PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910648

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910648

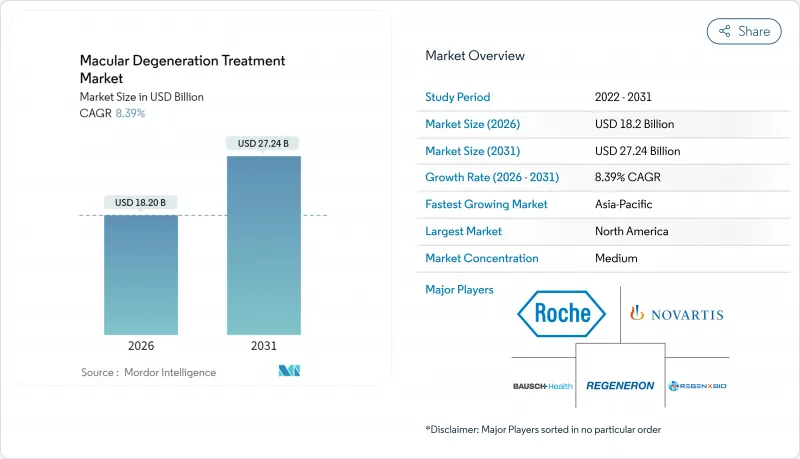

Macular Degeneration Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Macular degeneration treatment market size in 2026 is estimated at USD 18.2 billion, growing from 2025 value of USD 16.79 billion with 2031 projections showing USD 27.24 billion, growing at 8.39% CAGR over 2026-2031.

The outlook reflects demographic aging, regulatory support for breakthrough drugs, and rapid diffusion of digital diagnostics that identify disease earlier than conventional eye-care pathways. Elevated demand is reinforced by the 25% faster-than-aging rise in age-related macular degeneration (AMD) prevalence, the 94% sensitivity and 99% specificity of AI-based screening algorithms, and the pivot to complement pathway inhibitors that open therapy options for geographic atrophy. Gene and cell therapies in late-stage trials, sustained-release delivery platforms, and biosimilar price competition are reshaping revenue streams even as payers tighten utilization controls to contain biologic costs. Regionally, the United States retains first-mover access to novel treatments by leveraging the FDA's breakthrough-therapy channel, while Asia-Pacific's accelerating reimbursement expansion and massive elderly cohort underpin the fastest unit growth.

Global Macular Degeneration Treatment Market Trends and Insights

Rising Prevalence of Age-Related Eye Disorders

AMD prevalence is outpacing baseline aging trends by 25% as lifestyle factors such as prolonged screen time, poor diet quality, and rising urban pollution compound hereditary risks. WHO projects 288 million people living with AMD by 2030, pushing health systems toward earlier detection protocols that enlarge the treatable population by 40% relative to clinic-based screening. Untreated AMD already drains USD 343 billion in global productivity and care costs, spurring insurers to endorse preventive regimens including regular imaging and nutritional support. Nations with mature diagnostic networks are witnessing steep adoption of AI-enabled screening that reaches primary-care settings and pharmacies, effectively re-routing patients into therapy pipelines sooner. Pharmaceutical companies are responding with extended-duration implants that align with proactive care models and reduce office-visit congestion.

Rapid Growth of The Global Geriatric Population

Individuals aged >= 65 will represent 16.5% of humanity by 2030, and the 85+ cohort-most vulnerable to advanced AMD-is expanding at twice the broader elderly growth rate. Asia-Pacific nations led by Japan and South Korea are confronting unprecedented demand that strains specialist availability and catalyzes tele-ophthalmology adoption. Elderly patients often carry comorbid diabetes or hypertension, complicating anti-VEGF injection regimens and mandating closer safety oversight. U.S. Medicare spending on anti-VEGF therapy climbed from USD 2.51 billion in 2014 to USD 4.02 billion in 2019; projections show another doubling by 2030 absent less costly options. Governments thus favor self-administered agents and home-monitoring devices that cushion capacity bottlenecks and temper budget escalation.

High Cost of Biologic and Gene Therapies

Leading anti-VEGF injections are priced at USD 1,850-2,000 per dose, and typical regimens of 6-8 injections per year can exceed USD 15,000 before diagnostics and physician fees. One-time gene therapies under development may demand USD 200,000-500,000 per eye, igniting payer scrutiny despite potential lifetime cost offsets. Aflibercept biosimilars launched in 2024 shave 15-30% off list prices, yet switching inertia and product-specific safety data gaps curb rapid penetration. Payers are responding with step-therapy rules, site-of-care restrictions, and outcomes-based contracting pilots that tie reimbursement to visual-acuity durability. These access frictions temper near-term uptake of high-priced modalities and could drag the macular degeneration treatment market CAGR by nearly two percentage points.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Ocular Drug Delivery

- Strong Late-Stage Pipeline of Novel Therapies

- Limited Reimbursement in Low-Income Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wet AMD's 64.62% 2025 revenue dominance demonstrates the entrenchment of anti-VEGF therapy, yet growth deceleration is evident as biosimilars erode price and volume share. Trajectory shifts favor the dry-AMD segment, where SYFOVRE and IZERVAY approvals generated the first pharmacologic options for geographic atrophy, cutting lesion-expansion by up to 35%. As real-world data validate safety, payer adoption accelerates, propelling a 10.21% CAGR that reshapes portfolio priorities across the macular degeneration treatment market. Gene-therapy researchers concentrate disproportionately on dry AMD, attracted by a patient pool that comprises roughly 85% of total AMD cases and the opportunity to deliver one-time treatments that could circumvent lifelong injections.

Competitive investment now skews toward complement modulation and photoreceptor protection, with Phase III readouts expected across multiple mechanisms by 2027. Leading incumbents staunch wet-AMD share loss through high-dose aflibercept and combined VEGF/Ang-2 suppression, but strategic capital increasingly shifts to dry-AMD assets via acquisition and co-development deals. Commercial analysts anticipate convergence of wet and dry revenue lines by 2029 if dry-segment uptake maintains current velocity, a milestone that would recalibrate valuation metrics across the macular degeneration treatment industry.

Early-stage AMD accounted for 71.58% of the 2025 macular degeneration treatment market size, reflecting diagnostic expansion into primary-care, optometry, and community-pharmacy channels through cloud-connected fundus cameras. Ophthalmic societies endorse AREDS-based supplementation and lifestyle adjustments for newly diagnosed patients, anchoring a preventive-care economy that supports nutraceutical manufacturers and tele-monitoring vendors. Intermediate-stage AMD boasts the fastest segment CAGR at 10.78% through 2031 as complement inhibitors demonstrate lesion-growth suppression and extend "functional vision years" for patients. The commercial narrative emphasizes halting progression rather than restoring lost acuity, aligning payer interest with societal cost-avoidance.

Late-stage AMD remains the highest per-patient revenue tier because of recurring injection schedules and assistive-device demand. Nonetheless, sustained-release implants and gene therapies threaten to compress visit volumes and disrupt traditional fee-for-service business models. Real-time home-OCT devices streamline triage, routing only deteriorating eyes into clinic for prompt rescue, conserving capacity and advancing precision medicine across the macular degeneration treatment market.

The Macular Degeneration Treatment Market Report is Segmented by Disease Form (Dry Age-Related Macular Degeneration and Wet Age-Related Macular Degeneration), Stage of Disease (Early-Stage AMD, and More), Treatment Type (Drugs, and Surgery), Route of Administration (Intravitreal, and More), Sales Channels (Hospitals, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 41.88% of 2025 revenue, riding the twin engines of Medicare reimbursement and the world's densest ophthalmologist workforce. FDA priority-review and breakthrough-therapy pathways accelerate first-in-class launches, such as ENCELTO for MacTel approved in March 2025. Yet 5.4% Medicare fee cuts enacted in 2024 squeeze provider margins, catalyzing consolidation of retina practices and adoption of cost-efficient biosimilars. Rural access gaps persist, prompting state tele-optometry pilots that beam AI-evaluated images to urban hubs.

Europe is the second-largest region but faces heterogeneity in health-technology assessments. The EMA's 2024 denial of SYFOVRE underscores divergence from U.S. regulators and delays access in key markets. Germany and the UK, equipped with robust insurance and strong clinical networks, spearhead uptake of advanced therapies; Mediterranean states lag, constrained by budget ceilings that delay formulary inclusion. EU aging-over 20% of citizens are>= 65-intensifies demand, while Horizon 2030 grants inject R&D funds into regional biotechs, sustaining pipeline vibrancy.

Asia-Pacific is the fastest-growing arena at 9.41% CAGR. China's 260 million seniors by 2030 create colossal demand, but specialist scarcity and uneven insurance temper immediate penetration. Japan's super-aged society maximizes high-tech treatment uptake under its universal-care umbrella, positioning the nation as a launchpad for gene-therapy rollouts. India leverages AI-powered smartphone fundus imaging to extend reach across ophthalmologist-poor districts, unlocking early-stage volumes. Australia and South Korea blend robust reimbursement with clinical-trial participation, expediting regional approval cascades.

- Roche

- Novartis

- Regeneron Pharmaceuticals

- Bayer

- Bausch Health

- Alcon

- Apellis Pharmaceuticals Inc.

- Astellas Pharma Inc. (Iveric Bio)

- Samsung Bioepis

- REGENXBIO

- 4D Molecular Therapeutics

- Adverum Biotechnologies

- EyePoint Pharmaceuticals

- Ocular Therapeutix Inc.

- Lineage Cell Therapeutics

- PanOptica

- OLIX Pharmaceuticals

- ONL Therapeutics

- MeiraGTx Holdings plc

- OnPoint Vision Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Age-Related Eye Disorders

- 4.2.2 Rapid Growth of the Global Geriatric Population

- 4.2.3 Technological Advancements in Ocular Drug Delivery

- 4.2.4 Strong Late-Stage Pipeline of Novel Therapies

- 4.2.5 Expansion of Healthcare Access in Emerging Economies

- 4.2.6 Increasing Healthcare Expenditure on Vision Preservation

- 4.3 Market Restraints

- 4.3.1 High Cost of Biologic and Gene Therapies

- 4.3.2 Limited Reimbursement in Low-Income Regions

- 4.3.3 Stringent Regulatory and Safety Requirements

- 4.3.4 Chronic Treatment Burden and Patient Non-Compliance

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Disease Form

- 5.1.1 Dry Age-Related Macular Degeneration

- 5.1.2 Wet Age-Related Macular Degeneration

- 5.2 By Stage of Disease

- 5.2.1 Early-Stage AMD

- 5.2.2 Intermediate-Stage AMD

- 5.2.3 Late-Stage AMD (Geographic Atrophy & Neovascular)

- 5.3 By Treatment Type

- 5.3.1 Drugs

- 5.3.1.1 Anti-VEGF Agents

- 5.3.1.2 Complement Pathway Inhibitors

- 5.3.1.3 Gene & Cell Therapy

- 5.3.1.4 Dietary Supplements & Antioxidants

- 5.3.1.5 Other Drugs

- 5.3.2 Devices

- 5.3.2.1 Low-Vision Glasses

- 5.3.2.2 Contact Lenses

- 5.3.2.3 Retinal Implants & Vision Aids

- 5.3.3 Surgery

- 5.3.3.1 Laser Photocoagulation

- 5.3.3.2 Photodynamic Therapy

- 5.3.3.3 Other Surgical Procedures

- 5.3.1 Drugs

- 5.4 By Route of Administration

- 5.4.1 Intravitreal

- 5.4.2 Suprachoroidal

- 5.4.3 Intravenous

- 5.5 By Sales Channel

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Specialty & Retail Pharmacies

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.5.3.1 GCC

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 F. Hoffmann-La Roche Ltd

- 6.3.2 Novartis AG

- 6.3.3 Regeneron Pharmaceuticals Inc.

- 6.3.4 Bayer AG

- 6.3.5 Bausch Health Companies Inc.

- 6.3.6 Alcon Inc.

- 6.3.7 Apellis Pharmaceuticals Inc.

- 6.3.8 Astellas Pharma Inc. (Iveric Bio)

- 6.3.9 Samsung Bioepis

- 6.3.10 REGENXBIO Inc.

- 6.3.11 4D Molecular Therapeutics

- 6.3.12 Adverum Biotechnologies

- 6.3.13 EyePoint Pharmaceuticals

- 6.3.14 Ocular Therapeutix Inc.

- 6.3.15 Lineage Cell Therapeutics Inc.

- 6.3.16 PanOptica

- 6.3.17 OLIX Pharmaceuticals

- 6.3.18 ONL Therapeutics

- 6.3.19 MeiraGTx Holdings plc

- 6.3.20 OnPoint Vision Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment