PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906023

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906023

Middle East Mammography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

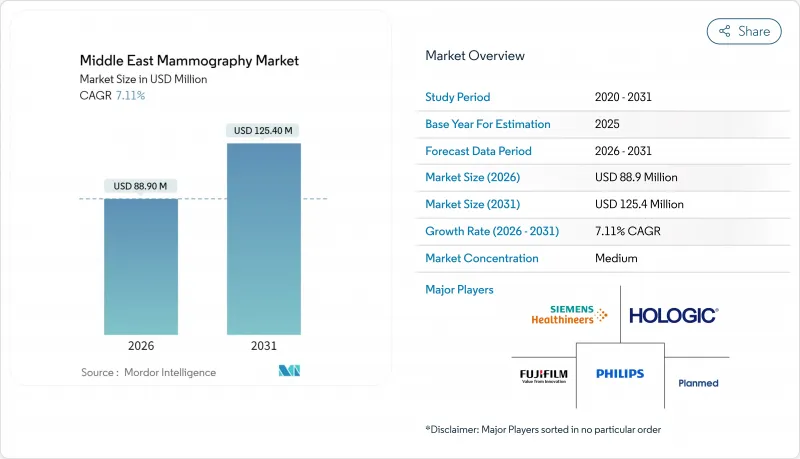

Middle East mammography market size in 2026 is estimated at USD 88.9 Million, growing from 2025 value of USD 83 Million with 2031 projections showing USD 125.4 Million, growing at 7.11% CAGR over 2026-2031.

Policy-linked procurement cycles in Saudi Arabia and the United Arab Emirates are anchoring near-term demand, while Egypt's programmatic push through public hospitals and mobile initiatives is expanding the screening base. Tender specifications in core GCC facilities are shifting budgets toward tomosynthesis and AI-enabled workflows, which will reinforce vendor preferences for fully integrated platforms. Private diagnostic networks are scaling fast in urban hubs, enabled by insurer partnerships and employer-paid screening, which is redistributing volumes away from public systems with longer wait times. Capacity bottlenecks persist due to a shortage of female technologists and workflow fragmentation across PACS and EHR systems, which slows cross-site coordination for follow-up care and teleradiology reads.

Middle East Mammography Market Trends and Insights

Rising Breast-Cancer Incidence Among Middle-Eastern Women

Incidence patterns in the Gulf and Egypt have shifted toward younger screening cohorts, which is accelerating guideline changes that bring first-time screening forward to the early 40s. Saudi Arabia's national reporting highlights growing diagnostic reach in major regions, but late presentation still occurs where cultural norms and access barriers discourage routine imaging among women below 50. Egypt embedded breast-cancer screening into primary care checkups and mobile rotations in governorates, which is expanding volumes while creating periodic spikes in training and equipment deployment needs. In the UAE, mandated coverage for biennial mammography starting at age 40 has lifted screening volumes, which exposes capacity gaps in public facilities aligned to single-shift operations. Turkey's urban centers have piloted weekend screening and AI-supported triage to prioritize high-risk patients within resource limits, while reimbursement for rapid follow-up procedures remains uneven across institutions.

Rapid Shift from Analog to 3-D Tomosynthesis Systems

Adoption divides the region into two speed tiers as GCC facilities and premium private chains standardize on 3-D platforms, while Egypt and rural Turkey continue staged upgrades from analog to 2-D digital. Saudi procurement guidance now favors tomosynthesis-ready systems and FDA-cleared AI modules for lesion scoring, which narrows award pools to vendors meeting both hardware and software criteria. In Abu Dhabi and across the UAE, accredited screening centers are moving toward tomosynthesis compliance, which has triggered early replacement cycles for older digital units. Qatar's flagship hospitals completed DBT upgrades to improve specificity in dense-breast populations, reporting reduced recall rates within hospital programs. Egypt's donor-funded rollouts favor 2-D platforms with software-activatable tomosynthesis to balance coverage and budget, while Turkey's payer policies reimburse DBT selectively for high-density cases flagged by prior screens to control costs.

High Acquisition & Maintenance Cost of DBT Units

Tomosynthesis platforms carry a premium over 2-D digital systems, which pushes public buyers toward entry-tier configurations and staged upgrades. Egypt's provincial tenders often price for refurbished or basic digital rooms in order to expand footprint, which constrains purchases of fully featured DBT equipment. In Turkey, fixed-fee reimbursement for mammography regardless of modality dampens the business case for DBT unless providers secure supplemental private fees. Smaller private facilities in Saudi Arabia opt for 2-D digital systems with dormant DBT options that can be activated later when volumes justify additional licensing and service costs. Maintenance for DBT includes detector calibration, tube replacement on multi-year cycles, and AI version updates that add recurring costs to annual budgets. In Kuwait, vendor financing can spread acquisition costs over longer durations, but it raises total cost of ownership and ties centers to proprietary service ecosystems.

Other drivers and restraints analyzed in the detailed report include:

- Government & NGO-Funded Screening Campaigns

- Health-System Capex Under KSA Vision 2030 and UAE 2031 Driving Replacements

- Radiation-Dose Concerns & Limited Follow-Up Reimbursement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital systems held 59.68% of the Middle East mammography market in 2025, reflecting the installed base across Saudi Arabia, the UAE, and urban Egypt, while tomosynthesis is projected to lead incremental capital spend due to tender and accreditation requirements for volumetric imaging with AI support. The Middle East mammography market is moving toward lower dose, AI-ready platforms that align with dense-breast screening needs, especially in GCC hospitals where accreditation and interoperability criteria shape awards. Analog units persist in specific rural and border locations, largely where power stability and operating budgets constrain upgrades, but parts availability is tightening. Other product types, such as portable digital systems for mobile vans and CESM-enabled configurations for occupational health, are expanding where mobility or high sensitivity is prioritized. In Saudi Arabia and the UAE, capital programs tied to national strategies emphasize DBT readiness and integrated image management, which directs spending toward vendors with strong service networks and validated AI modules.

Tomosynthesis accounts for most of the incremental growth as public buyers and premium private chains converge on 3-D capability. Egypt's public procurements favor digital units that can unlock tomosynthesis via software when staff training and PACS upgrades are completed, preserving budget flexibility while planning for future activation. Qatar and Kuwait deploy 3-D systems in tertiary centers while routing 2-D digital to primary sites, matching technology to patient-acuity and workflow complexity. Turkey often bundles mammography with other imaging in multi-modality tenders that reward portfolio breadth and local service presence. In mobile programs serving remote GCC regions, ruggedized portable digital units are gaining share, although durability and battery-life requirements add costs to field deployments.

The Middle East Mammography Market Report is Segmented by Product Type (Digital Systems, Analog Systems, Breast Tomosynthesis (3-D), and Other Product Types), End User (Hospitals, Specialty Clinics, Diagnostic Centers, and Emergency Medical Services), and Geography (Saudi Arabia, United Arab Emirates, Egypt, Turkey, Qatar, Kuwait, and Rest of Middle East). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Agfa Gevaert N.V.

- Allengers Medical Systems

- Carestream Health

- Fujifilm Holdings Corp.

- GE Healthcare

- Hologic

- IMS Giotto (GMM Group)

- Kheiron Medical Technologies

- Konica Minolta

- Koninklijke Philips

- Lunit

- Planmed

- ScreenPoint Medical (Transpara)

- Siemens Healthineers

- Trivitron Healthcare (Kiran Medical Systems)

- United Imaging Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Breast-cancer Incidence Among Middle-Eastern Women

- 4.2.2 Rapid Shift from Analog to 3-D Tomosynthesis Systems

- 4.2.3 Government & NGO-funded Screening Campaigns

- 4.2.4 Health-system Capex Under KSA Vision 2030 and UAE 2031 Driving Replacements

- 4.2.5 GCC-wide AI Teleradiology Reimbursement Pilots

- 4.3 Market Restraints

- 4.3.1 High Acquisition & Maintenance Cost of DBT Units

- 4.3.2 Radiation-dose Concerns & Limited Follow-up Reimbursement

- 4.3.3 Shortage of Female Mammography Technologists

- 4.3.4 Poor PACS/EHR Interoperability for CAD-AI Outputs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Digital Systems

- 5.1.2 Analog Systems

- 5.1.3 Breast Tomosynthesis (3-D)

- 5.1.4 Other Product Types

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Specialty Clinics

- 5.2.3 Diagnostic Centers

- 5.2.4 Emergency Medical Services

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Egypt

- 5.3.4 Turkey

- 5.3.5 Qatar

- 5.3.6 Kuwait

- 5.3.7 Rest of Middle East

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Agfa Gevaert N.V.

- 6.3.2 Allengers Medical Systems

- 6.3.3 Carestream Health

- 6.3.4 Fujifilm Holdings Corp.

- 6.3.5 GE HealthCare

- 6.3.6 Hologic Inc.

- 6.3.7 IMS Giotto (GMM Group)

- 6.3.8 Kheiron Medical Technologies

- 6.3.9 Konica Minolta Inc.

- 6.3.10 Koninklijke Philips N.V.

- 6.3.11 Lunit Inc.

- 6.3.12 Planmed Oy

- 6.3.13 ScreenPoint Medical (Transpara)

- 6.3.14 Siemens Healthineers

- 6.3.15 Trivitron Healthcare (Kiran Medical Systems)

- 6.3.16 United Imaging Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment