PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906026

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906026

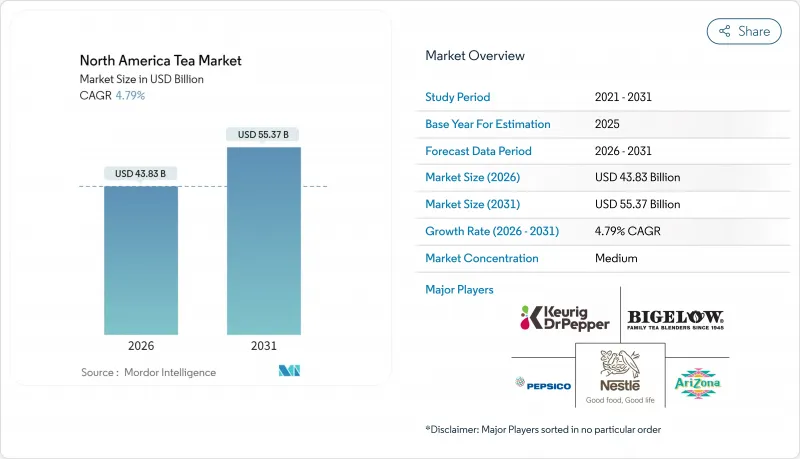

North America Tea - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America tea market was valued at USD 41.82 billion in 2025 and estimated to grow from USD 43.83 billion in 2026 to reach USD 55.37 billion by 2031, at a CAGR of 4.79% during the forecast period (2026-2031).

Robust demand for premium, functional, and low-calorie beverages has strengthened the competitive position of tea versus sugary drinks, a trend amplified by the U.S. Food & Drug Administration's December 2024 "healthy" label ruling for teas containing fewer than 5 calories per 12 fl-oz serving. While traditional black tea maintained its popularity, consumer demand increased for green tea, herbal blends, and specialty teas due to their health benefits. Besides, large-scale flavor innovation, growing organic adoption, and expanding direct-to-consumer models further underpin value growth. At the same time, Mexico's youthful demographic base and rising disposable income create a high-growth frontier for the North American tea market, complementing the United States' volume leadership.

North America Tea Market Trends and Insights

Rising health-and-wellness focus

The FDA's recent designation of tea as a "healthy" beverage, effective December 2024, represents a critical regulatory milestone that substantiates tea's wellness claims beyond traditional marketing. This endorsement applies to teas derived from the Camellia sinensis plant, such as green, black, white, and oolong teas, with fewer than 5 calories per 12 fl-oz serving, positioning tea as a credible health-supportive option. Census Bureau data indicate that 159 million Americans consume tea daily, while scientific research highlights that drinking two cups per day can significantly reduce the risks of heart disease and diabetes . The combination of regulatory approval and strong health evidence enhances tea's competitiveness within the functional beverage market. In response, manufacturers are strategically introducing adaptogenic and functional wellness teas. For example, Vigrs has launched stress-relieving blends featuring Tulsi and Ashwagandha, reflecting the growing consumer focus on mental health and stress management. The Tea Council of the USA's support for the FDA ruling underscores industry alignment in promoting tea's health benefits, driving broader consumer adoption. Brands like Freshleaf Teas, offering antioxidant-rich varieties such as Himalayan Green and Tulsi Green, exemplify the integration of traditional tea heritage with modern health demands. This momentum strengthens tea's position within the functional beverage segment and reinforces its image as a natural, scientifically validated pathway to wellness. Overall, the FDA endorsement boosts consumer confidence, fosters innovative product development, and enhances the health-centric messaging strategies of the North American tea market.

Growing popularity of organic and natural products

Major players in the tea industry are driving the shift of organic and natural teas from niche products to mainstream offerings. Brands are increasingly prioritizing organic tea certifications. For instance, in 2024, JUST ICE Tea rolled out organic, Fair Trade-certified lines in prominent retailers like Sprouts Farmers Market. Similarly, in March 2025, Numi Organic Tea unveiled its Premium Organic Latte Powders at Expo West, underscoring the trend of premium organic teas catering to health-conscious consumers who value ethical sourcing. Granum Inc. is capitalizing on this trend in Seattle, boasting a portfolio of over 80 varieties, all organic and Fair Trade Certified, and packaged in 100% recycled materials. This surge in the organic tea market is driven by consumers' growing preference for clean-label, pesticide-free teas, celebrated for their antioxidants and health benefits. With a focus on wellness, sustainable sourcing, and environmental responsibility, both established and new brands are broadening their organic offerings, including herbal and functional teas. Channels like online sales and specialty retail are pivotal in boosting organic tea's market presence. The ascent of organic and natural teas in North America underscores a clear consumer shift towards authentic, health-centric, and eco-friendly beverage choices.

High raw material costs and supply chain challenges

The tea industry in North America faces significant challenges due to rising raw material costs and a complex supply chain. Environmental factors such as soil degradation, chemical runoff, and climate change are driving up production costs and increasing supply volatility. The United States relies on five key trading partners, Japan, India, Argentina, China, and Sri Lanka, for approximately 60% of its tea imports. However, the introduction of a 10% tariff on Chinese goods in 2025 is expected to disrupt Sino-U.S. tea trade, prompting businesses to diversify their supply chains . Additionally, strict organic certification requirements, such as UPASI's three-year conversion period and the need for isolated cultivation sites, are creating bottlenecks that hinder supply expansion and sustain premium pricing. Companies like Numi Organic Tea and Bigelow, which prioritize organic and fair-trade sourcing, must navigate these obstacles while maintaining product integrity and consumer trust. The intersection of environmental sustainability concerns and geopolitical trade dynamics is driving manufacturers and distributors to innovate in sourcing strategies and inventory planning. These supply-side constraints are shaping market pricing, availability, and scalability, particularly affecting the mass-market segments and highlighting the value proposition of premium and certified teas in the North American market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing interest in premium and specialty tea demand

- Product innovation and flavor diversification

- Competition from coffee and other beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The ready-to-drink (RTD) tea segment accounted for a significant 47.62% market share in 2025, driven by consumer demand for convenience and portability. In contrast, the leaf tea segment is projected to achieve a strong 5.82% CAGR through 2031, reflecting a growing preference for premium and artisanal tea experiences among discerning consumers. This divergence indicates a dual trajectory in the tea market, where mass-market RTD consumption coexists with the rising demand for high-quality loose-leaf tea. CTC granular tea, while maintaining its traditional market positioning, faces competitive pressures from both the convenience-driven RTD formats and the premium loose-leaf alternatives. For instance, Milkadamia's planned launch of multiserve Milk Tea in cartons in January 2025 exemplifies innovation within the RTD category. This product, featuring dairy-free attributes and sustainable packaging, is strategically designed to appeal to Millennials and Gen Z consumers.

Meanwhile, the FDA's food packaging regulations, outlined under 21 CFR 112.116, ensure safety standards for RTD teas while fostering innovation in sustainable packaging solutions. TeaPot's THC-infused Blackberry Rooibos iced tea, launched in April 2025, demonstrates regulatory-compliant innovation in the cannabis-infused RTD segment. Produced in Ontario, each 355ml can contains 5mg of THC, adhering to regulatory standards. Additionally, Kung Fu Tea's lightly sweetened canned green tea, made from 100% natural extracts, highlights premiumization within the RTD category. This product emphasizes antioxidant benefits and features recyclable aluminum packaging, effectively combining convenience with wellness-focused positioning.

Black tea holds a commanding 69.85% share of the market in 2025, reflecting its entrenched position driven by strong consumer preferences. According to the US Census Bureau, 84% of Americans favor black tea varieties, particularly in traditional hot tea consumption. On the other hand, green tea is gaining momentum with a 6.23% CAGR, driven by increasing consumer focus on wellness and the adoption of functional beverages. Herbal tea benefits from its caffeine-free appeal and the inclusion of adaptogenic ingredients, while niche premium segments are served by varieties such as yellow, oolong, and white teas. This segment distribution aligns with regional consumption patterns, with the South and Northeast exhibiting higher concentrations of tea consumption.

In August 2024, Clipper Teas introduced organic dual-flavor combinations, including Chamomile and Peach and Orange and Turmeric, showcasing innovation within traditional categories while maintaining organic and B Corp certifications. Similarly, Moosa expanded category boundaries in 2024 by launching edible teas that combine South American fruits with caffeine-free formulations, signaling a shift beyond conventional beverage applications. Kirin Holdings and Rainforest Alliance also initiated regenerative tea farming projects in Sri Lanka in 2024. This development is particularly significant as 40% of Japan's black tea supply originates from Sri Lanka, highlighting the growing importance of supply chain sustainability and its potential impact on future product positioning.

The North America Tea Market Report is Segmented by Form (Leaf Tea, CTC Granular Tea, Ready-To-Drink Tea), Product Type (Black Tea, Green Tea, Herbal Tea, Others), Flavor Profile (Unflavored, Flavored), Packaging Type (Flexible, Rigid), Distribution Channel (On-Trade, Off-Trade), and Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Keurig Dr Pepper Inc.

- Nestle SA

- PepsiCo, Inc.

- Hain Celestial Group Inc.

- Arizona Beverages USA

- Tata Consumer Products

- R.C. Bigelow, Inc.

- William B. Reily & Company (Luzianne)

- Ito En Ltd.

- Bettys & Taylors Group

- DavidsTea Inc.

- Red Diamond, Inc.

- Starbucks Corp. (Teavana)

- Rishi Tea & Botanicals

- Harney & Sons Fine Teas

- The Republic of Tea

- Sound Beverages LLC

- Planting Hope Company Inc. (Argo Tea)

- Stash Tea Co.

- East West Tea Company, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising health-and-wellness focus

- 4.2.2 Growing popularity of organic and natural products

- 4.2.3 Increasing interest in premium and specialty tea demand

- 4.2.4 Product innovation and flavor diversification

- 4.2.5 Increasing participation in tea-related lifestyle and social events

- 4.2.6 Supply chain transparency and sustainability initiatives

- 4.3 Market Restraints

- 4.3.1 High raw material costs and supply chain challenges

- 4.3.2 Competition from coffee and other beverages

- 4.3.3 Regulatory constraints and labeling requirements

- 4.3.4 Environmental concerns in tea cultivation

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Leaf Tea

- 5.1.2 CTC (Granular) Tea

- 5.1.3 Ready-To-Drink Tea

- 5.2 By Product Type

- 5.2.1 Black Tea

- 5.2.2 Green Tea

- 5.2.3 Herbal Tea

- 5.2.4 Other(Yellow tea, oolong, white teas and others)

- 5.3 By Flavor Profile

- 5.3.1 Unflavored

- 5.3.2 Flavored

- 5.4 By Packaging Type

- 5.4.1 Flexible (Tea Bags, Pouches)

- 5.4.2 Rigid (Cans, Bottles, Pods)

- 5.5 By Distribution Channel

- 5.5.1 On-Trade

- 5.5.2 Off-Trade

- 5.5.2.1 Supermarkets/Hypermarkets

- 5.5.2.2 Specialty Stores

- 5.5.2.3 Convenience/Grocery Stores

- 5.5.2.4 Online Retail Stores

- 5.5.2.5 Other Distribution Channels

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

- 5.6.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Keurig Dr Pepper Inc.

- 6.4.2 Nestle SA

- 6.4.3 PepsiCo, Inc.

- 6.4.4 Hain Celestial Group Inc.

- 6.4.5 Arizona Beverages USA

- 6.4.6 Tata Consumer Products

- 6.4.7 R.C. Bigelow, Inc.

- 6.4.8 William B. Reily & Company (Luzianne)

- 6.4.9 Ito En Ltd.

- 6.4.10 Bettys & Taylors Group

- 6.4.11 DavidsTea Inc.

- 6.4.12 Red Diamond, Inc.

- 6.4.13 Starbucks Corp. (Teavana)

- 6.4.14 Rishi Tea & Botanicals

- 6.4.15 Harney & Sons Fine Teas

- 6.4.16 The Republic of Tea

- 6.4.17 Sound Beverages LLC

- 6.4.18 Planting Hope Company Inc. (Argo Tea)

- 6.4.19 Stash Tea Co.

- 6.4.20 East West Tea Company, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK