PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852137

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852137

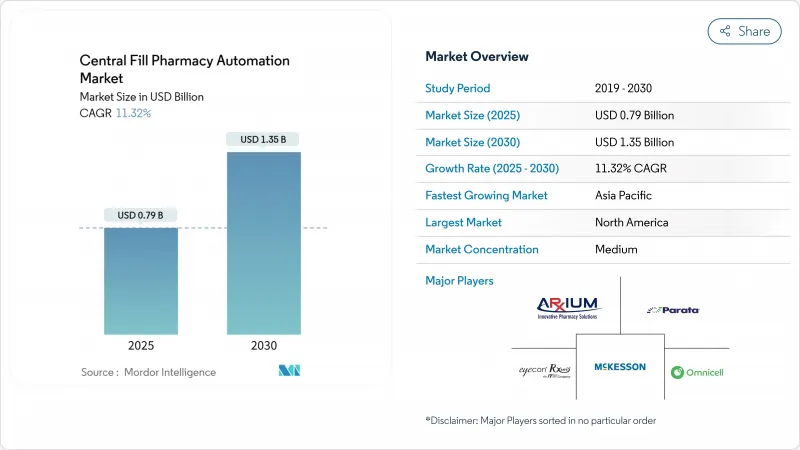

Central Fill Pharmacy Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The central fill pharmacy automation market size is valued at USD 0.79 billion in 2025 and is forecast to reach USD 1.35 billion in 2030, reflecting an 11.32% CAGR.

The growth trajectory mirrors rising labor costs, widening pharmacist shortages, and accelerating mail-order volumes that already exceed 16 million prescriptions each month. Investment momentum is further reinforced by stricter track-and-trace rules under the Drug Supply Chain Security Act, heightened demand for medication accuracy, and retailer cost-saving successes such as Walgreens' USD 500 million in annual fulfillment savings after rolling out micro-fulfillment hubs. Artificial-intelligence tools that spot drug shortages, IoT-linked robotics that run 24/7, and service-based financing models continue to expand the addressable base of hospital, retail, and mail-order operators. Collectively, these forces position the central fill pharmacy automation market as a mission-critical pillar in pharmacy supply-chain modernization worldwide.

Global Central Fill Pharmacy Automation Market Trends and Insights

Growing Demand for High-Throughput Prescription Fulfillment

Facilities processing above 20,000 prescriptions per day now require advanced robotic cells that sustain industrial-level throughput. Walgreens' newest micro-fulfillment hub handles about 13 million prescriptions annually for roughly 200 regional stores, underscoring the scale advantage now achievable. High-volume locations are posting a 13.65% CAGR because they lower per-script costs by 13%, improve inventory turns, and embed automated image-verification checkpoints that curb dispensing errors. Mail-order volumes have grown 126% since 2020, further concentrating scripts into fewer but larger hubs that operate 24/7 with less human oversight. The trend is rapidly redefining prescription fulfillment as a manufacturing workflow requiring conveyor sequencing, robotic induction, and palletization similar to consumer-goods distribution.

Rising Labor Costs and Need for Operational Efficiency

Graduating pharmacist numbers have fallen 10% while applicant pools have shrunk 60% over the past decade, widening wage pressures that automation helps contain. California's Assembly Bill 1286 adds mandatory staffing ratios, spurring chains to augment capacity without inflating payroll. Automated cells can cut technician prep time 59% and reduce pharmacist check time 80%, creating a swift payback in high-cost urban markets. Around-the-clock robotics also eliminate overtime premiums and mitigate scheduling gaps, allowing pharmacists to shift toward clinical services such as vaccinations, which climbed 40% once tasks moved to a hub model.

Limited Availability of Skilled Automation Workforce

Robotics-enabled pharmacies require technicians versed in interplay between medication regulations, software integration, and mechanical troubleshooting. Yet technical talent remains scarce, particularly in emerging markets where vocational programs lag. Six-to-twelve-month specialized courses are needed, and declining pharmacy-school cohorts further shrink the talent funnel. Market leaders now bundle on-site training and remote monitoring to offset gaps, but scarcity still lengthens implementation timelines and raises support costs. In some regions, operators defer upgrades altogether until service ecosystems mature.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Mail-Order and E-Commerce Pharmacy Channels

- Adoption of Advanced Analytics and Robotics

- High Capital Expenditure Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Equipment held 63.67% share of the central fill pharmacy automation market in 2024, anchored by high-speed robotic dispensing, automated pouch packagers, and vision-based verification lines. Automated units such as ScriptPro's SP Series report 99.6% uptime while preparing thousands of scripts per shift. The central fill pharmacy automation market size for services, however, is expanding faster at a 13.56% CAGR as owners seek predictive maintenance, optimization analytics, and compliance support. Outcome-linked programs, typified by Omnicell's XT Amplify, integrate clinical benchmarking with equipment upgrades to maximize error reduction and throughput. Consulting and workforce-training engagements are growing because facilities need cross-disciplinary expertise to fine-tune robotic pick paths, master new serialization mandates, and satisfy auditors.

The central fill pharmacy automation market share advantage for equipment remains intact because each greenfield hub needs conveyors, automated storage, labeling tunnels, and dispatch sorters. Even so, the recurring-revenue appeal of services is prompting vendors to create subscription bundles that include hardware refresh cycles, cloud software, and 24/7 remote monitoring. As a result, the central fill pharmacy automation industry is shifting from discrete capital sales toward solution lifecycle partnerships that lock in multiyear revenue visibility.

The Central Fill Pharmacy Automation Market Report is Segmented by Products & Services (Equipment and Services), End-User Type (Hospital-Owned Central Fill Pharmacies, Retail Chain Central Fill Facilities, and More), Throughput Capacity, Medium, and High), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 46.87% of the central fill pharmacy automation market in 2024, anchored by long-standing DSCSA serialization deadlines and chain-pharmacy consolidation that favors large hubs. Omnicell, BD, and ScriptPro maintain extensive service fleets and data-driven contracts, enabling rapid rollouts and cross-site benchmarking. State mandates-including e-prescribing laws in 35 states and California's staffing ratio rule-further strengthen the case for broad automation. Financing creativity, such as CoverMyMeds' service-based model, continues to broaden adoption among midsize groups.

Asia-Pacific is the fastest-growing territory, projected at 12.56% CAGR. China's policy push for pharmaceutical manufacturing digitalization underpins large-scale deployments such as Sinopharm's automated warehouse, the country's first of its kind. Japan's aging demographics and drug-safety mandates drive hospitals to invest in pouch inspection and traceability. Government subsidies for smart-manufacturing technology in India, South Korea, and Singapore expand the install base for robotic dispensing, inventory analytics, and cold-chain packaging.

Europe remains a steady growth contributor, underpinned by the Pharmaceutical Inspection Co-operation Scheme and country-specific e-health reforms. Dr. Max's 14,000 m2 automation center in Italy delivers nationwide scripts with SSI SCHAEFER shuttle towers and Geekplus AMRs, showcasing multi-vendor orchestration at scale. Denmark's 2024 Pharmacy Act amendment allows hospital pharmacies to dispense directly to outpatients, widening the addressable hub network. Sustainability targets motivate European operators to install energy-efficient shuttle systems and integrate recyclable packaging streams alongside robotic dispensing.

- ARxIUM

- Cornerstone Automation Systems

- KUKA AG

- Mckesson

- Omnicell

- Parata Systems

- Quality Manufacturing Systems

- RxSafe

- R/X Automation Solution

- ScriptPro

- Swisslog Healthcare

- Tension Packaging & Automation

- Capsa Healthcare (Kirby Lester)

- Knapp AG

- Innovation Associates

- Yuyama Co., Ltd.

- AmerisourceBergen Corporation

- MedAvail Holdings Inc

- GSL Solutions Inc

- Talyst Systems (Swisslog)

- TecSys Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for High-Throughput Prescription Fulfilment

- 4.2.2 Rising Labor Costs and Need for Operational Efficiency

- 4.2.3 Expansion of Mail-Order and E-Commerce Pharmacy Channels

- 4.2.4 Emphasis on Medication Safety and Accuracy

- 4.2.5 Adoption of Advanced Analytics And Robotics

- 4.2.6 Vertical Integration Across Pharmacy Supply Chain

- 4.3 Market Restraints

- 4.3.1 Limited Availability of Skilled Automation Workforce

- 4.3.2 High Capital Expenditure Requirements

- 4.3.3 Legacy System Integration Challenges

- 4.3.4 Regulatory Constraints on Centralized Dispensing

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Products & Services

- 5.1.1 Equipment

- 5.1.1.1 Automated Medication Dispensing Systems

- 5.1.1.2 Automated Packaging & Labeling Systems

- 5.1.1.3 Automated Medication Compounding Systems

- 5.1.1.4 Other Equipments

- 5.1.2 Services

- 5.1.2.1 Implementation & Integration Services

- 5.1.2.2 Maintenance & Support Services

- 5.1.2.3 Consulting & Training Services

- 5.1.1 Equipment

- 5.2 By End-User Type

- 5.2.1 Hospital-Owned Central Fill Pharmacies

- 5.2.2 Retail Chain Central Fill Facilities

- 5.2.3 Mail-Order & Online Pharmacies

- 5.2.4 Long-Term Care (LTC) Pharmacies

- 5.3 By Throughput Capacity

- 5.3.1 Low (<=5k Rx/Day)

- 5.3.2 Medium (5k-20k Rx/Day)

- 5.3.3 High (>=20k Rx/Day)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 ARxIUM Inc

- 6.3.2 Cornerstone Automation Systems LLC

- 6.3.3 KUKA AG

- 6.3.4 McKesson Corporation

- 6.3.5 Omnicell Inc

- 6.3.6 Parata Systems LLC

- 6.3.7 Quality Manufacturing Systems Inc

- 6.3.8 RxSafe LLC

- 6.3.9 R/X Automation Solutions

- 6.3.10 ScriptPro LLC

- 6.3.11 Swisslog Healthcare

- 6.3.12 Tension Packaging & Automation

- 6.3.13 Capsa Healthcare (Kirby Lester)

- 6.3.14 Knapp AG

- 6.3.15 Innovation Associates

- 6.3.16 Yuyama Co., Ltd.

- 6.3.17 AmerisourceBergen Corporation

- 6.3.18 MedAvail Holdings Inc

- 6.3.19 GSL Solutions Inc

- 6.3.20 Talyst Systems (Swisslog)

- 6.3.21 TecSys Inc

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment