PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910664

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910664

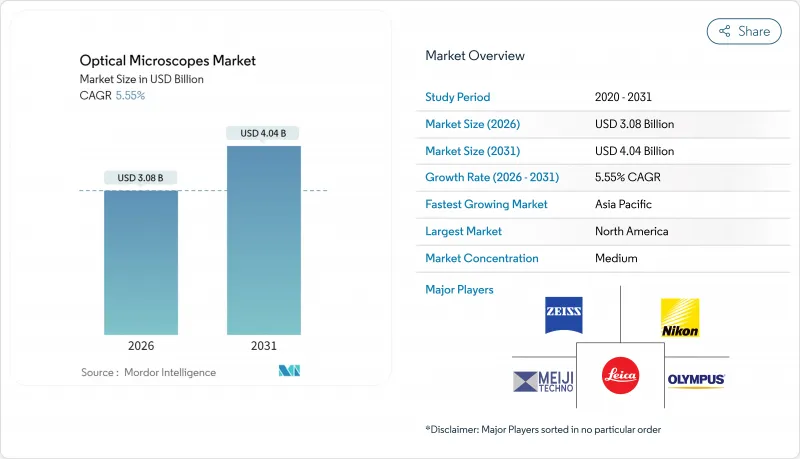

Optical Microscopes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Optical Microscopes market size in 2026 is estimated at USD 3.08 billion, growing from 2025 value of USD 2.92 billion with 2031 projections showing USD 4.04 billion, growing at 5.55% CAGR over 2026-2031.

Machine-learning algorithms now automate image acquisition and interpretation, cutting analysis times from hours to minutes and allowing laboratories to cope with mounting sample volumes. Quantum-sensor integrations are pushing spatial resolution to 10 nanometers, opening new investigative windows in molecular biology and nanomaterials research. Funding inflows particularly the National Institutes of Health's shared instrumentation grants underpin robust upgrade cycles in academic and clinical facilities. Meanwhile, democratized fabrication such as fully 3D-printed optical assemblies priced below USD 50 has begun to lower adoption barriers in resource-limited settings.

Global Optical Microscopes Market Trends and Insights

Rising Funding for Life-Science R&D

Federal and philanthropic programs are underwriting next-generation imaging facilities, such as NIH's USD 130 million cryo-EM expansion and Princeton University's endowment-backed optical core upgrades. Grant mechanisms favor shared-use models, elevating utilization rates and steering procurement toward versatile, modular platforms. Higher capital availability particularly benefits fluorescence and super-resolution instruments whose premium pricing aligns with advanced biomedical use cases. The optical microscopes market therefore locks in multi-year order visibility across academic consortia and regional research networks.

Digitization & AI-Enabled Image Analytics

Deep-learning pipelines now equal or exceed expert pathologists in tumor grading tasks, enabling microscopes to deliver actionable insights in near real time. Frameworks such as ATOMIC demonstrate zero-shot material characterization, removing pre-trained model bottlenecks and widening industrial applicability. Edge computing embedded directly into camera sensors slashes latency, and adaptive illumination guided by AI reduces phototoxic exposure by double-digit percentages. As a result, the optical microscopes market sees escalating demand for integrated hardware-software bundles rather than standalone optics.

Resolution Gap vs. Electron Microscopes

Optical systems remain bounded by diffraction, capping visible-light resolution near 200 nanometers, whereas electron setups routinely push into the sub-angstrom realm. Although MINFLUX and related modalities shrink biological imaging to the 1-3 nanometer domain, materials science still gravitates toward electron platforms for lattice-level insights. Advances in electron ptychography using standard TEMs intensify the comparison by delivering 0.44-angstrom resolution without costly aberration correction. Consequently, some capital budgets tilt toward multi-technique labs rather than pure-play optical upgrades, trimming optical microscopes market growth potential in high-precision metallurgy and semiconductor fabs.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Nanotechnology-Driven Microscopy Demand

- Growth of Clinical Point-of-Care Microscopy

- Price Erosion from Low-Cost Brands

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The digital sub-category accounted for 36.55% of the optical microscopes market in 2025, reflecting a decisive shift toward camera-centric architectures that merge optics with graphics-processing units for instantaneous rendering and annotation. Researchers and clinicians value integrated motorized stages, spectral unmixing, and AI-ready file formats that shrink end-to-end analysis times. Meanwhile, fluorescence and super-resolution systems lead growth, projected at a 7.28% CAGR through 2031, driven by breakthroughs such as λ/33 axial resolution deterministic nanoscopy that unlocks volumetric imaging of intracellular machinery. Compound microscopes remain staples in hematology and classroom instruction, while stereo variants serve electronics inspection and life-science dissection. Emerging quantum-sensor configurations capable of converting magnetic resonance into optical signals at 10 nanometers start to blur traditional product lines, promising a new echelon of versatility within the optical microscopes market.

Open-source ecosystems accelerate iteration cycles: universities now release 3D-printable rigs that hit sub-cellular clarity for under USD 50, catalyzing adoption in field surveillance of vector-borne diseases. Market leaders respond by embedding AI-guided autofocus and cloud telemetry, reinforcing differentiation through software. Inverted formats gain traction inside bioprocessing facilities thanks to live-cell chambers supporting long-term observation. Consequently, the optical microscopes market size for digital and fluorescence lines is projected to command the bulk of incremental revenue over the next half-decade, even as entry-level segments wrestle with price compression.

The Optical Microscopes Market Report is Segmented by Product (Compound Microscopes, Stereo Microscopes, Digital Microscopes, Inverted Microscopes, and More), End User (Hospitals & Clinics, Academic & Research Institutes, Diagnostic Laboratories, Pharmaceutical & Biotech Companies), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads the optical microscopes market with a 33.80% revenue contribution in 2025, supported by NIH-funded cryo-EM hubs and well-established clinical pathology workflows. Yet chronic laboratory technologist shortages 46% vacancy reported in 2024 limit throughput, prompting hospitals to prioritize automation and integrated AI platforms. Digital pathology penetration rises as teleconsultation becomes standard, and market players package scanners, analytics, and cloud storage in subscription models that ensure predictable spending.

Asia Pacific is the fastest mover, expanding at an 10.55% CAGR through 2031. China's provincial governments allocate multi-year budgets for tertiary-hospital upgrades that include multi-photon and quantum-sensor units, while India's diagnostics sector, creating fertile ground for decentralized imaging. Suppliers accelerate localization ZEISS inaugurated a 13,000 square-meter R&D and manufacturing site in Suzhou to tailor optics and software for local protocols. Still, regulatory uncertainty and reimbursement lag in some markets introduce revenue recognition delays, encouraging vendors to adopt partnership-led go-to-market models.

Europe maintains balanced growth, buoyed by Horizon Europe research grants and a cohesive CE-mark framework that simplifies cross-border sales. Middle East & Africa and South America collectively account for a modest but accelerating slice of the optical microscopes market as governments emphasize healthcare self-sufficiency and academic collaborations with G7 institutions drive technology transfers.

- Carl Zeiss

- Nikon Instruments

- Danaher

- Olympus

- Bruker

- Hitachi High-Tech Corp.

- Agilent Technologies

- Keyence Corp.

- Thermo Fisher Scientific

- Meiji Techno

- Labomed Inc.

- AmScope

- Celestron

- Accu-Scope Inc.

- Motic Microscope

- Andor Technology (Oxford Instr.)

- Jenoptik AG

- Prior Scientific Instruments

- Dino-Lite (AnMo Electronics)

- OPTO-Tech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Funding for Life-Science R&D

- 4.2.2 Digitization & AI-Enabled Image Analytics

- 4.2.3 Surge in Nanotechnology-Driven Microscopy Demand

- 4.2.4 Growth Of Clinical Point-Of-Care Microscopy

- 4.2.5 Open-Source Hardware & 3-D-Printed Optical Components

- 4.2.6 Lab-On-Chip / Micro-Fluidic Integration

- 4.3 Market Restraints

- 4.3.1 Resolution Gap Vs. Electron Microscopes

- 4.3.2 Price Erosion from Low-Cost Brands

- 4.3.3 Shortage of Advanced Microscopy Technicians

- 4.3.4 Availability of Low-Cost Alternatives

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Compound Microscopes

- 5.1.2 Stereo Microscopes

- 5.1.3 Digital Microscopes

- 5.1.4 Inverted Microscopes

- 5.1.5 Fluorescence & Super-Resolution Microscopes

- 5.1.6 Other Optical Microscopes

- 5.2 By End User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Academic & Research Institutes

- 5.2.3 Diagnostic Laboratories

- 5.2.4 Pharmaceutical & Biotech Companies

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Carl Zeiss AG

- 6.3.2 Nikon Instruments Inc.

- 6.3.3 Leica Microsystems (Danaher)

- 6.3.4 Olympus Corporation

- 6.3.5 Bruker Corporation

- 6.3.6 Hitachi High-Tech Corp.

- 6.3.7 Agilent Technologies

- 6.3.8 Keyence Corp.

- 6.3.9 Thermo Fisher Scientific

- 6.3.10 Meiji Techno

- 6.3.11 Labomed Inc.

- 6.3.12 AmScope

- 6.3.13 Celestron

- 6.3.14 Accu-Scope Inc.

- 6.3.15 Motic Microscope

- 6.3.16 Andor Technology (Oxford Instr.)

- 6.3.17 Jenoptik AG

- 6.3.18 Prior Scientific Instruments

- 6.3.19 Dino-Lite (AnMo Electronics)

- 6.3.20 OPTO-Tech

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment