PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906002

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906002

Riding Gear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

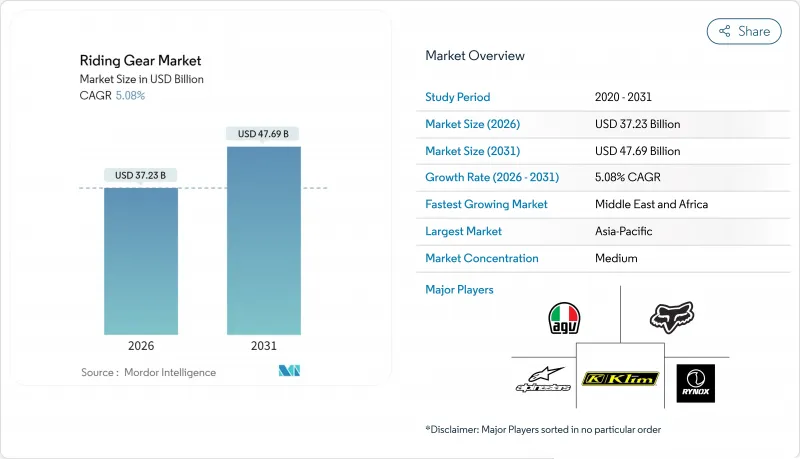

The Riding Gear Market was valued at USD 35.43 billion in 2025 and estimated to grow from USD 37.23 billion in 2026 to reach USD 47.69 billion by 2031, at a CAGR of 5.08% during the forecast period (2026-2031).

Mandatory helmet laws, widening female rider participation, and rapid adoption of air-bag jackets have reshaped demand patterns, pivoting the category from basic protection toward innovative, connected safety ecosystems. Technology-led differentiation tightens the gap between premium and mass segments as carbon-fiber composites and electronic sensors migrate from elite racing gear to mainstream products. Regulatory harmonization, most notably CE Marking under Regulation (EU) 2016/425, has expanded the addressable base by making certified gear a legal necessity rather than a lifestyle choice. At the same time, OEM lifestyle merchandising by brands such as Harley-Davidson and Triumph is blurring the divide between protective apparel and aspirational fashion, sustaining higher average selling prices despite macro-economic volatility. Fragmented competition continues to spur price rivalry, yet counterfeit crackdowns by agencies like the U.K. Driver and Vehicle Standards Agency are steering consumers back to reputable labels, reinforcing quality-driven purchasing behavior.

Global Riding Gear Market Trends and Insights

Rising Motorcycle Ownership In Emerging Markets

Spiraling two-wheeler uptake in India, Indonesia, and Vietnam translates into first-time purchases of certified helmets, jackets, and gloves, compressing what took decades in developed economies into a few selling seasons. Over the past year, sales in India's electric two-wheeler market have surged, underscoring robust growth and heightened consumer acceptance, instantly widening the safety-gear addressable base. China exported a huge number of motorcycles in 2024, more than half of global unit shipments, strengthening the country's status as the volume engine of the riding gear market. Because these countries implement modern safety rules concurrently with motorization, penetration curves steepen quickly, letting certified gear displace unbranded alternatives in record time. Manufacturers able to calibrate feature-rich mid-range lines for tropical climates and price-sensitive customers are capturing early loyalty that tends to persist through the ownership cycle.

Stricter Global Safety Regulations Mandating Protective Gear

Regulatory momentum continues to move from recommendation toward obligation. The European Commission's EN 17092 classification, effective 2018, introduced verifiable abrasion, impact, and seam-strength gradations that retailers must display at point of sale. The Personal Protective Equipment Regulation amplifies penalties for non-compliance, pre-emptively banning sub-standard imports at customs checkpoints. North American agencies reference similar ANSI/UL protocols, while Brazil and Indonesia are drafting mirror statutes slated for 2026. Compliance requirements raise the minimum technological baseline and create a moat around producers with in-house testing labs or long-standing notified-body partnerships. Market entrants lacking certification budgets now pivot toward private-label contracts for established brands, effectively consolidating manufacturing know-how under fewer roof-tops. Over the medium term, uniform global standards shrink the gray zone that fueled counterfeit trade, allowing premium players to cascade former high-end technologies into volume ranges with reduced liability exposure.

High Cost Of Certified Premium Protective Gear

Certification fees, multi-layer material bills, and brand royalties add sizable premiums that price out a portion of emerging-market buyers. An airbag-ready leather jacket can retail at USD 1,100-nearly the same as a basic commuter motorcycle in India-forcing riders to choose between vehicle acquisition and comprehensive protection. While modular design lowers replacement part costs over time, initial outlay remains a sticking point, particularly where helmet-only laws dominate. Manufacturers experiment with micro-financing partnerships and subscription models that spread payments across riding seasons, but adoption has been limited outside North America and Europe. Absent large-scale cost innovation, premium growth could decelerate once early adopters saturate.

Other drivers and restraints analyzed in the detailed report include:

- Boom In Adventure-Touring And Long-Distance Riding Culture

- OEM Lifestyle Merchandise Expansion By Motorcycle Brands

- Proliferation Of Counterfeit Ce-Marked Products Eroding Trust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The riding gear market size attributed to helmets remained dominant in 2025 as the category captured 24.46% of revenue. Regulatory mandates and universal risk acknowledgment ensure helmets remain non-discretionary, delivering predictable replacement cycles tied to crash events and five-year age limits. Helmet technology is evolving toward multi-density liners, rotational-force mitigation systems, and integrated heads-up displays, each feature nudging average selling prices upward without deterring unit growth. Simultaneously, the airbag jackets and vests sub-segment, forecast to expand at a 5.29% CAGR, channels premium demand toward torso protection solutions that can pair with any motorcycle style.

A growing segment of commuters now buys entry-level integral helmets first and postpones full riding suits until disposable income improves, creating staggered purchase cycles that enlarge lifetime customer value. Racing and off-road disciplines continue to dictate top-tier innovation, with FIM homologation for MotoGP and WorldSBK feeding trickle-down tech to consumer models within two to three seasons. Helmet-mounted action-camera bans in several European tracks emphasize the premium placed on aerodynamics and safety certification, indirectly lifting demand for factory-integrated camera ports, which maintain shell integrity while serving content creators. Collectively, these product-type nuances affirm that while helmets secure the broad base of the riding gear market, electronic airbag systems increasingly frame the narrative around premium protection.

Leather accounted for 53.11% of the riding gear market share in 2025, underscoring its enduring appeal built on abrasion resistance and cultural association with motorcycling. Tanned cowhide and kangaroo leather remain favored in racing for their slide durability. Still, environmental scrutiny and rising hide costs are opening avenues for lab-grown or plant-based synthetics that mimic grain structure while lowering CO2 footprints. Carbon-fiber composites, projected for a 5.26% CAGR, achieve crash energy dispersion at fractions of leather's weight, capturing the imagination of performance riders who equate reduced mass with handling gains. Integrated carbon-aramid weaves in gloves and boots yield ultra-thin protective layers, supporting dexterity without sacrificing impact mitigation. Kevlar, Nomex, and Cordura textiles fill the mid-market niche, offering washable, weather-proof alternatives that expand riding seasons in temperate climates.

Hybrid manufacturing combines leather exteriors for slide zones with carbon-fiber or Kevlar panels over impact points, achieving a safety-weight equilibrium that appeals across price tiers. Such fusion builds modularity into supply chains, letting vendors dial material splits based on regulatory destination and customer budget. Recycling pathways for composite off-cuts traditionally landfill waste are emerging through pyrolysis and chemical depolymerization, aligning premium innovation with sustainability credentials that resonate with younger riders. Altogether, material advancements ensure that heritage-rich leather continues to dominate unit volumes, yet cutting-edge composites are where margins and branding prestige now concentrate.

The Riding Gear Market Report is Segmented by Product Type (Jackets and More), Material (Leather, Textile, and More), Distribution Channel (Online and Offline), End-User (On-Road Riding, Off-road/Motocross, and More), Price Range (Premium, Mid-Range, and Economy), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 38.55% of global revenue in 2025, rivaled by no other region in sheer unit density due to China's 36.76 million motorcycle exports and India's surging electric two-wheeler adoption. The riding gear market size in the area benefits from governments enforcing the use of certified helmets for riders and pillion riders alike, instantly elevating baseline protection standards. Local manufacturers scale rapidly by partnering with regulated e-commerce platforms, such as T-Mall and Flipkart, thereby amplifying their reach to peri-urban clusters that were previously dependent on informal channels. Vertical integration-from yarn spinning to final assembly enables Asian companies to undercut imported gear without compromising CE compliance, thereby cementing regional self-sufficiency.

The Middle East and Africa region registers the fastest 5.37% CAGR through 2031 as infrastructural upgrades and ride-sharing platforms normalize two-wheel commuting across Cairo, Nairobi, and Lagos. Gulf states' affluent hobbyist riders gravitate toward premium European labels, yet burgeoning African courier fleets prefer rugged textile gear capable of enduring tropical downpours. Development agencies advocate wearable safety grants in conjunction with donor-funded helmets, fostering early adoption of protective jackets among gig-economy riders. Meanwhile, Latin America records mid-single digit growth anchored by Brazil and Colombia, where domestic apparel capacity meets only three-fifth of demand, opening import lanes for certified European and Asian products.

North America and Europe remain mature but lucrative; replacement cycles average 4-6 years, but riders willingly pay premiums for incremental safety gains. Eurozone inflation has not dampened demand for Level-2 armor and integrated airbags, indicating price elasticity in upper-income segments. Policy tools such as Germany's 2025 eco-bonus for electrically heated gloves during winter commuting illustrate how municipal regulations can nudge accessory uptake beyond core jackets and helmets. Across all geographies, convergence toward global safety standards homogenizes supply chains, yet climatic diversity keeps product development regionally nuanced.

- AGVSport

- Alpinestars S.p.A.

- Dainese S.p.A.

- Fox Racing Inc.

- Klim Technical Riding Gear

- REV'IT! Sport International

- ScorpionEXO

- Icon Motorsports

- Royal Enfield Gear

- HJC Helmets

- Shoei Co., Ltd.

- Arai Helmet Ltd.

- Bell Helmets

- Rynox Gears India Pvt. Ltd.

- Spartan ProGear Co.

- Kushitani Co., Ltd.

- Held GmbH

- Sena Technologies Inc.

- LS2 Helmets

- Studds Accessories Ltd.

- Komine Co., Ltd.

- Oxford Products Ltd.

- Thor MX

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Motorcycle Ownership In Emerging Markets

- 4.2.2 Stricter Global Safety Regulations Mandating Protective Gear

- 4.2.3 Boom In Adventure-Touring And Long-Distance Riding Culture

- 4.2.4 OEM Lifestyle Merchandise Expansion By Motorcycle Brands

- 4.2.5 Rapid Adoption Of Airbag-Integrated Jackets After Price Drop

- 4.2.6 Growing Female Rider Segment Demanding Tailored Apparel

- 4.3 Market Restraints

- 4.3.1 High Cost Of Certified Premium Protective Gear

- 4.3.2 Proliferation Of Counterfeit Ce-Marked Products Eroding Trust

- 4.3.3 Seasonality Dampening Demand In Cold Regions

- 4.3.4 Sustainability Backlash Against Animal-Based Leather Materials

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Product Type

- 5.1.1 Jackets

- 5.1.2 Helmets

- 5.1.3 Gloves

- 5.1.4 Pants / Trousers

- 5.1.5 Boots / Shoes

- 5.1.6 Body Armor & Protectors

- 5.1.7 Airbag Jackets & Vests

- 5.2 By Material

- 5.2.1 Leather

- 5.2.2 Textile

- 5.2.3 Mesh

- 5.2.4 Carbon-Fiber Composites

- 5.2.5 Kevlar / Aramid Blends

- 5.2.6 Other Materials

- 5.3 By Distribution Channel

- 5.3.1 Online

- 5.3.2 Offline

- 5.4 By End-user

- 5.4.1 On-road Riding

- 5.4.2 Off-road / Motocross

- 5.4.3 Adventure & Touring

- 5.4.4 Commuter

- 5.5 By Price Range

- 5.5.1 Premium

- 5.5.2 Mid-range

- 5.5.3 Economy

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Egypt

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 AGVSport

- 6.4.2 Alpinestars S.p.A.

- 6.4.3 Dainese S.p.A.

- 6.4.4 Fox Racing Inc.

- 6.4.5 Klim Technical Riding Gear

- 6.4.6 REV'IT! Sport International

- 6.4.7 ScorpionEXO

- 6.4.8 Icon Motorsports

- 6.4.9 Royal Enfield Gear

- 6.4.10 HJC Helmets

- 6.4.11 Shoei Co., Ltd.

- 6.4.12 Arai Helmet Ltd.

- 6.4.13 Bell Helmets

- 6.4.14 Rynox Gears India Pvt. Ltd.

- 6.4.15 Spartan ProGear Co.

- 6.4.16 Kushitani Co., Ltd.

- 6.4.17 Held GmbH

- 6.4.18 Sena Technologies Inc.

- 6.4.19 LS2 Helmets

- 6.4.20 Studds Accessories Ltd.

- 6.4.21 Komine Co., Ltd.

- 6.4.22 Oxford Products Ltd.

- 6.4.23 Thor MX

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment