PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852187

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852187

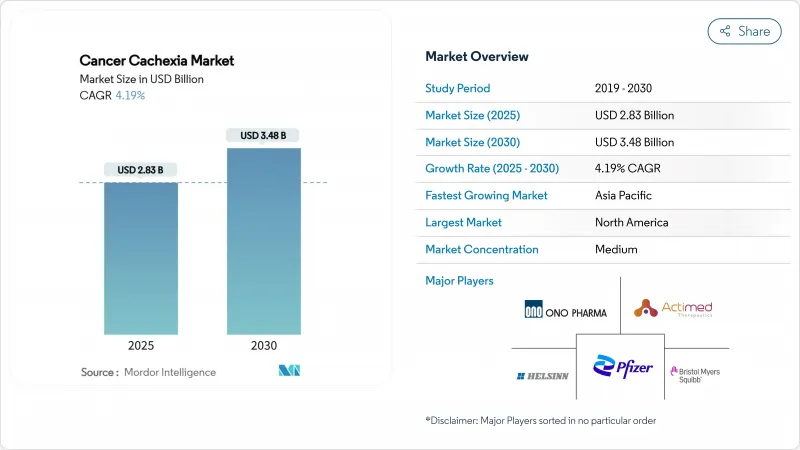

Cancer Cachexia - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cancer cachexia market size generated USD 2.83 billion in 2025 and is forecast to advance at a 4.19% CAGR, reaching USD 3.48 billion by 2030, as breakthrough therapeutics move from proof-of-concept into registration studies and early diagnosis programs widen the eligible patient pool.

Ongoing convergence of oncology survivorship gains, biomarker-enabled patient identification, and clear regulatory guidance positions the cancer cachexia market for durable expansion. Growth is anchored by ghrelin receptor agonists that already hold clinical traction, yet next-generation agents blocking GDF-15, myostatin, or dual anabolic-catabolic pathways are set to diversify the competitive field. Hospital pharmacies remain the dominant dispensing venue because of complex initiation protocols, although digital inventory solutions let online channels accelerate share capture. Regional momentum hinges on the United States, Japan, and China, where government-backed reimbursement pilots have begun to classify cachexia as a distinct treatable condition rather than a palliative endpoint.

Global Cancer Cachexia Market Trends and Insights

Rising Cancer Prevalence and Patient Survival

Global incidence rose to more than 20 million new diagnoses in 2024 and 5-year survival now averages 68%, effectively enlarging the at-risk population and prolonging the window for metabolic decline. Longer survival turns cachexia into a chronic comorbidity rather than a terminal sign, making durable pharmacologic control essential. Immuno-oncology agents further alter weight-loss trajectories, creating episodic muscle-wasting phases that require repeat intervention. Since ageing populations overlap with higher cancer incidence, cumulative prevalence stacks year over year. These structural forces bind the cancer cachexia market to the broader oncology growth curve.

High Unmet Clinical Need for Weight and Muscle Preservation

Absence of FDA-approved drugs in the American and European markets leaves physicians with off-label corticosteroids and megestrol, neither of which sustain lean body mass or functional capacity. Oncologists increasingly view cachexia as a limiting factor for chemotherapy dose intensity and immunotherapy response, thereby elevating demand for agents that prevent muscle atrophy. Health-related quality-of-life surveys consistently rank weight stability as a top priority for patients, yet current regimens offer marginal benefit. Diagnostic opacity compounds the treatment gap because dissimilar criteria obstruct multicenter trials and reimbursement audits.

Limited Approved Pharmacotherapies

The European Medicines Agency's rejection of anamorelin on grounds of insufficient functional benefit demonstrates how variable endpoint expectations chill developer confidence. Weight and appetite metrics alone rarely satisfy payers that seek validated correlations with hospitalization rates or survival. Without clear precedents, pipeline companies shoulder heavier financial risk and often opt to co-develop with larger partners, slowing overall innovation velocity. Absence of label-approved choices also perpetuates heterogeneity in clinical practice, masking true demand.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in Cachexia Pathophysiology Understanding

- Expanding Oncology Drug Pipeline and Combination Opportunities

- Safety and Efficacy Concerns of Novel Agents

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ghrelin receptor agonists held 34.56% cancer cachexia market share in 2024, reflecting Japan's clinical familiarity with anamorelin and supportive real-world data collected from more than 6,000 treated patients. The cancer cachexia market size for this class is projected to maintain steady momentum through incremental uptake in markets that await novel approvals. However, beta-blocker-based anabolic-catabolic transforming agents (ACTAs) are on course for a 6.56% CAGR, propelled by S-pindolol's Phase 2 success in colorectal cancer cohorts showing simultaneous attenuation of proteolysis and stimulation of muscle protein synthesis.

Drug developers increasingly bundle ghrelin agonists with anti-inflammatory or androgen receptor modulators to enhance efficacy. Progestogens and corticosteroids retain niche utility in advanced disease but contribute marginal incremental revenue because metabolic toxicity limits long-term dosing schedules. Selective androgen receptor modulators like enobosarm offer mechanistic novelty, though regulators continue to scrutinize safety for chronic administration. Portfolio strategies therefore gravitate toward mechanistic diversification, with companies balancing the validated appetite route against emerging ACTA combinations.

Appetite stimulators secured 46.54% of the 2024 revenue pool, yet catabolic-pathway inhibitors are forecast for the fastest 6.83% CAGR, mirroring rising clinician belief that caloric intake alone cannot halt sarcopenia. Appetite-based agents will still anchor first-line therapy in regions where regulatory clearance favors well-studied molecules, but second-generation treatments now bypass feeding behavior altogether to block muscle proteasome activation. The cancer cachexia industry thus witnesses a pivot toward agents that interrupt ubiquitin ligase activity or downstream inflammatory cascades.

Anabolic support through selective androgen receptor binding and myostatin inhibition continues to fill pipeline slots, often in multimodal regimens. Immunomodulators targeting IL-1 or TNF-alpha show additive effects when paired with ghrelin agonists, suggesting a future in which combination ecosystems replace monotherapy dominance. Dual-acting ACTAs epitomize this shift by delivering weight gain alongside improved hand-grip strength, a regulatory-recognized functional endpoint in Europe. Industry analysts anticipate that categorical boundaries will blur as companies patent merged mechanisms to defend franchise value.

The Cancer Cachexia Market Report is Segmented by Therapeutic Class (Ghrelin Receptor Agonists, and More), Mechanism of Action (Appetite Stimulators, Anabolic Agents, and More), Cancer Type (Lung Cancer, and More), Stage of Cachexia (Pre-Cachexia, and More), Distribution Channel (Hospital Pharmacies, and More), Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 43.45% of global revenue in 2024 thanks to resilient R&D financing, extensive clinical trial networks, and early inclusion of cachexia endpoints within major registrational studies. Academic centers routinely embed metabolic monitoring within oncology pathways, driving timely diagnosis and referral to supportive care clinics. Despite this edge, reimbursement headwinds linger because private payers weigh short-term drug costs against yet-to-be-quantified hospitalization savings.

Asia-Pacific is advancing at a 5.43% CAGR through 2030, propelled by Japan's landmark anamorelin listing and China's rapidly scaling oncology infrastructure. Harmonized guidelines across Korea, Australia, and Singapore are shortening review timelines for foreign dossiers. Local biotech pipelines target myostatin and GDF-15 pathways, reflecting strong government incentives for first-in-class launches. Public-private partnerships invest in muscle health programs that bundle nutritional counseling with pharmacotherapy, accelerating demand for comprehensive solutions.

Europe shows moderate growth as fragmented reimbursement landscapes slow rollout. The EMA's insistence on functional endpoints has delayed market entry for several candidates, yet national cancer plans are now adding cachexia screening metrics, which should lift diagnosis rates. Leading institutions in Germany and Italy pilot multimodal clinics pairing physiotherapists with pharmacologic regimens, generating real-world data that could tip cost-effectiveness evaluations in favor of adoption.

- Helsinn Group

- Ono Pharmaceutical

- Actimed Therapeutics

- Pfizer

- Bristol-Myers Squibb

- Merck

- Artelo Biosciences

- Novartis

- CatalYm GmbH

- NGM Bio

- AVEO Pharmaceuticals

- Aeterna Zentaris

- Fresenius

- TCI Peptide Therapeutics

- Cannabics Pharmaceuticals

- Tetra Bio-Pharma

- PsiOxus Therapeutics

- Aavogen

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Cancer Prevalence and Patient Survival

- 4.2.2 High Unmet Clinical Need for Weight and Muscle Preservation

- 4.2.3 Advancements in Cachexia Pathophysiology Understanding

- 4.2.4 Expanding Oncology Drug Pipeline and Combination Opportunities

- 4.2.5 Favorable Reimbursement and Regulatory Support in Key Markets

- 4.2.6 Growing Adoption of Multimodal Care Approaches

- 4.3 Market Restraints

- 4.3.1 Limited Approved Pharmacotherapies

- 4.3.2 Safety and Efficacy Concerns of Novel Agents

- 4.3.3 Lack of Standardized Diagnostic Criteria and Trial Endpoints

- 4.3.4 High Development Costs and Reimbursement Uncertainty

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Clinical-Trial Landscape

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Therapeutic Class

- 5.1.1 Ghrelin Receptor Agonists

- 5.1.2 Selective Androgen Receptor Modulators (SARMs)

- 5.1.3 Beta-blockers / ACTAs

- 5.1.4 Progestogens

- 5.1.5 Corticosteroids

- 5.1.6 Combination Therapy

- 5.1.7 Other Therapeutic Classess

- 5.2 By Mechanism of Action

- 5.2.1 Appetite Stimulators

- 5.2.2 Anabolic Agents

- 5.2.3 Catabolic-Pathway Inhibitors

- 5.2.4 Anti-inflammatory / Immunomodulators

- 5.2.5 Multi-target ACTAs

- 5.3 By Cancer Type

- 5.3.1 Lung Cancer

- 5.3.2 Gastro-intestinal Cancers

- 5.3.3 Breast Cancer

- 5.3.4 Prostate Cancer

- 5.3.5 Hematologic Malignancies

- 5.3.6 Other Cancer Types

- 5.4 By Stage of Cachexia

- 5.4.1 Pre-cachexia

- 5.4.2 Established Cachexia

- 5.4.3 Refractory Cachexia

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail Pharmacies

- 5.5.3 Online Pharmacies

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Helsinn Group

- 6.3.2 Ono Pharmaceutical

- 6.3.3 Actimed Therapeutics

- 6.3.4 Pfizer Inc.

- 6.3.5 Bristol-Myers Squibb

- 6.3.6 Merck KGaA

- 6.3.7 Artelo Biosciences

- 6.3.8 Novartis AG

- 6.3.9 CatalYm GmbH

- 6.3.10 NGM Bio

- 6.3.11 Aveo Oncology

- 6.3.12 Aeterna Zentaris

- 6.3.13 Fresenius Kabi

- 6.3.14 TCI Peptide Therapeutics

- 6.3.15 Cannabics Pharmaceuticals

- 6.3.16 Tetra Bio-Pharma

- 6.3.17 PsiOxus Therapeutics

- 6.3.18 Aavogen Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment