PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852209

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852209

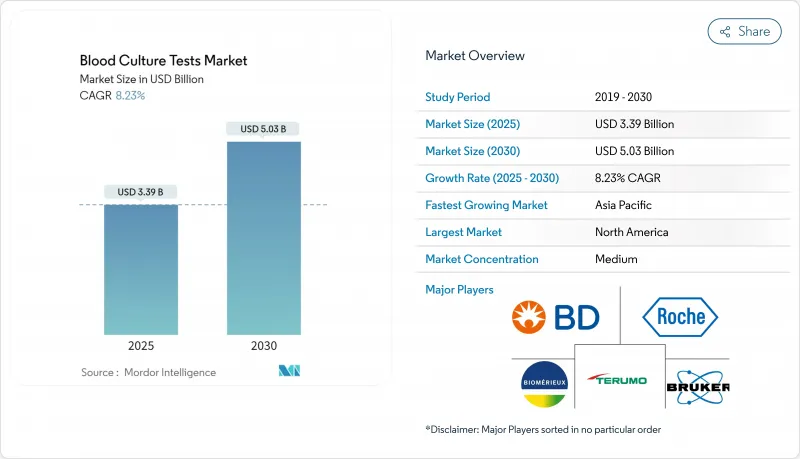

Blood Culture Tests - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The blood culture tests market is valued at USD 3.39 billion in 2025 and is projected to reach USD 5.03 billion by 2030, reflecting a sustained 8.23 % CAGR throughout the forecast period.

This trajectory is primarily underpinned by the rising clinical burden of bloodstream infections (BSIs) and sepsis, the steady introduction of rapid molecular diagnostics, and the shift by healthcare payers toward outcome-based reimbursement. Executives monitoring this space will appreciate that a market capable of expanding USD 1.64 billion in five years is also implicitly incentivising adjacent business models-such as data-analytics layers that interpret organism-level outputs in real time and feed them into antimicrobial stewardship dashboards-thereby broadening the competitive arena beyond traditional instrument vendors. North America currently commands a 38 % market share in 2024, while Asia-Pacific is on a faster 8.8 % CAGR path between 2025 and 2030, evidence that future volume growth may be geographically decoupled from present revenue concentration.

Global Blood Culture Tests Market Trends and Insights

Rising Incidences of Bloodstream Infections and Sepsis

Global surveillance confirms that central line-associated bloodstream infections remain a persistent clinical challenge: the Centers for Disease Control and Prevention reports roughly 250 000 events each year in U.S. acute-care hospitals. A 2023 meta-analysis funded by the National Institutes of Health attributes 1.7 million annual sepsis cases and nearly 350 000 deaths to infection progression across U.S. care settings. These numbers are shaping payer quality metrics that reward institutions for shaving hours off diagnostic turnaround, a linkage that subtly heightens the commercial appeal of rapid culture adjuncts.

Advancements in Diagnostics Technologies

Clinical metagenomics and matrix-assisted laser desorption ionization time-of-flight mass spectrometry (MALDI-TOF MS) are redefining diagnostic speed and breadth. Recent studies show that metagenomic pipelines can detect bacterial DNA at 1-5 CFU/mL within 9-12 hours. Though these figures derive from early-stage evaluations, their strategic meaning is clear: once detection sensitivity converges on culture-based baselines, laboratories may begin favouring single-workflow molecular solutions, triggering a mix-shift from consumables to software-orchestrated analytics. The investor takeaway is that profit pools may migrate toward companies owning proprietary bioinformatics algorithms rather than those supplying commodity culture bottles.

Time Consuming Nature of Conventional Methods

Conventional culture methods require 24-72 hours for actionable results, and that lag compels clinicians to initiate empiric broad-spectrum therapy. From a budget-holder perspective, every hour of empiric coverage carries a hidden cost: higher drug spend, risk of Clostridioides difficile infection, and downstream antimicrobial resistance. This dynamic sets a premium on hybrid systems that preserve the regulatory familiarity of growth-based detection while embedding near-real-time identification tools. A nuanced angle is that manufacturers able to package performance data showing reduced empiric-therapy windows can align their value proposition with antimicrobial stewardship key performance indicators-an alignment scarcely captured in conventional total-cost-of-ownership calculators.

Other drivers and restraints analyzed in the detailed report include:

- Growing Geriatric Population

- Increased Hospital-Acquired Infections

- Growing Awareness Regarding Early and Accurate Diagnosis

- High Initial Capital for Automated Culture Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables represent 64% of 2024 revenue, illustrating the razor-blade economic model. Each instrument placement seeds years of bottle, media, and panel purchases, producing high-visibility revenue streams that private-equity sponsors often value at premium multiples. A second-order consideration is that as molecular methods scale, consumables may transition from physical media to single-use cartridges embedding lyophilized reagents, subtly shifting gross-margin profiles while retaining the annuity-like pattern executives prize.

Automated testing accounts for 71% of current volume, yet manual methods are projected to advance at a 10.1% CAGR due to uptake in cost-constrained environments. The implication is that winning portfolios will likely straddle both ends of the automation continuum, offering a scalable upgrade path that protects clients' initial investments. Vendors neglecting the manual tier risk conceding a foothold to rivals that can later cross-sell modular automation when budgets expand.

The Blood Culture Tests Market Report Segments the Industry Into by Product (Instruments, Consumables, and More), by Type (Manual Blood Culture Testing, Automated Blood Culture Testing), by Technology (Culture-Based, and More), by Culture Type (Bacterial, Fungal, and More), by End User (Hospital Laboratories, Diagnostic Laboratories, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 38% share stems from robust reimbursement structures, stringent infection-control mandates, and large installed bases of automated systems. The CDC's contamination-prevention initiatives have positioned blood culture accuracy as a quality metric, effectively creating a policy-driven catalyst for instrument upgrades. Executives should note that such regulatory nudges often precede payer adjustments, implying further volume and pricing uplift.

Europe benefits from unified antimicrobial stewardship frameworks, but procurement heterogeneity across countries yields divergent adoption speeds. A practical corollary for suppliers is that demonstrating instrument robustness in multi-center evaluations can tip tenders in markets where technical criteria outweigh price. France, being home to bioMerieux, enjoys a local manufacturing hub, reminding competitors that regional proximity can translate into after-sales service advantages.

Asia-Pacific's forecast 8.8% CAGR reveals substantial white-space opportunity across tier-two and tier-three cities in China and India. The World Health Organization reports nosocomial infection prevalence approaching 8.7% in surveyed hospitals. Providers in these settings often leapfrog directly to compact automated systems compatible with fluctuating power supply, underscoring that product ruggedness can be as decisive as analytic sensitivity.

- Beckton Dickinson

- bioMerieux

- Danaher Corp.

- Roche

- Thermo Fisher Scientific

- Siemens Healthineers

- Abbott Laboratories

- Bruker Corp.

- T2 Biosystems

- Accelerate Diagnostics Inc.

- DiaSorin

- Terumo

- Hardy Diagnostics

- bioFire Diagnostics LLC

- QIAGEN

- Merck KGaA (MilliporeSigma)

- Sartorius

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidences of Bloodstream Infections and Sepsis

- 4.2.2 Advancements in Diagnostics Technologies

- 4.2.3 Rise of Outpatient Parenteral Antimicrobial Therapy (OPAT) Programs Requiring Point-of-Care Blood Culture

- 4.2.4 Growing Geriatric Population

- 4.2.5 Increased Hospital-Acquired Infections

- 4.2.6 Growing Awareness Regarding Early and Accurate Diagnosis

- 4.3 Market Restraints

- 4.3.1 Time Consuming Nature of Conventional Methods

- 4.3.2 High Initial Capital for Automated Culture Systems

- 4.3.3 Shortage of Skilled Professionals

- 4.3.4 Regulatory Complexities

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.2 Consumables (Media, Bottles, Panels)

- 5.1.3 Software & Services

- 5.2 By Type

- 5.2.1 Manual Blood Culture Testing

- 5.2.2 Automated Blood Culture Testing

- 5.3 By Technology

- 5.3.1 Culture-Based (Conventional, Resin-Based)

- 5.3.2 Proteomic (MALDI-TOF, LC-MS)

- 5.3.3 Molecular (NAAT, PCR-Based Panels, NGS)

- 5.4 By Culture Type

- 5.4.1 Bacterial

- 5.4.2 Fungal

- 5.4.3 Mycobacterial (e.g., TB)

- 5.5 By End User

- 5.5.1 Hospital Laboratories

- 5.5.2 Diagnostic Reference Laboratories

- 5.5.3 Academic & Research Institutes

- 5.5.4 Others (POC Clinics, Ambulatory Surgery Centers)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Becton, Dickinson and Company (BD)

- 6.4.2 bioMerieux SA

- 6.4.3 Danaher Corp.

- 6.4.4 F. Hoffmann-La Roche AG

- 6.4.5 Thermo Fisher Scientific Inc.

- 6.4.6 Siemens Healthineers AG

- 6.4.7 Abbott Laboratories

- 6.4.8 Bruker Corp.

- 6.4.9 T2 Biosystems Inc.

- 6.4.10 Accelerate Diagnostics Inc.

- 6.4.11 DiaSorin S.p.A

- 6.4.12 Terumo Corporation

- 6.4.13 Hardy Diagnostics

- 6.4.14 bioFire Diagnostics LLC

- 6.4.15 Qiagen NV

- 6.4.16 Merck KGaA (MilliporeSigma)

- 6.4.17 Sartorius AG

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment