PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852203

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852203

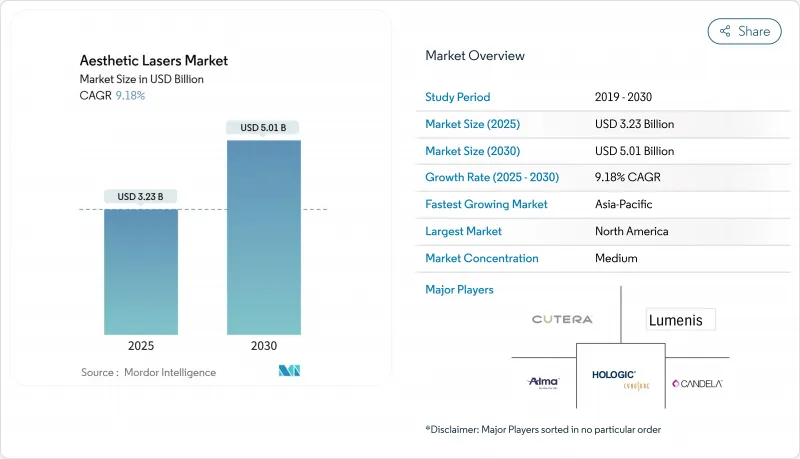

Aesthetic Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global aesthetic lasers market was valued at USD 3.23 billion in 2025 and is projected to advance at a 9.18% CAGR through 2030.

Rising consumer demand for minimally invasive cosmetic interventions that deliver visible results with limited downtime continues to redefine capital-equipment purchase criteria among dermatology practices. An additional implication, derived from the same growth dynamic, is that equipment vendors able to shorten practitioner learning curves may now command pricing premiums that were previously associated only with clinical efficacy.

Global Aesthetic Lasers Market Trends and Insights

Aging Demographics Driving Precision-Targeted Treatments

A rapidly expanding 65-plus cohort now prioritizes skin laxity correction through laser tightening, substituting surgical facelifts with outpatient regimens. Because geriatric dermis heals more slowly, device makers are integrating finer energy-increment settings and closed-loop temperature feedback to mitigate overtreatment risk . Clinics that position these protocols as "maintenance of vitality" rather than vanity appeal find higher acceptance among older patients intimately concerned with mobility and recovery time.

Technological Convergence Accelerates Innovation Cycles

Makers are stacking multiple wavelengths and radiofrequency channels into single chassis, effectively collapsing four or five standalone devices into one. The direct result is shorter replacement cycles as single-modality workhorses appear under-spec'd, but the secondary effect is that software upgradability becomes the real lock-in mechanism, not the hardware shell. Alma Hybrid's CO2 + 1570 nm pairing illustrates how future competitive advantage may pivot from light sources to treatment algorithms controlled by firmware updates.

Limited Reimbursement Creates Market Stratification

Laser treatment for rosacea and acne remains widely classified as elective, with UnitedHealthcare's medical policy deeming it "not medically necessary" . Consequently, high-income urban dwellers propel premium clinic revenues, while mid-market providers rely on creative financing or pay-per-session plans to broaden access. The stratification opens a niche for low-cost portable units targeting emerging-market entrepreneurs who lack capital for flagship systems.

Other drivers and restraints analyzed in the detailed report include:

- Picosecond Technology Transforms Millennial Aesthetic Priorities

- Medical Tourism Reshapes Global Treatment Distribution

- Regulatory Complexity Delays Innovation Commercialization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-ablative systems held 65 % market share of the aesthetic lasers market size in 2024, propelled by consumer insistence on treatments that do not interfere with daily routines. Evidence showing that fractional thulium fiber lasers improve epidermal thickness in Asian photodamage cases underscores their cross-ethnic applicability. This dominance also implies that clinics may allocate a disproportionate share of marketing budgets to highlight downtime-free outcomes, subtly shifting competitive discourse away from single-session efficacy toward cumulative skin-quality upgrades.

Standalone lasers retained 72 % share in 2024, yet multiplatform hybrids are posting a 13.5 % CAGR. The embedded inference is that financing companies could soon recalibrate depreciation schedules, treating multiplatform units more like software-upgradable assets than conventional capital equipment. Longer economic life increases the appeal of leasing models, creating recurring-revenue streams for both lessors and manufacturers.

The Aesthetic Laser Market Report Segments the Industry Into by Type (Ablative Laser, Non-Ablative Laser), by Modality (Standalone Laser Systems, and More), by Portability (Non-Portable and Portable), by Application (Skin Resurfacing/Skin Rejuvenation, Hair Removal, and More), End-User (Hospitals, Ambulatory Surgical Centers, and More), and by Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 40% of global market share in 2024, supported by robust provider networks and early technology adoption. The market size of U.S. minimally invasive "tweakment" procedures reinforces the importance practitioners place on incremental corrections rather than dramatic makeovers. A parallel observation is that patient expectations in major metropolitan areas increasingly revolve around synergistic protocols combining injectables with sub-ablative lasers, suggesting cross-selling opportunities for integrated practices.

Asia-Pacific is forecast to register 12.2% CAGR through 2030, the fastest pace of any region. Countries emphasizing even skin tone as a cultural ideal drive above-average adoption of picosecond and nano-second pigment lasers. Clinics that stock devices capable of addressing both melasma and vascular redness stand to capture share, because dual-indication versatility defrays capital investment more quickly in markets where procedure pricing is tightly competitive.

Europe remains a mature yet expanding market, where preference for natural-appearing outcomes encourages protocols that blend low-energy passes over multiple sessions. An indirect implication is that patient retention may supersede new-patient acquisition as the primary revenue lever for many clinics, particularly in Germany, France, and the UK where word-of-mouth referrals carry considerable weight.

- Alma Lasers

- Candela Medical

- Cynosure

- Lumenis

- Cutera

- Solta Medical

- Aerolase

- Sciton

- El.En.

- Iridex

- sharplight technologies

- Fotona d.o.o.

- Jeisys Medical

- Lutronic

- Venus Concept Inc.

- InMode Ltd.

- Quanta System S.p.A.

- Zimmer MedizinSysteme

- BTL

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Population & Rise in Skin-Laxity-Driven Laser Tightening

- 4.2.2 Growing Technological Advancements

- 4.2.3 AI-Enabled Laser Parameter Optimization Reducing Adverse Events

- 4.2.4 Uptake of Picosecond Lasers for Pigmented Lesions Among Millennials

- 4.2.5 Medical-Tourism-Led Boom in Laser Hair Removal

- 4.2.6 Changing Lifestyle and Growing Disposable Income

- 4.3 Market Restraints

- 4.3.1 Limited Reimbursement in Public Healthcare Systems

- 4.3.2 Stringent Laser Safety Regulations Delaying Product Launches

- 4.3.3 Social Stigma Associated With Cosmetic Treatments

- 4.3.4 Shortage of Trained Laser Technicians in Emerging Nations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Scenario

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Ablative Lasers

- 5.1.1.1 Carbon Dioxide (CO2) Laser

- 5.1.1.2 Erbium Laser

- 5.1.2 Non-Ablative Lasers

- 5.1.2.1 Pulsed-Dye Laser (PDL)

- 5.1.2.2 Nd:YAG Laser

- 5.1.2.3 Alexandrite Laser|

- 5.1.2.4 Diode Laser

- 5.1.1 Ablative Lasers

- 5.2 By Modality

- 5.2.1 Standalone Laser Systems

- 5.2.2 Multiplatform / Hybrid Systems

- 5.3 By Portability

- 5.3.1 Non-Portable

- 5.3.2 Portable

- 5.4 By Application

- 5.4.1 Skin Resurfacing & Rejuvenation

- 5.4.2 Hair Removal

- 5.4.3 Acne & Scar Management

- 5.4.4 Tattoo Removal

- 5.4.5 Body Sculpting & Skin Tightening

- 5.4.6 Vascular & Pigmented Lesion Treatmen

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Dermatology & Aesthetic Clinics

- 5.5.3 Medical Spas & Beauty Centres

- 5.5.4 Ambulatory Surgical Centres

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 GCC

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Alma Lasers

- 6.4.2 Candela Medical

- 6.4.3 Cynosure

- 6.4.4 Lumenis

- 6.4.5 Cutera

- 6.4.6 Solta Medical

- 6.4.7 Aerolase Corporation

- 6.4.8 Sciton Inc.

- 6.4.9 El.En. Group

- 6.4.10 IRIDEX Corporation

- 6.4.11 sharplight technologies

- 6.4.12 Fotona d.o.o.

- 6.4.13 Jeisys Medical

- 6.4.14 Lutronic Corporation

- 6.4.15 Venus Concept Inc.

- 6.4.16 InMode Ltd.

- 6.4.17 Quanta System S.p.A.

- 6.4.18 Zimmer MedizinSysteme

- 6.4.19 BTL Industries

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment