PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906036

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906036

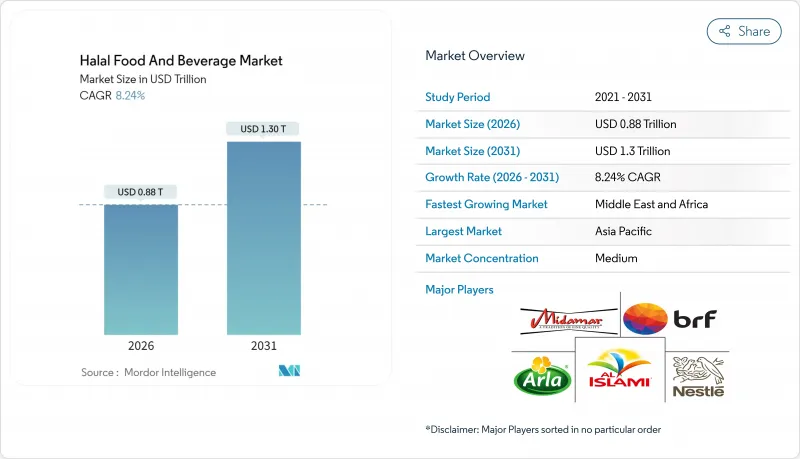

Halal Food And Beverage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global halal food and beverage market was valued at USD 810 billion in 2025 and estimated to grow from USD 876.74 billion in 2026 to reach USD 1303.7 billion by 2031, at a CAGR of 8.24% during the forecast period (2026-2031).

Driven by demographic growth and rising incomes in Muslim-majority markets, the halal-certified packaged food and beverage industry is on a clear upward trajectory. Non-Muslim consumers are increasingly drawn to halal products, seeking assurances on quality, provenance, and ethical standards. Forecasts suggest the global halal food market will expand over the next decade. Dominating the value share are packaged food products, including ready-to-eat meals, frozen poultry and red meat, bakery and confectionery items, dairy products, and packaged snacks. Meanwhile, halal beverages, spanning dairy alternatives, functional drinks, and specialty soft drinks, are emerging as faster-growing niches. While traditional supermarkets and hypermarkets still lead in volume, halal-dedicated e-marketplaces and online channels are rapidly gaining ground. This shift is particularly pronounced among younger, urban Muslim consumers who prioritize transparency and convenience. To ensure end-to-end halal compliance, technological enablers like blockchain traceability, QR-code certification scanning, and IoT monitoring in cold chain logistics are being increasingly adopted. Furthermore, consumer perceptions are shifting: a growing number of non-Muslims now view halal certification as synonymous with "safe, ethical, and quality" food. The halal-certified packaged food and beverage industry is transitioning from a niche religious market to a mainstream, quality-driven segment. While anchored in key growth regions, its penetration is notably rising in Western and emerging non-Muslim markets.

Global Halal Food And Beverage Market Trends and Insights

Growing Cultural Awareness and Demand for Halal Products

As global awareness of halal standards rises, consumer preferences are shifting, making halal-certified packaged foods and beverages mainstream staples. By 2025, Muslims, constituting about 24.1% of the global population, will number around 2 billion, forming a substantial consumer base driving the demand for trusted halal options . In Southeast Asia, brands like Indomie (known for its instant noodles) and Sedaap have bolstered their halal labeling and integrated QR-code verification, catering to younger Muslim shoppers who prioritize transparency and authenticity. Responding to the growing incorporation of halal assurance in daily routines, Middle Eastern producers, including Al Islami Foods and Almarai, have broadened their offerings to include halal-certified frozen meats, dairy products, and ready-to-eat meals. This evolution has led major retailers in the UAE and Saudi Arabia to elevate these brands from seasonal or niche status to core offerings. In Europe, global giants like Nestle and Kellogg's are introducing halal-certified products, such as breakfast cereals, dairy drinks, and even halal-labeled variants of KitKat and Milo, targeting both Muslim families and non-Muslim consumers who equate halal certification with enhanced safety and ethical sourcing. Concurrently, in northern and central Africa, local brands like Nadec and Mezzo are broadening their range to include halal-labeled staples such as yogurt, cheese, and poultry, responding to the surging everyday demand. These strategic moves by brands underscore the profound impact of heightened cultural awareness and a sizable, youthful global Muslim demographic on shopping behaviors, propelling the worldwide growth of halal-certified packaged foods and beverages.

Halal as a Marker of Quality and Authenticity

Halal certification is increasingly recognized as a mark of quality and authenticity, reshaping consumer behavior and driving the growth of halal-certified packaged food and beverages. In 2024, Nestle Malaysia introduced new halal-certified dairy drinks and instant noodles to its product lineup. This move underscored not just compliance with halal standards but also emphasized product purity and traceability. Such attributes resonated with both Muslim and non-Muslim consumers, all of whom are increasingly seeking trustworthy packaged goods. Similarly, in the UAE and Saudi Arabia, BRF's Sadia Halal brand bolstered its premium frozen poultry line. By leveraging its halal credentials, the brand underscored its commitment to superior safety and humane processing. This strategic emphasis prompted retailers to position Sadia alongside other premium imported meats. Across the UK and Germany, specialty grocers began touting halal-certified KitKat and other confectionery products as "cleaner" alternatives. This marketing strategy targeted health- and quality-conscious non-Muslim consumers. In Southeast Asia, platforms like GrabMart introduced dedicated halal categories for frozen meals and beverages. This addition mirrors a growing trust in halal labeling as a mark of authenticity. These instances illustrate a shifting perception: halal is increasingly seen as a benchmark for ethical sourcing, product integrity, and quality. This evolving viewpoint is reshaping shopping habits, attracting a wider consumer base, and fueling growth in both traditional Muslim markets and mainstream global retail.

Stricter Regulations and Safety Standards

While stricter regulations and safety standards in halal certification are essential for ensuring authenticity and building consumer trust, they can unintentionally hinder market growth, particularly for small and medium-sized enterprises (SMEs). In Malaysia, SMEs often find the halal certification process overwhelming and time-consuming. Frequent changes in raw materials and the difficulty of ensuring all suppliers comply with halal standards can significantly delay certification, creating obstacles for smaller producers trying to enter the market. Furthermore, the lack of standardized halal certification criteria across various certifying bodies adds another layer of complexity, leading to confusion for both businesses and consumers. In the United States, the absence of a centralized halal regulatory authority results in inconsistent certification standards. This inconsistency makes it challenging for consumers to verify the authenticity of halal products and for businesses to navigate the certification process efficiently. These regulatory challenges not only increase operational costs but also create significant barriers to entry for SMEs.

Other drivers and restraints analyzed in the detailed report include:

- Government Support for Halal-Certified Production

- Digital Marketing and Social Media Influence on Halal Brands

- Higher Certification Costs for Halal Compliance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Halal food dominates the halal-certified packaged food and beverage market, holding a commanding 66.85% share. Traditional categories, notably meat, poultry, dairy, and bakery products, primarily drive this dominance. The protein segment, encompassing meat and poultry, leads in consumption volumes, bolstered by significant industry investments signaling confidence in sustained demand. Illustrating this trend, JBS has expanded its processing facility in Saudi Arabia, while BRF has committed to bolstering regional production, both underscoring a focus on catering to the surging protein demand in halal markets. Meanwhile, dairy and plant-based alternatives are gaining momentum. Strauss Group's CowFree range, a testament to innovation in animal-free protein production, appeals to both the religiously observant and health-conscious consumers.

Halal beverages, the fastest-growing segment, boast an 8.78% CAGR. This growth is fueled by innovations in functional drinks, plant-based dairy alternatives, and ready-to-drink formulations that seamlessly blend convenience with nutrition. Companies such as Gorilla Energy have set up production hubs in the UAE, catering to the Middle East and Africa. They offer proprietary blends that align with both functional trends and halal standards. Online retail channels are pivotal in broadening consumer access to these products. Platforms showcasing ready-to-drink beverages, energy drinks, and protein-infused formulations are particularly resonating with younger, urban, and digitally-savvy consumers.

The Halal Food and Beverage Market Report is Segmented by Product Type (Halal Food, Halal Beverages), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Other Distribution Channels), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific hosts the largest share of the world's Islamic population; this demographic base generates consistently high demand for halal-certified food and drinks, thus reaching the market share of Asia-Pacific at 59.45%. Many countries in the region have government-backed halal certification systems and supportive regulations, which build consumer trust and lower barriers for halal-product supply. Rapid urbanization, expanding middle-class populations, and changing lifestyles are increasing demand for convenient, packaged, and processed halal foods, beyond just traditional home-cooked meals. In addition, rising awareness about food safety, hygiene, and ethical sourcing is encouraging even non-Islamic consumers across Asia-Pacific to choose halal-certified products. Finally, a diverse offer of halal-certified product categories, meat, dairy, beverages, snacks, across a vast geography makes Asia-Pacific both the largest and a highly dynamic market

In the Middle East and Africa, the halal-certified packaged food and beverage market is the fastest-growing, with a CAGR of 8.97%. A robust infrastructure, high domestic consumption, and proactive government support bolster this stronghold. Saudi Arabia stands out, with its Vision 2030 initiatives luring significant international investments. Notable expansions include JBS's facility and BRF's regional production, both enhancing the nation's industrial and supply chain prowess. The UAE, recognized as a pivotal distribution center, witnesses companies like Gorilla Energy setting up operations to cater to the expansive Middle East and Africa markets. With established halal certification systems, heightened consumer awareness, and government-endorsed industrialization, the region cements its status as the epicenter of global halal production and consumption.

An expanding Islamic demographic fuels a surge in Europe. The mainstreaming of halal in retail and a growing interest among non-Muslims in halal products, often viewed as symbols of quality and ethical sourcing. European brands like Alpro, Vitasoy, and The Collective are at the forefront, offering a range of products from plant-based beverages to dairy alternatives, appealing to both the devout and the discerning. Countries like France, Germany, and the UK are witnessing retailers amplifying their halal-certified offerings, while brands harness e-commerce to connect with a tech-savvy audience. North America are charting steady growth trajectories, each influenced by distinct market nuances. North America's growth narrative is shaped by its burgeoning Muslim populace and the mainstreaming of brand certifications. Organizations like Islamic Services of America are pivotal, certifying products from brands like Beyond Meat, Midamar, and Welch's, ensuring they meet halal standards while resonating with a broader audience.

- Nestle S.A.

- Al Islami Foods LLC

- American Halal Company, Inc.

- Arla Foods A.m.b.A

- Beyond Meat, Inc.

- Midamar Corporation

- Crescent Specialty Foods, Inc.

- Almarai Company Limited

- SADAFCO

- BRF S.A.

- Shan Foods

- Riz Global Foods

- Maple Leaf Foods Inc.

- Zabiha Halal

- Tanmiah Food Company

- JBS S.A.

- Toufayan Bakeries

- Kikkoman Corporation

- Aldella Food Production Co.

- Savola Group Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Cultural Awareness and Demand for Halal Products

- 4.2.2 Halal as a Marker of Quality and Authenticity

- 4.2.3 Government Support for Halal-Certified Production

- 4.2.4 Expansion of Wider Distribution Networks

- 4.2.5 Product Innovation in the Halal Market

- 4.2.6 Digital Marketing and Social Media Influence on Halal Brands

- 4.3 Market Restraints

- 4.3.1 Stricter Regulations and Safety Standards

- 4.3.2 Higher Certification Costs for Halal Compliance

- 4.3.3 Limited Consumer Awareness in Non-Muslim Regions

- 4.3.4 Risk of Fraud and Mislabeling in the Halal Market

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Halal Food

- 5.1.1.1 Dairy and Dairy Alternatives

- 5.1.1.2 Confectionery

- 5.1.1.2.1 Sugar Confectionery

- 5.1.1.2.2 Chocolates

- 5.1.1.2.3 Snack Bars

- 5.1.1.2.4 Others

- 5.1.1.3 Bakery

- 5.1.1.4 Savory Snacks

- 5.1.1.5 Meat, Poultry and Seafood

- 5.1.1.5.1 Red Meat

- 5.1.1.5.2 Seafood

- 5.1.1.5.3 Poultry

- 5.1.1.6 Baby Food

- 5.1.1.7 Ready Meals

- 5.1.1.8 Condiments and Sauces

- 5.1.1.9 Other Product Types

- 5.1.2 Halal Beverages

- 5.1.1 Halal Food

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets / Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Online Retail Stores

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Spain

- 5.3.2.6 Netherlands

- 5.3.2.7 Sweden

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Indonesia

- 5.3.3.6 South Korea

- 5.3.3.7 Thailand

- 5.3.3.8 Singapore

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Chile

- 5.3.4.5 Peru

- 5.3.4.6 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 Morocco

- 5.3.5.7 Turkey

- 5.3.5.8 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 Al Islami Foods LLC

- 6.4.3 American Halal Company, Inc.

- 6.4.4 Arla Foods A.m.b.A

- 6.4.5 Beyond Meat, Inc.

- 6.4.6 Midamar Corporation

- 6.4.7 Crescent Specialty Foods, Inc.

- 6.4.8 Almarai Company Limited

- 6.4.9 SADAFCO

- 6.4.10 BRF S.A.

- 6.4.11 Shan Foods

- 6.4.12 Riz Global Foods

- 6.4.13 Maple Leaf Foods Inc.

- 6.4.14 Zabiha Halal

- 6.4.15 Tanmiah Food Company

- 6.4.16 JBS S.A.

- 6.4.17 Toufayan Bakeries

- 6.4.18 Kikkoman Corporation

- 6.4.19 Aldella Food Production Co.

- 6.4.20 Savola Group Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK