PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852160

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852160

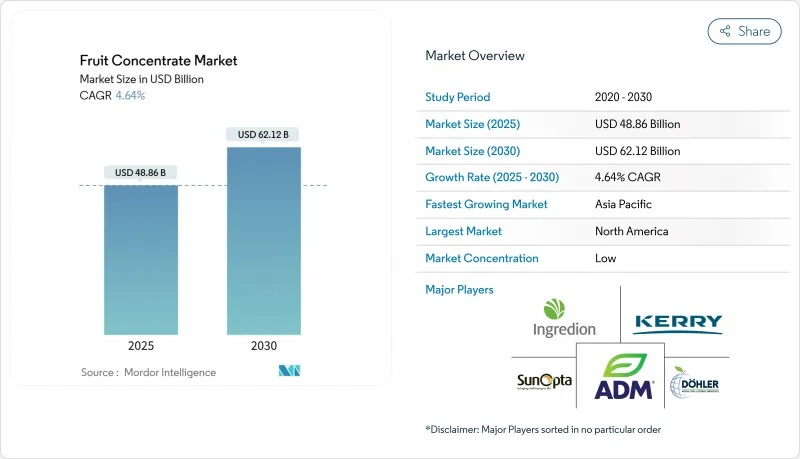

Fruit Concentrate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The fruit concentrates market size stood at USD 48.86 billion in 2025 and is forecast to expand to USD 62.12 billion by 2030, advancing at a 4.64% CAGR.

This steady climb reflects a decisive shift from commodity juice bases toward premium functional ingredients, encouraged by the U.S. FDA's updated "healthy" definition that took effect in February 2025 and tightened limits on added sugars. Heightened consumer preference for natural components, wider adoption of low-energy membrane and freeze-concentration technologies, and greater interest in immunity-supporting beverages are giving processors new revenue streams and higher margins. Meanwhile, supply-chain volatility-exemplified by Brazil's 27.4% drop in 2024/25 orange output-has amplified the value of geographic diversification and shelf-stable formats, according to the CEPEA - Center for Advanced Studies on Applied Economics. Department of Economy, Administration and Sociology. Across categories, the fruit concentrates market is transforming from volume-led trading into a platform for clean-label, nutritional, and sustainability solutions.

Global Fruit Concentrate Market Trends and Insights

Rising Demand for Natural Ingredients

Kerry's 2025 research reveals that 86% of consumers are ready to pay a premium for functional benefits, underscoring a major shift in fruit concentrate specifications driven by the demand for clean-label products. This trend extends beyond traditional applications, as food manufacturers increasingly replace artificial flavors with fruit concentrates to meet transparency expectations. The California Food Safety Act has further accelerated this transition, prompting many brands to rely solely on natural colors and flavors, thereby driving sustained demand for fruit-based alternatives. Advanced stabilization techniques are improving the performance of natural colors, making fruit concentrates a practical option in applications previously dominated by synthetic alternatives. This change reflects a permanent evolution in the market rather than a temporary trend, as regulatory frameworks continue to favor natural ingredient solutions.

Growth in Functional Beverages

Fruit concentrates are increasingly vital in immunity-boosting formulations, with 51% of consumers focusing on skin support and 44% prioritizing immune benefits in their beverage preferences. The growing popularity of adaptogenic beverages, which combine fruit concentrates with botanical extracts, reflects a shift from traditional juice applications to pharmaceutical-grade functionality. Companies, such as Kerry with its Tastesense technology, are creating specialized concentrate blends that provide specific health benefits while preserving taste, achieving sugar reduction without compromising flavor. To meet the rising demand for low-sugar and gut-health beverages, the industry is utilizing fruit pomace and fiber-rich concentrates. This trend is evident in the increasing number of prebiotic and probiotic drink launches anticipated in 2025. Consequently, the role of fruit concentrates is transforming, moving from basic commodity sweeteners to premium, value-added ingredients.

Volatile Raw Material Prices

Raw material price volatility poses a consistent challenge, especially for citrus and tropical fruits. In 2025, weather-induced production declines led to record-high Brazilian orange prices. Simultaneously, European buyers sought reduced contract prices in light of a proposed 50% U.S. tariff on imports. Such disruptions resulted in Brazil's juice stocks hitting zero and a 20% reduction in Florida's orange crop. Additionally, import-export of raw material plays a significant role. According to the Observatory of Economic Complexity data from 2024, Canada imported USD 966 million worth of tropical fruits. This underscores the urgency for diversified sourcing and adaptable procurement strategies, as highlighted by the Center for Advanced Studies on Applied Economics. In response, companies are channeling investments into contract farming and regenerative agriculture, aiming to bolster traceability and supply resilience. Additionally, businesses are exploring advanced technologies, such as precision agriculture and blockchain, to enhance supply chain transparency and mitigate risks associated with price fluctuations. These measures are expected to play a crucial role in ensuring long-term sustainability and stability in the citrus and tropical fruit markets.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Production and Processing

- Health-driven Sugar-replacement Adoption

- Stringent Government Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, citrus fruits commanded a dominant 37.23% share of the market, underscoring their pivotal role in beverage and food processing. Their widespread use in juices, flavoring agents, and processed foods highlights their entrenched position in the industry. Yet, tropical fruits are surging ahead, boasting a 6.12% CAGR through 2030, fueled by a growing consumer appetite for exotic flavors and bolstered supply chains in Southeast Asia and Latin America. The increasing availability of tropical fruits, such as mangoes, pineapples, and papayas, in processed forms like purees and frozen products is further driving their growth. While red berries and fruits occupy a smaller volume, their rising prominence in functional and premium products caters to the health-conscious demographic. These fruits, including strawberries, raspberries, and blueberries, are increasingly incorporated into products marketed for their antioxidant and nutritional benefits.

The "others" category, encompassing apples, pears, and stone fruits, is reaping rewards from contract farming advancements and sustainability drives, especially in organic and traceable sourcing. These initiatives are enhancing consumer trust and meeting the growing demand for ethically sourced produce. Furthermore, the FDA and USDA's regulatory oversight, particularly concerning juice content and labeling, plays a pivotal role in shaping fruit selection and product positioning. Compliance with these regulations ensures transparency and influences consumer purchasing decisions, further impacting market dynamics.

The Fruit Concentrates Market Report is Segmented by Fruit Type (Citrus Fruits, Red Fruits and Berries, Tropical Fruits, Others), Product Form (Liquid Concentrate, Powder Concentrate, Others), Application (Beverages, Bread and Bakery Products, Confectionery, and More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America commanded a dominant 31.50% market share, bolstered by its established processing infrastructure, clear regulations, and a robust consumer appetite for functional and clean-label beverages. However, the region's strong supply chain grapples with climate-induced challenges, especially in citrus and cherry production, highlighting the urgent need for investments in diverse sourcing and cutting-edge processing technologies.

Asia Pacific is poised to be the fastest-growing region, projecting a 6.45% CAGR from 2025 to 2030. This growth is driven by a burgeoning middle class, heightened investments in processing capabilities, and the rise of both local and regional brands. China's expansion in citrus production, coupled with Vietnam's embrace of advanced IQF processing, underscores the region's commitment to both volume and quality. Meanwhile, India and Indonesia are making strides with new processing plants and contract farming initiatives, ensuring a steady raw material supply for domestic needs and export opportunities.

Europe's market is navigating a stringent regulatory landscape and an increasing focus on sustainability. The 2023/2024 season saw the EU's citrus production grappling with challenges posed by droughts and elevated temperatures. Yet, Europe stands at the forefront of clean label and organic certifications, driven by a robust consumer push for ingredient transparency and environmental stewardship. South America and Africa are carving out their niches as pivotal suppliers of tropical and citrus concentrates. Brazil and Ghana, capitalizing on their cost advantages and closeness to major import markets, are leading the charge. Yet, these regions aren't without challenges; they contend with significant supply chain vulnerabilities stemming from weather fluctuations and tariff shifts. In response, there's a noticeable pivot towards bolstering local processing and export infrastructures.

- Archer Daniels Midland Company

- Dohler GmbH

- Kerry Group plc

- Ingredion Incorporated

- SunOpta Inc.

- AGRANA Beteiligungs-AG

- Tree Top Inc. (Northwest Naturals)

- China Haisheng Juice Holdings Co. Ltd.

- Royal Cosun (SVZ)

- FruitSmart Inc.

- Louis Dreyfus Company Juice

- Sucocitrico Cutrale Ltda.

- Citrosuco S.A.

- Diana Food (Symrise)

- SVZ International B.V.

- Welch Foods Inc.

- Mysore Fruit Products Ltd

- LemonConcentrate SLU

- Vie-Del Company

- Capullo Fruit Concentrates

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Natural Ingredients

- 4.2.2 Growth in Functional Beverages

- 4.2.3 Technological Advancements in production and processing

- 4.2.4 Health-driven sugar-replacement adoption

- 4.2.5 Rising Growth in Emerging Markets

- 4.2.6 Stable Shelf Life, Driving the Demand

- 4.3 Market Restraints

- 4.3.1 Volatile Raw Material Prices

- 4.3.2 Stringent Government Regulations

- 4.3.3 Seasonality and Supply Chain Issues

- 4.3.4 Adoption of Alternative Sweeteners and Ingredient Innovations

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST

- 5.1 By Fruit Type (Value)

- 5.1.1 Citrus Fruits

- 5.1.2 Red Fruits & Berries

- 5.1.3 Tropical Fruits

- 5.1.4 Others

- 5.2 By Product Form (Value)

- 5.2.1 Liquid Concentrate

- 5.2.2 Powder Concentrate

- 5.2.3 Others

- 5.3 By Application (Value)

- 5.3.1 Beverages

- 5.3.1.1 Fruit Juices and Drinks

- 5.3.1.2 Soft Drinks and Carbonated Beverages

- 5.3.1.3 Alcoholic Beverages

- 5.3.2 Bread and Bakery Products

- 5.3.3 Confectionery

- 5.3.3.1 Candies and Gummies

- 5.3.3.2 Jellies and Fruit Pastilles

- 5.3.3.3 Fruit Bars and Snacks

- 5.3.3.4 Others

- 5.3.4 Dairy and Frozen Products

- 5.3.5 Others

- 5.3.1 Beverages

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Dohler GmbH

- 6.4.3 Kerry Group plc

- 6.4.4 Ingredion Incorporated

- 6.4.5 SunOpta Inc.

- 6.4.6 AGRANA Beteiligungs-AG

- 6.4.7 Tree Top Inc. (Northwest Naturals)

- 6.4.8 China Haisheng Juice Holdings Co. Ltd.

- 6.4.9 Royal Cosun (SVZ)

- 6.4.10 FruitSmart Inc.

- 6.4.11 Louis Dreyfus Company Juice

- 6.4.12 Sucocitrico Cutrale Ltda.

- 6.4.13 Citrosuco S.A.

- 6.4.14 Diana Food (Symrise)

- 6.4.15 SVZ International B.V.

- 6.4.16 Welch Foods Inc.

- 6.4.17 Mysore Fruit Products Ltd

- 6.4.18 LemonConcentrate SLU

- 6.4.19 Vie-Del Company

- 6.4.20 Capullo Fruit Concentrates

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK