PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852108

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852108

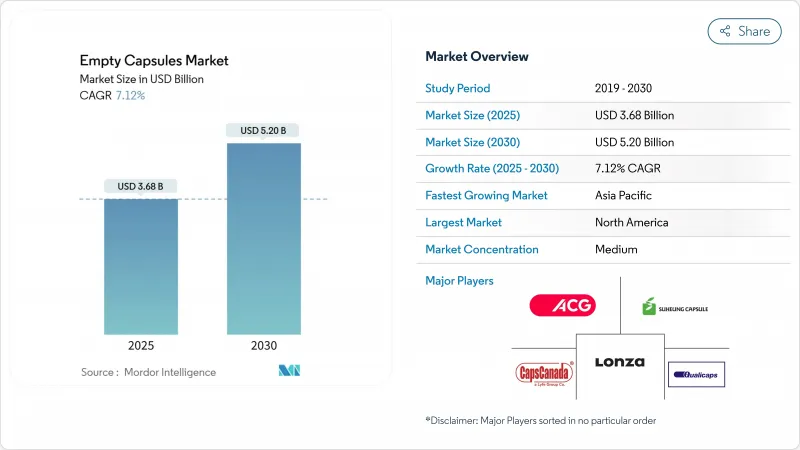

Empty Capsules - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The empty capsules market size is valued at USD 3.68 billion in 2025 and is forecast to reach USD 5.20 billion by 2030, expanding at a 7.12% CAGR.

Growth springs from larger pharmaceutical production runs, wider acceptance of capsule-based therapies and rapid improvements in high-speed filling equipment. Rising demand for personalized dose packaging, especially in North America and Europe, lifts premium capsule grades that meet strict regulatory and patient-centric requirements. Technology upgrades that integrate machine vision and IoT sensors are raising first-pass yield rates and lowering unit costs, encouraging producers to scale capacity. Simultaneously, nutraceutical brands are shifting to capsules to protect delicate ingredients, which adds a fresh layer of demand diversity. Competitive intensity is sharpening as leading suppliers expand output in India and China while exploring divestitures or joint ventures that promise sharper strategic focus.

Global Empty Capsules Market Trends and Insights

Growing Pharmaceutical Manufacturing Volume

Expanding drug output, propelled by aging populations and wider insurance coverage, creates sustained demand for high-precision empty capsules market supply chains. Lonza's CHF 85 million upgrade that adds 30 billion units a year shows how producers scale capacity to secure continuity of supply. Continuous production lines need feedstock uniformity and real-time quality data, which favors premium capsule grades. Heightened biologics output intensifies requirements for contamination-free shells. Flexible manufacturing models, where plants hold larger safety stocks to enable rapid changeovers, further lift unit consumption across regions.

Rising Nutraceutical Consumption

Preventive-health habits are steering consumers toward probiotics, adaptogens and bespoke blends that rely on capsules to protect sensitive actives. Formulators pick plant-based HPMC shells for clean-label claims because they avoid animal derivatives. Double-digit sales growth of probiotic capsules in the United States and Germany demonstrates the trend. Smaller batch runs for personalized nutrition create fresh orders for niche capsule sizes. Brand owners also use clear or tinted shells to signal transparent labeling, which reinforces the capsule format as a premium delivery vehicle.

Volatility in Gelatin Raw-Material Supply

Tighter bovine and porcine supply and potential 10-25% import tariffs on pharmaceutical-grade gelatin raise short-term cost pressure on the empty capsules market. Seasonal plant shutdowns in China compound scarcity, exposing firms that rely on single-source contracts. Pharmaceutical buyers respond by dual-sourcing and pre-booking volumes, but that strategy ties up working capital. Climate-driven livestock disruptions may persist, nudging formulators toward plant-based shells despite higher unit prices. Broader adoption of HPMC capsules could therefore accelerate if gelatin volatility persists.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in Capsule Filling Technology

- Shift Toward Personalized Dose Packaging

- Stringent Religious and Dietary Compliance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gelatin shells retained 84.34% of empty capsules market share in 2024, thanks to entrenched cost advantages and proven functionality. Yet non-gelatin capsules are moving at a 10.32% CAGR, signaling a structural pivot driven by clean-label preferences and multi-faith compliance requirements. Hard gelatin variants dominate high-volume oral solids, while soft gelatin capsules support lipid-soluble formulations. Innovation in cellulose chemistry equips HPMC shells with dissolution and mechanical properties once exclusive to gelatin. Pullulan and starch capsules occupy premium niches where oxygen barrier performance or specific vegetarian claims hold sway.

HPMC adoption rises fastest in nutraceutical lines that encapsulate moisture-sensitive probiotics or herbal extracts. Producers overcome previous brittleness by optimizing moisture content during drying. Pullulan's superior oxygen resistance makes it ideal for high-potency botanicals. Emerging enteric HPMC capsules such as Enprotect reach 98% buffer-conditioned release efficiency without secondary coating, cutting process steps and validating the premium positioning. Starch variants remain limited to cost-sensitive segments but stand to benefit if conversion economics further improve.

Immediate-release shells held 72.45% share of the empty capsules market size in 2024, favored for their established compendial standards. However, sustained-release uses are growing at 9.84% CAGR as pharma companies chase once-daily regimens that lift adherence. Delayed-release capsules fill a smaller yet strategic niche for acid-labile APIs, evolving through polymer layering that triggers site-specific dissolution. Continuous coating methods yield tighter polymer distribution, enhancing batch uniformity and easing regulatory filings.

Bi-layer shells merge immediate and sustained profiles in a single unit, eliminating the need for tablet-capsule hybrids. pH-independent matrices counter patient-to-patient variability in gastric conditions. Real-time analytics embedded in continuous lines give operators direct control over coating weight gain, reducing deviations. As digital therapeutics integrate drug release data into patient dashboards, demand for bespoke release profiles is poised to strengthen over the forecast horizon.

The Empty Capsules Market Report is Segmented by Product (Gelatin Capsules and Non-Gelatin Capsules), Functionality (Immediate-Release Capsules, and More), Therapeutic Application (Antibiotic & Antibacterial, and More), End User (Pharmaceutical Industry, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with a 38.54% stake in the empty capsules market in 2024, backed by advanced GMP facilities and FDA oversight that prizes documentation and batch consistency. Continuous manufacturing pilots in the United States push suppliers to meet tight specification ranges and real-time release testing. Canada's generics production and Mexico's contract-manufacturing base add depth to regional capsule demand. Plants that can certify for FDA, Health Canada and USP standards thus win preferred-supplier status.

Asia-Pacific records the highest 8.72% CAGR through 2030 and is set to re-shape global volume flows. China upgrades its pharmaceutical infrastructure while antidumping probes into low-cost capsule exports force realignment of sourcing strategies. India leverages cost advantages and a skilled workforce; Natural Capsules' INR 250 million expansion indicates confidence in export contracts. Japan targets geriatric formulations that demand easy-to-swallow shells, favoring smaller sizes and enhanced glidants. Southeast Asian economies follow suit as universal healthcare programs expand access to oral therapies.

Europe maintains a mature yet innovative landscape. German biotechnology hubs require advanced capsule technologies for specialty drugs, while post-Brexit policy tweaks stimulate United Kingdom-based investments. EU environmental directives encourage a pivot to plant-based shells, with HPMC uptake gathering momentum. Producers market low-carbon footprints and solvent-free processes to align with corporate sustainability targets. Across the bloc, personalized medicine pilots tap into e-prescription platforms, and capsule suppliers that can provide rapid small-lot deliveries gain competitive edges.

- ACG Worldwide

- Lonza Group

- Qualicaps

- Suheung Capsule

- CapsCanada Corporation

- Bright Pharma Caps

- Medi-Caps

- HealthCaps India Ltd

- Sunil Healthcare Ltd

- Fujifilm Corp. (Fujicaps)

- Roxlor LLC

- Farmacapsulas S.A.

- Patheon (Thermo Fisher)

- Sirio Pharma Co., Ltd.

- Er-Kang Pharmaceutical Co. Ltd

- Qingdao Yiqing Medicinal Capsules

- Shanxi Guangsheng Medicinal Capsules

- Shanxi JC Biological Technology

- Natural Capsules Ltd

- Zhejiang Huangyan Gelatin Capsule Co. Ltd

- Zhejiang Ruixin Capsules Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Pharmaceutical Manufacturing Volume

- 4.2.2 Rising Nutraceutical Consumption

- 4.2.3 Advancements in Capsule Filling Technology

- 4.2.4 Shift Toward Personalized Dose Packaging

- 4.2.5 Integration of Digital Health Technologies

- 4.2.6 Expansion of Continuous Manufacturing Infrastructure

- 4.3 Market Restraints

- 4.3.1 Volatility In Gelatin Raw Material Supply

- 4.3.2 Stringent Religious and Dietary Compliance

- 4.3.3 Limited Availability of Pharmaceutical-Grade HPMC

- 4.3.4 Climate-Induced Stability Challenges In Supply Chain

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Gelatin Capsules

- 5.1.1.1 Hard Gelatin Capsules

- 5.1.1.2 Soft Gelatin Capsules

- 5.1.2 Non-Gelatin Capsules

- 5.1.2.1 HPMC Capsules

- 5.1.2.2 Pullulan Capsules

- 5.1.2.3 Starch-Based Capsules

- 5.1.1 Gelatin Capsules

- 5.2 By Functionality

- 5.2.1 Immediate-Release Capsules

- 5.2.2 Delayed-Release Capsules

- 5.2.3 Sustained/Extended-Release Capsules

- 5.3 By Therapeutic Application

- 5.3.1 Antibiotic & Antibacterial

- 5.3.2 Vitamins & Dietary Supplements

- 5.3.3 Antacid & Antiflatulent

- 5.3.4 Cardiovascular Therapy

- 5.3.5 Other Therapeutic Applications

- 5.4 By End User

- 5.4.1 Pharmaceutical Industry

- 5.4.2 Nutraceutical Industry

- 5.4.3 Cosmetic & Personal-Care

- 5.4.4 Research & Academic Laboratories

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 ACG Worldwide

- 6.3.2 Lonza Group (Capsugel)

- 6.3.3 Qualicaps

- 6.3.4 Suheung Capsule Co. Ltd

- 6.3.5 CapsCanada Corporation

- 6.3.6 Bright Pharma Caps Inc.

- 6.3.7 Medi-Caps Ltd

- 6.3.8 HealthCaps India Ltd

- 6.3.9 Sunil Healthcare Ltd

- 6.3.10 Fujifilm Corp. (Fujicaps)

- 6.3.11 Roxlor LLC

- 6.3.12 Farmacapsulas S.A.

- 6.3.13 Patheon (Thermo Fisher)

- 6.3.14 Sirio Pharma Co., Ltd.

- 6.3.15 Er-Kang Pharmaceutical Co. Ltd

- 6.3.16 Qingdao Yiqing Medicinal Capsules Co. Ltd

- 6.3.17 Shanxi Guangsheng Medicinal Capsules Co. Ltd

- 6.3.18 Shanxi JC Biological Technology Co. Ltd

- 6.3.19 Natural Capsules Ltd

- 6.3.20 Zhejiang Huangyan Gelatin Capsule Co. Ltd

- 6.3.21 Zhejiang Ruixin Capsules Co. Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment