PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1905993

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1905993

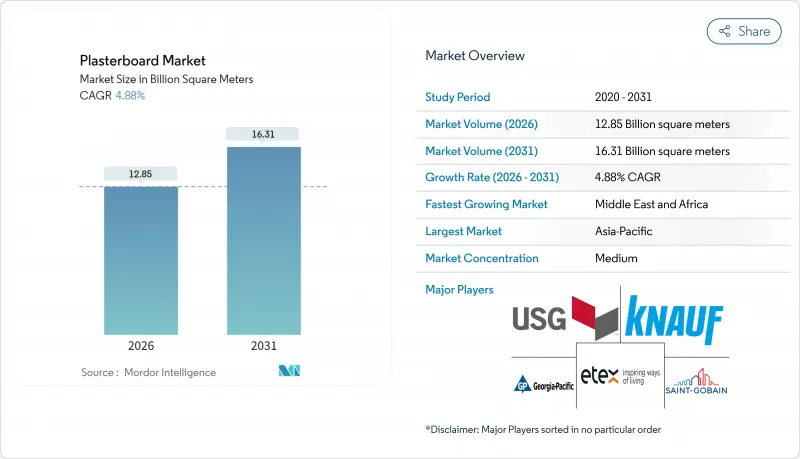

Plasterboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Plasterboard Market was valued at 12.25 Billion square meters in 2025 and estimated to grow from 12.85 Billion square meters in 2026 to reach 16.31 Billion square meters by 2031, at a CAGR of 4.88% during the forecast period (2026-2031).

This growth trajectory reflects the accelerating adoption of dry construction techniques, stricter green-building mandates, and the expansion of synthetic gypsum supply chains. Contractors seeking shorter project cycles are opting for lightweight boards that reduce labor hours, while regulators are implementing low-VOC requirements that favor gypsum solutions formulated with recycled content. Rapid urbanization in the Asia-Pacific, megaprojects in the Gulf, and commercial real-estate recovery in North America and Europe are widening the addressable plasterboard market. Price-competitive synthetic gypsum sourced from flue-gas desulfurization plants in coal-reliant economies is lowering raw material costs, encouraging manufacturers to scale up their output. Competitive intensity is poised to rise as leading brands deploy closed-loop recycling systems to comply with landfill restrictions and differentiate on sustainability.

Global Plasterboard Market Trends and Insights

Rapid Shift Toward Dry Construction Techniques Over Wet Methods

Builders favor dry systems for labor efficiency and predictable timelines. Saudi mega-developments, such as NEOM, specify standardized drywall assemblies to minimize on-site curing delays. Building codes now recognize drywall for its consistent quality and reduced moisture defects. Demand is spreading to installation tools, joint compounds, and finishing accessories, enlarging the plasterboard market. Manufacturers are engineering thinner, dimensionally stable boards compatible with prefabricated modules.

Residential Megaproject Pipelines in Asia and GCC Boost Volume Demand

Urbanization policies in India, Indonesia, and Saudi Arabia are driving mass housing programs that anchor long-term supply contracts with board producers. India's infrastructure plan valued at USD 1.4 trillion up to 2035 underpins capacity expansions by regional manufacturers. Clustered developments reduce logistics miles and promote consistent board specifications, reinforcing economies of scale.

Moisture Sensitivity and Mold Risk Increase Remediation Costs

Boards that remain damp can foster mold, triggering insurance claims that average USD 15,000-50,000 per dwelling. Building authorities in coastal zones now specify moisture-resistant grades, yet these products cost 15-25% more. Some developers switch to fiber cement in high-risk sites. Skilled labor for correct vapor-barrier installation is limited in emerging regions, which slows the uptake of plasterboard in the market.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Green-Building Codes Mandate Low-VOC, High-Recycled-Content Boards

- Price-Competitive Synthetic Gypsum Supply in Emerging Markets Widens Adoption

- Volatile Gypsum and Energy Prices Squeeze Producer Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tapered-edge boards commanded 61.42% of the plasterboard market share in 2025. Their recessed edges simplify joint finishing and remain the default for residential interiors. The plasterboard market size for tapered boards is expected to grow at a slower pace than overall demand as modular construction gains ground. Square-edge products are projected to advance at a 5.03% CAGR through 2031, as architects in logistics and industrial projects increasingly adopt exposed joints that align with minimalist design.

Square-edge boards integrate seamlessly with metal framing and pre-finished panels used in factory-built construction, reducing the need for sanding and compound use. Contractors cite lower-skilled labor hours as the chief gain. In contrast, homeowners and interior renovators still prefer the seamless appearance enabled by tapered edges. Manufacturers are marketing hybrid boards with micro-beveled edges that balance speed and aesthetics, a sign of converging form preferences within the plasterboard market.

The Plasterboard Market Report is Segmented by Form (Square-Edge and Tapered), Type (Standard, Fire-Resistant, Thermal-Insulated, Moisture-Resistant, Sound-Resistant, and Impact-Resistant), End-Use Sector (Residential and Non-Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Square Meters).

Geography Analysis

The Asia-Pacific's plasterboard market benefits from sustained public housing initiatives and factory construction that adopts drywalling as the default. Synthetic gypsum sourced from regional power plants lowers costs and supports competitive pricing. Governments are adopting seismic and fire regulations that increase board thickness standards, pushing average material intensity per square meter higher.

The Middle East and Africa region is scaling board consumption through giga-projects in Saudi Arabia, Kuwait, and Egypt. Harsh climate conditions and rapid schedules make moisture-resistant and lightweight boards attractive. Local producers partner with global majors to facilitate technology transfer and establish joint logistics networks, thereby reducing import dependency.

Europe emphasizes circular economy objectives, rewarding plants with take-back schemes and near-zero-waste performance. British Gypsum's recycled-content SoundBloc line meets stringent landfill limits. North America invests in electrified factories sourcing renewable power, positioning the region as a testing ground for zero-carbon board production. Latin America lags in per-capita consumption but is seeing gradual growth tied to commercial interiors modernization.

- Ahmed Yousuf & Hassan Abdullah Co. (AYHACO)

- American Gypsum Company LLC

- AtIskan AlcI

- AWI Licensing LLC

- CSR Limited

- Etex Group

- Fletcher Building

- Georgia-Pacific

- GYPSEMNA CO LLC

- Gyptec Iberica

- Holcim

- Jason New Materials

- Knauf Group

- Mada Gypsum Company

- National Gypsum Services Company

- Saint-Gobain

- USG Boral

- VOLMA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid shift toward dry construction techniques over wet methods

- 4.2.2 Residential megaproject pipelines in Asia and GCC boost volume demand

- 4.2.3 Tightening green-building codes mandate low-VOC, high-recycled-content boards

- 4.2.4 Price-competitive synthetic gypsum supply in emerging markets widens adoption

- 4.2.5 Recycling-grade gypsum shortages in the West spur investment in closed-loop systems

- 4.3 Market Restraints

- 4.3.1 Moisture sensitivity and mould risk increase remediation costs

- 4.3.2 Volatile gypsum/energy prices squeeze producer margins

- 4.3.3 Stringent landfill bans on gypsum waste raise disposal costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Volume)

- 5.1 By Form

- 5.1.1 Square-edge

- 5.1.2 Tapered

- 5.2 By Type

- 5.2.1 Standard

- 5.2.2 Fire-resistant

- 5.2.3 Thermal-insulated

- 5.2.4 Moisture-resistant

- 5.2.5 Sound-resistant

- 5.2.6 Impact-resistant

- 5.3 By End-use Sector

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Nordic Countries

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Ahmed Yousuf & Hassan Abdullah Co. (AYHACO)

- 6.4.2 American Gypsum Company LLC

- 6.4.3 AtIskan AlcI

- 6.4.4 AWI Licensing LLC

- 6.4.5 CSR Limited

- 6.4.6 Etex Group

- 6.4.7 Fletcher Building

- 6.4.8 Georgia-Pacific

- 6.4.9 GYPSEMNA CO LLC

- 6.4.10 Gyptec Iberica

- 6.4.11 Holcim

- 6.4.12 Jason New Materials

- 6.4.13 Knauf Group

- 6.4.14 Mada Gypsum Company

- 6.4.15 National Gypsum Services Company

- 6.4.16 Saint-Gobain

- 6.4.17 USG Boral

- 6.4.18 VOLMA

7 Market Opportunities & Future Outlook

- 7.1 White-space and Unmet-need Assessment