambers

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical & Specialty Clinics

- 5.3.3 Stand-alone Hyperbaric Treatment Centers

- 5.3.4 Home-Care Settings

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Environmental Tectonics Corporation

- 6.3.2 HAUX-LIFE-SUPPORT GmbH

- 6.3.3 Sechrist Industries Inc.

- 6.3.4 Perry Baromedical Corp.

- 6.3.5 Fink Engineering

- 6.3.6 Hearmec Co. Ltd

- 6.3.7 Hyperbaric SAC

- 6.3.8 Hyperbaric Modular Systems Inc. (HMS)

- 6.3.9 Pan America Hyperbarics Inc.

- 6.3.10 OxyHeal Health Group

- 6.3.11 IHC Hytech B.V.

- 6.3.12 BioBarica

- 6.3.13 BAROKS Hyperbaric

- 6.3.14 AHA Hyperbarics

- 6.3.15 Tekna Manufacturing

- 6.3.16 Gulf Coast Hyperbarics

- 6.3.17 Submarine Mfg & Products Ltd

- 6.3.18 Eternalhealth Medical Equip.

- 6.3.19 OxyVal Hyperbaric

- 6.3.20 Hyperbaric Medical Solutions

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment