PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1905999

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1905999

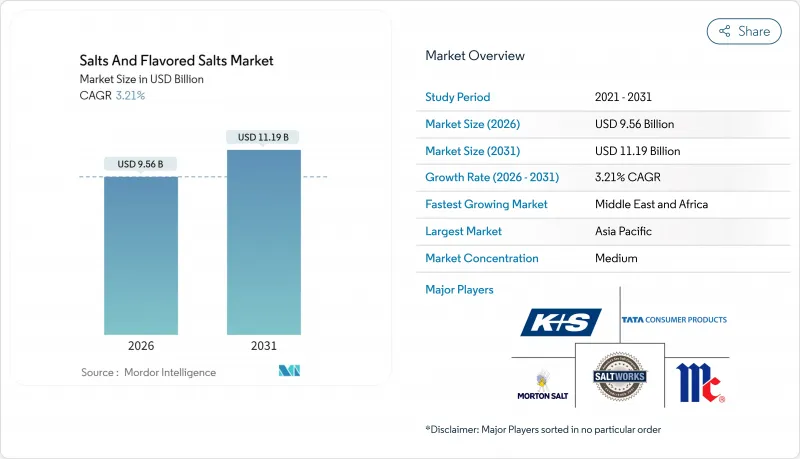

Salts And Flavored Salts - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Salts and Flavored Salts Market was valued at USD 9.26 billion in 2025 and estimated to grow from USD 9.56 billion in 2026 to reach USD 11.19 billion by 2031, at a CAGR of 3.21% during the forecast period (2026-2031).

Market expansion is primarily supported by increasing consumer preference for premium salt products, continuous innovation in developing unique flavored salt combinations, and necessary product reformulations to meet evolving regulatory standards. However, traditional salt segments maintain steady but modest growth patterns. The Asia-Pacific region continues to dominate the market, driven by substantial per-capita sodium consumption, robust food processing industry operations, and a rapidly expanding middle-class consumer base. North American and European markets exhibit strong growth in specialty salt segments, influenced by increasing health consciousness, demand for clean-label products, and growing interest in gourmet cooking. The market dynamics are shaped by weather-dependent production fluctuations and strategic industry consolidation through mergers and acquisitions, while technological advancements in flavor enhancement capabilities continue to unveil new market opportunities.

Global Salts And Flavored Salts Market Trends and Insights

Demand for Natural, Organic, and Clean-Label Ingredients

Consumer demand for food transparency is influencing product formulations across food categories, as consumers show willingness to pay higher prices for clean-label products. Salt producers have responded by implementing traceable sourcing protocols and minimal processing methods, particularly for naturally harvested sea salts and rock salts with verified origins. McCormick's 2025 introduction of finishing salts with natural flavor infusions, free from artificial additives, reflects the industry's alignment with clean-label requirements. The FDA's updated voluntary sodium reduction guidelines present dual requirements for clean ingredients and functional reformulation. The combination of health awareness and premium positioning allows salt producers to maintain higher profit margins while meeting consumer demands for ingredient authenticity and minimal processing. The organic products market shows significant expansion, with organic purchases present in over 95% of households last year and an addition of 2 million new buyers. Consumer preference for organic products continues to exceed that of conventional products, primarily driven by younger consumers' value-based purchasing decisions. Market growth stems from increased online and direct-to-consumer sales, alongside retailers expanding their organic product offerings. Despite a slowdown in organic product innovation, with companies adopting more strategic approaches, organic products remain central to the natural products industry in 2025 .

Popularity of Gourmet and Specialty Foods

Specialty food retailers demonstrated substantial growth in their annual performance, effectively securing their competitive position against traditional grocery retail channels. The fusion of sweet and salty flavors has become increasingly prominent in consumer preferences, with market projections indicating significant expansion in menu offerings through 2027. This evolution has positioned flavored salts as fundamental ingredients, driving innovative culinary applications throughout the food service industry. Premium salt varieties consistently generate substantial price premiums compared to conventional table salt, reflecting strong consumer acceptance and willingness to invest in distinguished flavor experiences and premium-quality ingredients. The market dynamics showcase a clear shift in consumer behavior, where value perception extends beyond basic functionality to encompass enhanced taste experiences and culinary sophistication. This trend has encouraged specialty food retailers to expand their premium salt offerings, capitalizing on the growing consumer appetite for gourmet ingredients and unique flavor profiles.

Regulatory Challenges in Flavor Formulation and Labeling

The FDA's 2024 voluntary sodium reduction targets present significant operational challenges for flavored salt manufacturers, who must now navigate the intricate process of product reformulation while ensuring their products maintain consumer-preferred taste profiles and necessary shelf stability. In North America, manufacturers face a complex regulatory environment, with Mexico's NOM-051 labeling requirements and Canada's nutritional labeling standards creating distinct compliance obligations in each market. The European Union's comprehensive Farm to Fork strategy introduces additional layers of requirements focused on sustainability and labeling, which directly impact how companies source their salt and maintain processing documentation. These diverse regulatory frameworks across international markets necessitate companies to develop and maintain separate product formulations and implement multiple labeling systems, resulting in increased operational complexity and resource allocation. The situation becomes particularly challenging in the flavored salt category, where manufacturers must ensure their natural flavor declarations align with varying international requirements for ingredient transparency and safety documentation, while meeting local market expectations.

Other drivers and restraints analyzed in the detailed report include:

- Increase in Global Culinary Cultural Exchange and Awareness

- Preference for Artisanal, Minimally Processed Products

- Safety Concerns About Artificial Additives in Certain Flavored Salts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Table salt holds an 84.65% market share in 2025, maintaining its essential position across global markets. Its dominance stems from widespread use in food processing operations, diverse industrial applications, and consistent household consumption patterns. The seasoned salt/flavored salt segment demonstrates robust growth potential, advancing at a 4.69% CAGR through 2031, as consumers increasingly seek convenient options and innovative flavor experiences.

McCormick's strategic 2025 product line expansion encompasses 5 new finishing salts, including Balsamic & Herb, Smoky Garlic & Rosemary, and Watermelon Lime, responding to evolving consumer preferences. In the flavored segments, truffle salt and smoked salt variants continue to command premium prices, while garlic salt maintains steady demand across both retail and food service sectors. The market observes notable growth in jalapeno salt and lime-lemon varieties, which align with the emerging "swicy" trend. This flavor profile is projected to experience significant menu growth over the next 4 years, indicating strong potential for increased adoption in restaurant applications.

The Salts and Flavored Salts Market Report is Segmented by Product Type (Table Salt, and Seasoned Salt/Flavored Salt), Source (Mineral, Rock, and Naturally Harvested), Distribution Channel (Supermarket/Hypermarket, Convenience/Grocery Stores, Online Stores, and Other Distribution Channels), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value and Volume (USD/Tonnes).

Geography Analysis

In 2025, Asia-Pacific is projected to hold a 55.72% share of the global salt market. This dominance is attributed to the region's large population and cultural preference for sodium-rich cuisines. Consumption patterns highlight significant intake levels, with South Korea at 12.3g per day, Singapore at 11.5g, and Thailand at 10.8g. The market is deeply rooted in traditional fermentation practices and umami-focused culinary traditions, driving demand for specialty salt varieties. Additionally, the growing middle-class populations in India, Indonesia, and Southeast Asia present opportunities for premium products. However, there is a clear urban-rural divide, as specialty salt products primarily cater to urban areas with higher purchasing power.

The Middle East and Africa region is expected to achieve a robust compound annual growth rate (CAGR) of 4.38% through 2031. This growth is fueled by expanding food processing capabilities, urbanization, and increased cultural exchange through tourism. Key markets such as the UAE, Saudi Arabia, and South Africa are witnessing shifts in consumer preferences and rising prosperity, which support demand for premium salt products. Traditional preservation methods and spice-rich culinary practices in the region align well with flavored salt varieties. Growth is further supported by strategic infrastructure development and improved distribution networks, facilitating the availability of both local and imported salt products.

North America and Europe continue to hold significant positions in the global salt market, despite operating in mature consumption landscapes. These regions are experiencing shifts driven by regulatory measures, such as the FDA's sodium reduction guidelines and the EU's sustainability standards. These regulations encourage innovation in low-sodium alternatives and clean-label products. The premium segment remains strong, with consumers willing to pay 300-500% more for artisanal and specialty salts that offer unique flavor profiles and transparent sourcing practices.

- Morton Salt Inc.

- McCormick & Company Inc.

- K+S AG

- SaltWorks Inc.

- Tata Consumer Products

- Cargill Inc.

- Compass Minerals

- Murray River Gourmet Salt

- Infosa

- Maldon Crystal Salt Co.

- San Francisco Salt Co.

- Cornish Sea Salt Co.

- Himalayan Salt Company

- Akzo Nobel N.V.

- United Salt Corporation

- Fleur de Sel de Camargue (Salins du Midi)

- Jacobsen Salt Co.

- Selina Naturally

- Pink Himalayan Salt Co.

- Pacific Sea Salt LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for natural, organic, and clean-label ingredients

- 4.2.2 Popularity of gourmet and specialty foods

- 4.2.3 Increase in global culinary cultural exchange and awareness

- 4.2.4 Preference for artisanal, minimally processed products

- 4.2.6 Innovation in low-sodium salt blends and fortified products

- 4.3 Market Restraints

- 4.3.1 Regulatory challenges in flavor formulation and labeling

- 4.3.2 Safety concerns about artificial additives in certain flavored salts

- 4.3.3 Limited awareness in developing markets for premium salts

- 4.3.4 Environmental impact of salt harvesting practices

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Table Salt

- 5.1.2 Seasoned Salt/Flavored Salt

- 5.1.2.1 Truffle Salt

- 5.1.2.2 Garlic Salt

- 5.1.2.3 Lime and Lemon Salt

- 5.1.2.4 Smoked Salt

- 5.1.2.5 Jalapeno Salt

- 5.1.2.6 Others

- 5.2 By Source

- 5.2.1 Mineral

- 5.2.2 Rock

- 5.2.3 Naturally Harvested

- 5.3 By Distribution Channel

- 5.3.1 Supermarket/Hypermarket

- 5.3.2 Convenience/Grocery Stores

- 5.3.3 Online Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Morton Salt Inc.

- 6.4.2 McCormick & Company Inc.

- 6.4.3 K+S AG

- 6.4.4 SaltWorks Inc.

- 6.4.5 Tata Consumer Products

- 6.4.6 Cargill Inc.

- 6.4.7 Compass Minerals

- 6.4.8 Murray River Gourmet Salt

- 6.4.9 Infosa

- 6.4.10 Maldon Crystal Salt Co.

- 6.4.11 San Francisco Salt Co.

- 6.4.12 Cornish Sea Salt Co.

- 6.4.13 Himalayan Salt Company

- 6.4.14 Akzo Nobel N.V.

- 6.4.15 United Salt Corporation

- 6.4.16 Fleur de Sel de Camargue (Salins du Midi)

- 6.4.17 Jacobsen Salt Co.

- 6.4.18 Selina Naturally

- 6.4.19 Pink Himalayan Salt Co.

- 6.4.20 Pacific Sea Salt LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK