PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852156

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852156

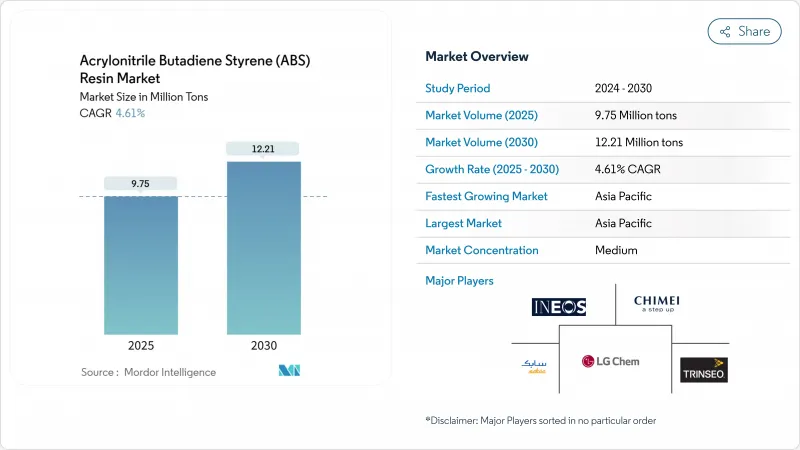

Acrylonitrile Butadiene Styrene (ABS) Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The acrylonitrile butadiene styrene market stood at 9.75 million tons in 2025 and is forecast to reach 12.21 million tons by 2030, advancing at a 4.61% CAGR.

Consistent demand stems from the resin's strength-to-weight ratio, chemical resistance, and ease of processing, qualities that continue to attract high-volume users in automotive, electronics, and construction. Electric-vehicle platforms now specify reinforced ABS grades to replace aluminum brackets and housings, saving up to 40% in weight and 20% in cost while preserving structural integrity. Tight coupling between 5 G infrastructure build-outs and electroplatable ABS grades for antenna housings further widens the resin's opportunity set.

Global Acrylonitrile Butadiene Styrene (ABS) Resin Market Trends and Insights

Lightweighting and Metal Replacement in E-Mobility Platforms

Electric-vehicle designers target mass reduction to extend driving range, and reinforced ABS grades are replacing metal brackets, ducts, and enclosures at scale. Glass-fiber-modified grades achieve tensile strengths above 75 MPa yet weigh 40% less than aluminum, aligning with the U.S. Department of Energy's goal of trimming 25% off light-duty vehicle curb weight by 2030. Automakers also cite lower tooling costs and faster cycle times, which compress program launch schedules. The acrylonitrile butadiene styrene market benefits directly as battery-pack makers specify resin housings that integrate fasteners and cooling channels.

Smart-Home Appliances Requiring High-Gloss Heat-Resistant Grades

Connected home devices pack advanced processors into sleek casings that must withstand sustained temperatures near 100 °C. Appliance OEMs validate glossy, heat-stabilized ABS formulations that retain dimensional accuracy and resist discoloration over multi-year duty cycles. Brand owners also cite the polymer's compatibility with laser-etch debossing, enabling seamless back-lit logos without secondary operations. Short product-refresh cycles maintain high baseline demand and encourage formulators to accelerate color-match services.

Substitution by Bio-Based Polymers in Electronics

Consumer-electronics brands increasingly trial halogen-free biopolymer blends with carbon footprints seven times lower than ABS while still achieving UL-94 V-0 ratings. Europe's Chemicals Strategy for Sustainability tightens scrutiny on petrochemical-derived materials, nudging procurement guidelines toward renewable content. American brands pursue ESG scorecard improvements that raise evaluation hurdles for traditional ABS unless accompanied by recycled content. The acrylonitrile butadiene styrene market retains incumbency where cost, processability, and supply reliability still dominate, yet faces gradual displacement in premium segments.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Desktop 3-D Printers in Education

- Mandatory Flame-Retardant Cockpit Components

- Stringent Nordic VOC Limits on Processing Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Injection Blow Molding secured 48% of 2024 production volume and is growing 5.15% annually, reflecting its efficiency in turning pellets into complex parts with minimal post-processing. Thin-wall capability enables brand owners to cut resin usage without performance loss, supporting sustainability scorecards. Real-time cavity-pressure feedback and conformal-cooling inserts shave cycle times by up to 18%, translating into higher line uptime.

The Acrylonitrile Butadiene Styrene (ABS) Market Report Segments the Industry by Processing Technology (Injection Blow Molding, Extrusion Blow Molding, and More), ABS Grade (General-Purpose, High Impact, and More), End-User Industry (Automotive and Transportation, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominated the acrylonitrile butadiene styrene market with 75% volume in 2024 and will grow 5.17% annually through 2030. China anchors supply and demand by combining world-scale crackers, extensive compounding expertise, and proximity to high-growth consumer-electronics hubs.

North American demand is stable yet shifts toward premium grades. The average car built in 2025 contains 426 lb of plastics, with ABS supplying interior trims, bezels, and taillight modules. In Europe, policy-driven sustainability triggers higher recycled-content targets for automotive polymers, nudging OEMs toward circular ABS streams. Simultaneously, stricter emission controls in Nordic processing plants raise compliance.

Brazil's appliance and automotive sectors underpin regional consumption, while Argentina and Colombia explore near-shoring of electronics assembly. Gulf Cooperation Council states leverage feedstock advantage and a 93% capacity-utilization rate to pivot from export-grade feedstock to local sheet and compound production

- BEPL

- CHIMEI

- ELIX POLYMERS

- Eni S.p.A.

- Formosa Plastics Group

- INEOS

- JSR Corporation

- KUMHO PETROCHEMICAL

- LG Chem

- LOTTE Chemical Corporation

- NIPPON A&L INC.

- PetroChina Company Limited

- SABIC

- Shandong INEOS-YPC

- Techno-UMG Co., Ltd.

- TORAY INDUSTRIES, INC.

- TotalEnergies

- Trinseo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Lightweighting and Metal Replacement in E-Mobility Platforms

- 4.1.2 Smart-Home Appliances Requiring High-Gloss Heat-Resistant Grades

- 4.1.3 Rapid Adoption of Desktop 3-D Printers in Education

- 4.1.4 Mandatory Flame-Retardant Cockpit Components

- 4.1.5 5G Infrastructure Driving Electroplatable ABS Demand

- 4.2 Market Restraints

- 4.2.1 Volatile Acrylonitrile Feedstock Prices

- 4.2.2 Substitution by Bio-based Polymers in Electronics

- 4.2.3 Stringent Nordic VOC Limits on Processing Plants

- 4.3 Value Chain Analysis

- 4.4 Pricing Trends

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Processing Technology

- 5.1.1 Injection Blow Molding

- 5.1.2 Extrusion Blow Molding

- 5.1.3 Injection Stretch Blow Molding

- 5.2 By ABS Grade

- 5.2.1 General-Purpose

- 5.2.2 High-Impact

- 5.2.3 Electro-plating

- 5.2.4 Flame-Retardant

- 5.2.5 Heat-Resistant

- 5.3 By End-user Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Electronics

- 5.3.3 Consumer Goods and Appliances

- 5.3.4 Construction

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Vietnam

- 5.4.1.7 Malaysia

- 5.4.1.8 Indonesia

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Turkey

- 5.4.3.8 Nordics

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Egypt

- 5.4.5.5 South Africa

- 5.4.5.6 Nigeria

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BEPL

- 6.4.2 CHIMEI

- 6.4.3 ELIX POLYMERS

- 6.4.4 Eni S.p.A.

- 6.4.5 Formosa Plastics Group

- 6.4.6 INEOS

- 6.4.7 JSR Corporation

- 6.4.8 KUMHO PETROCHEMICAL

- 6.4.9 LG Chem

- 6.4.10 LOTTE Chemical Corporation

- 6.4.11 NIPPON A&L INC.

- 6.4.12 PetroChina Company Limited

- 6.4.13 SABIC

- 6.4.14 Shandong INEOS-YPC

- 6.4.15 Techno-UMG Co., Ltd.

- 6.4.16 TORAY INDUSTRIES, INC.

- 6.4.17 TotalEnergies

- 6.4.18 Trinseo

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Growing usage of PC-ABS Resin in Industrial Applications