PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852114

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852114

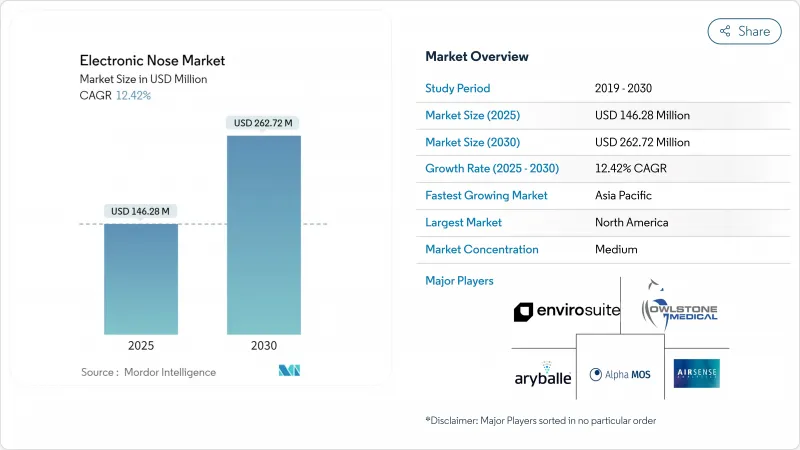

Electronic Nose - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The electronic nose market size is valued at USD 146.28 million in 2025 and is forecast to reach USD 262.72 million by 2030, expanding at a 12.42% CAGR over the period.

Strong momentum arises from miniaturized MEMS sensor arrays, neuromorphic AI algorithms, and increasing deployment across healthcare, food safety, and environmental monitoring. High-speed odor detection now matches mammalian olfaction with millisecond response times, making the technology viable for real-time diagnostics. North America holds a 30.5% electronic nose market share in 2024 on the back of supportive regulatory frameworks for breath diagnostics. Meanwhile, the Asia-Pacific is the fastest-growing region at 14.0% CAGR, fueled by quality control demands in manufacturing and agriculture. Across end-user verticals, food and beverage commands 35.3% revenue while healthcare shows the highest 13.6% CAGR, driven by validated breath-based disease tests.

Global Electronic Nose Market Trends and Insights

Rapid Miniaturization and Cost Decline of MEMS Sensor Arrays

MEMS-based systems now fit on credit-card footprints while maintaining >95% detection accuracy. Standardized semiconductor packaging and expanded wafer fabs in China, South Korea, and Taiwan have shaved 40-60% off unit costs since 2022. Tungsten-trioxide nanorod heaters enable 0.5-1 s identification, far outpacing legacy 10-30 s platforms.Duty-cycling strategies cut power draw to 160 µW at 250 °C, opening battery-operated and wearable use cases. The net result: entry barriers fall and the electronic nose market penetrates consumer electronics, telehealth, and smart-home ecosystems.

Integration of Neuromorphic AI for Real-Time Pattern Recognition

Spiking neural networks modeled on the mammalian olfactory bulb accomplish >97% classification accuracy with <16 ms latency on 1 mW ASICs. Large-language-model extensions fuse chemical signatures with contextual metadata, sharpening selectivity for overlapping VOC profiles. Edge implementations trim cloud traffic, critical for hazardous-gas alerts in mining and process plants. Online active-learning loops counter sensor drift, keeping long-term accuracy above 90% without manual recalibration. These breakthroughs underpin the next wave of autonomous odor-analysis devices across defense, healthcare, and industrial safety.

Sensor Drift and Calibration Complexity in Harsh Environments

Metal-oxide sensors exhibit pronounced baseline drift under humidity and temperature swings, forcing quarterly recalibration that inflates operating costs. Seven-year field studies confirm performance erosion necessitating sensor replacement in refinery stacks and landfills. Wavelet-decomposition and machine-learning compensation reach 100% identification over one-year horizons but demand embedded computing power, raising the bill of materials. While one-class drift schemes cut calibration samples by 70%, they still rely on controlled training cycles. Industries requiring 24/7 uptime, such as petrochemical processing, view these maintenance burdens as adoption barriers.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Bio-security Mandates in Agri-Exporting Nations

- VOC-Based Disease Diagnostics Gaining Regulatory Fast-Track

- Data-Privacy Concerns for Breath-Biopsy Health Records

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Healthcare is projected to post a 13.6% CAGR through 2030. Breath-based oncology screening and asthma-monitoring devices drive demand, supported by favorable reimbursement pilots in the United States and Germany. Food and beverage remains the largest vertical, leveraging e-noses for meat freshness, wine oxidation, and dairy adulteration checks. Adoption spreads from processing plants to quick-service restaurants, integrating cloud dashboards for daily product audits.

Military, defense, and homeland security made up 9.1% revenue in 2025, propelled by toxic-gas detection requirements within NATO and Asia-Pacific defense modernization. Waste-management operators deploy odor sensors to comply with landfill emission caps in EU member states. Industrial safety and HVAC companies embed arrays in ventilation systems for 24/7 CO2 and VOC tracking, reducing sick-building complaints. Overall, healthcare's elevated CAGR positions it to eclipse food and beverage revenue post-2030.

The Electronic Nose Market Report is Segmented by End-User Vertical (Military and Defense, Healthcare, Food and Beverage, and More), Sensor Technology (Metal-Oxide Semiconductor, Quartz Crystal Microbalance, and More), Application (Disease Diagnosis, Quality Control and Shelf-Life Prediction, and More), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 30.5% of the electronic nose market, underpinned by NIH grants and early FDA clearances for breath diagnostics. Defense and homeland-security spending on chemical-threat detection further stimulates demand. Academic-industry collaborations at institutions such as Stanford and MIT accelerate new-product pipelines.

Asia-Pacific is projected to clock the fastest 14.0% CAGR as China, Japan, and India digitize food-supply chains and smart-factory lines. Semiconductor manufacturing hubs in Taiwan and South Korea offer cost-effective fabs for MEMS die, lowering regional ASPs. Local start-ups in Shenzhen and Bengaluru use edge AI to tailor low-cost modules for curry freshness, rice-wine quality, and urban air pollution use cases.

Europe is sustained by EN 13725:2022 odor-emission enforcement that obliges industrial sites to deploy continuous monitoring. The region's agri-exporters integrate e-noses in bio-security protocols to protect trade with the Middle East and Asia. In South America and the Middle East, and Africa, the demand for electronic nose is driven by agricultural export inspection and oil-and-gas methane detection respectively, albeit from a lower base.

- Alpha MOS SA

- Electronic Sensor Technology Inc.

- Plasmion GmbH

- Envirosuite Ltd.

- The eNose Company BV

- Airsense Analytics GmbH

- Sensigent LLC

- Common Invent BV

- E-Nose Pty Ltd.

- Owlstone Medical Ltd.

- Smart Nanotubes Technologies GmbH

- Scentroid Inc.

- Oizom Instruments Pvt Ltd. (Odosense)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid miniaturisation and cost decline of MEMS sensor arrays

- 4.2.2 Integration of neuromorphic AI for real-time pattern recognition

- 4.2.3 Heightened bio-security mandates in agri-exporting nations

- 4.2.4 VOC-based disease diagnostics gaining regulatory fast-track

- 4.2.5 Odour-as-a-service platforms unlocking recurring revenue

- 4.2.6 Edge-to-cloud analytics lowering total cost of ownership

- 4.3 Market Restraints

- 4.3.1 Sensor drift and calibration complexity in harsh environments

- 4.3.2 Data-privacy concerns for breath-biopsy health records

- 4.3.3 Absence of harmonised global odour emission standards

- 4.3.4 Limited battery life in portable e-nose devices

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End-user Vertical

- 5.1.1 Military and Defence

- 5.1.2 Healthcare

- 5.1.3 Food and Beverage

- 5.1.4 Waste Management (Environmental Monitoring)

- 5.1.5 Industrial Safety and HVAC

- 5.2 By Sensor Technology

- 5.2.1 Metal-Oxide Semiconductor (MOS)

- 5.2.2 Quartz Crystal Microbalance (QCM)

- 5.2.3 Field Asymmetric Ion Mobility Spectrometry (FAIMS)

- 5.2.4 Conducting Polymer

- 5.2.5 Optical and Photo-Ionisation

- 5.3 By Application

- 5.3.1 Disease Diagnosis (Breath Analysis)

- 5.3.2 Quality Control and Shelf-life Prediction

- 5.3.3 Hazardous Gas Detection

- 5.3.4 Indoor Air Quality Monitoring

- 5.3.5 Research and Academic Testing

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alpha MOS SA

- 6.4.2 Electronic Sensor Technology Inc.

- 6.4.3 Plasmion GmbH

- 6.4.4 Envirosuite Ltd.

- 6.4.5 The eNose Company BV

- 6.4.6 Airsense Analytics GmbH

- 6.4.7 Sensigent LLC

- 6.4.8 Common Invent BV

- 6.4.9 E-Nose Pty Ltd.

- 6.4.10 Owlstone Medical Ltd.

- 6.4.11 Smart Nanotubes Technologies GmbH

- 6.4.12 Scentroid Inc.

- 6.4.13 Oizom Instruments Pvt Ltd. (Odosense)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment