PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852181

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852181

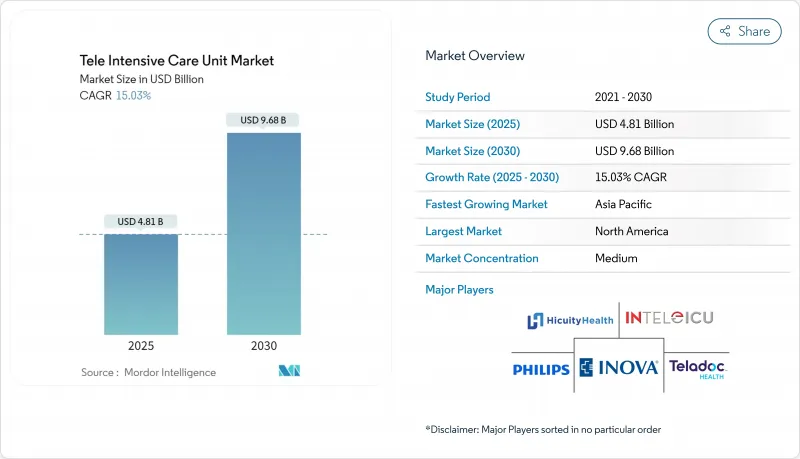

Tele Intensive Care Unit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Tele Intensive Care Unit Market size is estimated at USD 4.81 billion in 2025, and is expected to reach USD 9.68 billion by 2030, at a CAGR of 15.03% during the forecast period (2025-2030).

Growth is fueled by persistent intensivist shortages, the need to extend critical-care expertise into underserved regions, and rapid progress in real-time connectivity technologies. North America retains its leadership position by combining mature hospital networks with payer policies that reimburse virtual critical-care encounters, while Asia-Pacific records the quickest uptake as health-system investors back5G-ready facilities and remote-monitoring pilots. Hybrid command-center models gain support because they couple centralized specialists with on-site clinical teams, moderating cost while lifting clinical performance. New5G deployments inside hospitals have lowered round-trip latency to under10ms, which is enabling high-definition imaging review, robot-assisted ultrasound, and continuous video analytics during admissions. Although reimbursement cliffs and high start-up costs temper near-term adoption, public grants and the permanence of post-pandemic telehealth waivers continue to widen the business case for virtual critical care across hospital sizes.

Global Tele Intensive Care Unit Market Trends and Insights

Aging Population Intensifies ICU Demand

Demand for critical-care beds climbs as older adults represent a growing share of admissions. The American Hospital Association notes that people aged 65 and older will surpass 20% of the United States population by 2030, a shift that elevates chronic disease complexity and raises ICU utilization . Hospitals report rising ventilation hours and longer monitoring requirements, prompting administrators to add tele-ICU coverage across multisite systems. Tele-ICU programs show mortality reductions of up to 40% in recent multisite cohorts because remote intensivists can intervene earlier during deterioration events criticalcaremedicine. These outcomes strengthen the business case for virtual oversight in geriatric hotspots and encourage payers to maintain reimbursement codes tied to population.

Accelerated Adoption of 5G-Ready Hospital Networks

Hospital-owned 5G stand-alone networks now carry bedside video, imaging, and device telemetry with sub-10 ms latency, a threshold that supports telesurgery guidance and continuous computer-vision analytics. Finland's Hola 5G Oulu project recorded instantaneous transmission of MRI sequences and live ultrasound streams, reducing clinical decision lag and driving new quality benchmarks. Singapore's National University Health System achieved 1 Gbps downlink speeds on a hybrid 5G enterprise network, paving the way for bandwidth-heavy tele-ICU dashboards. Early adopters report 44.5% fewer patient falls after integrating smart cameras and 5G backbones, highlighting the operational impact of seamless, high-definition video monitoring valleyhealth. Capital budgets increasingly earmark 5G upgrades as network resilience becomes a prerequisite for advanced virtual-care services.

High Implementation Cost

Launch budgets still approach USD 50,000 to 100,000 per monitored bed when factoring servers, audiovisual endpoints, integration software, and 24 X 7 clinical staffing. University pilot sites report initial capital outlays above USD 1.1 million and annual operating expenses near USD 2.5 million, figures that deter smaller hospitals from full-scale adoption. Despite an incremental cost-effectiveness ratio of USD 45,320 per quality-adjusted life year, financial sustainability hinges on patient volume. Break-even models show large centers recoup investment within three years, whereas sub-200-bed facilities often require grant support to offset start-up costs. Vendors respond with subscription-based packages and shared-service contracts aimed at lowering the entry barrier.

Other drivers and restraints analyzed in the detailed report include:

- Remote Patient Monitoring Adoption

- Post-COVID Telehealth Waivers Become Permanent

- Limited Reimbursement Variability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software & Services contributed 60.5% of the tele-intensive care unit market size in 2024 because remote intensivist coverage, nursing triage, and analytics support remain indispensable for continuous patient oversight. Outsourcing clinical expertise lets hospital administrators compensate for regional workforce gaps while standardizing practice across networks. Vendors bundle 24 X 7 coverage, quality-metric reporting, and change-management programs, raising switching costs and reinforcing service revenues. At the same time, AI-enabled workflow engines now filter waveform and laboratory streams, reducing alert fatigue and allowing a single clinician to supervise a larger census.

Hardware revenue stems from physiological monitors, ceiling-mounted cameras, and command-center displays. Smart cameras stand out, expanding at a 14.1% CAGR as computer-vision algorithms classify posture, detect apnea events, and trigger fall alerts with macro F1-scores above 0.92. Software portfolios increasingly integrate decision-support modules such as Multiscale Vision Transformers capable of estimating nursing-activity scores, which helps staffing managers fine-tune resource deployment. This convergence of hardware, software, and services heightens differentiation among vendors and sustains long-term subscription growth inside the tele-intensive care unit market.

Tele ICU Market Report is Segmented by Component (Hardware, Software and Services), by Model Type (Centralized Model and Decentralized Model), by Hospital Size (more Than 500 Beds and 200-499 Beds, Less Than 200 Beds) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Report Offers the Value (USD) for the Above Segments.

Geography Analysis

North America held 43.6% of global revenue in 2024 and remains the center of commercial innovation in the tele-intensive care unit market. U.S. hospital networks deploy virtual critical-care dashboards that integrate electronic medical records with live camera feeds, providing clinicians unified patient views at local and remote sites. The American Hospital Association supports legislation to eliminate geographic restrictions permanently and to extend provider eligibility, moves that would further stabilize reimbursement. The Department of Veterans Affairs funds access points in rural communities, bringing specialist oversight to dispersed veteran populations.

Asia-Pacific is forecast to grow at 15.87% CAGR, the fastest among all regions. Health ministries in Singapore, Australia, and South Korea subsidize 5G private networks inside tertiary hospitals, clearing capacity for high-bandwidth tele-ICU video streams. Thailand pilots telemedicine kiosks to route non-critical cases away from crowded urban centers. Local start-ups partner with academic centers to deliver multilingual user interfaces that address cultural and regulatory heterogeneity.

Europe occupies a solid third position, supported by national e-health strategies in 40 countries and sustained investment from public payers. Projects like Hola 5G Oulu demonstrate clinical utility for sub-second data exchange, inspiring similar initiatives in Germany and Spain. The European Society of Intensive Care Medicine highlights persistent intensivist shortages, prompting outsourced e-ICU staffing contracts that allow hub hospitals to supervise smaller spokes across borders . EU programs such as Thera4Care channel research funds into AI-enabled theranostics, which dovetail with tele-ICU analytics to create integrated care pathways.

The Middle East and Africa and South America represent smaller but accelerating opportunities. Gulf states showcase digital-first hospitals, and regional exhibitions like Arab Health feature command-center demonstrations that link operating rooms with remote anesthesiologists. Latin American ministries negotiate public-private partnerships that equip provincial hospitals with cloud-based monitoring platforms, aligning with workforce-development goals.

List of Companies Covered in this Report:

- Koninklijke Philips

- GE HealthCare Technologies Inc.

- Hicuity Health

- SOC Telemed (a Patient Square Capital Co.)

- Advanced ICU Care (US Acute Care Solutions)

- Teladoc Health

- Cisco Systems

- eVideo Telemedicine

- AMD Global Telemedicine

- Cerner Corp. (Oracle Health)

- Epic Systems Corp.

- Baxter International (Hillrom Guardian)

- iMDsoft

- CLEW Medical

- Inspiren

- Vitreous Health

- AlertWatch

- Masimo Corp.

- Medtronic

- Nihon Kohden Corp.

- Spacelabs Healthcare

- Mindray Bio-Medical Electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Population Driven Critical Care Demand Surge

- 4.2.2 Accelerated Adoption of 5G-Ready Hospital Networks

- 4.2.3 Increasing Demand for Remote Patient Monitoring

- 4.2.4 Large-Scale Public Tele-ICU Grants

- 4.2.5 Post-COVID Remote Monitoring Policies Becoming Permanent

- 4.2.6 Chronic Intensivist Shortage Triggering Outsourced e-ICU Staffing in Europe

- 4.3 Market Restraints

- 4.3.1 Limited Reimbursement

- 4.3.2 High Cost of Treatment and Expensive Setup

- 4.3.3 Data-Integration Silos Between EMR Vendors & Tele-ICU Platforms

- 4.3.4 Nurse & Intensivist Resistance to Remote Oversight in Tier-2 Hospitals

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (value)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software & Services

- 5.2 By Model Type

- 5.2.1 Centralized Model

- 5.2.2 Decentralized Model

- 5.2.3 Hybrid / Distributed Hub-and-Spoke Model

- 5.3 By Hospital Size

- 5.3.1 More than 500 Beds

- 5.3.2 200-499 Beds

- 5.3.3 Less than 200 Beds

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia- Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 GE HealthCare Technologies Inc.

- 6.3.3 Hicuity Health

- 6.3.4 SOC Telemed (a Patient Square Capital Co.)

- 6.3.5 Advanced ICU Care (US Acute Care Solutions)

- 6.3.6 Teladoc Health, Inc.

- 6.3.7 Cisco Systems, Inc.

- 6.3.8 eVideo Telemedicine

- 6.3.9 AMD Global Telemedicine

- 6.3.10 Cerner Corp. (Oracle Health)

- 6.3.11 Epic Systems Corp.

- 6.3.12 Baxter International (Hillrom Guardian)

- 6.3.13 iMDsoft

- 6.3.14 CLEW Medical

- 6.3.15 Inspiren

- 6.3.16 Vitreous Health

- 6.3.17 AlertWatch

- 6.3.18 Masimo Corp.

- 6.3.19 Medtronic PLC

- 6.3.20 Nihon Kohden Corp.

- 6.3.21 Spacelabs Healthcare

- 6.3.22 Mindray Bio-Medical Electronics

7 Market Opportunities & Future Outlook