PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852153

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852153

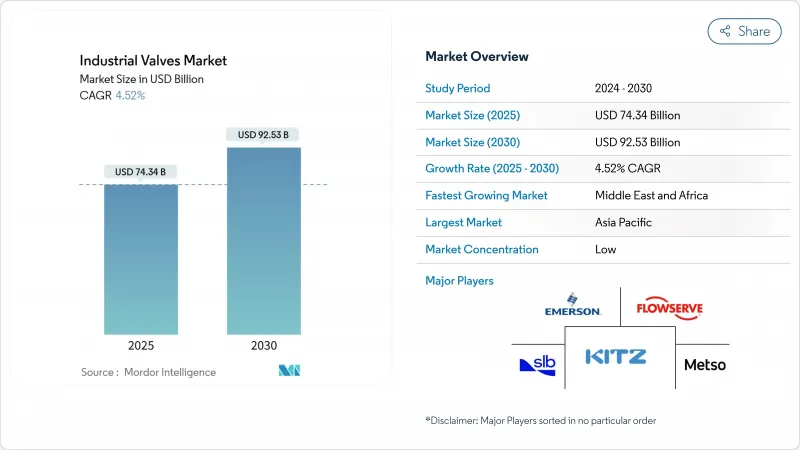

Industrial Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Industrial Valves Market size is estimated at USD 74.34 billion in 2025, and is expected to reach USD 92.53 billion by 2030, at a CAGR of 4.52% during the forecast period (2025-2030).

This steady expansion is underpinned by simultaneous growth in hydrogen, LNG, and desalination infrastructure, alongside cyclical recovery in offshore oil and gas spending. Rising investments in predictive maintenance and stricter fugitive-emission rules are accelerating replacement cycles, while supply-chain bottlenecks for nickel-based alloys are forcing material substitutions. Competitive intensity is increasing because tier-one suppliers are racing to certify valves for hydrogen service and to integrate digital diagnostics, and these dynamics together keep the industrial valves market resilient during the energy transition.

Global Industrial Valves Market Trends and Insights

Hydrogen and Carbon Capture Projects

Expanding hydrogen valleys and carbon-capture hubs across Europe and North America translate into urgent requirements for high-pressure and high-purity valves that tolerate hydrogen embrittlement and CO2 corrosion. The continent already hosts 512 operational hydrogen facilities with 11.23 Mt of production capacity, and project developers continue to favour certified quarter-turn designs for electrolyser balance-of-plant service. Valve suppliers are responding with purpose-built offerings such as Emerson's HV-7000 series, which delivers two-stage pressure reduction up to 700 bar for vehicle refuelling. The push to lock in hydrogen readiness elevates qualification costs but simultaneously creates premium pricing windows, adding meaningful volume to the industrial valves market. Stringent fugitive-emission limits for hydrogen further reinforce demand for metal-seated ball valves sporting low-permeation stem seals. As public-funded policy frameworks earmark EUR 90 billion for hydrogen through 2030, project pipelines are large enough to support sustained double-digit order growth for specialised valve packages

LNG Terminal Build-outs

Global LNG consumption is expected to increase by 2040, driven by industrial users in China and new demand centres across South and Southeast Asia. China alone leads global regasification capacity additions, while the United States is on track to lift LNG exports 18% in 2025, from a 2% rise in 2024. Each new liquefaction train or regasification berth requires thousands of cryogenic ball, plug, and gate valves. Despite labour-cost inflation of up to 20% on the U.S. Gulf Coast, supply contracts remain robust, making LNG infrastructure a near-term catalyst for the industrial valves market. Original-equipment sales predominate, but turnback projects aimed at debottlenecking existing terminals add lucrative retrofit revenues for smart actuators and positioners.

Nickel-Based Alloy Shortage

Battery-sector uptake drove nickel demand up more than 200% between 2019 and 2023, tightening supply for valve-grade alloys. With 93% of matte feedstock controlled by Indonesia-to-China flows, high-alloy castings now exceed 40-week lead times, hampering delivery of cryogenic and sour-service valves. Manufacturers are pivoting to low-nickel duplex substitutes, yet qualification cycles slow switchover. The drag is acute for LNG and hydrogen projects that demand 9% nickel steel or Inconel trim, trimming near-term growth in the industrial valves market.

Other drivers and restraints analyzed in the detailed report include:

- Desalination Plant Investments

- Predictive Maintenance Adoption

- Ductile-Iron Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ball valves held 40% of the industrial valves market in 2024, due to their zero-leakage shut-off, quick quarter-turn motion, and compatibility with piggable pipelines. Recent product innovations focus on polymer seat designs that endure hydrogen permeation, enabling premium niches inside the broader ball-valve family. At the same time, check valves, critical for backflow prevention, are projected to grow at 7.11% CAGR, underpinned by rising investments in LNG tank-farm pump isolation and municipal water networks. Silent-operating dual-plate styles are gaining share because they mitigate water hammer, protecting downstream assets.

Quarter-turn valves, spanning ball, butterfly, and plug constructions, accounted for 54% of 2024 revenue. Their compact footprints, low torque, and short actuation times continue to underpin procurement choices in refinery manifolds and water distribution loops. Multi-turn valves grow faster (5.8% CAGR) where precise throttling is paramount, yet rising automation mandates still favour quarter-turn designs because ISO-5211 mounting pads ease actuator integration. New offerings such as Emerson's AVENTICS XV series double the airflow of earlier generations, lowering cycle time in pneumatic networks.

The Industrial Valves Market Report Segments the Industry by Type (Ball Valve, Butterfly Valve, Gate Valve, Globe Valve, and More), Product (Quarter-Turn Valve, Multi-Turn Valve, and Others), Valve Function (Isolation Valves, and More), Body Material (Steel, Alloy-Based, and More), Application (Oil and Gas, Power, Water and Wastewater Management, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific leads the industrial valves market with 40% of 2024 spending. The region's momentum stems from China's petrochemical complexes, India's distributed water treatment build-outs, and the rise of LNG receiving terminals. China is forecast to commission the bulk of global regasification projects before 2030, increasing on-site requirements for cryogenic isolation and emergency shutdown valves.

Planned U.S. LNG export expansions of 18% in 2025 point to a near-term installation wave for pressure-relief, anti-surge, and blow-down packages. Digital retrofits are gathering pace in Gulf Coast chemical corridors, where predictive analytics shorten turnaround cycles. Canada's carbon-capture incentives also stimulate demand for corrosion-resistant alloy valves in CO2 transport networks.

Europe's market reflects accelerating hydrogen commitments, environmental compliance and aging infrastructure replacement. The Middle-East and Africa are the fastest-growing regions at 6.51% CAGR. Saudi Arabia and the UAE jointly constitute 65% of GCC desalination throughput, and their expansion to 80 million m3/day by 2050 underlines sizable valve procurement pipelines

- Alfa Laval

- AVK International A/S

- Baker Hughes Company

- Circor International Inc.

- Crane Company

- Curtiss-Wright Corporation

- Danfoss A/S

- Emerson Electric Co.

- Flowserve Corporation

- Georg Fischer Ltd.

- Hitachi Ltd

- Honeywell International Inc.

- IMI Critical Engineering (IMI PLC)

- ITT Inc.

- KITZ Corporation

- KLINGER Holding

- Metso

- Mueller Co. LLC

- Nibco Inc.

- Okano Valve Mfg. Co. Ltd.

- SAMSON AKTIENGESELLSCHAFT

- SLB

- Technipfmc PLC

- The Weir Group PLC

- Valvitalia SpA

- Velan

- Xylem

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Hydrogen and Carbon Capture Projects Driving High-Pressure Valve Demand in Europe and North America

- 4.2.2 LNG Terminal Build-outs Across APAC Requiring Valves

- 4.2.3 Accelerating Desalination Plant Investments in GCC Boosting Valve Sales

- 4.2.4 Rapid Adoption of Predictive Maintenance Platforms Elevating Replacement Cycles for Valves in North America Chemical Plants

- 4.2.5 Offshore Deep-water Energy and Power Capex Recovery Stimulating Valve Orders

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Shortage of Nickel-Based Alloy Castings Extending Lead Times Beyond 40 Weeks

- 4.3.2 Price Volatility in Ductile Iron Increasing Total Cost of Ownership for Utility Buyers in Europe

- 4.3.3 Stricter Fugitive-Emission Regulations Elevating Qualification Costs for Small and Mid-Size Manufacturers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Ball Valve

- 5.1.2 Butterfly Valve

- 5.1.3 Gate Valve

- 5.1.4 Globe Valve

- 5.1.5 Plug Valve

- 5.1.6 Other Types

- 5.2 By Product

- 5.2.1 Quarter-Turn Valve

- 5.2.2 Multi-Turn Valve

- 5.2.3 Other Products

- 5.3 By Valve Function

- 5.3.1 Isolation Valves

- 5.3.2 Regulation Valves

- 5.3.3 Check and Safety Valves

- 5.4 By Body Material

- 5.4.1 Steel (Carbon and Stainless Steel)

- 5.4.2 Alloy-Based (Duplex, Inconel, etc.)

- 5.4.3 Cast/Ductile Iron

- 5.4.4 Cryogenic Nickel Alloys

- 5.4.5 Others

- 5.5 By Application

- 5.5.1 Oil and Gas

- 5.5.2 Power

- 5.5.3 Water and Wastewater Management

- 5.5.4 Chemicals

- 5.5.5 New Energy

- 5.5.6 Other Applications (Includes Food Processing, Mining, and Marine)

- 5.6 By Geography

- 5.6.1 Asia-Pacific

- 5.6.1.1 China

- 5.6.1.2 India

- 5.6.1.3 Japan

- 5.6.1.4 South Korea

- 5.6.1.5 Indonesia

- 5.6.1.6 Vietnam

- 5.6.1.7 Malaysia

- 5.6.1.8 Thailand

- 5.6.1.9 Rest of Asia-Pacific

- 5.6.2 North America

- 5.6.2.1 United States

- 5.6.2.2 Canada

- 5.6.2.3 Mexico

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 Italy

- 5.6.3.4 France

- 5.6.3.5 Nordics

- 5.6.3.6 Turkey

- 5.6.3.7 Russia

- 5.6.3.8 Spain

- 5.6.3.9 Rest of Europe

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle-East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Qatar

- 5.6.5.4 Egypt

- 5.6.5.5 Nigeria

- 5.6.5.6 South Africa

- 5.6.5.7 Rest of Middle-East and Africa

- 5.6.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alfa Laval

- 6.4.2 AVK International A/S

- 6.4.3 Baker Hughes Company

- 6.4.4 Circor International Inc.

- 6.4.5 Crane Company

- 6.4.6 Curtiss-Wright Corporation

- 6.4.7 Danfoss A/S

- 6.4.8 Emerson Electric Co.

- 6.4.9 Flowserve Corporation

- 6.4.10 Georg Fischer Ltd.

- 6.4.11 Hitachi Ltd

- 6.4.12 Honeywell International Inc.

- 6.4.13 IMI Critical Engineering (IMI PLC)

- 6.4.14 ITT Inc.

- 6.4.15 KITZ Corporation

- 6.4.16 KLINGER Holding

- 6.4.17 Metso

- 6.4.18 Mueller Co. LLC

- 6.4.19 Nibco Inc.

- 6.4.20 Okano Valve Mfg. Co. Ltd.

- 6.4.21 SAMSON AKTIENGESELLSCHAFT

- 6.4.22 SLB

- 6.4.23 Technipfmc PLC

- 6.4.24 The Weir Group PLC

- 6.4.25 Valvitalia SpA

- 6.4.26 Velan

- 6.4.27 Xylem

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increase in Demand for Automatic Valves