PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1905992

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1905992

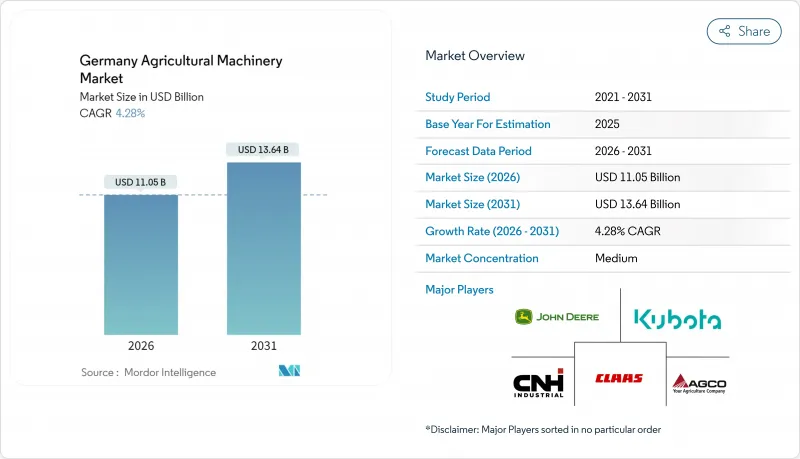

Germany Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Germany agricultural machinery market size in 2026 is estimated at USD 11.05 billion, growing from 2025 value of USD 10.6 billion with 2031 projections showing USD 13.64 billion, growing at 4.28% CAGR over 2026-2031.

Strong demand for tractors, rapid irrigation system uptake, and sustained subsidy inflows offset reduced equipment registrations and lower farm incomes. Farmers pivot toward precision and autonomous technologies to cope with labor shortages, regulatory emission targets, and climate-driven water stress. Manufacturers scale retrofit kits that embed ISOBUS compliance and smart-connected features, lowering barriers for aging machine fleets. OEMs (Original Equipment Manufacturers) also deploy creative finance models that smooth seasonal cash flows and mitigate high upfront costs. Meanwhile, policy incentives such as EUR 6.2 billion (USD 6.8 billion) in annual CAP transfers keep equipment investment resilient in the Germany agricultural machinery market amid volatile commodity prices.

Germany Agricultural Machinery Market Trends and Insights

Ageing-workforce-driven Labor Scarcity

Germany's agricultural sector faces a significant labor shortage due to an aging workforce and limited interest among younger generations. As older farmers retire, hiring gaps widen, prompting a surge in mechanization and automation. Government initiatives support the deployment of mini-robots for targeted field tasks, reducing reliance on manual labor. Plug-and-play interfaces and retrofit kits allow older machinery to integrate with smart implements, making upgrades more accessible. This shift transforms the agricultural machinery market, with increased demand for autonomous solutions and adaptable technologies that maintain productivity across diverse farm sizes and crop types.

EU and Federal Subsidies for Precision-Machinery Purchases

Policy reforms at both the EU and federal levels are increasing investment in precision agriculture technologies across Germany. CAP reforms lift green premium payouts to 130% of the base rate, steering farmers toward precision sprayers and smart irrigation. Gas-oil tax relief of EUR 0.21480 per liter (USD 0.24) cuts running costs for high-tech tractors. State plans such as ILU 2023 add grants for emission-cutting machinery, supporting steady equipment turnover in the Germany agricultural machinery market.This modernization of the agricultural machinery market aligns economic incentives with environmental goals and strengthens Germany's farming infrastructure.

High Upfront Cost and Long Payback Period

The high capital cost of advanced agricultural machinery continues to challenge German farmers, particularly those operating smaller farms. Large combines and precision equipment require substantial investment, and rising financing costs have extended the time needed to recover these expenses. As a result, many farmers are postponing equipment upgrades, which slows overall market turnover and affects manufacturer sales. Smaller farms experience the greatest impact, as they often lack the financial resources to invest in newer technologies. This situation moderates growth in Germany's agricultural machinery market, where cost and return on investment remain significant barriers to modernization.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Smart-connected Implements and ISOBUS Standards

- Carbon-footprint Regulations Favoring Tier-V and Electric Tractors

- Cybersecurity and Data Ownership Concerns in Digitally Enabled Fleets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors represent 62.28% of the Germany agricultural machinery market size in 2025, maintaining their dominant position. Despite decreased registration volumes, demand remains robust due to fuel-efficient engines and smart implement compatibility. Farmers are modernizing existing fleets through ISOBUS retrofits and plug-and-play upgrades rather than complete replacements. Electric tractors are gaining adoption in the vegetable farming and municipal services segments. The testing of models like the e100 Vario indicates a gradual transition toward electrification as battery technology advances.

Irrigation machinery demonstrates the highest growth rate at 6.56% CAGR through 2031, driven by climate variability and water-efficient farming requirements. While irrigation adoption remains moderate, increasing drought conditions and changing weather patterns accelerate the uptake of sprinkler and drip systems. Government subsidies and energy tax incentives reduce operational costs, improving access to precision irrigation systems. Climate resilience requirements are transforming irrigation from a supplementary investment to an essential component, influencing Germany's agricultural machinery market dynamics and infrastructure planning.

The Germany Agricultural Machinery Market Report is Segmented by Type (Tractors, Plowing and Cultivating Machinery, Planting Machinery, Harvesting Machinery, Haying and Forage Machinery, Irrigation Machinery, and Other Types). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AGCO Corporation

- Deere & Company

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Kubota Corporation

- SDF S.p.A.

- Lemken Beteiligungs-GmbH

- Maschinenfabrik Bernard KRONE GmbH & Co.KG

- Horsch Holding SE

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- AMAZONEN-Werke H. Dreyer GmbH & Co. KG

- Rauch Landmaschinenfabrik GmbH

- Kalverkamp Innovation GmbH (Nexat GmbH)

- Duport Machinery (Gustrower Maschinenbau GmbH)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing-workforce-driven Labor Scarcity

- 4.2.2 EU and Federal Subsidies for Precision-Machinery Purchases

- 4.2.3 Rapid Adoption of Smart-connected Implements and ISOBUS Standards

- 4.2.4 Carbon-footprint Regulations Favouring Tier-V and Electric Tractors

- 4.2.5 Autonomous Multi-task Platforms Gaining Pilot Traction

- 4.2.6 Suitable OEM Finance Models

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost and Long Payback Period

- 4.3.2 Cybersecurity and Data Ownership Concerns in Digitally Enabled Fleets

- 4.3.3 Margin Pressure from Falling Commodity Prices and Volatile Energy Costs

- 4.3.4 Regulatory Uncertainty over Pesticide Reduction and Nitrogen Caps

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Tractors

- 5.1.1.1 By Horse-Power

- 5.1.1.1.1 Less than 40 HP

- 5.1.1.1.2 40-100 HP

- 5.1.1.1.3 101-150 HP

- 5.1.1.1.4 Above 150 HP

- 5.1.1.2 By Tractor Type

- 5.1.1.2.1 Compact Utility

- 5.1.1.2.2 Utility

- 5.1.1.2.3 Row-Crop

- 5.1.1.1 By Horse-Power

- 5.1.2 Plowing and Cultivating Machinery

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Others (Ridger, Rotary tillers, etc.)

- 5.1.3 Planting Machinery

- 5.1.3.1 Seed Drills

- 5.1.3.2 Planters

- 5.1.3.3 Spreaders

- 5.1.3.4 Others(Transplanters, Precision Seeders, etc.)

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Others (Potato Harvesters, Potato Harvesters, etc.)

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers

- 5.1.5.2 Balers

- 5.1.5.3 Others (Rakes, Tedders, etc.)

- 5.1.6 Irrigation Machinery

- 5.1.6.1 Sprinkler

- 5.1.6.2 Drip

- 5.1.6.3 Others (Micro-Sprinklers, Center-Pivot Irrigation, etc.)

- 5.1.7 Other Types

- 5.1.1 Tractors

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 AGCO Corporation

- 6.4.2 Deere & Company

- 6.4.3 CLAAS KGaA mbH

- 6.4.4 CNH Industrial N.V.

- 6.4.5 Kubota Corporation

- 6.4.6 SDF S.p.A.

- 6.4.7 Lemken Beteiligungs-GmbH

- 6.4.8 Maschinenfabrik Bernard KRONE GmbH & Co.KG

- 6.4.9 Horsch Holding SE

- 6.4.10 GRIMME Landmaschinenfabrik GmbH & Co. KG

- 6.4.11 AMAZONEN-Werke H. Dreyer GmbH & Co. KG

- 6.4.12 Rauch Landmaschinenfabrik GmbH

- 6.4.13 Kalverkamp Innovation GmbH (Nexat GmbH)

- 6.4.14 Duport Machinery (Gustrower Maschinenbau GmbH)

7 Market Opportunities and Future Outlook