PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852149

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852149

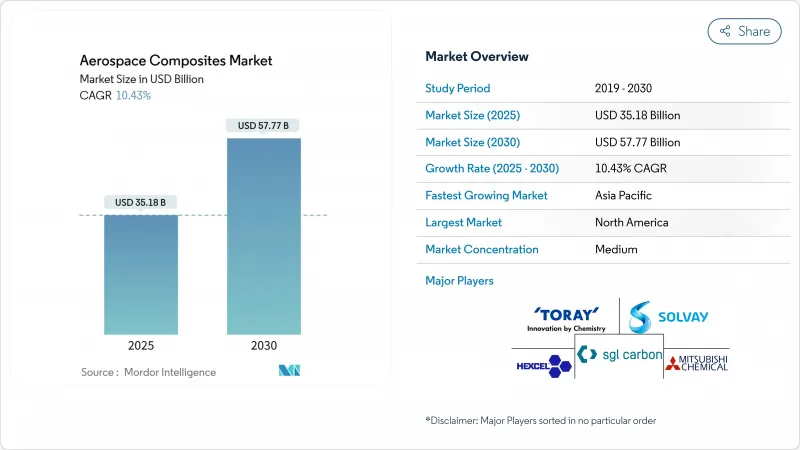

Aerospace Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aerospace composites market is valued at USD 35.18 billion in 2025 and is projected to reach USD 57.77 billion by 2030, registering a 10.43% CAGR over the forecast period.

Strong demand for lightweight structures that enhance fuel efficiency, expanding hypersonic programs, and the growing need for recyclable materials are the central forces shaping the market. Automated fiber placement (AFP) systems delivering 4-8 times higher throughput than legacy lay-up lines, the rapid uptake of thermoplastics in single-aisle backlogs, and fleet electrification requirements for high-temperature parts are among the most influential growth drivers. Major aircraft OEMs vertically integrate composite production to control quality and cost, intensifying supplier competition and accelerating qualification cycles for novel resins. Asia's expanding manufacturing base and rising investments in electric propulsion are turning the region into the fastest-growing hub in the market.

Global Aerospace Composites Market Trends and Insights

Rapid Adoption of Thermoplastic Composites

Collins Aerospace demonstrates that thermoplastic aerostructures cut production cycles by 80%, eliminate autoclave curing, and are nearly 100% recyclable.European single-aisle programs have embraced the material to reduce delivery backlogs. At the same time, an Arkema-Hexcel partnership produced the first fully thermoplastic commercial aircraft structure, validating large-scale out-of-autoclave fabrication. High recyclability aligns with emerging sustainability mandates, positioning thermoplastics as a cornerstone of future market expansion.

Increasing Penetration of Carbon Fiber in Next-Gen Narrow-Body Wings

Airbus's eXtra Performance Wing testbed incorporates extensive CFRP skins to lower drag and cut CO2, showcasing the build feasibility of 32 m-long carbon-fiber wingskins. North American programs perform parallel studies, aiming to match or exceed European CFRP usage. Weight savings of up to 50% versus aluminum and AFP throughput gains directly address the backlog challenge.

High Preform and Autoclave Capital Costs

Aerospace-grade autoclaves cost USD 5-10 million and require extensive infrastructure, deterring Tier-2 entrants. Out-of-autoclave thermoplastic welding and resin infusion are emerging as lower-investment alternatives that can broaden supplier participation across the aerospace composites market.

Other drivers and restraints analyzed in the detailed report include:

- Fleet Electrification and More-Electric Aircraft

- Space Launch Commercialization

- Supply-Chain Volatility of Aerospace-Grade Precursors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Carbon fiber retained 52.51% of the aerospace composites market share in 2024, thanks to mature supply chains and superior stiffness-to-weight ratios. Ceramic fibers, however, are pacing the segment with a 10.92% CAGR, propelled by hypersonic and space vehicle demand for 1,500 °C capability. Hybrid laminates combining carbon and ceramic plies are gaining favor among engine OEMs aiming to cut cooling air draw by 25%. Graphene-enhanced rovings under evaluation show 20-30% modulus boosts while embedding strain-sensing pathways, a step toward self-monitoring wingskins.

The cost-effective positioning of glass fiber maintains relevance in radome and fairing skins, while aramid fibers sustain a share in ballistic-resistant helicopter floors. Continued material innovation supports diversification, yet carbon and ceramic remain the backbone of the market size throughout the forecast horizon.

Thermoset epoxy and BMI systems commanded 46.12% of 2024 revenue because of an extensive qualification pedigree. Thermoplastic PEKK and PEI families are surging at a 13.51% CAGR, driven by 80% cycle-time reductions cited by Collins Aerospace. The aerospace composites market size for thermoplastics is projected to exceed USD 17 billion by 2030 as AFP lines pivot to in-situ consolidation. Bio-based resins pioneered by SHD Composites offer near-100% renewable content and withstand 200 °C service, aligning environmental targets with mechanical integrity.

Qualification momentum is accelerating: the FAA has already cleared welded thermoplastic control surfaces for business jets, signaling an imminent broadening of use cases across the industry.

The Aerospace Composites Market Report is Segmented by Fiber Type (Glass Fiber, Carbon Fiber, and More), Resin Type (Thermoset Composites, and More), Manufacturing Process (Filament Winding, and More), Aircraft Type (Commercial Aircraft, and More), Structural Component (Interior Components, and More), End-User (OEM, and More) and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remains the largest regional contributor with a market share of 30.05%, anchored by The Boeing Company, GE Aerospace, and Lockheed Martin Corporation. The region accounts for roughly 75% of North American sales, with Canada's Montreal cluster supplying high-end nacelles. NASA's HiCAM program underpins thermoplastic welding certification, reinforcing domestic supply chains.

Europe follows, propelled by Airbus and a robust tier network in Germany, France, and the United Kingdom. Aggressive sustainability mandates, such as the EU's Fit for 55 package, are catalyzing the adoption of bio-based composites. Thermoplastic wineskins under production in Wales exemplify Europe's commitment to high-rate, low-carbon manufacturing.

Asia-Pacific is the fastest-growing territory with a CAGR of 10.10%, driven by China's COMAC fleet ramp-up and electric-propulsion R&D hubs in Japan and South Korea. HRC's new Chinese plant supplies AFP stringers for aerospace and high-speed rail, underscoring manufacturing scale advantages. India is nurturing a composites corridor around Bengaluru, supplying ISRO launch vehicles and HAL fighters, further enlarging regional aerospace composites market activity.

Latin America, led by Brazil's Embraer, integrates composites in E2 jet families, while Mexico's Queretaro cluster fabricates nacelle doors for North American primes. In the Middle East and Africa, the United Arab Emirates' Strata composites facility and South Africa's Denel Aerostructures are emerging contributors, aided by offset agreements and skills transfer.

- Toray Industries, Inc.

- Hexcel Corporation

- Solvay

- SGL Carbon

- Mitsubishi Chemical Carbon Fiber and Composites, Inc. (Mitsubishi Chemical Group Corporation)

- Teijin Aramid

- DuPont de Nemours, Inc.

- Spirit AeroSystems Inc.

- General Electric Company

- Rolls-Royce plc

- Safran SA

- Bally Ribbon Mills

- Materion Corporation

- Park Aerospace Corp.

- Lee Aerospace, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of thermoplastic composites to accelerte production rates of single-aisle programs (Europe-led)

- 4.2.2 Increasing penetration of carbon fiber in next-gen narrow-body wings in North America

- 4.2.3 Fleet eletrification and more-electric aircraft (MEA) driving high-temperature composite demand in Asia

- 4.2.4 Space-launch commercialization boosing demand for lightweight composite structures

- 4.2.5 Military stealth programs propelling ceramic-matrix composite uptake in hypersonic applications

- 4.2.6 OEM sustainability targets pushing recyclable composite solutions

- 4.3 Market Restraints

- 4.3.1 High preform and autoclave capital costs limiting adoption in tier-2 suppliers

- 4.3.2 Supply-chain volatility for aerospace-grade precursors for PAN-based carbon fiber

- 4.3.3 Qualification and certification delays for novel resin systems with FAA/EASA

- 4.3.4 Limited repairability expertise for advanced thermoplastics in MRO sector

- 4.4 Value Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Fiber Type

- 5.1.1 Glass Fiber

- 5.1.2 Carbon Fiber

- 5.1.3 Ceramic Fiber

- 5.1.4 Aramid Fiber

- 5.1.5 Other Fiber Types

- 5.2 By Resin Type

- 5.2.1 Thermoset Composites

- 5.2.2 Thermoplastic Composites

- 5.3 By Manufacturing Process

- 5.3.1 Lay-Up (Hand and Automated)

- 5.3.2 Resin Transfer Molding (RTM)

- 5.3.3 Filament Winding

- 5.3.4 Injection/Compression Molding

- 5.3.5 Automated Fiber Placement and Tape Laying

- 5.3.6 Additive Manufacturing of Composites

- 5.4 By Aircraft Type

- 5.4.1 Commercial Aircraft

- 5.4.1.1 Narrow-Body

- 5.4.1.2 Wide-Body

- 5.4.1.3 Regional Jets

- 5.4.1.4 Freighters

- 5.4.2 Business Jets

- 5.4.3 Military Aircraft

- 5.4.3.1 Fighter Jets

- 5.4.3.2 Transport and Tanker

- 5.4.3.3 Rotorcraft

- 5.4.4 Helicopters

- 5.4.5 Spacecraft and Launch Vehicles

- 5.4.1 Commercial Aircraft

- 5.5 By Structural Component

- 5.5.1 Interior Components

- 5.5.2 Exterior and Airframe

- 5.5.3 Engine Components

- 5.5.4 Auxiliary Structures

- 5.6 By End-User

- 5.6.1 OEM

- 5.6.2 Aftermarket/MRO

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Toray Industries, Inc.

- 6.4.2 Hexcel Corporation

- 6.4.3 Solvay

- 6.4.4 SGL Carbon

- 6.4.5 Mitsubishi Chemical Carbon Fiber and Composites, Inc. (Mitsubishi Chemical Group Corporation)

- 6.4.6 Teijin Aramid

- 6.4.7 DuPont de Nemours, Inc.

- 6.4.8 Spirit AeroSystems Inc.

- 6.4.9 General Electric Company

- 6.4.10 Rolls-Royce plc

- 6.4.11 Safran SA

- 6.4.12 Bally Ribbon Mills

- 6.4.13 Materion Corporation

- 6.4.14 Park Aerospace Corp.

- 6.4.15 Lee Aerospace, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment