PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910563

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910563

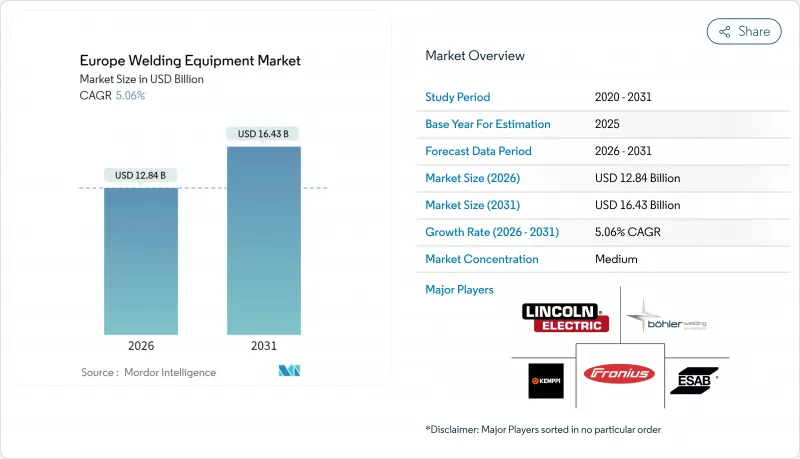

Europe Welding Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Welding Equipment Market size in 2026 is estimated at USD 12.84 billion, growing from 2025 value of USD 12.22 billion with 2031 projections showing USD 16.43 billion, growing at 5.06% CAGR over 2026-2031.

Market expansion reflects accelerated equipment modernization as manufacturers migrate toward Industry 4.0 production cells that integrate sensors, software, and robotics Demand intensity rises most sharply in battery-pack assembly and lightweight aluminum joining for electric vehicles, while Green Deal infrastructure programs sustain public-sector procurement of heavy-duty welding systems. Suppliers compete on process innovations laser sources with higher beam quality, inverter-based power supplies with lower electromagnetic emissions, and weld-data analytics platforms rather than on pure pricing. Continued shortages of certified welders reinforce automation investments, and mid-sized enterprises adopt collaborative robot cells to hedge against labor volatility.

Europe Welding Equipment Market Trends and Insights

Automation & Robotics Penetration Across European Production Lines

Manufacturers across the continent install robot welding cells to offset the 300,000-worker welder gap and to meet ISO 3834 quality demands. Adaptive control algorithms adjust current and travel speed in real time, improving bead consistency on complex joint geometries. German automotive suppliers report 40% cycle-time reductions after integrating collaborative robots that share work zones with human operators. Digital twin simulations optimize weld paths before deployment, shrinking commissioning cycles and boosting overall equipment effectiveness. Adoption cascades from tier-one OEMs to mid-tier suppliers as modular cells become affordable and financeable on three- to five-year leases. The resulting productivity gains convert labor scarcity from a bottleneck into a catalyst for modernization.

Surge in EV-Related Welding Needs

Battery-tray and enclosure fabrication requires joining aluminum and steel while limiting heat-affected zones. Fiber-laser sources operating at 1,030 nm deliver penetration at speeds above 10 m/min, replacing resistance spot welding and eliminating post-processing on 6000-series extrusions. The transition supports tighter battery-pack tolerances demanded by UN ECE R100 safety rules. TRUMPF extended lead times for multi-kilowatt laser systems as European integrators ramp up lines to meet rising EV output. Process monitoring modules log melt-pool dimensions and energy input, generating traceability records essential for automotive homologation audits. Consequently, laser welding investments align with the twin imperatives of productivity and compliance.

High Capex for Advanced & Laser Systems

Laser welding cells cost EUR 200k - 2 million each, and ancillary ventilation or guarding can double project outlays. Payback horizons of five or more years deter SME buyers despite throughput benefits. Financing gaps widen as leasing companies apply higher risk premiums to high-power laser assets with uncertain residual values. Annual service contracts of EUR 50,000 for optics, chillers, and software updates inflate the total cost of ownership. Consequently, many small fabricators continue using semi-automatic MAG units even when precision demands favor laser solutions.

Other drivers and restraints analyzed in the detailed report include:

- EU Green Deal Infrastructure Spending

- Hand-Held Fiber-Laser Welders Gaining SME Adoption

- Shortage of Certified Welders & Trainers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Arc welding held 56.12% of the Europe welding equipment market share in 2025, and the segment is forecast to advance at a 4.94% CAGR through 2031. The arc category's scale is anchored in civil construction, shipbuilding, and plant-maintenance jobs where portability and thick-section capability remain essential. Laser and plasma systems capture the fastest revenue acceleration as users pursue narrow heat-affected zones and higher line speeds for aluminum body components and thin-gauge electronics housings. The European welding equipment market size tied to "other" processes soldering, brazing, forge welding posts a 7.92% CAGR on the back of electronics miniaturization and heritage-structure restoration. Consumable vendors respond with aluminum-nickel fillers for dissimilar-metal joints, while monitoring start-ups embed optical sensors that log bead geometry for real-time quality alerts. Regulations curbing welding fumes further motivate a shift from gas welding toward inverter-based MIG units that offer higher deposition efficiency. As additive manufacturing gains traction, wire-arc deposition heads bolt onto existing robots, unlocking incremental revenue without replacing the entire cell.

Second-generation arc power sources ship with multiprocess firmware that toggles seamlessly between MIG, TIG, and stick modes, boosting asset flexibility for job shops. Resistance spot welding preserves share within high-volume automotive lines, though remote-seam lasers begin to replace some stations for aluminum battery enclosures. Plasma welding's niche expands inside aerospace engine programs that require deep penetration in nickel super-alloys with minimal distortion. Process diversification, therefore, mirrors Europe's multi-speed manufacturing base, stretching from heavy steel fabrication to precision medical devices.

The Europe Welding Equipment Market Report is Segmented by Process (Arc Welding, Resistance Welding and More), by End-User (Construction & Infrastructure, Oil Gas & Petrochemicals and More), by Automation Level (Manual, Semi-Automatic and More), and by Geography (United Kingdom, Germany, France and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Lincoln Electric Holdings Inc.

- ESAB Corp.

- Fronius International GmbH

- Kemppi Oy

- voestalpine Bohler Welding

- Carl Cloos SchweiBtechnik GmbH

- AMADA WELD TECH

- EWM AG

- Hobart Welders

- Denyo Co. Ltd

- W.W. Grainger Inc.

- Obara Corporation

- Polysoude SAS

- CEBORA S.p.A

- TRUMPF Group

- Air Liquide SA

- Panasonic Industry Europe GmbH

- Daihen Corp.

- IPG Photonics (EU operations)

- Plansee SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automation & robotics penetration across European production lines

- 4.2.2 Surge in EV-related welding needs (battery trays & lightweight aluminium)

- 4.2.3 EU Green Deal infrastructure-renewal spending

- 4.2.4 Compliance retrofits triggered by EU EMF-exposure directive 2013/35/EU

- 4.2.5 Hand-held fibre-laser welders gaining SME adoption

- 4.2.6 Traceability platforms (weld-data analytics) aligned with ESG audits

- 4.3 Market Restraints

- 4.3.1 High capex for advanced & laser systems

- 4.3.2 Shortage of certified welders & trainers

- 4.3.3 Steel & aluminium price volatility

- 4.3.4 Rising compliance cost for EMF & fume-exposure limits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Values, In USD Billion)

- 5.1 By Process

- 5.1.1 Arc Welding

- 5.1.2 Resistance Welding

- 5.1.3 Leser Welding

- 5.1.4 Plasma Welding

- 5.1.5 Gas Welding

- 5.1.6 Others - Soldering & Brazing, Forge Welding, etc.

- 5.2 By End-user

- 5.2.1 Construction & Infrastructure

- 5.2.2 Oil, Gas & Petrochemicals

- 5.2.3 Energy & Power Generation

- 5.2.4 Automotive & Transportation

- 5.2.5 Heavy Engineering & Industrial Equipment

- 5.2.6 Aerospace & Defence

- 5.2.7 Others (Specialized Applications - Small-scale fabrication workshops, maintenance & repair, and custom welding services)

- 5.3 By Automation Level

- 5.3.1 Manual

- 5.3.2 Semi-automatic

- 5.3.3 Automatic / Robotic

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Lincoln Electric Holdings Inc.

- 6.4.2 ESAB Corp.

- 6.4.3 Fronius International GmbH

- 6.4.4 Kemppi Oy

- 6.4.5 voestalpine Bohler Welding

- 6.4.6 Carl Cloos SchweiBtechnik GmbH

- 6.4.7 AMADA WELD TECH

- 6.4.8 EWM AG

- 6.4.9 Hobart Welders

- 6.4.10 Denyo Co. Ltd

- 6.4.11 W.W. Grainger Inc.

- 6.4.12 Obara Corporation

- 6.4.13 Polysoude SAS

- 6.4.14 CEBORA S.p.A

- 6.4.15 TRUMPF Group

- 6.4.16 Air Liquide SA

- 6.4.17 Panasonic Industry Europe GmbH

- 6.4.18 Daihen Corp.

- 6.4.19 IPG Photonics (EU operations)

- 6.4.20 Plansee SE

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment