PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852127

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852127

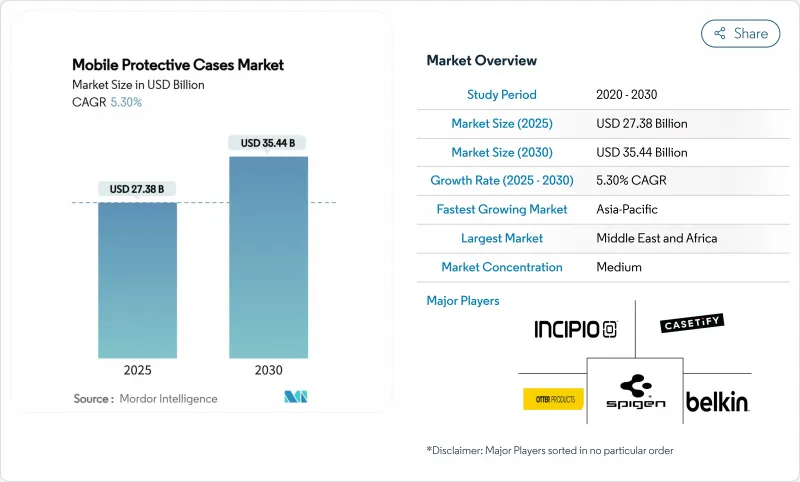

Mobile Protective Cases - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The mobile phone protective cases market recorded a market size of USD 27,381 million in 2025 and is forecast to reach USD 35,445 million by 2030, advancing at a 5.30% CAGR during 2025-2030.

Rising premium-smartphone adoption, continuous material innovation, and omnichannel retail strategies sustain the growth momentum despite price competition. Silicon remains the dominant material, yet leather and next-generation biodegradable thermoplastic polyurethane gain ground as environmental regulations tighten. With the rise in e-commerce sales, online channels are steadily surpassing offline formats. The Asia-Pacific region continues to lead, driven by strong integrated supply chains and a growing middle-income population. In this dynamic market, competitive differentiation now relies on features such as wireless-charging compatibility, antimicrobial finishes, and sustainable sourcing, aligning with stricter PFAS and plastics regulations.

Global Mobile Protective Cases Market Trends and Insights

Surge in premium-smartphone sales

The proliferation of flagship smartphones is transforming the demand for protective cases. In India, smartphone exports are expected to reach USD 21 billion by 2025. Apple is a key contributor, with iPhone exports accounting for nearly 70% of the total and generating USD 14.39 billion in 2024, according to the India Brand Equity Foundation. Premium smartphone users focus on protecting their investments, driving demand for cases that offer superior protection against drops, scratches, and wear. As premium smartphone sales grow, consumers are increasingly spending USD 30-80 on protective solutions for devices priced between USD 800-1,200. This trend is particularly prominent in developed markets, where extended device replacement cycles, often exceeding three years, highlight the need for durable protection. Additionally, advanced features in flagship smartphones, such as wireless charging and sophisticated camera systems, are driving demand for specialized case designs that integrate these technologies without compromising functionality.

Material and design innovation

Breakthroughs in sustainable materials are redefining industry standards by addressing environmental concerns while maintaining performance capabilities. Algenesis Corporation has developed a biodegradable thermoplastic polyurethane (TPU) that decomposes rapidly through composting. Soil microorganisms break down this TPU into harmless nutrients, effectively mitigating the issue of microplastics. This advancement is particularly relevant given the concerns over toxic substances in mobile phone protective cases, where studies have detected polybrominated diphenyl ethers (PBDEs) and heavy metals in traditional materials. Additionally, advanced manufacturing techniques are enabling precise engineering of thermal management properties, which are critical for wireless charging. This is especially important as the Federal Communications Commission (FCC) enforces a specific absorption rate (SAR) limit of 1.6 W/kg for general population exposure. Beyond sustainability, material innovations now include antimicrobial properties, enhanced drop protection, and smart feature integration, transforming protective cases into advanced technology platforms. For instance, in September 2024, Apple introduced the iPhone 16 Plus Clear Case, a Silicone Case with MagSafe technology.

Counterfeit and look-alike products

Counterfeit products are stifling the growth of legitimate markets. Mobile phone accessories, with their straightforward manufacturing processes and lucrative profit margins, are especially susceptible. This allows counterfeiters to churn out convincing replicas at a fraction of the cost. E-commerce platforms, often lacking robust verification mechanisms, unintentionally aid in the spread of counterfeits. The challenge is further compounded for customs authorities, who grapple with enforcement due to the nature of small parcel shipments. In Italy, the "Ministry of the Interior" reported 509 cases of e-commerce counterfeits in 2023. Beyond the economic ramifications, the safety concerns are alarming: many counterfeit products bypass rigorous material testing, potentially harboring hazardous substances that endanger consumer health. Enforcing intellectual property rights is a daunting task, especially in areas where lax regulatory oversight and minimal international collaboration embolden counterfeiting operations.

Other drivers and restraints analyzed in the detailed report include:

- Growth of e-commerce and digital retail

- Fashion and lifestyle influence

- Plastics regulations and PFAS restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Back plate designs dominated the mobile phone protective cases market in 2024 with a 74.70% revenue share and are projected to grow at a 5.64% CAGR (2025-2030), supported by their slim profile and manufacturing cost advantages. Device makers recommend these single-piece shells because they leave displays unhindered while covering glass backs that are prone to shattering. The launch of the Qi2 magnetic profile, which elevates wireless-charging efficiencies to as high as 90%, positions compatible back plate cases for enhanced demand as consumers perceive tangible charging speed improvements. Over the forecast period, folio and rugged variants will remain niche, serving professional or outdoor users who require card slots or dustproof sealing.

A notable design pivot concerns heat dissipation. Reverse-wireless-charging capability in recent flagships compels the integration of graphite sheets or aluminum inserts to diffuse localized hotspots. Suppliers that master thermally conductive yet RF-transparent back plates are likely to secure OEM partnerships, further cementing the back plate segment's centrality in the mobile phone protective cases market.

Silicon accounted for 56.64% of 2024 revenue, reflecting its elasticity, scratch resistance, and labor-efficient molding. Silicone cases are becoming more functional as they increasingly incorporate features like antimicrobial coatings, MagSafe compatibility, and support for wireless charging. Yet anticipated PFAS legislation and growing consumer eco-consciousness bolster demand for leather and plant-based polymers that post a 6.68% CAGR through 2030. Luxury handset owners gravitate toward full-grain leather, while sustainability-minded buyers choose biodegradable TPU lines.

Amid growing public health concerns during 2024-2025, material developers are actively incorporating silver-ion and zinc additives into products to inhibit microbial growth on high-touch surfaces. This innovation aims to address hygiene demands in various applications. Meanwhile, silicon continues to hold a dominant position in the mobile phone protective cases market. However, its leadership is increasingly being contested, as evidenced by a notable rise in patent filings for hybrid silicone-textile lattices. These advanced materials offer enhanced durability, including the ability to withstand drops from heights of up to 2 meters, signaling a shift in market dynamics.

The Mobile Phone Protective Cases Market Report is Segmented by Case Type (Back Plate Cases, and More), Material Type (Silicon, Genuine and PU Leather, and More), Price Range (Mass, Premium), Distribution Channel (Online Retail Stores, Offline Retail Stores), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific led the mobile phone protective cases market in 2024 with 43.73% revenue share, anchored by integrated handset manufacturing clusters in China, South Korea, and Vietnam. Local suppliers benefit from just-in-time logistics that shorten concept-to-launch cycles to under 60 days. Rising disposable incomes in India and Indonesia spur mid-tier smartphone upgrades, expanding the addressable base for entry-level cases. Government broadband initiatives further increase smartphone penetration, widening accessory demand.

In North America, the market presents a mature yet profitable environment where flagship handsets gain widespread adoption, supported by handset subsidies. Premium smartphone cases, featuring advanced attributes such as MagSafe rings for enhanced compatibility, antimicrobial coatings for improved hygiene, and warranty-backed drop protection claims, are increasingly appealing to consumers. Additionally, stringent chemical regulations enforced by the FCC and state-level authorities are driving material innovation. These regulations introduce additional compliance costs, which tend to favor well-established brands with the resources to adapt. In Europe, the market reflects similar trends observed in North America but is further shaped by stronger consumer activism. European consumers place greater emphasis on product recyclability and carbon labeling, pushing sustainability to the forefront. This shift has prompted retailers to prioritize and promote eco-scored product assortments, aligning with the growing demand for environmentally responsible options.

The Middle East and Africa market grows the fastest, posting a projected 7.65% CAGR through 2030. Youthful demographics and rapid 5G rollouts in Gulf economies boost high-spec handset uptake. E-commerce infrastructure improves through cross-border logistics hubs in the United Arab Emirates, widening product availability. Conversely, currency volatility in parts of Africa sustains demand for mass-market cases, yet growing urban centers such as Lagos and Nairobi provide footholds for premium lines.

- Market Overview

- Market Drivers

- Market Restraints

- Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- Porter's Five Forces

- Market Concentration

- Strategic Moves

- Market Share Analysis

- Otter Products LLC

- Spigen Inc.

- Casetagram Limited

- Incipio LLC

- Belkin International Inc.

- Urban Armor Gear

- ZAGG Inc.

- RhinoShield (Evolutive Labs)

- TORRAS Technology

- Speck Products

- Pelican Products

- ESR Gear

- Mous Products

- SUPCASE (i-Blason)

- Tech21

- Ringke

- Reiko Wireless

- Griffin Technology

- Poetic Cases

- Totallee

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in premium-smartphone sales

- 4.2.2 Customization and personalization trend

- 4.2.3 Material and design innovation

- 4.2.4 Fashion and lifestyle influence

- 4.2.5 Growth of e-commerce and digital retail

- 4.2.6 Consumer focus on multifunctionality

- 4.3 Market Restraints

- 4.3.1 Counterfeit and look-alike products:

- 4.3.2 Plastics regulations and PFAS restrictions

- 4.3.3 Thermal-management risk with reverse charging

- 4.3.4 Price commoditization and margin squeeze

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 Case Type

- 5.1.1 Back Plate Cases

- 5.1.2 Folio Cases

- 5.1.3 Other Case Types

- 5.2 By Material Type

- 5.2.1 Silicon

- 5.2.2 Genuine and PU Leather

- 5.2.3 Plastic (Polyurethane, Polycarbonate)

- 5.2.4 Other Material Types

- 5.3 Price Range

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Online Retail Stores

- 5.4.2 Offline retail Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Sweden

- 5.5.3.8 Belgium

- 5.5.3.9 Poland

- 5.5.3.10 Netherlands

- 5.5.3.11 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Thailand

- 5.5.4.5 Singapore

- 5.5.4.6 Indonesia

- 5.5.4.7 South Korea

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.5 Otter Products LLC

- 6.6 Spigen Inc.

- 6.7 Casetagram Limited

- 6.8 Incipio LLC

- 6.9 Belkin International Inc.

- 6.10 Urban Armor Gear

- 6.11 ZAGG Inc.

- 6.12 RhinoShield (Evolutive Labs)

- 6.13 TORRAS Technology

- 6.14 Speck Products

- 6.15 Pelican Products

- 6.16 ESR Gear

- 6.17 Mous Products

- 6.18 SUPCASE (i-Blason)

- 6.19 Tech21

- 6.20 Ringke

- 6.21 Reiko Wireless

- 6.22 Griffin Technology

- 6.23 Poetic Cases

- 6.24 Totallee

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK