PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1905982

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1905982

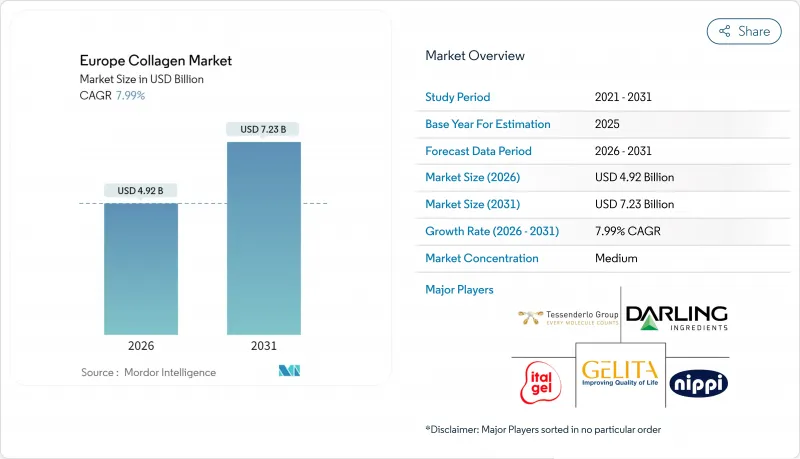

Europe Collagen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European collagen market is expected to grow from USD 4.56 billion in 2025 to USD 4.92 billion in 2026 and is forecast to reach USD 7.23 billion by 2031 at 7.99% CAGR over 2026-2031.

Heightened consumer focus on proactive health, visible skin benefits, and joint-care efficacy underpins steady category trading up, while regulatory clarity on permissible health claims accelerates premium innovation. Demand is shifting from conventional bovine and porcine ingredients to traceable marine sources that offer superior bioavailability and a smaller environmental footprint. Brand owners that combine clinical substantiation with responsible sourcing capture disproportionate shelf visibility, and German, French, and Dutch retailers report sustained double-digit sell-out for marine collagen lines despite above-category price points. Innovation in precision fermentation and recombinant platforms is widening the addressable use-case set in medical devices and functional foods, while integrated producers leverage their scale to navigate the European Union's demanding compliance landscape.

Europe Collagen Market Trends and Insights

Increasing Consumer Demand for Health and Wellness Products

European consumers are increasingly adopting preventive health strategies, shifting their focus from reactive healthcare to proactive wellness management. This shift has expanded the use of collagen from traditional beauty applications to functional nutrition. Educated consumers aged 35-55, in particular, consider collagen supplementation essential for maintaining joint mobility and skin elasticity. The combination of aging demographics and rising health awareness is driving consistent demand for premium collagen products. European consumers are notably willing to pay 25-40% more for scientifically validated formulations. Additionally, regulatory frameworks under EFSA guidance are increasingly endorsing health claims for collagen peptides, providing manufacturers with clearer opportunities for product positioning and marketing communications.

Ageing Population Seeking Joint-Care Solutions

Europe's aging population is fueling a surge in demand for joint-care solutions. Projections from Eurostat indicate that the old-age dependency ratio in Europe will rise from 33.4% in 2023 to a staggering 59.7% by 2100. Clinical studies, as highlighted in the Journal of Integrative and Complementary Medicine, have shown that supplementation with undenatured type II collagen can notably enhance knee joint flexibility. Specifically, after 24 weeks of supplementation, subjects exhibited a 3.23° improvement in flexion and a 2.21° boost in extension. This demographic evolution is propelling a consistent demand for collagen-infused joint health products, especially among Europeans over 50 who often grapple with activity-induced joint discomfort. The European market is leaning towards collagen hydrolysate formulations, prized for their bioavailability and proven clinical benefits. Notably, a daily dosage of 10g has emerged as the benchmark for joint health applications. Furthermore, healthcare systems across Europe are increasingly viewing collagen supplementation as a budget-friendly strategy, not only to uphold joint function but also to potentially curtail long-term orthopedic care expenses.

Rise of Vegan Protein Alternatives

The European market is under increasing pressure from the growth of plant-based protein alternatives and advancements in synthetic biology, which challenge traditional collagen sourcing models. PlantForm Corporation's production of recombinant human collagen using plant-based systems highlights the commercial feasibility of vegan alternatives, with the market projected to reach USD 11.4 billion by 2030. Consumer preferences are shifting toward ethical and sustainable options, particularly among younger demographics who emphasize environmental impact and animal welfare. The competition intensifies as vegan collagen alternatives achieve functional equivalence with animal-derived products while offering better consistency and regulatory benefits. In response, European manufacturers are investing in fermentation-based production technologies and creating hybrid formulations that integrate traditional and alternative protein sources to retain their market position while addressing ethical concerns.

Other drivers and restraints analyzed in the detailed report include:

- Expansion in the Beauty and Personal Care Sector

- Increasing Applications in Dietary Supplements

- Stringent Regulatory Compliance and Certification Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Animal-based collagen maintains market leadership with a 65.05% share in 2025, reflecting established supply chains and consumer familiarity with bovine and porcine sources. However, marine-based collagen demonstrates superior growth dynamics at 10.11% CAGR through 2031, driven by sustainability advantages and regulatory preferences that favor traceable marine sources over traditional animal derivatives. The marine segment benefits from technological advances in extraction methods and growing consumer awareness of bioavailability advantages, with fish collagen demonstrating 1.5 times higher absorption rates than mammalian alternatives.

European regulatory frameworks increasingly favor marine sources due to reduced BSE risk and clearer traceability requirements, with EFSA assessments confirming safety advantages over ruminant-derived collagen. Innovation in marine collagen extraction from fish processing by-products addresses sustainability concerns while creating economic value from waste streams, with research demonstrating potential annual production exceeding 6,500 tons from European fisheries alone. The competitive landscape evolves as traditional animal collagen producers invest in marine processing capabilities while specialized marine biotechnology companies gain market share through premium positioning and sustainability credentials.

The Europe Collagen Market Report is Segmented by Source (Animal-Based, Marine-Based), End User/Application (Food & Beverages, Dietary Supplements, Personal Care & Cosmetics, Pharmaceuticals, Animal Nutrition), and Geography (Germany, United Kingdom, Italy, France, Spain, Netherlands, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Gelita AG

- Darling Ingredients Inc. (Rousselot)

- PB Leiner (Tessenderlo Group)

- Italgel S.r.l.

- Nippi, Incorporated

- Lapi Gelatine S.p.A.

- Collagen Solutions Plc

- DSM-Firmenich

- Symrise AG

- Weishardt Group

- Gelnex

- Lonza Group Ltd.

- BioCell Technology LLC

- Jellagen Ltd

- CollaSwiss (Swiss Nutrivalor)

- Medichema GmbH

- Evonik Industries AG

- Essentia Protein Solutions

- PB Gelatins

- NovaColl (Geltor)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing consumer demand for health and wellness products,

- 4.2.2 Ageing population seeking joint-care solutions

- 4.2.3 Expansion in the beauty and personal care sector

- 4.2.4 Increasing Applications in Dietary Supplements

- 4.2.5 Shift toward sustainable marine collagen sources

- 4.2.6 Rising Innovation in research and production

- 4.3 Market Restraints

- 4.3.1 Rise of vegan protein alternatives

- 4.3.2 Stringent regulatory compliance and certification requirements

- 4.3.3 Ethical and allergenic concerns related to animal-derived collagen

- 4.3.4 High costs of sourcing and processing high-quality collagen raw materials

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST

- 5.1 By Source

- 5.1.1 Animal-based

- 5.1.2 Marine-based

- 5.2 By End User / Application

- 5.2.1 Food & Beverages

- 5.2.2 Dietary Supplements

- 5.2.3 Personal Care & Cosmetics

- 5.2.4 Pharmaceuticals

- 5.2.5 Animal Nutrition

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Netherlands

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Gelita AG

- 6.4.2 Darling Ingredients Inc. (Rousselot)

- 6.4.3 PB Leiner (Tessenderlo Group)

- 6.4.4 Italgel S.r.l.

- 6.4.5 Nippi, Incorporated

- 6.4.6 Lapi Gelatine S.p.A.

- 6.4.7 Collagen Solutions Plc

- 6.4.8 DSM-Firmenich

- 6.4.9 Symrise AG

- 6.4.10 Weishardt Group

- 6.4.11 Gelnex

- 6.4.12 Lonza Group Ltd.

- 6.4.13 BioCell Technology LLC

- 6.4.14 Jellagen Ltd

- 6.4.15 CollaSwiss (Swiss Nutrivalor)

- 6.4.16 Medichema GmbH

- 6.4.17 Evonik Industries AG

- 6.4.18 Essentia Protein Solutions

- 6.4.19 PB Gelatins

- 6.4.20 NovaColl (Geltor)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK