PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852157

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852157

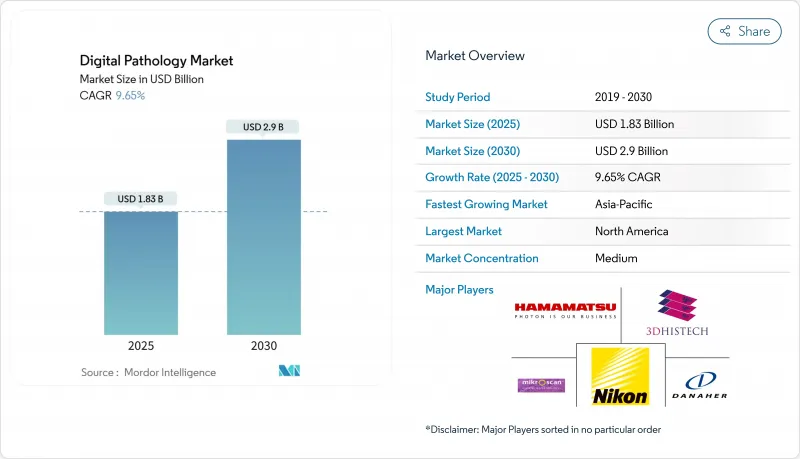

Digital Pathology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The digital pathology market is valued at USD 1.42 billion in 2025 and is projected to reach USD 2.14 billion by 2030, expanding at an 8.54 % CAGR.

The acceleration is tied to a regulatory environment that is no longer exploratory; multiple FDA clearances have reframed whole-slide imaging from an experimental tool into a clinically validated standard of care, subtly pressuring hospital procurement teams to treat digital pathology as a baseline infrastructure expense rather than an optional upgrade. That reprioritization is echoed in budgeting cycles where digital platforms are now bundled alongside radiology PACS refreshes, effectively changing the internal politics of capital allocation.

Global Digital Pathology Market Trends and Insights

Global Pathologist Workforce Shortages: Automation Becomes Mission-Critical

Demand for histopathology continues to rise even as the global pathologist pool contracts. In the United States, a projected 7% decline in qualified pathologists by 2030 collides with a 41% surge in specimen volume, producing a structural workload mismatch that intuitively redirects investment toward automation. Countries across Asia-Pacific face even starker ratios, which, in practical terms, re-positions digital pathology from a productivity luxury to an operational safeguard against diagnostic backlogs. Laboratories adopting AI triage tools report 15-25% faster case throughput, a margin that is not just efficiency but also a latent capacity lever-one that executives increasingly value as a hedge against revenue loss from delayed reporting . The cascading implication is that digital pathology budgets are now being justified on the same grounds as workforce stabilization programs, a framing that elevates them in health-system financial models.

Oncology Clinical Trials: Image-Based Biomarkers Drive Centralization

Precision-oncology trials depend on quantitative tissue analytics that manual microscopy cannot reliably scale. A growing majority of biotech sponsors already route trial samples through centralized digital pathology hubs, thereby standardizing biomarker endpoints while compressing study timelines. The economic ripple effect is that CROs increasingly invest in high-capacity scanners to keep pace, and in parallel, hospital labs are discovering new revenue streams by subcontracting trial work. Executives who once questioned the near-term monetization of digital pathology now recognize that clinical-research revenue can serve as an amortization engine for capital equipment.

High Upfront Costs: Mid-Tier Laboratories Face Adoption Barriers

Capital outlay for scanner fleets, storage arrays, and network upgrades remains the chief hurdle for community laboratories. One publicly disclosed survey by Labcorp notes that only about one-third of clinical labs have installed whole-slide imaging, primarily citing financial constraints. Cloud deployments promise lower entry barriers by converting fixed costs into pay-as-you-go models, but hesitancy persists around subscription budgeting and data-sovereignty obligations. Consequently, vendors are piloting hybrid financing schemes-combining per-scan fees with service credits-that mimic reagent-rent models familiar to clinical chemistry, an approach that aligns vendor incentives with actual slide volume growth.

Other drivers and restraints analyzed in the detailed report include:

- Government Healthcare Digitization: National AI Initiatives Provide Capital

- Companion Diagnostics Growth: Quantitative Analytics at Commercial Scale

- Tele-Consultations: Remote Expertise Reshapes Service Delivery

- Interoperability Standards: Ecosystem Fragmentation Impedes Integration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Whole-slide imaging scanners held a 45% market share in 2024, yet image analysis & AI software are expanding faster, posting a 9.5 % CAGR through 2030. This dichotomy signals that hardware is becoming an entry ticket, while recurring service revenue-encompassing workflow integration and AI algorithm subscriptions-drives margin expansion. For vendors, the strategic implication is that lifetime value hinges less on initial sale price and more on post-installation usage intensity, prompting investments in customer-success teams who optimize scanner uptime and AI adoption.

Brightfield imaging controls 82% of the 2024 market, but fluorescence techniques are outpacing at a 10.2% CAGR. Fluorescence's capacity for multiplexed staining now resonates with clinicians who need multi-marker panels to guide immuno-oncology regimens. Vendors repositioning fluorescence scanners from research labs into CLIA-certified workflows are discovering that compliance consulting services command premium margins, effectively compensating for lower hardware unit volumes.

The Digital Pathology Market Report Segments the Industry Into by Product (Whole Slide Imaging Scanners, and More), by Imaging Technique (Brightfield and Fluorescence), by Application (Disease Diagnosis, Drug Discovery and More), by End User (Pharmaceutical, Biotechnology, Companies and CROs, and More), by Deployment Model, and Geography. The Market Provides the Value (in USD Million) for the Above-Mentioned Segments.

Geography Analysis

North America commands 46% of 2024 revenue, buoyed by a proactive regulatory climate. The FDA's Digital Pathology Program is publishing standardized performance benchmarks, which lowers validation costs for hospitals integrating AI modules and in turn supports faster go-live timelines. While adoption is deep within academic medical centers, community hospitals are adopting more cautiously, often via specimen-sharing agreements that let them access digital review capacity without owning scanners outright. That collaborative model ensures that even smaller facilities remain within value-based care networks that reward diagnostic consistency.

Asia-Pacific is the fastest-growing region, posting an 11% CAGR (2025-2030). National health-digitization blueprints in China, Japan, and India are unlocking budget for tier-two and tier-three hospitals, whose leadership views digital pathology as a leapfrog technology. Vendor strategies increasingly rely on managed-service contracts that bundle slide scanning, cloud archival, and AI rentals-distilling digital pathology into a monthly per-case fee that aligns with capitation reimbursement prevalent in several APAC health systems. The region's leapfrog dynamic also means that cloud deployment often circumvents legacy data-center constraints, producing markedly shorter implementation timelines than in Western markets.

Europe maintains solid momentum, powered by Germany and the United Kingdom. The new EU In Vitro Diagnostic Regulation (IVDR) compels vendors to demonstrate algorithm safety and performance, thereby raising the compliance threshold but simultaneously increasing buyer confidence. Hospital consortia in Scandinavia have responded by negotiating multi-country procurement frameworks, leveraging collective bargaining power to secure volumetric discounts and unified AI validation protocols. These shared-services models hint at future continental platforms where pathology data become a federated research asset, fueling precision-medicine initiatives.

- Danaher Corp. (Leica Biosystems)

- Koninklijke Philips

- F. Hoffmann-La Roche Ltd (Ventana)

- Hamamatsu Photonics

- 3DHistech

- Nikon Corp.

- Olympus Corp.

- Sectra

- Visiopharm

- Proscia

- Mikroscan Technologies

- XIFIN Inc.

- Huron Digital Pathology Inc.

- Indica Labs Inc.

- Inspirata Inc.

- OptraSCAN Inc.

- PathAI Inc.

- Paige AI Inc.

- Aiforia Technologies Oy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global pathologist workforce shortages accelerating adoption of automation-enabled digital workflows.

- 4.2.2 Large-scale oncology and immunotherapy clinical trials mandating centralized, image-based biomarker assessment

- 4.2.3 Government-funded healthcare digitization and national AI initiatives providing capital grants and regulatory fast-tracks.

- 4.2.4 Growth of companion diagnostics and personalized therapies requiring quantitative tissue-image analytics at commercial scale.

- 4.2.5 Enterprise imaging strategies integrating digital pathology, radiology and EHRs to enable hospital-wide precision-medicine programs.

- 4.2.6 Growing Number of Tele-Consultations

- 4.3 Market Restraints

- 4.3.1 High upfront scanner, storage and IT integration costs limiting adoption among mid-tier and public laboratories.

- 4.3.2 Absence of universally accepted interoperability standards between scanners, LIS and AI software ecosystems.

- 4.3.3 Data-sovereignty and cross-border transfer regulations slowing cloud-based deployment in Europe, APAC and MEA

- 4.3.4 Limited reimbursement pathways for primary digital slide diagnosis in many national health systems

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Product

- 5.1.1 Whole Slide Imaging Scanners

- 5.1.2 Image Analysis & AI Software

- 5.1.3 Communication & Storage Systems

- 5.1.4 Slide Management Systems & Accessories

- 5.2 By Imaging Technique

- 5.2.1 Brightfield

- 5.2.2 Fluorescence

- 5.3 By Application

- 5.3.1 Disease Diagnosis

- 5.3.2 Drug Discovery & Companion Diagnostics

- 5.3.3 Telepathology & Consultation

- 5.3.4 Education & Training

- 5.3.5 Quality Assurance & Archiving

- 5.4 By End User

- 5.4.1 Hospital & Reference Laboratories

- 5.4.2 Pharmaceutical & Biotechnology Companies and CROs

- 5.4.3 Diagnostic Centers

- 5.4.4 Other End Users

- 5.5 By Deployment Model

- 5.5.1 On-premise

- 5.5.2 Cloud-based / SaaS

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles ((includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Danaher Corp. (Leica Biosystems)

- 6.4.2 Koninklijke Philips N.V.

- 6.4.3 F. Hoffmann-La Roche Ltd (Ventana)

- 6.4.4 Hamamatsu Photonics K.K.

- 6.4.5 3DHISTECH Ltd.

- 6.4.6 Nikon Corp.

- 6.4.7 Olympus Corp.

- 6.4.8 Sectra AB

- 6.4.9 Visiopharm A/S

- 6.4.10 Proscia Inc.

- 6.4.11 Mikroscan Technologies Inc.

- 6.4.12 XIFIN Inc.

- 6.4.13 Huron Digital Pathology Inc.

- 6.4.14 Indica Labs Inc.

- 6.4.15 Inspirata Inc.

- 6.4.16 OptraSCAN Inc.

- 6.4.17 PathAI Inc.

- 6.4.18 Paige AI Inc.

- 6.4.19 Aiforia Technologies Oy

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment