PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906028

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906028

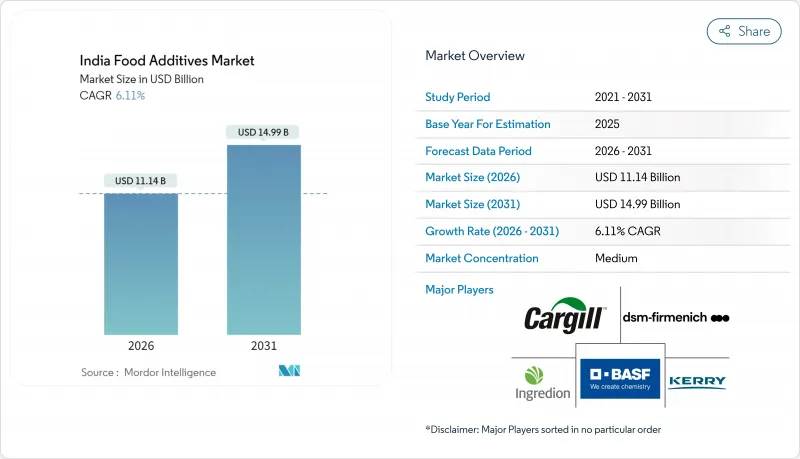

India Food Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indian food additives market is expected to grow from USD 10.50 billion in 2025 to USD 11.14 billion in 2026 and is forecast to reach USD 14.99 billion by 2031 at 6.11% CAGR over 2026-2031.

Rising urban incomes, shifting dietary habits, and sustained government incentives for food processing underpin this expansion trajectory. Manufacturers continue to scale capacity because packaged foods, quick-service restaurants, and e-commerce grocery platforms require dependable solutions that lengthen shelf life, optimize texture, and deliver consistent taste. At the same time, consumer scrutiny of labels is steering demand toward plant-based colorants, natural sweeteners, and fermentation-derived preservatives. Technology adoption-ranging from AI-assisted formulation to enzyme fermentation-enables producers to improve yields while meeting stricter quality norms. Collectively, these trends keep the Indian food additives market on a steady growth path even as raw-material cost swings and evolving safety regulations add complexity.

India Food Additives Market Trends and Insights

Growing Demand for Processed and Convenience Foods

India's urbanization, now encompassing 35% of the population, is driving a significant rise in processed food consumption. Working professionals are increasingly opting for ready-to-eat meals and packaged snacks. In 2024, the organized food processing sector recorded an 8.2% growth, surpassing the overall manufacturing sector. This expansion is primarily due to companies investing in preservation technologies and shelf-life extension solutions, as noted by the Ministry of Statistics and Programme Implementation. Quick-service restaurant chains and food delivery platforms are further boosting the demand for standardized food additives, which are essential for maintaining consistent taste, texture, and appearance across multiple preparation centers. Additionally, tier-2 cities are becoming key growth drivers, with household spending on packaged foods rising by 12% annually. This growth necessitates the use of preservatives, emulsifiers, and flavor enhancers to ensure product quality across extended distribution networks. The transition from traditional cooking to convenience foods is also increasing the demand for natural preservatives and clean-label solutions, as health-conscious consumers prioritize processed options that retain nutritional value.

Rising Demand for Natural, Clean-Label, and Organic Food Additives

With growing health consciousness, 67% of Indian consumers actively examine ingredient labels to avoid synthetic chemicals, as revealed by recent studies. The Food Safety and Standards Authority of India (FSSAI)has implemented progressive regulations, introducing updated standards for plant-based colorants and organic preservatives, which are accelerating the adoption of natural additives. Leading food brands such as Britannia and Parle are spearheading this transition by reformulating products to incorporate natural alternatives and promoting clean-label initiatives that exclude artificial preservatives and synthetic colors. The organic food market, growing at an impressive 20% annually, is driving increased demand for certified organic additives, particularly in dairy, bakery, and beverage sectors, where natural ingredients command higher prices. Additionally, export-focused food manufacturers are adopting natural additives to comply with international certification standards and to cater to global markets that are increasingly rejecting synthetic food chemicals.

Fluctuations in Raw Material Prices

Key inputs in additive manufacturing, including citric acid, lecithin, and natural extracts, have experienced price fluctuations of 15-25%, driven by supply chain disruptions and weather-related crop yield variations. Indian manufacturers, who rely heavily on imports for specialized raw materials, are exposed to currency fluctuations and international trade policies. Approximately 40% of premium additive ingredients are sourced from regions such as China, Europe, and Southeast Asia. Additionally, energy costs for additive production, particularly for processes like spray-drying and fermentation, are influenced by crude oil prices and domestic coal availability, directly impacting profit margins for energy-intensive operations. Small and medium-scale additive manufacturers face difficulties in managing raw material inventory and price hedging, which limits their ability to compete with larger players that utilize economies of scale to mitigate short-term cost variations.

Other drivers and restraints analyzed in the detailed report include:

- Government Initiatives Supporting Food Processing Industry Growth

- Technological Advancements in Additive Formulation

- Health Concerns Over Synthetic Additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, sweeteners hold a dominant 76.92% market share, highlighting India's role as a leading sugar producer and the extensive use of sugar alternatives in processed foods, beverages, and pharmaceuticals. Food colorants, driven by consumer preferences for visually appealing products and regulatory shifts favoring natural colorants like turmeric, beetroot, and spirulina, are the fastest-growing segment with a 7.59% CAGR through 2031, as supported by the Food Safety and Standards Authority of India. Preservatives continue to see stable demand in bakery and dairy applications, while emulsifiers benefit from the growth of processed food manufacturing and increasing texture requirements in convenience foods. Enzymes are gaining popularity in brewing, baking, and dairy processing as manufacturers focus on process optimization and natural alternatives to chemical treatments.

These segment trends reflect a broader industry movement toward natural ingredients. As regulatory approvals increase and consumer acceptance grows, synthetic sweetener demand is declining, paving the way for alternatives like stevia and monk fruit. Anti-caking agents are essential in spice processing and powdered food production. Hydrocolloids are increasingly used in gluten-free and plant-based food formulations. Food flavors and enhancers are experiencing growth due to the expanding snack food industry and the rising restaurant sector, particularly in tier-2 cities where organized food services are rapidly growing. Acidulants maintain steady demand in beverages and preservation applications, supporting the market's overall growth despite variations in adoption rates across segments.

The India Food Additives Market Report Segments the Industry Into Type (Preservatives, Sweeteners, Sugar Substitutes, Emulsifier, Anti-Caking Agents, Enzymes, Hydrocolloids, Food Flavors and Enhancers, Food Colorants, Acidulants) and Application (Dairy & Frozen, Bakery, Meat & Sea Food, Beverages, Confectionery, Other Applications). Get Five Years of Historical Data and Future Market Forecasts.

List of Companies Covered in this Report:

- Cargill Inc.

- Ingredion Incorporated

- DSM-Firmenich

- BASF SE

- International Flavors & Fragrances, Inc.

- Kerry Group PLC

- Tate & Lyle PLC

- Corbion NV

- Novozymes A/S

- Sunshine Chemicals (India)

- Vinayak Ingredients (India) Pvt. Ltd.

- Mane Group

- Archer Daniels Midland Company

- Finar Limited

- Matangi Industries LLP

- Aarkay Food Products Ltd.

- Rajvi Enterprises

- New Alliance Fine Chem Private Limited

- Sensient Technologies

- Layn Naturals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for processed and convenience foods

- 4.2.2 Rising demand for natural, clean-label, and organic food additives

- 4.2.3 Government initiatives supporting food processing industry growth

- 4.2.4 Technological advancements in additive formulation

- 4.2.5 Growing popularity of functional foods and fortified products

- 4.2.6 Rising export opportunities

- 4.3 Market Restraints

- 4.3.1 Fluctuations in raw material prices

- 4.3.2 Health concerns over synthetic additives

- 4.3.3 Supply chain complexities and infrastructure gaps

- 4.3.4 Labeling Challenges and Transparency Pressures

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST

- 5.1 By Product Type

- 5.1.1 Preservatives

- 5.1.2 Sweeteners

- 5.1.3 Sugar Substitutes

- 5.1.4 Emulsifiers

- 5.1.5 Anti-Caking Agents

- 5.1.6 Enzymes

- 5.1.7 Hydrocolloids

- 5.1.8 Food Flavors & Enhancers

- 5.1.9 Food Colorants

- 5.1.10 Acidulants

- 5.2 By Source

- 5.2.1 Natural

- 5.2.2 Synthetic

- 5.3 By Application

- 5.3.1 Bakery and Confectionery

- 5.3.2 Dairy and Desserts

- 5.3.3 Beverages

- 5.3.4 Meat and Meat Products

- 5.3.5 Soups, Sauces, and Dressings

- 5.3.6 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Cargill Inc.

- 6.4.2 Ingredion Incorporated

- 6.4.3 DSM-Firmenich

- 6.4.4 BASF SE

- 6.4.5 International Flavors & Fragrances, Inc.

- 6.4.6 Kerry Group PLC

- 6.4.7 Tate & Lyle PLC

- 6.4.8 Corbion NV

- 6.4.9 Novozymes A/S

- 6.4.10 Sunshine Chemicals (India)

- 6.4.11 Vinayak Ingredients (India) Pvt. Ltd.

- 6.4.12 Mane Group

- 6.4.13 Archer Daniels Midland Company

- 6.4.14 Finar Limited

- 6.4.15 Matangi Industries LLP

- 6.4.16 Aarkay Food Products Ltd.

- 6.4.17 Rajvi Enterprises

- 6.4.18 New Alliance Fine Chem Private Limited

- 6.4.19 Sensient Technologies

- 6.4.20 Layn Naturals

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK